On November 2, 2018, the U.S. Securities and Exchange Commission (the SEC or Commission) Division of Enforcement (the Division) released its annual report discussing enforcement-related actions and key initiatives (the Report).1 Notably, the Report — which covered the fiscal year ended September 30, 2018 (FY 2018) — highlighted that the number of SEC enforcement actions filed in FY 2018 increased by approximately 8.8 percent from fiscal year 2017 (FY 2017), and penalties ordered increased approximately 72.9 percent from $832 million in FY 2017 to $1.439 billion in FY 2018. Overall monetary remedies obtained by the SEC (penalties and disgorgement) increased by a more modest 4 percent from approximately $3.789 billion in FY 2017 to $3.945 billion in FY 2018.2

Division Co-Directors Stephanie Avakian and Steven Peikin emphasized that quantitative metrics fail to sufficiently capture the effectiveness of the enforcement program; instead, they advocate that the enforcement program’s effectiveness be assessed by whether the program reflects the following five principles, which were reiterated in this year’s Report: (1) focus on the Main Street investor; (2) focus on individual accountability; (3) keeping pace with technological change; (4) imposing remedies that most effectively further enforcement goals; and (5) constantly assessing the allocation of SEC resources. Consideration of these principles, according to the co-directors, reflects that the Division’s work in FY 2018 was a “great success.”3

The following summarizes the key metrics for FY 2018 and the key trends and enforcement priorities described in the Report, including new initiatives undertaken in FY 2018 that we expect to continue in the coming year.

Key Takeaways

- There was an overall increase in number of SEC enforcement actions and penalties imposed in FY 2018, but a decrease in total disgorgement imposed.

- The SEC continues to prioritize cases involving protection of retail investors, including through the use of the Commission’s advanced capabilities in data analytics.

- There is a continued focus on individual accountability, reflected by the fact that almost three quarters of the SEC’s stand-alone enforcement actions in FY 2018 involved charges against at least one individual.

- Two recent high-profile enforcement actions highlighted in the Report reflect a willingness by the SEC to tailor remedial tools to address alleged misconduct, sometimes in novel ways.

- The SEC is increasingly focused on cybersecurity and related issues, including the timeliness and accuracy of disclosures of cyber-related issues and the need to implement sufficient internal accounting controls to prevent cyber breaches.

FY 2018 by the Numbers and the SEC’s Allocation of Limited Resources

In FY 2018, the Commission brought a mix of 821 enforcement actions, an increase of 67 actions over FY 2017. The percentage of “stand-alone” actions increased by approximately 9.8 percent from FY 2017, with a total of 490 stand-alone actions brought in FY 2018. The penalties imposed in FY 2018 also increased by 72.9 percent from $832 million in FY 2017 to $1.439 billion in FY 2018.

On the other hand, disgorgement of profits for FY 2018 totaled $2.506 billion, a decrease over the prior fiscal year of approximately 15.2 percent, when the Commission imposed a total of $2.957 billion in disgorgement. This decrease may be attributable, at least in part, to the effect of the 2017 U.S. Supreme Court opinion in Kokesh v. SEC, which held that SEC claims for disgorgement are subject to a five-year statute of limitations, thereby limiting the Commission’s ability to collect disgorgement in long-running cases.4 The Kokesh decision, according to the Report, may result in the Commission forgoing up to approximately $900 million in disgorgement with respect to enforcement actions already filed.

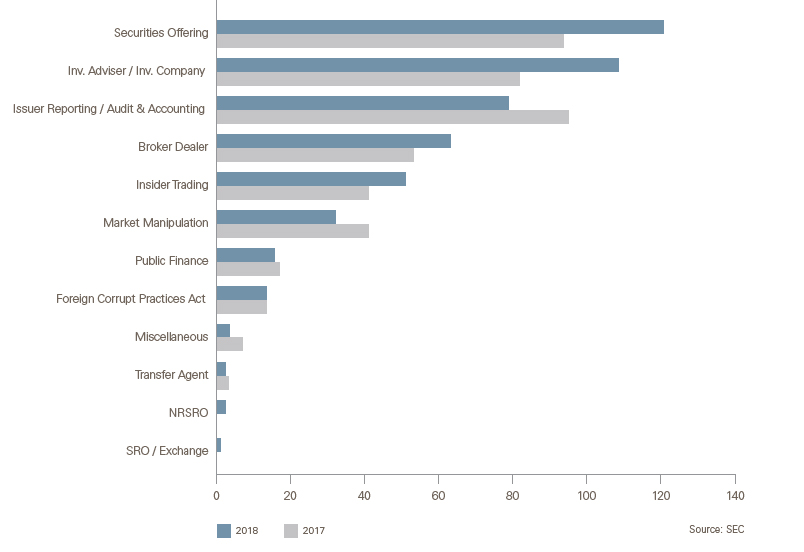

Over the past fiscal year, the SEC increased the number of actions it brought related to securities offerings, investment adviser issues, broker-dealer misconduct and insider trading. Cases concerning securities offerings made up the bulk of the SEC’s actions, amounting to approximately 25 percent of the total 490 stand-alone cases. A significant number of stand-alone actions brought in FY 2018 also involved investment adviser issues (approximately 22 percent) and broker-dealer misconduct (approximately 16 percent). There was a decrease, however, in the number of stand-alone actions related to issuer reporting and disclosure (approximately 16 percent), as well as market manipulation (approximately 7 percent). Foreign Corrupt Practices Act cases remained consistent at 13 cases in each of FY 2017 and FY 2018.

The following chart shows the number of cases by category:5

The enforcement statistics for FY 2018 reflect that the Division continues to execute on its mission and file an increasing number of actions, even while operating with fewer resources than in past years. Due to a hiring freeze that began in late 2016, the Division’s employee and contractor staffing levels have decreased by approximately 10 percent over the last two years. To meet emerging threats while working with a more limited staff, the SEC has shifted its resources to its most pressing issues.6

Focus on Main Street: Protecting Retail Investors

In FY 2018, the Division prioritized bringing enforcement actions that served to protect Main Street (or retail) investors.7 To support this mission, the SEC created the Retail Strategy Task Force (RSTF), which focuses on data analytics. Those analytics have been applied in areas that the SEC believes impact retail investors the most: disclosure concerning fees, expenses and conflicts of interest for managed accounts; market manipulations; and fraud involving unregistered offerings.8 The use of data analytics involves collaboration with the Division of Economic and Risk Analysis (DERA) and the Office of Compliance Inspections and Examinations (OCIE), two data analytics groups within the Commission. The RSTF has also partnered with the Division’s Cyber Unit and Microcap Fraud Task Force, as well as the Division of Corporation Finance, to launch an initiative involving trading suspensions for companies purporting to be in the cryptocurrency and distributed ledger technology space.9

In addition, the Division announced its Share Class Selection Disclosure Initiative (SCSD Initiative) designed to address misconduct that occurs in the interactions between investment professionals and retail investors. The SCSD Initiative is a voluntary program for investment advisers to self-report failures to disclose financial conflicts of interest relating to marketing fees and expenses connected to mutual fund share classes. For those investment advisers that self-report and satisfy the requirements of the SCSD Initiative, the Division will recommend to the Commission settlements with standardized terms that include antifraud charges and an agreement to pay disgorgement (but exclude a recommendation for the payment of a penalty). The SCSD Initiative aims to bring relief to retail investors who may have been harmed by investment professionals’ failure to disclose conflicts of interest.

Focus on Individual Accountability and Imposing Effective Remedies

The SEC focused in FY 2018 on individual accountability, especially as it relates to senior corporate officers and other prominent figures within organizations, and we expect that focus to continue in coming years. In FY 2018, 72 percent of the SEC’s stand-alone enforcement actions involved charges against at least one individual, including a U.S. congressman, the former chief executive officer (CEO) and chief financial officer of Walgreens Boots Alliance, Inc., and the CEOs of Theranos Inc. and Tesla Inc.10

With respect to the enforcement actions against the CEOs of Theranos and Tesla, the Report explained that these actions not only reflect the SEC’s focus on individuals, but they also reflect a willingness by the SEC to use a wide range of remedial tools in novel ways to address misconduct.11 In its settlement with Theranos, the SEC included undertakings that required the CEO to relinquish her voting rights and guarantee that she would not profit from a sale of the company unless other investors were compensated first. According to the SEC, these undertakings were meant to protect investors from the CEO’s potential misuse of her controlling position. In the Tesla matter, the SEC was concerned about the CEO’s communication practices and the alleged lack of sufficient oversight and control over those communications. The undertakings in that settlement included the requirement that the CEO resign as chairman of the company, and the requirements that Tesla add two independent directors to its board and establish a committee of independent directors to oversee the CEO’s public communications.12

Keeping Pace With Technological Change: Cybersecurity and Related Disclosures and Controls

The SEC announced the creation of its Cyber Unit in September 2017.13 The Cyber Unit was formed to consolidate the expertise of the Division and enhance its ability to identify and investigate cyber-related threats. In commenting on the Cyber Unit’s launch, Division Co-Director Stephanie Avakian identified cyber-related threats as “among the greatest risks facing investors and the securities industry.” The Commission brought 20 stand-alone cases in FY 2018 related to cyber fraud and, by the end of the fiscal year, the Division had more than 225 ongoing cyber-related investigations.14 It is notable that, in many of these investigations, companies that were victims of cyberattacks now find themselves under investigation for how they responded to the attacks.

During FY 2018, the Commission brought an action alleging for the first time violations of Regulation S-ID, the Identity Theft Red Flags Rule, which is meant to protect individuals from the risk of identity theft.15 Specifically, the SEC brought settled proceedings against a broker-dealer and investment adviser related to alleged failures in cybersecurity policies and procedures following a cyberattack that compromised the personal information of thousands of customers in violation of Regulations S-P and S-ID.16

The Commission is focused on companies’ policies concerning cybersecurity and has emphasized the need for promptness and accuracy in cyber-related disclosures. In April 2018, the Cyber Unit was involved in bringing a cyber-related enforcement action against a technology company for allegedly misleading shareholders by not disclosing a data breach in its public filings for nearly two years.17 The $35 million settlement was the first SEC enforcement action against a public company relating to the disclosure of a data breach.18

In October 2018, the SEC issued a Report of Investigation detailing an investigation by the Enforcement Division into the internal accounting controls of nine issuers that were victims of “business email compromises,” a form of cyber fraud.19 The SEC issued the Report of Investigation pursuant to Section 21(a) of the Securities Exchange Act of 1934, forgoing a traditional enforcement action, to communicate the SEC’s view that this issue is problematic and putting issuers and individuals on notice that the SEC intends to pursue enforcement actions concerning similar conduct in the future.

In the Report of Investigation, the SEC emphasized that issuers should consider cyber threats when implementing internal accounting controls. In releasing the report, the SEC is sending a clear message that it expects issuers to not only act responsibly in the event of a cybersecurity incident but also to institute appropriate controls to mitigate the risks of cyber-related threats and safeguard company assets from those risks.

The past few years have also seen a significant increase in digital assets and crypto-asset offerings, mainly initial coin offerings (ICO). In response, the Division’s Cyber Unit began to address misconduct relating to digital assets and ICOs.20 As of the end of FY 2018, the Commission has brought over a dozen enforcement actions involving ICOs, focusing on allegations of fraud as well as compliance with the registration requirements of the federal securities laws.21 Additional ICO enforcement actions are likely in FY 2019.

Associate Desislava K. Kireva assisted in the preparation of this alert.

_________________

1 U.S. Securities and Exchange Commission Division of Enforcement, “Annual Report 2018,” available at https://www.sec.gov/divisions/enforce/enforcement-annual-report-2018.pdf (the Report).

2 A significant amount of the money ordered in FY 2018 came from a single settlement ordering payment of disgorgement and prejudgment interest totaling $933,473,797 and a penalty of $853,200,000. The order further provides that respondent’s monetary obligations (for all but $85,320,000) shall be deemed satisfied through payments made in related actions involving the Department of Justice, a class action settlement fund and Brazilian authorities. See Report at 11, n. 17.

3 The New York Times recently published its analysis of enforcement activity at the Commission and Department of Justice. Ben Protess, Robert Gebeloff and Danielle Ivory, Trump Administration Spares Corporate Wrongdoers Billions in Penalties, N.Y. TIMES (Nov. 3, 2018), https://www.nytimes.com/2018/11/03/us/trump-sec-doj-corporate-penalties.html.

4 Kokesh v. SEC, 137 S. Ct. 1635 (2017).

5 See Report at 10.

6 See id. at 4.

7 Over half of the stand-alone actions brought in FY 2018 involved retail investors. See Report at 6.

8 See id.

9 See id. at 7.

10 See id. at 12.

11 See id. at 12-13.

12 On September 29, 2018, the SEC announced that Tesla Inc. and its CEO and then-Chairman Elon Musk agreed to settle securities fraud charges brought by the Commission. See Elon Musk Settles SEC Fraud Charges; Tesla Charged With and Resolves Securities Law Charge, SEC Press Release 2018-226 (Sept. 29, 2018), https://www.sec.gov/news/press-release/2018-226. The settlements were approved by the U.S. District Court for the Southern District of New York on October 16, 2018.

13 See SEC Announces Enforcement Initiatives to Combat Cyber-Based Threats and Protect Retail Investors, SEC Press Release 2017-176 (Sept. 25, 2017), https://www.sec.gov/news/press-release/2017-176.

14 See Report at 7.

15 See id.

16 U.S. Securities and Exchange Commission Press Release, “SEC Charges Firm With Deficient Cybersecurity Procedures” (Sept. 26, 2018), available at https://www.sec.gov/news/press-release/2018-213. Regulation S-P is an SEC regulation requiring registered broker-dealers, investment companies and investment advisers to “adopt written policies and procedures that address administrative, technical, and physical safeguards for the protection of customer records and information.” 17 C.F.R. § 248.30.

17 Altaba, Formerly Known as Yahoo!, Charged With Failing to Disclose Massive Cyber Security Breach; Agrees to Pay $35 Million, SEC Press Release (Apr. 24, 2018), https://www.sec.gov/news/press-release/2018-71.

18 Additionally, the SEC issued interpretative guidance to assist public companies with preparing disclosures about cybersecurity risks and incidents.

19 Report of Investigation Pursuant to 21(a) of the Securities Exchange Act of 1934 Regarding Certain Cyber-Related Frauds Perpetrated Against Public Companies and Related Internal Accounting Controls Requirements, Exch. Act. Release No. 84,429 (Oct. 16, 2018), https://www.sec.gov/litigation/investreport/34-84429.pdf.

20 See Report at 3.

21 See id. at 7-8.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.