Introduction

The Main Street lending program is a key component of the federal government's response to the economic impact of the COVID-19 pandemic. Implemented and primarily funded by the Federal Reserve, the program is expected to facilitate hundreds of billions of dollars of low-interest loans to a wide range of businesses.

See all our COVID-19 publications and webinars.

The Federal Reserve first mentioned its intent to create a Main Street program to facilitate loans to small- and medium-sized businesses in a broader press release on March 23, 2020. An outline of the Main Street program's contemplated structure and terms did not emerge until the Federal Reserve released initial term sheets on April 9, 2020. The Federal Reserve then issued revised term sheets, as well as guidance in the form of answers to frequently asked questions, on April 30, 2020. In late May and early June, the Federal Reserve released further updated guidance and legal documentation for the Main Street program. Those materials are available here.

Sources of Government Funding for the Main Street Program

The Main Street program derives its legal authority and government funding from two places: (i) an equity investment by the U.S. Department of the Treasury (Treasury) authorized under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and (ii) emergency debt funding provided by the Federal Reserve under Section 13(3) of the Federal Reserve Act.

The CARES Act became law on March 27, 2020. The economic stimulus package in the CARES Act included federal funding for business stimulus in three broad categories: (i) funding to support small businesses through programs administered by the Small Business Administration (SBA), including the Paycheck Protection Program (PPP); (ii) support in the form of grants and loans from Treasury to passenger air carriers and related businesses, cargo air carriers and businesses critical to maintaining national security; and (iii) authority for Treasury to invest more than $450 billion in lending programs to be established by the Federal Reserve.1 Using funds authorized under this third category, Treasury will make an initial $75 billion equity investment in the Main Street program.

The total dollars available under the Main Street program will be much greater than the amount invested by Treasury. The Main Street program also will draw on the Federal Reserve's practically unlimited financial capacity as the U.S. central bank. The Federal Reserve has long-standing authority under Section 13(3) of the Federal Reserve Act to implement and fund lending programs in "unusual and exigent circumstances."2 Using this emergency lending authority, the Federal Reserve will provide significant debt funding to the Main Street program.3

Taking into account both Treasury's equity investment of $75 billion and the Federal Reserve's emergency debt funding, the Federal Reserve set the initial aggregate size of the Main Street program at $600 billion. The Federal Reserve indicated that it will continue to assess the situation and may adjust the size of the program in the future.

Basic Structure of the Main Street Program

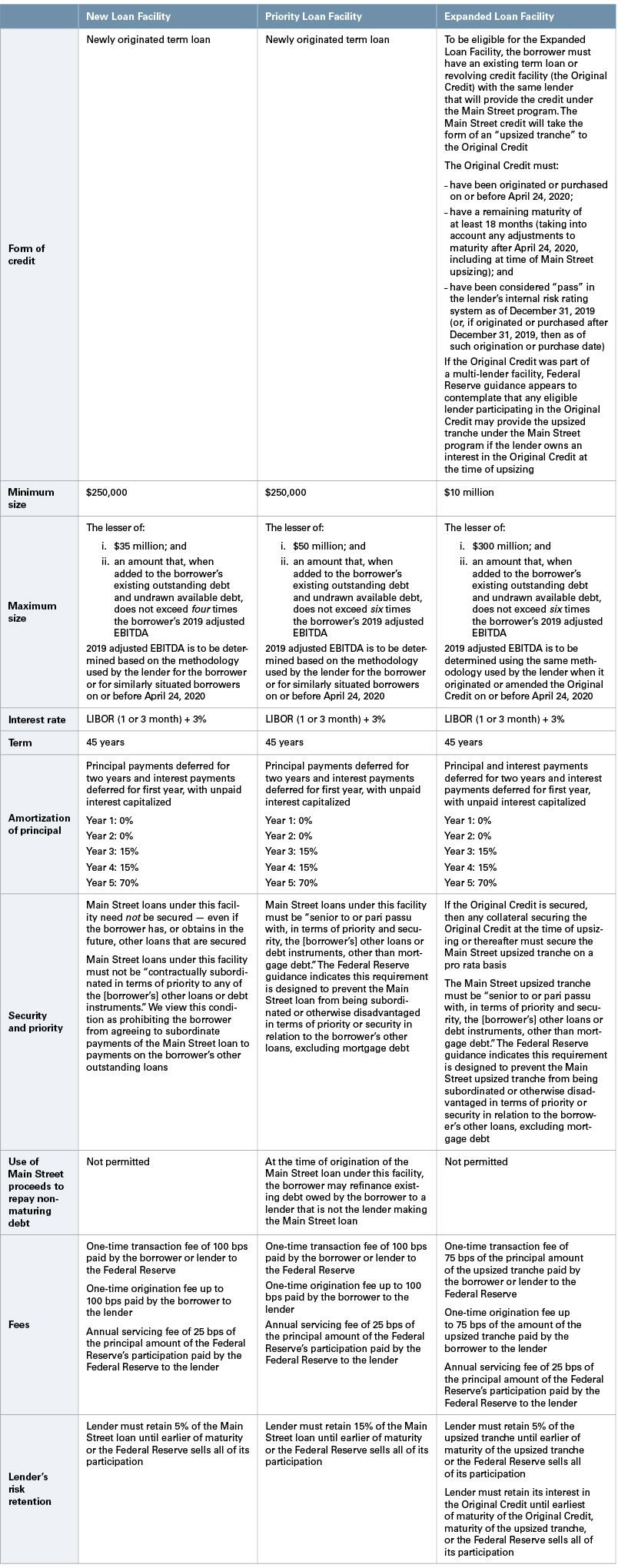

The Main Street program consists of three facilities: Main Street New Loan Facility, Main Street Priority Loan Facility and Main Street Expanded Loan Facility. The table below highlights key features of the three facilities. However, all three facilities have the same basic structure.

Under the Main Street program, an eligible borrower may apply to an eligible lender for term credit that has a five-year maturity with principal payments deferred during the first two years and interest payments deferred during the first year, has an interest rate of LIBOR plus 3%, and is prepayable without penalty. As part of the loan application, the applicant will provide to the lender a number of certifications to establish that the applicant meets the criteria of an eligible borrower under the Main Street program. Those eligibility criteria are summarized in the section below on eligible borrowers.

The Main Street program is not like the SBA's PPP, in which small business applicants that meet the basic eligibility requirements are processed by banks without much additional case-by-case review by the lender. In the Main Street program, simply meeting the Federal Reserve's criteria as an eligible borrower will not entitle an applicant to be approved or to receive the maximum allowable loan amount. The ultimate decision whether to extend credit to the applicant will rest with the lender. The Federal Reserve has made clear that lenders should "apply [their] own underwriting standards in evaluating the financial condition and creditworthiness of the borrower" and that lenders may require additional information and documentation from applicants.4

If a lender approves the applicant for a Main Street loan, then the lender will originate and fund the loan. The lender will then be able to sell a 95% participation in the loan at par to a special purpose vehicle established by the Federal Reserve. The lender will retain the remaining interest in the loan and will service the loan.

By selling the participation in the Main Street loan to the Federal Reserve-backed special purpose vehicle, the lender will significantly mitigate its credit risk and capital cost of extending credit to the borrower. In this manner, the Federal Reserve intends that lenders will be more willing to extend credit at favorable terms to eligible borrowers and thereby support the economy during the pandemic.

Eligible Lenders

Eligible lenders in the Main Street program are U.S. federally insured depository institutions (e.g., FDIC-insured banks and thrifts and NCUA-insured credit unions), U.S. branches and agencies of foreign banks, and many U.S. nonbank affiliates of the foregoing. There is no requirement that eligible lenders participate or offer Main Street loans to their customers.

Eligible Borrowers

This section summarizes the key criteria to be an eligible borrower under the Main Street program.

U.S. Presence

An eligible borrower must be a for-profit5 business that:

- was established prior to March 13, 2020;

- was created or organized in the United States or under the laws of the United States;

- has "significant operations in" the United States; and

- has a "majority of its employees based in" the United States.

Nothing in the CARES Act or the Federal Reserve guidance to date suggests that a party who otherwise meets these criteria would be disqualified from participating solely because it has a non-U.S. parent company.

Size Test. An eligible borrower must meet at least one of the following two size tests.

Employee Count. The borrower and all of its affiliates together had 15,000 or fewer employees based on the average total number of employees for each pay period over the 12 months prior to origination of the Main Street loan. Businesses should count as employees all full-time, part-time, seasonal or otherwise employed persons, excluding volunteers and independent contractors.

Revenue. The borrower and all of its affiliates together had 2019 annual revenues of $5 billion or less. The Federal Reserve guidance provides alternative methodologies to determine revenues for this purpose, allowing reliance on either 2019 audited financial statements in accordance with GAAP or annual receipts for 2019 as reported to the Internal Revenue Service (IRS). The Federal Reserve guidance to date does not indicate a methodology to be used for purposes of the eligibility revenue test if neither of these sources is applicable (e.g., unaudited financial statements, non-GAAP accounting or receipts not required to be reported to the IRS).

Both of these size tests require aggregation of the borrowing entity with its affiliates. In determining what entities are affiliates of the borrower for purposes of these size tests, the Federal Reserve guidance incorporates by reference the affiliation rules of the SBA. The SBA affiliation rules generally treat entities as affiliates based on concepts of control and common control. Such control can exist under the SBA affiliation rules under various circumstances based on ownership (including at levels below 50% of voting stock), common management, governance rights (e.g., veto rights over major decisions of board of directors), or other relationships.

Loans With Lender Must Have Been Considered 'Pass'

Banks generally maintain internal risk monitoring programs that assign risk ratings to loans and other credits consistent with supervisory guidance from their regulators. A loan is typically considered "pass" when the bank has not risk-rated the loan as having potential weaknesses deserving bank management's close attention (i.e., special mention) or worse (i.e., substandard, doubtful or loss). If a Main Street applicant had other loans outstanding with the lender as of December 31, 2019, then those other loans generally must have been considered "pass" within the lender's internal risk rating system as of December 31, 2019.8

Must Not Be Insolvent

The Federal Reserve is not permitted to use its emergency lending authority under Section 13(3) to lend to parties who are “insolvent.” Each borrower in the Main Street program will generally be required to certify that it is not in bankruptcy or certain other insolvency proceedings and it was not generally failing to pay undisputed debts as they became due during the 90 days preceding the Main Street loan (unless such failure was because of certain governmental actions related to the COVID-19 pandemic).

Must Not Be on List of Ineligible Businesses

An eligible borrower must not be deemed an "ineligible business" under certain SBA regulations cited in the Federal Reserve term sheets.9 Some examples of "ineligible businesses" are financial businesses primarily engaged in the business of lending; passive businesses owned by developers and landlords that do not actively use or occupy the assets acquired or improved with the loan proceeds (except for certain eligible passive companies defined under the SBA regulations); life insurance companies; and hedge funds and private equity firms (although portfolio companies of hedge funds and private equity firms may be eligible).

Unable To Secure Adequate Credit Accommodation

Section 13(3) requires the Federal Reserve, when using its emergency lending authority, to obtain evidence that participants are “unable to secure adequate credit accommodations from other banking institutions.” Federal Reserve regulations provide flexibility in how the Federal Reserve can meet this requirement, including by relying on evidence of economic or market conditions generally or on a simple certification from the participant."

The Federal Reserve indicated that participants will be required to certify that “as of the date [of the certification,] the [b]orrower[] is unable to secure adequate credit accommodations from other banking institutions, consistent with 12 CFR 201.4(d)(8).” The Federal Reserve indicated that this certification “does not necessarily mean that no other credit is available for the [b]orrower’s purpose. Rather the [b]orrower can certify that it is unable to secure ‘adequate credit accommodations’ because the amount, price, or terms of credit available from other sources are inadequate for the [b]orrower’s needs during the current unusual and exigent circumstances.”

Limitation on Participation in Other Stimulus Programs

An eligible borrower must not have received specific support under Title IV of the CARES Act, which generally refers to those stimulus programs providing grants and direct loans to specific industries (e.g., air carriers and related businesses, air cargo and national security). The Federal Reserve made clear that participation in the SBA PPP does not prohibit a borrower from also participating in the Main Street program.

An eligible borrower may participate in only one of the Main Street facilities and may not also participate in the Federal Reserve’s Primary Market Corporate Credit Facility (PMCCF). The PMCCF is a Federal Reserve program that purchases newly issued bonds, or makes syndicated loans to, investment-grade borrowers.

Prohibition on Certain Capital Distributions

A Main Street borrower must comply with the following prohibitions while the loan is outstanding and for an additional 12 months.

No Buybacks of Publicly Traded Equity. A Main Street borrower may not repurchase equity securities of itself or its parent that were listed on a national exchange while the loan was outstanding, except as otherwise required pursuant to a contract in effect on March 27, 2020.

No Dividends or Capital Distributions on Common Stock. A Main Street borrower may not pay dividends or make other capital distributions on common stock. In its revised term sheets and guidance, the Federal Reserve clarified that this prohibition will not apply to distributions made by an S corporation or other tax pass-through entity to the extent reasonably required to cover its owners' tax obligations in respect of the entity's earnings.

Restrictions on Compensation

A Main Street borrower must comply with the following compensation restrictions while the loan is outstanding and for one additional year.

No Increases for Employees Above $425,000. An officer or employee of the borrower whose total compensation exceeded $425,000 in calendar year 2019 may not receive (i) total compensation from the borrower during any 12-consecutive-month period exceeding the total compensation that individual received in calendar year 2019 or (ii) severance pay or other benefits upon termination of employment exceeding twice the total compensation that individual received in calendar year 2019. This limitation does not apply to employees whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020.

Cutback for Employees Above $3 Million. An officer or employee of the borrower whose total compensation exceeded $3 million in calendar year 2019 may not receive total compensation from the borrower during any 12-consecutive-month period in excess of the sum of $3 million plus 50% of the total compensation over $3 million the individual received in calendar year 2019.

For purposes of these restrictions on compensation, the CARES Act defines "total compensation" to include "salary, bonuses, awards of stock, and other financial benefits provided by [the borrower] to an officer or employee of the [borrower]."10

Efforts to Maintain Payroll and Retain Employees

The Federal Reserve term sheets state that a Main Street borrower "should make commercially reasonable efforts to maintain its payroll and retain its employees during the time the [Main Street loan] is outstanding."11 The guidance appears to refine this "commercially reasonable efforts" standard and explains that a Main Street borrower should "undertake good-faith efforts to maintain payroll and retain employees, in light of its capacities, the economic environment, its available resources, and the business need for labor."12 It is unclear what form this requirement may take in the definitive documentation of Main Street loans.

Public Disclosure of Participation

Parties considering the Main Street program should expect that their participation will become public. The Federal Reserve has indicated that it will publicly disclose information regarding participation in the Main Street program, including the names of lenders and borrowers, amounts borrowed, interest rates charged, and overall costs, revenues and fees. In addition, the CARES Act grants Congress significant oversight authority, and establishes various oversight and investigatory bodies, with respect to the economic stimulus programs that receive funding thereunder, which includes the Main Street program.

Key Features of the Three Main Street Facilities

The table below highlights key features of the three Main Street facilities.

_______________

1 The Main Street program implemented by the Federal Reserve should not be confused with the "Assistance to Mid-Sized Businesses" provisions in the CARES Act. Those other provisions in the CARES Act contemplate a different program by Treasury, which would have conditioned borrower participation on a series of certifications related to employment levels, restoration of compensations and benefits, outsourcing and offshoring, collective bargaining agreements and union organizing. The Main Street program is authorized under different provisions and does not require these additional certifications. To date, Treasury has not released any information about, or suggested that it is working on, a program pursuant to the Assistance for Mid-Sized Businesses provisions of the CARES Act.

2 See 12 U.S.C. § 343(3); 12 C.F.R. § 201.4(d).

3 Section 13(3) limits the Federal Reserve's ability to take credit risk in connection with emergency lending programs. Treasury's equity investment in the Main Street program will absorb any initial losses suffered by the program, which will mitigate credit risk to the Federal Reserve and help satisfy the statutory conditions for the Federal Reserve's use of emergency lending authority under Section 13(3).

4 See Federal Reserve, Main Street Lending Program Frequently Asked Questions (FAQs) (as of June 8, 2020) at I.2.

5 On June 8, 2020, the Federal Reserve indicated that it is “working to establish soon one or more loan options that are suitable for non-profit organizations.”

6 This is a change from the original Main Street term sheets, which did not require aggregation.

7 See 13 C.F.R. § 121.301(f).

8 If the Original Credit (defined in the table below) was originated or purchased after December 31, 2019, then the “pass” criterion must be satisfied as of such origination or purchase date. The term sheet for the Expanded Loan Facility appears to impose this “pass” requirement only with respect to the Original Credit.

9 See 13 C.F.R. § 120.110(b)-(j) and (m)-(s), as modified by regulations implementing the PPP.

10 CARES Act § 4004(b).

11 This is a change from the original Main Street term sheets, which would instead have required a borrower to attest "it will make reasonable efforts to maintain its payroll and retain its employees during the term of the [Main Street loan]."

12 See FAQ G.8. The Federal Reserve guidance also makes clear that businesses that have already laid off or furloughed workers as a result of the COVID-19 crisis may still be eligible for the Main Street program.

_______________

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.