In the inaugural issue of Investment Management Update, we summarize regulatory, litigation and industry developments from February 2019 to May 2019 impacting the investment management sector.

Rules and Regulations

SEC Proposes Securities Offering Reforms for Business Development Companies and Registered Closed-End Investment Companies

On March 20, 2019, the Securities and Exchange Commission (SEC) voted to propose a series of rule and form amendments — as directed by Congress under the Small Business Credit Availability Act (SBCA) and the Economic Growth, Regulatory Relief, and Consumer Protection Act (Consumer Protection Act) — that are intended to modernize the registration, communication and offering processes for business development companies (BDCs) and registered closed-end investment companies (CEFs) under the Securities Act of 1933 (Securities Act). (CEFs and BDCs are defined in the proposing release and referred to in this newsletter as the “affected funds.”) Importantly, the proposed amendments would allow affected funds to use the securities offering rules that have been available to operating companies since 2005.

The proposed amendments would, among other things:

- streamline the registration process for eligible affected funds, including by allowing them to use a short-form shelf registration statement on Form N-2, which would also permit forward incorporation by reference of filings under the Securities Exchange Act of 1934 (Exchange Act);

- permit eligible affected funds to qualify as “well-known seasoned issuers” (WKSIs) under Rule 405 of the Securities Act;

- permit affected funds to satisfy final prospectus delivery requirements by using the same “access equals delivery” method as operating companies; and

- harmonize the public communication rules applicable to affected funds with those applicable to operating companies, which would provide affected funds with greater flexibility to communicate with investors, including through the use of “free writing prospectuses.”

The proposing release also includes amendments intended to further harmonize the existing disclosure and regulatory framework for affected funds with that of operating companies. In particular, the proposed amendments would impose on affected funds structured data requirements (i.e., a requirement to tag certain information using Inline eXtensible Business Reporting Language (Inline XBRL)) and new annual and current reporting disclosure requirements (i.e., under the proposed amendments, CEFs would be subject to Form 8-K current reporting requirements, just like operating companies and BDCs). Additionally, CEFs that make periodic repurchase offers pursuant to Rule 23c-3 under the Investment Company Act of 1940 (1940 Act), commonly referred to as interval funds, would be permitted to pay securities registration fees using the same method currently used by mutual funds and exchange-traded funds (ETFs).

If adopted as proposed, these amendments would have broad application in the CEF industry, impacting funds in varying degrees depending on size and type. Comments on the proposed amendments were due June 10, 2019.

For a detailed discussion regarding the proposed amendments and the benefits they may provide BDCs and CEFs, see our April 22, 2019, client alert “SEC Proposes Securities Offering Reforms for Business Development Companies and Registered Closed-End Investment Companies.” See also the proposing release “Securities Offering Reform for Closed-End Investment Companies.”

Skadden Files Comment Letter in Response to the SEC’s Proposed New Rule for Fund-of-Fund Arrangements

On December 19, 2018, the SEC proposed new Rule 12d1-4 and related amendments under the 1940 Act to “streamline and enhance the regulatory framework for fund of funds arrangements.” Among other things, the proposal would:

- create new Rule 12d1-4, which would permit registered investment companies or BDCs (acquiring funds) to acquire the securities of other registered investment companies or BDCs (acquired funds) beyond the limits contained in Section 12(d)(1) of the 1940 Act, provided certain conditions have been met;

- rescind Rule 12d1-2 under the 1940 Act (which allows open-end funds to invest in a range of other investments, including securities issued by other registered investment companies, subject to certain limits) as well as most exemptive orders granting relief from Sections 12(d)(1)(A), (B), (C) and (G) of the 1940 Act;

- amend Rule 12d1-1 under the 1940 Act to allow open-end funds investing in other open-end funds within the same fund group in accordance with Section 12(d)(1)(G) of the 1940 Act to continue to invest in unaffiliated money market funds; and

- amend Form N-CEN to include a requirement that funds report whether they have relied on new Rule 12d1-4 or the statutory exemption contained in Section 12(d)(1)(G) of the 1940 Act during the reporting period.

On May 2, 2019, we submitted a comment letter on this proposal, which contained recommendations to enhance certain aspects of new Rule 12d1-4. We noted in the letter that new Rule 12d1-4 should be revised in order to prevent potential abuses and further enhance investor protections, especially in situations involving CEFs that are often the targets of activist investors seeking to profit at the expense of CEFs’ long-term shareholders by employing an abusive discount arbitrage strategy. We also explained that new Rule 12d1-4 should be revised as follows:

- an acquiring fund should not be permitted to rely on the proposed rule unless it is truly a “passive investor” that can make the same certification about passive investment intent as is required to be eligible to file on a Schedule 13G instead of a Schedule 13D under the Exchange Act;

- an acquiring fund should be required to use only mirror voting instead of having the option between mirror voting and “pass through” voting;

- the definition of “advisory group” should be expanded to include all advisory clients, including separately managed accounts; and

- funds that do not maintain an active registration statement should be permitted to claim “acquiring fund” status in annual or semiannual reports to shareholders.

See our comment letter.

SEC Relaxes ‘In-Person’ Voting Requirements for Investment Company Boards

On February 28, 2019, the SEC’s Division of Investment Management issued a no-action letter (IDC letter) relaxing its views on “in-person” voting requirements for the board of directors of a registered management investment company (or a separate series thereof, as the context requires) or a BDC. In the IDC letter, the staff states that it would not recommend action to the SEC for violations of Sections 12(b), 15(c) or 32(a) of the 1940 Act, or Rules 12b-1 or 15a-4(b)(2) thereunder, if directors, in certain circumstances, approve the company’s investment management agreement or certain other matters (required approvals) telephonically, by video conference or by other means by which all participating directors may participate and communicate with each other simultaneously during a meeting, instead of at a meeting where the required directors are physically present.

The circumstances to which this position applies are:

- Emergency Situations: The directors needed for the required approval physically cannot be present due to unforeseen or emergency circumstances, provided that (i) no material changes to the relevant contract, plan and/or arrangement are proposed to be approved, or are approved, at the meeting, and (ii) such directors ratify the applicable approval at the next board meeting at which the directors needed for the required approval are physically present; and

- Prior Discussion Situations: The directors needed for the required approval previously fully discussed and considered all material aspects of the proposed matter at a meeting where the required directors were physically present, but did not vote on the matter at that time, provided that no director requests another meeting where all required directors are physically present.

The required approvals to which this position applies are:

- renewal (or approval or renewal in the case of prior discussion situations) of an investment advisory contract or principal underwriting contract pursuant to Section 15(c) of the 1940 Act;

- approval of an interim advisory contract pursuant to Rule 15a-4(b)(2) following the termination of an existing advisory contract under the 1940 Act (with respect to prior discussion situations only);

- selection of the fund’s independent public accountant pursuant to Section 32(a) of the 1940 Act (with respect to emergency situations, such accountant must be the same accountant as selected in the immediately preceding fiscal year); and

- renewal (or approval or renewal in the case of prior discussion situations) of the fund’s Rule 12b-1 plan.

Boards should, however, be cognizant that the IDC letter represents only the views of the staff with respect to the recommendation of enforcement action; it is not a law and it is not a rule, regulation or statement of the SEC, which has neither approved nor disapproved its content. With the emergency situations relief, in particular, this relief should only be relied upon in true emergencies. It does not apply in situations such as a change in control of an investment adviser to a fund that results in the termination of the prior contract, or the approvals required to launch a new fund (i.e., investment advisory contract, principal underwriting contract and auditors). As in the past, funds and their boards could seek individualized relief in these circumstances.

For additional information regarding the IDC letter, see our March 11, 2019, client alert “SEC Relaxes ‘In-Person’ Voting Requirements for Investment Company Boards.” See also the IDC letter.

SEC Proposes to Expand ‘Test the Waters’ Accommodation to All Issuers

On February 19, 2019, the SEC voted to propose a new rule (Rule 163B) and related amendments under the Securities Act to expand the use of “testing-the-waters” communications — currently available to emerging growth companies (EGCs) — to all issuers, including those that are, or are considering becoming, registered investment companies or BDCs. The proposal, if adopted, would permit a fund, including any person authorized to act on its behalf, to make oral and written offers to qualified institutional buyers (QIBs) and institutional accredited investors (IAIs) regarding a contemplated offering without either being an EGC or complying with the filing, disclosure and legending requirements of the 1940 Act and the Securities Act.

Proposed Rule 163B would permit any issuer, or any person authorized to act on its behalf (including an underwriter), to engage in oral or written communications with potential investors that are, or are reasonably believed to be, QIBs or IAIs, either prior to or following the filing of a registration statement, to determine whether such investors might have an interest in a contemplated registered securities offering. All issuers — including nonreporting issuers, EGCs, non-EGCs, well-known seasoned issuers and investment companies (including registered investment companies and BDCs) — would be eligible to rely on the proposed rule.

The proposed rule would be nonexclusive, and an issuer could rely on other Securities Act communications rules or exemptions when determining how, when and what to communicate related to a contemplated securities offering. The proposed rule would not be available, however, for any communication that, while in technical compliance with the rule, is part of a plan or scheme to evade the requirements of Section 5 of the Securities Act.

Under the proposed rule:

- Testing-the-waters communications would not need to be filed with the SEC or be required to include any specific legend.

- Issuers would not be required to verify investor status as long as they reasonably believe the potential investor meets the requirements of the rule. The proposing release notes that based on the particular facts and circumstances, an issuer could reasonably believe that a potential investor is a QIB or an IAI even though the investor may have provided false information or documentation to the issuer.

- Testing-the-waters communications may not conflict with material information in the related registration statement.

- Issuers subject to Regulation FD would need to consider whether any information in a testing-the-waters communication, or the fact that the issuer is making an investor outreach, would trigger disclosure obligations under that regulation or whether an exemption would apply.

Comments on the proposed rules were due April 29, 2019.

For additional information regarding proposed Rule 163B, see our February 20, 2019, client alert “SEC Proposes New Rule 163B to Expand ‘Testing-the-Waters’ Communications to All Issuers.” See also the proposing release “Solicitation of Interest Prior to a Registered Public Offering.”

SEC Issues Order Granting Exemptive Relief for Nontransparent Active ETFs

On May 20, 2019, the SEC issued an order granting exemptive relief to Precidian Funds LLC (Initial Adviser) and its registered open-end investment companies (the Trusts, and together with the Initial Adviser, Precidian) to permit them to operate actively managed ETFs that do not provide daily portfolio transparency. The relief requires the Trusts to comply with certain protective conditions in addition to those included in prior ETF exemptive orders.

ActiveShares ETFs

In the application, Precidian proposes to offer funds — ActiveShares ETFs — that are designed to provide an arbitrage mechanism that ensures the exchange-traded shares (Shares) will trade at market prices that are at or close to the net asset value (NAV) per Share of the fund without disclosing the fund’s portfolio each day.

ActiveShares ETFs would have two important structural components:

- Verified Intraday Indicative Value. To facilitate arbitrage, an ActiveShares ETF would disseminate a “verified intraday indicative value” (VIIV), reflecting the value of its portfolio holdings, calculated every second during the trading day, rather than every 15 seconds like existing ETFs. Moreover, each ActiveShares ETF also would only invest in certain securities that trade on a U.S. exchange, contemporaneously with the ETF’s Shares, and no ActiveShares ETF would buy securities that are illiquid investments. The ActiveShares ETFs would adopt uniform procedures governing the calculation and dissemination of the VIIV, and each fund’s adviser would be responsible for oversight of such process. In addition, each ActiveShares ETF would employ a primary and secondary calculation engine (together, the Calculation Engines) to provide two independently calculated sources of intraday indicative values and would employ a “Pricing Verification Agent,” who would be in charge of comparing the two data streams from the Calculation Engines on a real-time basis. If, during the process of real-time price verification, the indicative values from the Calculation Engines differ by more than 25 basis points for 60 consecutive seconds, the pricing verification agent would alert the adviser and the adviser would request that the listing exchange halt trading of the fund’s Shares until the two indicative values come back into line.

- Authorized Participant Representatives. To protect the identity and weighting of its portfolio, an ActiveShares ETF would sell and redeem its Shares in creation units to and from authorized participants (Authorized Participants) only through unaffiliated broker-dealers acting on an agency basis for the Authorized Participants (AP Representatives) using confidential brokerage accounts (Confidential Accounts). On any given business day, the names and quantities of the in-kind deposit of specified instruments and the in-kind transfer of specified instruments would correspond pro rata to the positions in the fund’s portfolio, and thus be identical. Before the commencement of trading each business day, the custodian of an ActiveShares ETF would disclose to each AP Representative the basket securities that the ActiveShares ETF would exchange for its shares, which would generally correspond to a pro rata slice of the fund’s portfolio. Pursuant to a contract, the AP Representative would be restricted from disclosing the basket of securities; the AP Representative would also undertake an obligation not to use the identity and weighting of the securities in the basket for any purpose other than executing creations and redemptions for an ActiveShares ETF. In the application, Precidian noted the importance of pro rata baskets for the proposed arbitrage mechanism.

- For creations, an Authorized Participant would deliver to the AP Representative the cash necessary to purchase the basket of securities to be exchanged for the Shares of the ActiveShares ETF.

- For redemptions, the ActiveShares ETF would deliver a basket of securities to the AP Representative, who, in turn, would sell them in exchange for cash on behalf of the Authorized Participant.

This information would permit the AP Representative to buy and sell positions in portfolio securities to permit creations or redemptions upon receiving a corresponding instruction from an Authorized Participant, without disclosing the information to the Authorized Participant.

ActiveShares License

Precidian has sought a patent over certain of the methodologies included in implementing the ActiveShares ETFs. According to the application, the ActiveShares methodology has been licensed by several managers.

Proposed ETF Rule

On June 28, 2018, the SEC approved the proposal of Rule 6c-11 under the 1940 Act, which would allow the vast majority of ETFs to operate without first obtaining an exemptive order from the SEC. In the proposing release, the SEC stated, “We are proposing to require full transparency for all ETFs under this rule rather than proposing alternative transparency requirements for index-based ETFs or actively managed ETFs.” Precidian would not be able to rely on Rule 6c-11, as currently proposed.

See the SEC order and a copy of the application.

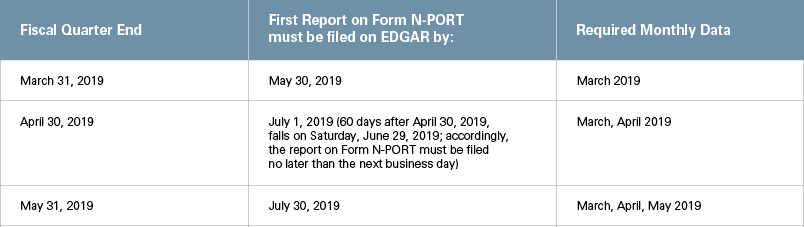

SEC Announces Modifications to Timing for Filing Nonpublic Form N-PORT Data

On February 27, 2019, the SEC adopted an interim final rule (Interim Rule) that modifies the timing of filing reports on Form N-PORT for most mutual funds, ETFs and CEFs. In the adopting rule release, the SEC remarked that the Interim Rule was a result of the SEC’s “ongoing evaluation of its collection of sensitive and non-public data,” acknowledging the cybersecurity risks associated with the “frequency, volume, complexity, as well as the potentially sensitive and non-public nature, of much of the data collected on Form N-PORT.” The SEC amended Rule 30b1-9 and Form N-PORT to require funds to file a report on Form N-PORT for each month in the fund’s fiscal quarter no later than 60 days after the end of that fiscal quarter (instead of monthly within 30 days of month-end) and to require funds, no later than 30 days after the end of each month, to maintain in their records the information that is required to be included in Form N-PORT. As a result of extending the fiscal quarter-end filing deadline from 30 to 60 days, the report on Form N-PORT for the last month of the applicable quarter will be made publicly available immediately upon filing. Prior to the amendments, the SEC would have been required to keep this data nonpublic for at least one month after filing. The Interim Rule also amends Form N-LIQUID to provide for a voluntary explanatory notes section.

The Interim Rule does not change the public availability of data reported on Form N-PORT; data reported on Form N-PORT for the first and second months of each fiscal quarter will remain nonpublic. Additionally, the current compliance dates for Form N-PORT have not changed — April 1, 2019, for large fund groups (i.e., funds that together with other investment companies in the same group of related investment companies have net assets of $1 billion or more as of the end of the most recent fiscal year of the fund) and April 1, 2020, for smaller fund groups (i.e., funds that together with other investment companies in the same group of related investment companies have net assets of less than $1 billion as of the end of the most recent fiscal year of the fund).

The table below describes the filing dates for the first reports on Form N-PORT by large fund groups:

The effective date of the Interim Rule was March 6, 2019. See the Interim Rule.

SEC Adopts Amendments to Modernize and Simplify Disclosure and Compliance Requirements

On March 20, 2019, the SEC adopted rule changes, as mandated by the Fixing America’s Surface Transportation Act (FAST Act), to modernize and simplify disclosure requirements for public companies, investment advisers and investment companies. In the adopting release, the SEC noted that the amendments are intended to “reduce[] the costs and burdens on registrants while continuing to provide all material information to investors” and “improve the readability and navigability of disclosure documents and discourage repetition and disclosure of immaterial information.” The amendments implement several recommendations contained in the SEC’s November 23, 2016, report to Congress titled “Report on Modernization and Simplification of Regulation S-K” and reflect the SEC’s experience with Regulation S-K arising from the Division of Corporation Finance’s review program and the SEC staff’s broader review of the SEC’s disclosure regime. Below is a brief overview of the notable rule changes that impact investment advisers and investment companies.

Exhibit Hyperlinks and HTML Format Requirements

Investment companies filing registration statements on Forms S-6, N-14, N-5, N-1A, N-2, N-3, N-4, N-6 and N-8B-2 and reports on Form N-CSR must generally include a hyperlink to each exhibit (other than an exhibit filed in XBRL) identified in the applicable filing’s exhibit index. A registered investment company will be required to correct an inaccurate or nonfunctioning link or hyperlink to an exhibit, although the timing requirement varies by filing type. In the case of a registration statement that is not yet effective, the filer will be required to file an amendment to the registration statement containing the inaccurate or nonfunctioning link or hyperlink. In the case of a registration statement that has become effective, the filer will be required to correct an inaccurate or nonfunctioning link or hyperlink in the next post-effective amendment, if any, to the registration statement. Finally, in the case of a report on Form N-CSR, the filer will be required to correct the inaccurate or nonfunctioning link or hyperlink in its next report on Form N-CSR.

Additionally, investment companies are now required to file registration statements and reports on Form N-CSR (and any amendments thereto) in HTML format.

Incorporation by Reference

The SEC adopted amendments to simplify and modernize the rules and forms governing incorporation by reference, including by eliminating redundant or outdated requirements. The SEC adopted amendments to Rule 0-4 and a number of forms under the 1940 Act and certain conforming amendments to Rule 0-6 under the Investment Advisers Act of 1940 (Advisers Act) and rescinded Rules 8b-23, 8b-24 and 8b-32 under the 1940 Act:

- Rule 0-4 provides general incorporation by reference rules for investment company registration statements, applications and reports filed with the SEC. Certain provisions of Rules 8b-23, 8b-24 and 8b-32 were consolidated into the amendments to Rule 0-4. Rule 0-4 was also amended to require registrants to provide hyperlinks to information that is incorporated by reference if that information is available on EDGAR.

- Rule 8b-23 (additional incorporation by reference rules for registration statements and reports), Rule 8b-24 (rules regarding summaries or outlines of documents), and Rule 8b-32 (incorporation of exhibits by reference) provide additional incorporation by reference rules for investment company registration statements and reports.

- Rule 0-6 governs incorporation by reference for investment adviser applications for SEC orders under the Advisers Act other than applications for registration as an investment adviser.

Financial Statements: Incorporation by Reference and Cross-Reference of Information. The SEC adopted amendments to Rule 0-4 under the 1940 Act that prohibit financial statements from incorporating by reference, or cross-referencing, information outside of the financial statements, unless otherwise specifically permitted or required by SEC rules, U.S. Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards as issued by the International Accounting Standards Board, whichever is applicable.

Redaction of Confidential Information in Material Contract Exhibits

The SEC adopted amendments to the registration forms used by investment companies to allow them to redact immaterial provisions or terms from exhibits filed as “other material contracts” that would likely cause the registrant competitive harm if publicly disclosed.

Omission of Schedules and Attachments

The SEC adopted amendments to the exhibit requirements of investment company registration forms and Form N-CSR to permit investment companies to omit entire schedules and similar attachments to their required exhibits in registration statements and Form N-CSR, provided the schedules and attachments do not contain material information and were not otherwise disclosed in the exhibit or the disclosure document. Each exhibit that includes omitted schedules or other attachments in reliance on these new provisions must contain a list briefly identifying the contents of each such schedule or attachment. However, registrants are not required to prepare a separate list if that information is already included within the exhibit in a manner that conveys the subject matter of the omitted schedules and attachments.

Redaction of Personally Identifiable Information

The SEC adopted amendments to investment company registration forms and Form N-CSR permitting a registrant to redact information from exhibits required to be filed if disclosure of such information would constitute a clearly unwarranted invasion of privacy. The SEC stated that registrants who choose to avail themselves of this accommodation may provide their exhibit with appropriate redactions and are not required to provide an analysis supporting the redactions at the time of filing.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A)

Currently, companies, including BDCs, are required to provide in their MD&A two comparative year-to-year discussions covering the three fiscal years presented in the financial statements. The rule changes will permit companies to omit the discussion of the earliest of the three years, so long as the company has previously filed the omitted discussion (e.g., in the prior year’s Form 10-K or other prior SEC filing). Companies electing to omit a discussion of the earliest year must include a statement identifying the location in the prior filing where the omitted discussion may be found.

Form Amendments

Exchange Act Form Cover Page Changes. The cover pages of annual reports on Forms 10-K, 20-F and 40-F will require disclosure of the company’s trading symbol(s), in addition to the (i) title of each class of securities registered under Exchange Act Section 12(b) and (ii) name of each exchange on which such securities are registered, which already are required. The same disclosure also will be required on the cover pages of quarterly reports on Form 10-Q and current reports on Form 8-K. In addition, the foregoing cover pages will need to be tagged with XBRL, subject to the three-year phase-in period described below.

Delinquent Section 16 Filings. Form 10-K will no longer include a checkbox indicating that late Section 16 filing information is or will be disclosed in the Form 10-K or annual proxy statement. In addition, the current heading required under Item 405, “Section 16(a) Beneficial Ownership Reporting Compliance,” will be changed to “Delinquent Section 16(a) Reports.”

Compliance Dates

Hyperlinks. All registration statement and Form N-CSR filings made on or after April 1, 2020, must be made in HTML format and comply with the rule and form amendments relating to the use of hyperlinks.

Confidential Treatment Requests. The amendments governing redaction of confidential information in material contract exhibits became effective on April 2, 2019. The remainder of the final amendments became effective May 2, 2019.

Inline XBRL Tagging. The new cover page XBRL tagging requirements are subject to a three-year phase-in, depending on the type of filer. Large accelerated filers and accelerated filers that prepare their financial statements in accordance with GAAP will be required to comply in reports for fiscal periods ending on or after June 15 in 2019 and 2020, respectively. All other filers will be required to comply in reports for fiscal periods ending on or after June 15, 2021.

For additional information regarding the SEC’s rule changes to modernize and simplify the disclosure and compliance obligations of SEC reporting companies, see our March 26, 2019, client alert “SEC Modernizes and Simplifies Disclosure and Compliance Requirements.” See also the SEC adopting release “FAST Act Modernization and Simplification of Regulation S-K.”

SEC Staff Requests Comments on the Custody Rule: Non-DVP Settlement and Digital Assets

On March 12, 2019, Paul Cellupica, deputy director and chief counsel of the SEC’s Division of Investment Management, on behalf of the division’s staff, issued a public letter to the Investment Adviser Association, discussing Rule 206(4)-2 under the Advisers Act (Custody Rule) and issues involving the regulatory status of investment adviser and trading practices that are not processed or settled on a delivery versus payment (Non-DVP) basis. The staff encourages advisers, other market participants and the public to comment on these issues, as well as on the application of the Custody Rule to digital assets. The staff notes that amendments to the Custody Rule are on the SEC’s long-term unified agenda.

Non-DVP Settlement

The Division of Investment Management’s Analytics Office has launched an initiative to gather information on non-DVP practices and requests input on the following questions:

- What types of instruments trade on a Non-DVP basis? How do these instruments trade?

- Describe the risks of misappropriation or loss associated with various types of Non-DVP trading. What controls do investment advisers have in place to address the risks of misappropriation related to such trading? What types of independent checks, other than a surprise examination, do investment advisers use currently to test these controls?

- Are there particular types of securities transactions settled on a Non-DVP basis that present greater or lesser risk of misappropriation or loss?

- What role do custodians play in the settlement process of Non-DVP trading? What role do they play in mitigating risks of misappropriation or loss arising from such trading?

- For advisers who currently obtain surprise examinations, what is the marginal cost of adding accounts that trade on a Non-DVP basis to the list of client accounts provided to the accountant performing the surprise examination of a sample of client accounts?

- What challenges do investment advisers have in obtaining surprise examinations regarding Non-DVP-traded securities? How do advisers to unaudited private funds that are subject to surprise examinations address these challenges?

- Are there types of external checks that could be more effective and less costly than surprise examinations with respect to Non-DVP-traded securities?

- To what extent do Non-DVP assets appear on client account statements from qualified custodians? To what extent does an investment adviser have any influence over, or input into, whether and how such assets appear on account statements? Are there any assets that trade on a Non-DVP basis that would not appear on a qualified custodian’s account statements?

- To what extent could evolving technologies, such as blockchain/distributed ledger technology (DLT), provide enhanced or diminished client protection in the context of Non-DVP trading?

Digital Assets

The staff of the Division of Investment Management and the SEC’s Strategic Hub for Innovation and Financial Technology (FinHub) have engaged with investment advisers, broker-dealers, service providers, market observers, academics and others to discuss compliance questions related to digital assets. Through its engagement with the financial services industry, the staff and market participants considered how the unique characteristics of digital assets affect compliance with the Custody Rule. The letter notes that some of these unique characteristics are “the use of DLT to record ownership, the use of public and private cryptographic key pairings to transfer digital assets, the ‘immutability’ of blockchains, the inability to restore or recover digital assets once lost, the generally anonymous nature of DLT transactions, and the challenges posed to auditors in examining DLT and digital assets.”

The staff requests input on the following questions:

- What challenges do investment advisers face in complying with the Custody Rule with respect to digital assets? What considerations specific to the custody of digital assets should the staff evaluate when considering any amendments to the Custody Rule? For example, are there disclosures or records other than account statements that would similarly address the investor protection concerns underlying the Custody Rule’s requirement to deliver account statements?

- To what extent are investment advisers construing digital assets as “funds,” “securities” or neither, for purposes of the Custody Rule? What considerations are advisers applying to reach this conclusion?

- To what extent are investment advisers including digital assets in calculating regulatory assets under management for purposes of meeting the thresholds for registering with the SEC? What considerations are included within this analysis?

- To what extent do investment advisers use state-chartered trust companies or foreign financial institutions to custody digital assets? Have these investment advisers experienced similarities/differences in custodial practices of such trust companies as compared to those of banks/broker-dealers?

- What role do internal control reports, such as System and Organization Controls (SOC) 1 and SOC 2 reports (Type 1 and 2), play in an adviser’s evaluation of potential digital asset custodians? What role should they play?

- How should concerns about misappropriation of digital assets be addressed and what are the most effective ways in which technology can be leveraged to address such concerns? How can client losses due to misappropriation of digital assets most effectively be remedied?

- What is the settlement process of peer-to-peer digital asset transactions (i.e., transactions where there is no intermediary) and what risks does this process present? What is the settlement process for intermediated transactions in digital assets, such as those that execute on trading platforms or on the over-the-counter markets, and what risks does this process present?

- To what extent do investment advisers construe digital assets as “securities” for purposes of determining whether they meet the definition of an “investment adviser” under Section 202(a)(11) of the Advisers Act? What considerations are included in such an analysis?

- To what extent can DLT be used more broadly for purposes of evidencing ownership of securities? Can DLT be useful for custody and record-keeping purposes for other types of assets, and not just digital asset securities? What, if any, concerns are there about the use of DLT with respect to custody and record keeping?

Comments can be submitted to the Division of Investment Management by emailing IMOCC@sec.gov. There is no specified deadline for comments.

See a copy of the letter.

SEC Releases No-Action Letter With Respect to Jet Charter Token

On April 3, 2019, the SEC’s Division of Corporation Finance issued a no-action letter with respect to a proposed digital asset token to be issued by TurnKey Jet, Inc. (TKJ), an air charter service.

In its letter to the SEC, TKJ explained that it faced “significant transactional costs and inefficiencies” regarding payment settlement and accepting wire transfer payments for those looking to procure charter jet services. TKJ’s business plan is to create a private, permissioned blockchain platform where charter jet users pay for a membership in the platform and then procure TKJ tokens that could be used to purchase charter jet services from carriers. The platform would also support brokers who act to connect consumers and carriers. The TKJ tokens could only be used on the platform and would not be transferable to nonmembers, and there is no assurance they could be redeemed for cash. Only TKJ would have the authority and capability to issue TKJ tokens into circulation (which it would do at a fixed price of $1 per token) or remove them from circulation upon redemption. The development of the platform and tokens would be funded by TKJ through its own capital resources and not through any token sale. The platform would be fully developed and operational at the time any tokens were sold.

In its response letter, the Division of Corporation Finance stated that it would not recommend enforcement action to the SEC if TKJ sold the tokens without registration, based on the opinion of its counsel. Among the factors the division cited were no token sale would be used to finance development; the platform would be “fully developed and operational” when the tokens were sold; and the tokens would be immediately available for purchasing air charter services, would have a fixed price and could only be used within the platform, and would be marketed solely for their functionality.

For further information regarding this no-action letter, see our April 15, 2019, client alert “Distributed Ledger: Blockchain, Digital Assets and Smart Contracts.”

Litigation

Court Rules in BlackRock’s Favor in Excessive Fee Trial

On February 8, 2019, following an eight-day bench trial, Judge Freda L. Wolfson of the U.S. District Court for the District of New Jersey ruled in favor of certain subsidiaries of BlackRock, Inc. (BlackRock) on $1.55 billion in claims brought under Section 36(b) of the 1940 Act concerning two of BlackRock’s largest mutual funds. In re BlackRock Mut. Funds Adv. Fees Litig., No. 3:14-cv-01165-FLW-TJB. Skadden represented BlackRock in the trial.

BlackRock is the first trial decision on the so-called “subadvisory” or “reverse manager of managers” theory in excessive fee litigation and is one of the largest mutual fund cases ever. The court applied the Gartenberg standard, adopted by the U.S. Supreme Court in Jones v. Harris Associates L.P., 559 U.S. 335 (2010), and determined that the shareholder plaintiffs failed to demonstrate at trial that the fee charged by BlackRock was “so disproportionate that it could not be one that was negotiated at arms’ length.” The BlackRock decision further underscores the importance of an independent, conscientious, well-informed fund board, and a robust Section 15(c) process during which information regarding the Gartenberg factors is clearly and thoughtfully outlined for the board.

On March 8, 2019, the plaintiffs provided notice that they are appealing both the February 8, 2019, post-trial order and the June 13, 2018, order partially granting the defendants’ motion for summary judgment.

For a detailed discussion of this case, see our February 19, 2019, client alert “Court Rules in BlackRock’s Favor in Excessive Fee Trial, One of Largest Mutual Fund Cases Ever.”

Robare v. SEC

On April 30, 2019, the U.S. Court of Appeals for the District of Columbia Circuit (D.C. Circuit) issued an important decision regarding the disclosure obligations of investment advisers. The court held that The Robare Group, Ltd. (Robare), an investment advisory firm, and its principals acted negligently in violation of Section 206(2) of the Advisers Act. The court concluded, however, that Robare’s and its principals’ negligent failure to disclose conflicts under Section 206(2) cannot support a finding of willfulness under Section 207 of the Advisers Act. Many feel this latter conclusion is a significant departure from precedent.

Background

Robare is an independent investment adviser located in Houston, Texas. In 2004, Robare entered into a “revenue sharing arrangement” with Fidelity Investments (Fidelity), through which Fidelity paid Robare when its clients invested in certain funds offered on Fidelity’s online platform.

The SEC’s Division of Enforcement initiated administrative and cease-and-desist proceedings against Robare and its principals in September 2014, alleging that Robare and its principals had failed for many years to disclose the compensation they receive through their arrangements with Fidelity and the conflicts of interest arising from such compensation to their clients and to the SEC, in violation of Sections 206(1), 206(2) and 207 of the Advisers Act. Section 206 proscribes fraudulent conduct by investment advisers. While a violation of Section 206(1) requires proof of scienter, proof of simple negligence is sufficient for a Section 206(2) violation. Additionally, Section 207 provides that “[i]t shall be unlawful for any person willfully to make any untrue statement of a material fact in any registration application or report filed with the Commission under section 203 or 204, or willfully to omit to state in any such application or report any material fact which is required to be stated therein.”

Following an evidentiary hearing, an administrative law judge dismissed the charges, concluding that the principals had not acted “with scienter or any intent to deceive, manipulate or defraud” its clients and that the division had failed to prove a negligent violation under Section 206(2) or a willful violation under Section 207.

The division sought de novo review by the SEC. The SEC concluded that the principals “failed adequately to disclose material conflicts of interest” and “in so doing they acted negligently (but without scienter) and thus violated Section 206(2) ... (but not Section 206(1)).” The SEC also determined that Robare and its principals violated Section 207 because they failed to disclose material conflicts of interest on Robare’s Form ADV.

The D.C. Circuit’s Opinion

The court upheld the SEC’s decision that Robare and its principals violated Section 206(2) by negligently failing to disclose the arrangement with Fidelity to their clients, noting that “the evidence before the Commission demonstrated that [Robare] and its principals persistently failed to disclose known conflicts of interest arising from the payment arrangement with Fidelity in a manner that would enable their clients to understand the source and nature of the conflicts.” The court agreed with the SEC that the generalized conflicts disclosure in Robare’s Form ADV, Robare’s General Information and Disclosure Brochure and Fidelity’s Brokerage Account Client Agreement did not fully describe Robare’s payment arrangements with Fidelity and failed to adequately alert clients to the potential conflicts of interest presented by the payment arrangement. Moreover, the court stated that “[b]ecause a reasonable adviser with knowledge of the conflicts would not have committed such clear, repeated breaches of its fiduciary duty, [Robare] and its principals acted negligently.”

With respect to the meaning of “willfully” under Section 207, the court “assumed (without deciding)” that the standard set forth in Wonsover v. SEC, 205 F.3d 408, 413-15 (D.C. Cir. 2000), governs this case. In Wonsover, the court stated that willfully means “intentionally committing the act which constitutes the violation” and rejected the interpretation that a person “[must] also be aware that he is violating” the federal securities laws. The SEC had argued that the principals acted willfully because they reviewed the Form ADVs before the forms were filed with the SEC and were responsible for the forms’ content. The court in Robare held that the SEC misinterpreted Wonsover. The court explained that Section 207 “does not proscribe willfully completing or filing a Form ADV that turns out to contain a material omission but instead makes it unlawful ‘willfully to omit ... any material facts’ from a Form ADV.” The SEC therefore had to find that at least one of the principals “subjectively intended to omit material information” from the Form ADVs. Because the SEC found that its principals negligently failed to disclose conflicts of interest in the Form ADV, the court determined that the SEC could not rely on the same failures as evidence of “willful” conduct for purposes of Section 207.

See the D.C. Circuit’s opinion.

SEC Takes Unexpected Disclosure Position in Deutsche Bank Case

On April 25, 2019, the SEC charged Deutsche Bank Trust Company Americas (Deutsche) with violating Section 17(a)(2) of the Securities Act, which prohibits any person in the offer or sale of securities from obtaining money or property by means of any untrue statement of material fact or any omission to state a material fact necessary in order to make statements made not misleading.

According to the SEC’s order, Deutsche, in marketing materials, requests for proposals and other related documents provided to clients, disclosed that it relies on an independent, in-house research group that uses a “multi-step due diligence process to identify, evaluate and select best-in-class asset managers.” The SEC’s order takes the position that Deutsche’s disclosures in its marketing materials and advisory agreements did not adequately disclose that Deutsche only evaluated and recommended hedge funds that would agree to share their management fees with Deutsche (referred to as “retrocessions”). On this basis, the SEC determined that Deutsche’s disclosures were materially misleading.

This is an unexpected expansion of the SEC’s position on what constitutes adequate disclosure to clients given that Deutsche’s advisory agreements contained general disclosure that Deutsche “may” receive retrocessions and that prior to acquiring any interests in a hedge fund for clients Deutsche disclosed to each client the existence and amount of the retrocession it would receive from that hedge fund. In this case, the SEC appears to have taken issue with (i) the fact that Deutsche did not further disclose that it would only recommend hedge funds that agreed to pay retrocessions and (ii) the use of “may” as opposed to more definitive language. Although the SEC’s position here was unexpected, it offers the opportunity for others to reconsider and reevaluate generalized disclosures that have historically been considered adequate and not misleading under the federal securities laws.

See the SEC’s order.

Court Enjoins Blockvest Initial Coin Offering

On February 14, 2019, Judge Gonzalo P. Curiel of the U.S. District Court for the Southern District of California granted the SEC’s motion for reconsideration in its enforcement action against Blockvest, LLC and its chairman and founder Reginald Buddy Ringgold III arising out of the defendants’ offer and sale of digital tokens. Judge Curiel had previously denied the SEC’s motion for a preliminary injunction. Upon further review, however, the court considered marketing materials on the Blockvest website and concluded that the SEC’s evidence was sufficient to give rise to a prima facie showing that defendants engaged in an unregistered securities offering under Howey. In light of this conclusion, as well as the likelihood of future violations, the court granted the SEC’s reconsideration motion and imposed a preliminary injunction from violating the Securities Act.

For further information regarding Blockvest, see our April 15, 2019, client alert “Distributed Ledger: Blockchain, Digital Assets and Smart Contracts.”

Industry Developments

Director of Division of Investment Management Delivers Keynote Address at the ICI Mutual Funds and Investment Management Conference

On March 18, 2019, Director Dalia Blass of the SEC’s Division of Investment Management delivered the keynote address at the Investment Company Institute’s Mutual Funds and Investment Management Conference. In her address, she discussed (i) the division’s 2018 agenda and accomplishments; (ii) its goals for 2019, particularly the division’s focus on proxy advisers and international policy; and (iii) asset management trends in 2019.

2018 Agenda and Accomplishments

Director Blass highlighted the division’s work in 2018 to “improve the investor experience,” noting its request for comment on how to improve investment company disclosures, the proposal to improve variable annuity disclosure through the use of summary prospectuses, and the adoption of a notice and access approach to the delivery of shareholder reports. Director Blass noted the development of the proposed “customer or client relationship summary” (Form CRS), which registered advisers, broker-dealers and dual registrants will be required to deliver to retail investors;1 the proposed interpretative guidance under the Investment Advisers Act of 1940 (Advisers Act), which she stated “would clarify the investment adviser fiduciary duty”; and Regulation Best Interest, which she stated is “designed to enhance the standard of conduct for broker-dealers when making recommendations to their retail customers.”

On the division’s efforts to modernize the regulatory framework, Director Blass noted its recommendations to the SEC on ETFs, fund of funds, fund liquidity reporting and fund research reports.

Director Blass also discussed the division’s Board Outreach Initiative and its issuance of no-action letters on the affiliated transaction rules and in-person meeting requirements and engagement with fund boards to update the SEC’s valuation and auditing guidance.

Looking Ahead to 2019

Director Blass discussed the division’s goals for 2019, including continued efforts on the Investor Experience Initiative, modernization efforts and “good government” projects.

On the Investor Experience Initiative, Director Blass noted that the division is considering ideas from its request for comments on improving investment company disclosure and also studying the comments on the variable annuity disclosure proposal. She also stated that the division is continuing to prioritize delivering to the SEC its recommendations on Form CRS and the fiduciary duty interpretation and working closely with the Division of Trading and Markets to support its efforts on Regulation Best Interest.

On the division’s modernization efforts, Director Blass noted that finalizing the ETF and fund of funds rules will be a high priority.

On the Board Outreach Initiative, Director Blass noted that the division will be recommending updates to the SEC’s valuation guidance, advancing into the public comment process a proposal for BDC and CEF offering reform (see “SEC Proposes Securities Offering Reforms for Business Development Companies and Registered Closed-End Investment Companies” above) and presenting a proposal on modernizing the advertising and solicitation rules for investment advisers and a re-proposal regarding the use of derivatives by investment companies.

On the division’s “good government” projects, Director Blass stated that it will review prior staff statements to determine whether any of the prior statements should be modified, rescinded or supplemented in light of market or other developments. Additionally, she noted that the Chief Counsel’s Office has been working to improve the exemptive application process to create a more streamlined approach.

Proxy Advisers. Director Blass stated that in 2019, the division will explore ways to update current guidance to clarify how investment advisers should fulfill their fiduciary duties with respect to the proxy process. In particular, the division’s review will include the following questions: (i) how to promote voting practices that are in the best interests of advisory clients, including voting on an issuer-specific basis when appropriate; (ii) whether advisers are expected to vote every proxy; (iii) how advisers should evaluate recommendations of proxy advisers, particularly where the issuer disagrees with the factual assumptions of the recommendation; and (iv) how advisers should address conflicts of interest that a proxy adviser may have.

International Policy. Director Blass discussed two major themes for the division’s work in international policy: (i) monitoring the effects of foreign policy on regulated entities and (ii) engaging with international organizations that have shown an interest in asset management policy.

On the first theme, Director Blass noted that regulatory change in Europe can pose significant challenges for U.S. firms, especially in regard to the European Union’s Markets in Financial Instruments Directive (MiFID II). Director Blass discussed the three no-action letters released in 2018 to assist in compliance with MiFID II. She noted that the division has been engaging with a wide variety of interested parties to support additional policy initiatives, and she shared four observations. First, she stated that in considering any potential regulatory steps, the division should be mindful of the many parties and interests involved. Second, she stated that the division has looked closely at the Advisers Act. She explained that the act establishes a “principles-based regime that provides significant flexibility to accommodate relationships with both modest retail accounts and large institutional accounts.” Third, she stated the development of certain market solutions — such as fund managers using reconciliation or reimbursement processes to deliver cost transparency while addressing compliance — may make extending no-action relief unnecessary. Finally, she noted that the SEC staff encourages market participants to continue to engage with the division, including with respect to solutions to “create a permanent blanket exemption from the protections of the [Advisers] Act for providers of research to institutional asset managers.”

On the second theme, Director Blass noted that the division will continue to engage with the International Organization of Securities Commissions and the Financial Stability Board on conversations regarding the U.S. asset management markets.

See a copy of Director Blass’ speech.

SEC Delays Decision on Bitwise Bitcoin ETF and VanEck SolidX Bitcoin Trust

The SEC recently delayed decisions on proposals to list and trade shares of the Bitwise Bitcoin ETF Trust (Bitwise ETF) and the VanEck SolidX Bitcoin Trust (VanEck ETF). On January 28, 2019, the NYSE Arca, Inc. (NYSE Arca) filed with the SEC a proposed rule change to list and trade shares of the Bitwise ETF; similarly, on January 30, 2019, following the withdrawal of its previous application, the Cboe BZX Exchange, Inc. (BZX) refiled with the SEC a proposed rule change to list and trade shares of SolidX Bitcoin Shares issued by the VanEck ETF.

To approve a Bitcoin ETF rule change, the SEC must find that the rule meets the requirements of Exchange Act Section 6(b)(5), which requires, in relevant part, that the rules of a national securities exchange be designed “to prevent fraudulent and manipulative acts and practices” and “to protect investors and the public interest.” The main concerns of the SEC continue to be market manipulation and the measures taken by the exchanges to protect investors, including a focus on surveillance sharing agreements and an analysis of whether bitcoin is itself inherently resistant to market manipulation. There appear to be two central questions of concern to the SEC, as outlined in its earlier rejection of the Bats BZX Exchange, Inc. application to list and trade shares of the Winklevoss Bitcoin Trust:

- Unique Resistance. Whether the bitcoin market is uniquely resistant to market manipulation and fraudulent activity; and

- Surveillance Sharing. Whether the listing exchange has entered into a surveillance sharing agreement with a regulated market of significant size in bitcoin or derivatives on bitcoin.

The sponsor for Bitwise ETF argued in its application, as amended on May 7, 2019, that the Bitwise ETF meets these objectives, and the sponsor for VanEck ETF has made this argument as well. On May 14, 2019, the SEC announced in a filing that it was delaying its decision on the Bitwise ETF, and on May 20, 2019, the SEC announced in a filing that it was delaying its decision on the VanEck ETF. In both instances, the SEC solicited additional public comment on a variety of topics that largely reflected these apparent concerns regarding market manipulation and the measures taken by the platforms to protect its investors.

See the SEC order for Bitwise ETF and the SEC order for VanEck ETF.

OCIE Risk Alert: Investment Adviser and Broker-Dealer Compliance Issues Related to Regulation S-P — Privacy Notices and Safeguard Policies

On April 16, 2019, the SEC’s Office of Compliance Inspections and Examinations (OCIE) issued a risk alert, which identifies compliance issues related to Regulation S-P that the OCIE staff observed during its recent examinations of registered investment advisers and broker-dealers. The OCIE staff noted that the information in the risk alert is intended to assist advisers and broker-dealers in providing compliant privacy and opt-out notices and adopting and implementing effective policies and procedures for safeguarding customer records and information under Regulation S-P.

The risk alert explains that Regulation S-P, among other things, requires a registrant to: (i) provide a clear and conspicuous notice to its customers that accurately reflects its privacy policies and practices generally no later than when it establishes a customer relationship (Initial Privacy Notice); (ii) provide a clear and conspicuous notice to its customers that accurately reflects its privacy policies and practices not less than annually during the continuation of the customer relationship (Annual Privacy Notice, and together with the Initial Privacy Notice, Privacy Notices); and (iii) deliver a clear and conspicuous notice to its customers that accurately explains the right to opt out of some disclosures of nonpublic personal information about the customer to nonaffiliated third parties (Opt-Out Notice).

The risk alert also explains that the “safeguard rule” of Regulation S-P (Safeguard Rule) requires registrants to adopt written policies and procedures that (i) “address administrative, technical, and physical safeguards for the protection of customer records and information”; and (ii) are “reasonably designed to ensure the security and confidentiality of customer records and information, protect against any anticipated threats or hazards to the security or integrity of customer records and information, and protect against unauthorized access to or use of customer records or information that could result in substantial harm or inconvenience to any customer.”

Privacy and Opt-Out Notices

The OCIE staff found that registrants failed to provide Initial Privacy Notices, Annual Privacy Notices and Opt-Out Notices to their customers or such notices did not accurately reflect a firm’s policies and procedures. The staff also noted Privacy Notices that did not provide notice to customers of their right to opt out of the registrant sharing their nonpublic personal information with nonaffiliated third parties.

Lack of Policies and Procedures

The OCIE staff found that registrants did not have written policies and procedures as required under the Safeguard Rule. The staff also found written policies and procedures that contained numerous blank spaces designed to be filled in by registrants and policies that addressed the delivery and content of a Privacy Notice, but did not contain any written policies and procedures required by the Safeguard Rule.

Policies Not Implemented or Not Reasonably Designed to Safeguard Customer Records and Information

The OCIE staff found that registrants had written policies and procedures that did not appear implemented or reasonably designed to “(1) ensure the security and confidentiality of customer records and information, (2) protect against anticipated threats or hazards to the security or integrity of customer records and information, and (3) protect against unauthorized access to or use of customer records or information that could result in substantial harm or inconvenience to customers.”

The OCIE staff encouraged registrants to review their written policies and procedures, including their implementation of those policies and procedures, to ensure that they comply with Regulation S-P.

See the OCIE risk alert “Investment Adviser and Broker-Dealer Compliance Issues Related to Regulation S-P — Privacy Notices and Safeguard Policies.”

SEC Staff Issues Accounting and Disclosure Information on Filings Under Rule 485(a) of the Securities Act

On April 2, 2019, the SEC’s Division of Investment Management issued Accounting and Disclosure Information 2019-07 (ADI) regarding the SEC staff’s review of certain filings under Rule 485(a) of the Securities Act.

Rule 485(a) provides that a post-effective amendment to a registration statement filed by a registered open-end fund can become effective as early as 60 days after filing. Additionally, the rule allows a new open-end fund that is organized as a new series of an existing registrant to file a post-effective amendment to an existing registration statement that becomes automatically effective in as early as 75 days. SEC staff action is not required to bring about effectiveness in either case.

The ADI states that while most filings seeking automatic effectiveness under Rule 485(a) do not raise unique or novel issues, filings that “raise complex issues not easily resolved because of a lack of precedent” can complicate the SEC staff’s efforts to effectively protect investors. The ADI provides examples of issues in filings that require additional review and interaction with disclosure reviewers, noting that such issues “typically involve novel investment strategies, fee structures, and/or operational policies (e.g., significant changes to policies related to purchases and redemptions by investors).”

In the ADI, the SEC staff urges registrants to contact the staff before making any filings under Rule 485(a) if such filings may “raise material questions of first impression” or “address issues in a manner inconsistent with previous precedent.” The SEC staff additionally requests that registrants respond to staff comments on a Rule 485(a) filing as a general matter no later than five business days before the filing is scheduled to become effective automatically.

See the ADI.

OCIE Risk Alert: Transfer Agent Safeguarding of Funds and Securities

On February 13, 2019, OCIE issued a risk alert based on its examinations of transfer agents that also served as paying agents over a three-year period. The risk alert highlights risks and issues associated with paying agent activities, identifies significant exam deficiencies related to the safeguarding of funds and securities by paying agents, and provides a listing of some common features of robust safeguarding policies, procedures and controls for paying agents.

As noted in the risk alert, paying agent activities vary but commonly include:

- Processing and disbursing principal, interest and dividend payments to bondholders or shareholders based on an issuer’s payment schedule;

- Administering direct stock purchase and dividend reinvestment plans;

- Handling escheatment and lost shareholder search and report filing;

- Managing interest bearing accounts or demand deposit accounts in the name of mutual funds for activities such as inflows and outflows from fund orders; and

- Making distributions for mutual funds.

The OCIE staff stated that its observations from recent examinations of paying agents generally fall into two categories: (i) the transfer agents’ safeguarding of funds and securities, as required by Rule 17Ad-12 (Safeguarding Rule) under the Exchange Act; and (ii) the transfer agents’ notification to unresponsive payees and policies and procedures for lost securityholder searches, as required by Rule 17Ad-17 (Lost Securityholder/Unresponsive Payee Rule) under the Exchange Act.

Safeguarding Rule

The risk alert provides examples of deficiencies and weaknesses that the OCIE staff observed in connection with the Safeguarding Rule, including (i) misappropriation of shareholder funds and the theft of physical certificates by transfer agents; (ii) inadequate policies, procedures and controls for the safeguarding of funds and securities, including, for example, instances in which transfer agents did not have policies and procedures for any paying agent activities or policies and procedures that address the issuance and handling of checks, the distribution of dividends, bank account reconciliation, escheatment or periodic redemption requests for limited partnerships; (iii) inadequate account reconciliation controls and procedures; and (iv) instances in which agents did not secure access to vaults, computers and areas of the firm that handle disbursement operations, creating a risk of theft, loss or destruction.

Lost Securityholder/Unresponsive Payee Rule

The risk alert also provides examples of deficiencies and weaknesses that the OCIE staff observed in connection with the Lost Securityholder/Unresponsive Payee Rule, including (i) failures by transfer agents to comply with database search requirements to identify lost securityholders using public resources; (ii) failures to send written notifications to unresponsive payees and failures to send these notifications in a timely manner; and (iii) weaknesses with the transfer agents’ Lost Securityholder/Unresponsive Payee Rule policies and procedures, including written procedures that did not require database searches, address unresponsive payee notifications, designate responsibility for performing and documenting reviews, or outline the methodology utilized to comply with the rule.

Robust Policies, Procedures and Controls

The risk alert states that during the examinations, the OCIE staff observed several transfer agents that appeared to have implemented robust written policies, procedures and controls related to the processing of funds, handling of physical certificates, lost securityholder searches and unresponsive payee notifications, and included examples of these practices for transfer agents to consider implementing.

See the OCIE risk alert “Transfer Agent Safeguarding of Funds and Securities.”

SEC Releases Framework for Analyzing Initial Coin Offerings

On April 3, 2019, the SEC’s FinHub released its much-anticipated guidance (the Framework) for analyzing whether U.S. federal securities laws apply to so-called initial coin offerings (ICOs) under the U.S. Supreme Court’s decision in SEC v. W.J. Howey Co., 328 U.S. 293 (1946) (holding that an “investment contract” constitutes a regulated security when three factors are satisfied: (1) an investment of money (2) in a common enterprise (3) with the reasonable expectation of profits derived from the efforts of others). Although the Framework provides insight into how the SEC views certain factors that may arise in an ICO analysis, it is evident that a Howey analysis of an ICO very much remains a case-by-case facts and circumstances analysis. It should also be noted that the primary focus of the Framework is on so-called utility tokens (i.e., tokens that are presold but that will eventually have use to procure goods or services on a platform). The Framework is less focused on cryptocurrencies and does not address tokens used to securitize a physical asset (such as real property), since such “security tokens” are typically not offered in an ICO.

The Framework focuses heavily on the third prong of Howey — reasonable expectation of profits derived from the efforts of others — noting briefly that with most digital assets, the first and second prongs (investment of money and common enterprise, respectively) were typically satisfied. However, it is noteworthy that when discussing the investment-of-money prong, FinHub states that “airdrops” — where a digital asset is distributed to holders of another digital asset or simply offered at no cost — can satisfy this Howey factor, providing some clarity in the debate as to whether using them automatically means an ICO would not meet the Howey factors. Additionally, FinHub’s framework notes that while courts often analyze for horizontal or vertical commonality, the SEC’s position is that common enterprise is not “a distinct element” of the analysis, and rather, the fact that “the fortunes of digital asset purchasers have been linked” is typically enough to satisfy the test.

With respect to the third prong (reasonable expectation of profits derived from the efforts of others), the Framework breaks the analysis into three separate parts: reliance on the efforts of others, reasonable expectation of profits and other relevant considerations. After noting that this prong is an objective test, the Framework provides characteristics of each of the subparts to provide some guidance to individuals in determining whether an ICO is an investment contract.

For a detailed discussion of the Framework, including on the three subparts of the third prong of Howey, see our April 15, 2019, client alert “Distributed Ledger: Blockchain, Digital Assets and Smart Contracts.”

_______________

1 Under the proposed rule, firms would be required to deliver to retail investors a four-page customer or client relationship summary on Form CRS, disclosing the nature and scope of services provided by the firm, the types of fees customers would incur, the conflicts of interest faced by the firm and the firm’s disciplinary history. In addition to the Form CRS requirement, the proposed rule would restrict the use of the terms “adviser” and “advisor” by a broker-dealer and its associated persons, and require a firm and its investment professionals to disclose their SEC registration status in communications with retail investors.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.