On November 4, 2013, the Internal Revenue Service released an internal directive that completes a two-part process of reshaping the dynamic between taxpayers and IRS examiners during the information-gathering phase of an audit. The directive, issued by the Commissioner of the IRS’s Large Business and International Division (LB&I) to its employees (the Directive), describes a mandatory enforcement process designed to enhance the ability of the IRS to gather information from taxpayers under examination.1 The Directive is part of a larger effort by the IRS in recent years to alter the traditional audit process. Together with an earlier directive on the requirements for issuing Information Document Requests (IDRs),2 the IRS has completely changed its approach to issuing and enforcing IDRs. Because the new enforcement process is mandatory and has no exceptions, the Directive places an even greater premium on understanding LB&I as an organization and the rules of engagement to which it adheres.

Requirements for Issuing IDRs

LB&I examiners and specialists use IDRs to obtain information and documents substantiating positions reflected on the tax return under examination. The new requirements for issuing IDRs announced earlier this year require that each IDR be transparent in its aim, be discussed with the taxpayer before it is finalized and, if possible, reflect an agreed-upon response date. The Directive reiterates these requirements and attaches a 13-point list of requirements for issuing IDRs. Under these new requirements:

- All IDRs must identify and focus on a single issue. Each IDR must be written using clear and concise language, and must be customized to the taxpayer or industry.

- Before preparing an IDR, the examiner must explain to the taxpayer how the information requested is related to the issue under examination and why that information is necessary.

- After having this initial discussion with the taxpayer, the examiner may determine what information will ultimately be requested in the IDR.

- The examiner must then issue a draft of the IDR and discuss with the taxpayer both the contents of the draft and the timeframe for responding to the IDR.

- If agreement on a response date cannot be reached, the examiner will set a reasonable response date, which becomes a hard deadline for the taxpayer (the IDR Deadline).

- The IDR also must identify a date by which the examiner will have reviewed the IDR response and inform the taxpayer whether the information received satisfies the request.

The Directive provides that any IDR that does not meet the above criteria must be reissued to conform with it and include a new response date. The enforcement process set forth below does not apply until the above criteria have been met.

Mandatory IDR Enforcement Process

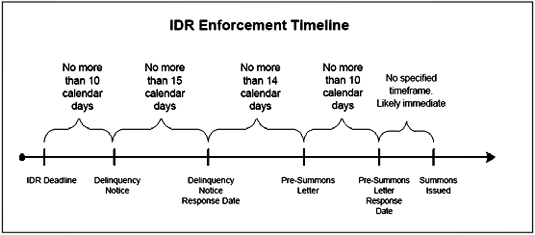

Effective January 2, 2014, if the information requested in an IDR is not received by the response date, the LB&I examiner or specialist is required to follow the enforcement process set forth in the Directive. This process is mandatory and has no exceptions. There are three stages in this enforcement process:

- Delinquency Notice. If the taxpayer misses the IDR Deadline, the examiner must issue a delinquency notice within 10 calendar days of the missed IDR Deadline. The examiner must discuss this delinquency notice with the taxpayer and ensure that the taxpayer understands the steps that will follow if the taxpayer fails to comply by the response date to the delinquency notice, which generally will not be more than 15 calendar days unless the territory manager approves a longer extension.

- Pre-Summons Letter. If the taxpayer does not respond in full to the IDR by the date specified in the delinquency notice, the territory manager will issue a pre-summons letter within 14 calendar days. The territory manager must discuss the pre-summons letter with the taxpayer, and the letter should be issued to an official at the taxpayer who is one management level above the official to whom the delinquency notice was issued. The pre-summons letter, which is prepared with assistance from IRS counsel, will advise the taxpayer that a summons will be issued if the taxpayer fails to comply by the response date to the pre-summons letter, which generally will not be more than 10 calendar days unless the director of field operations approves a longer extension.

-

Summons. If the taxpayer does not respond in full to the IDR by the date specified in the pre-summons letter, the examiner will work with IRS counsel to prepare and issue a summons to the taxpayer.

The IRS has wide latitude to obtain records from taxpayers as part of the examination process.3 And because taxpayers bear the burden of substantiating positions reflected on their tax returns, absent a valid claim of privilege, taxpayers generally are required to comply with IRS requests. If a taxpayer fails to comply with a summons, the government can commence a proceeding in a U.S. district court to enforce the summons. If the government establishes a prima facie case for enforcement, the court will enforce the summons unless the taxpayer can disprove the elements of the prima facie case or can demonstrate that enforcement of the summons would be an abuse of the judicial process.4 As a general matter, by far the bulk of successful defenses to summons enforcement are based on arguments that certain documents or information sought by the summons are protected from disclosure by reason of privilege or work product protection.5

Observations

The mandatory enforcement process established under the Directive is part of an overall effort by IRS leadership to make the examination process more efficient and transparent. For this effort to be effective, IRS examiners and taxpayers will need to effectively communicate and collaborate before IDRs are issued so that the IDRs are properly focused and provide adequate time for the taxpayer to respond in full. That is the only opportunity for the taxpayer to negotiate the scope of the IDR and the timeline for producing responsive information. Active engagement by the taxpayer and the taxpayer’s representatives at this stage stands to have a critical impact on the ease and success of the examination.

In contrast, once the IDR has been issued and the IDR Deadline has been set, it does not appear under the Directive that either the examiner or the taxpayer have any real opportunity to adjust the scope or timeline for the IDR response. The Directive makes clear that only in rare instances will an IDR Deadline be changed after the IDR has been issued in final form. Thus, once an IDR has been issued, the taxpayer’s only recourse is to focus on execution because the Directive makes it incumbent upon the taxpayer to respond timely to the IDR in full to avoid a summons.

How the process works in practice will depend largely on how the IRS exercises its discretion in the first two required consultations with taxpayers on the potential subject of an IDR, and on the specific drafting of an IDR. If there are collaborative, substantive discussions between taxpayers and examiners at these stages, the process should yield productive IDRs and responses. There should be few disputes about whether a response satisfies an IDR. If, on the other hand, there is no meaningful taxpayer input during the early stages, or if a taxpayer’s ultimate response to the IDR is not evaluated in light of those discussions, the new procedures could yield many more disputes, as disagreements over the appropriate scope of information gathering are escalated even to judicial proceedings. Companies will be best equipped to keep the IDR process confined to requests and responses, not extending to the mandated enforcement steps, if they are able to forge relationships with the IRS examination teams and supervisory personnel that lay the groundwork for meaningful conversations early in the audit.

_____________________

1 See Large Business and International Directive on Information Document Request Enforcement Process (LB&I-04-1113-009) Nov. 4, 2013, available at http://www.irs.gov/Businesses/Corporations/Large-Business-and-International-Directive-on-Information-Document-Request-Enforcement-Process.

2 See Large Business and International Directive on Information Document Requests (IDRs) (LB&I-04-0613-004) June 18, 2013, available at http://www.irs.gov/Businesses/LBI-Directive-on-Information-Document-Requests.

3 See U.S. v. Arthur Young & Co., 465 U.S. 805, 816 (1984) (stating that, “In order to encourage effective tax investigations, Congress has endowed the IRS with expansive information gathering authority.”).

4 The Supreme Court enunciated a four-part framework by which the IRS can establish a prima facie case for summons enforcement in U.S. v. Powell, 379 U.S. 48 (1964). Under that framework, the government can meet its burden by demonstrating, ordinarily through an affidavit from the IRS examiner who issued the summons, that (1) the investigation has a legitimate purpose, (2) the information summoned is relevant to that purpose, (3) the documents sought are not already in the IRS’s possession and (4) the procedural steps required by the Internal Revenue Code for issuing the summons were followed.

5 In 2010, the IRS reiterated its long-standing policy of restraint with respect to seeking production of tax accrual workpapers as part of the examination process. (See “IRS Issues Final Rules on Disclosing Uncertain Tax Positions; Policy of Restraint Clarified.”) As that policy is not codified in the Code or Treasury Regulations, however, it remains unclear whether a court would hold the government to that policy in a summons enforcement proceeding.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.