On January 16, 2023, France’s financial prosecutor, the “Parquet National Financier” (PNF), issued updated guidance (the Guidelines) regarding its approach to offering, negotiating and entering into French deferred prosecution agreements (“convention judiciaire d’intérêt public,” or CJIPs). The PNF first issued the guidelines in 2019, in cooperation with the French Anti-Corruption Agency (AFA). (See our previous analysis.)

The update is intended to align the PNF’s guidelines with its practices over the past five years.

Though the previous version of the Guidelines already emphasized the importance of corporate cooperation in the CJIP process, the updates provide welcome clarification on the weight that the PNF places on voluntary self-reporting, internal investigations and remediation measures.

With the updates, the PNF aligns its practice with — and to some extent adds on to — the approaches adopted by U.S. and U.K. enforcement authorities. In particular, the Guidelines seek to incentivize early and voluntary self-reporting and cooperation, which mirrors the approach of the U.S. Department of Justice (DOJ) in its January 17, 2023, updates to the Criminal Division’s Corporate Enforcement Policy. (See our client alert.)

Through its Guidelines, the PNF also continues to promote CJIPs as the legal instruments through which French companies can enter into coordinated resolutions in France, the U.S., the U.K. and other countries.

The jurisdictions that are most active in cross-border settlements are increasingly aligning their guidelines with respect to sentencing and leniency. Such guidelines have focused on:

- timely preservation of all relevant evidence;

- credible investigation plans and methodologies;

- a comprehensive review of the facts;

- documented interview protocols and summaries;

- the identification of personnel involved in the misconduct;

- the timely disclosure of misconduct to authorities (even before the end of an internal investigation);

- thorough cooperation with prosecutors; and

- identification of compliance failures and implementation of remediation measures (including disciplinary action) at the earliest possible stages of the investigation.

Background

CJIPs were created by the so-called Sapin II law in 2016 to allow companies to settle criminal investigations without pleading guilty in a limited range of matters, namely:

- corruption and bribery;

- tax fraud;

- the laundering of funds associated with these offenses; and

- environmental matters.

CJIPs are offered at the initiative of French prosecutors, including but not limited to the PNF, which is responsible for the enforcement of complex financial and economic crimes (corruption, tax fraud, money laundering, market manipulation, competition). Because the Guidelines are published by the PNF, they only apply to CJIPs negotiated in matters falling within the scope of the PNF’s remit: corruption, bribery, tax fraud and the laundering of funds associated with these offenses.

However, as the PNF recently stated in the law review Dalloz actualité, other French prosecutors can choose to adopt similar approaches.

The Guidelines aim to make the CJIP framework more “readable, transparent and predictable” for companies, the PNF said in the article. They are also a response to the Ministry of Justice’s Circular of June 2, 2020, on the enforcement of corruption matters, which invited the PNF to work on a framework that would incentivize companies to self-report criminal misconduct.

The Guidelines are organized in a way that follows the life of a CJIP, from when it is first offered to its execution and imposition of obligations. Though key issues such as voluntary self-reporting, corporate cooperation and recidivism were already discussed in the previous version (which itself stemmed from the 2018 Ministry of Justice Circular on CJIPs), the updated Guidelines introduce a new simplified concept of corporate “good faith” as a condition to obtaining a CJIP and clarify how companies can maximize their chances for leniency.

According to the PNF 2021 Activity Report, 80% of its caseload that year had an international nexus. Thus, the Guidelines provide valuable insight into the resolution of cross-border investigations.

Negotiating a CJIP

Confidentiality. Similar to their prior version, the Guidelines note that, although CJIPs can only be offered by the prosecutor, in practice the company’s representative or its external counsel can approach the PNF to express their desire to negotiate a settlement. Such discussions can occur orally, and the updated Guidelines clarify that these exchanges will be covered by the customary confidentiality that applies to communications between lawyers and magistrates/prosecutors (“foi du palais”).

Use of documents. The Guidelines further clarify that, if CJIP negotiations fail, documents produced by the company to the PNF before the formalization of a CJIP will not be used as evidence by the PNF in criminal proceedings.1 The PNF can, however, use them if they are obtained through requisitions or seizures. At first glance, the Guidelines provide broader protection of the use of documents in failed CJIP negotiations compared to the U.K. and U.S. However, this protection remains limited because the PNF can seize documents that the company initially produced voluntarily.

Demonstrating good faith. Aside from certain legal requirements, the Guidelines explain that the PNF does not intend to impose ex ante conditions to entering into a CJIP.2 However, the PNF expects companies to demonstrate their good faith throughout the CJIP process. To assess good faith, the PNF will, first and foremost, look at whether the company self-reported the matter, and whether it did so shortly after it became aware of the misconduct. The PNF notes that the company’s good faith will be all the more valued if the company reports facts that the PNF had not been aware of.

Conducting an internal investigation. The PNF also expects companies to actively participate in “uncovering the truth” of the matter, by conducting an internal investigation into the facts, personnel involvement and compliance failures that led to the misconduct. As such, the PNF expects companies to provide it with a copy of their internal investigation report, and to take steps to preserve all relevant evidence. Footnote 19 of the Guidelines usefully previews that the PNF and the AFA will publish the final version of their internal investigation guidelines in 2023, which companies will be able to refer to when conducting internal reviews.

Other good faith measures described in the Guidelines include:

- the implementation of a compliance program, including for companies that do not fall within the anti-corruption requirements of Sapin II;

- taking remediation measures in a timely manner to enhance the quality and efficiency of the company’s compliance program;

- adapting the company’s strategy to the risks identified in the investigation;

- potentially making changes to the management team; and

- compensating victims before the CJIP is signed.

As further described below, the PNF also considers some of these to be mitigating factors for the purpose of calculating the fine.

To assess good faith, the PNF will ask to review the investigatory steps the company has taken (such as to conduct an e-review and employee interviews) to ensure it did not “interfere with the criminal investigation.”

The PNF will consider declining to offer a CJIP to companies that, although subject to the anti-corruption requirements of Sapin II (i.e., companies with over 500 employees and €100 million in turnover), failed to implement an anti-corruption program or to take remediation measures following the identification of the misconduct.

What’s in a CJIP

CJIPs can include one of the following obligations:

- paying a “public interest” fine capped at 30% of a company’s average annual turnover over the last three years;

- implementing a compliance program under the supervision of the AFA for a maximum of three years;3 and

- compensating victims for any losses, where victims can be identified.4

Fine Calculation

The main change brought by the Guidelines relates to the calculation of the fine, which is now more detailed than ever.

First, though CJIP fines cannot exceed 30% of a company’s turnover, the Guidelines explain that the PNF will calculate the fine based on the consolidated turnover of the group to which the company belongs (where applicable) rather than on the individual company’s turnover. Per the PNF’s recent statements in the newspaper Les Echos, this is meant to dissuade large groups from transferring potential criminal liability onto subsidiaries with low revenues. Though the Guidelines only bind the PNF and not other French prosecutors, this approach goes beyond what the law requires.

Second, the fine is made up of two components: a “restitution” component (disgorgement) and an “afflictive” component (which the previous version of the Guidelines described as “punitive”). The former is equal to the benefits drawn from the misconduct, and the latter is calculated by applying mitigating and aggravating factors to the restitution amount.

With respect to the restitution component of the fine, the Guidelines explain that it is calculated based on “direct” and “indirect” benefits resulting from the misconduct covered in the CJIP.

- Direct benefits relate to any profit generated by the misconduct, such as from a procurement contract that was illegally obtained, the receipt or use of laundered funds, tax evasion and tax credits received as the result of a fraud.

- Indirect benefits include other potential advantages obtained as a result of the misconduct, such as increased market share, visibility or treasury benefits resulting from the monetary flows derived from the misconduct.

Direct and indirect benefits can include future expected gains, meaning that the fine can include benefits that have not yet been realized by the company at the time it signs the CJIP. The Guidelines explain that the methodology for calculating direct and indirect gains will be discussed with the company.

The Guidelines also provide examples of such calculations, such as in the case of an illegally obtained procurement contract. In this example, the Guidelines state that in the event that a company attempted but failed to enter into a procurement contract illegally, the fine will be calculated based on the likelihood of the profit that would have been made if the contract had been obtained.

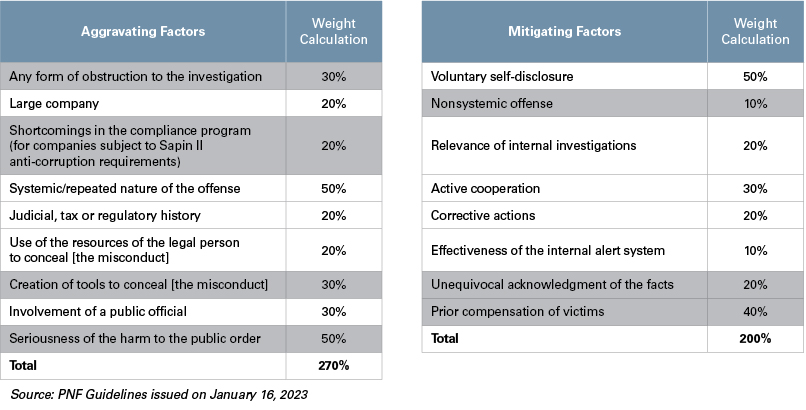

With respect to the punitive aspect of the fine, the Guidelines supplement the previous lists of mitigating and aggravating factors the PNF used to calculate the fine, along with the weight assigned to each factor.

The Guidelines also added new factors to the lists, which are highlighted in gray in the below charts.

The updated lists are comprised of nine aggravating factors and eight mitigating factors, the former weighing more in total than the latter. The factors highlight the importance the PNF places on corporate cooperation, both at the outset of the investigation (self-reporting: 50%) and during the investigation (active cooperation: 30%). It also gives a substantial weight to the compensation of victims (40%).

Companies that fail to cooperate (30%), engaged in systemic pervasive misconduct (50%), created specific vehicles for the purpose of the misconduct (30%) and/or are particularly large (20%) will be more severely punished. Companies that harmed the public order will also risk a 50% fine increase, though this concept is ill-defined. And corporate compliance programs also affect the amount of the fine: The PNF will increase the fine for companies subject to Sapin II that did not maintain an anti-corruption compliance program (20%) but will reward companies that maintained an effective whistleblowing program (10%) or took relevant remediation measures before signing the CJIP (20%).

During a January 16, 2023, law school conference about the Guidelines, the PNF indicated that the above factors are cumulative. In other words, companies could hypothetically see their fine increased by 270% if all aggravating factors were applied to the maximum cap. Conversely, companies could benefit from a 200% fine reduction if all mitigating factors were applied to their fullest extent.

This approach mirrors the DOJ’s newly updated Corporate Enforcement Policy by setting out specific percentage reductions that are available to companies that self-disclose early, fully cooperate and remediate. For example, under the recent policy update, the DOJ can now accord, or recommend to a sentencing court, a fine reduction of up to 75%, if the company voluntarily self-disclosed, and a reduction of up to 50% if a company fully cooperated and remediated but did not self-disclose.

The PNF’s aggravating factors are also similar to concepts used in the U.S. Sentencing Guidelines for determining the fine on which the DOJ may then accord or recommend a reduction pursuant to the Corporate Enforcement Policy. For example, involvement of a public official in a high-level decision-making or sensitive position will increase the offense level for calculating the base fine.

The PNF Guidelines and the DOJ’s policy differ in that the PNF does not provide for the concept of a “declination,” which is potentially available in the United States. For example, the DOJ’s policy update now allows for prosecutors to decline to take any enforcement action, even where aggravating circumstances are present, if:

- Voluntary self-disclosure was made immediately upon the company becoming aware of the allegation of misconduct (even if the company has not completed an internal investigation);

- At the time of the misconduct and disclosure, the company had an effective compliance program and system of internal accounting controls that enabled the identification of the misconduct and led to the company’s voluntary self-disclosure; and

- The company provided “extraordinary” cooperation with the DOJ’s investigation and undertook “extraordinary” remediation.

The U.K. has not adopted guidance that sets out specific percentage reductions that are available to companies entering into a deferred prosecution agreement (DPA). In the U.K., the financial penalty under a DPA is calculated with reference to sentencing principles of culpability and harm that are set out in the Sentencing Council guidelines “Fraud, Bribery and Money Laundering: Corporate Offenders.” These sentencing guidelines provide that culpability is represented by an assessment of the company’s motivation and the extent of its role in the wrongdoing.

Step 3 of the sentencing guidelines provides guidance on the level of culpability. For example, high culpability includes:

- a corporation playing a leading role in organized;

- planned unlawful activity;

- willful obstruction of detection;

- offending committed over a sustained period of time; and

- corruption of local or national government officials or ministers.

Step 4 provides the starting point and category range for calculating the penalty, with factors increasing seriousness being:

- previous relevant convictions or being subject to previous relevant civil or regulatory enforcement action;

- corporation or subsidiary set up to commit fraudulent activity;

- attempts made to conceal misconduct;

- substantial harm suffered by victims of offending or by third parties affected by offending;

- risk of harm greater than actual or intended harm;

- substantial harm caused to integrity or confidence of markets;

- substantial harm caused to integrity of local or national governments;

- serious nature of underlying criminal activity; and

- offense committed across borders or jurisdictions.

Factors reducing seriousness or reflecting mitigation are the converse.

AFA Monitorship

Contrary to the U.S. system, the Guidelines do not provide guidance on the criteria that the PNF will use to decide whether to impose a remediation program under the monitorship of the AFA. The Guidelines only state that, in making that decision, the PNF will consider past AFA reviews of the company’s compliance program.

In the U.S., the DOJ has stated that it generally would not require a monitor if, at the time of the resolution, a company had demonstrated that it had implemented and tested an effective compliance program, and remediated the root cause of the misconduct. Though the Guidelines do not provide similar guarantees, CJIP precedent indicates that the PNF looks at similar criteria in deciding whether to impose an AFA monitorship.

Similar to their prior version, the Guidelines describe the AFA’s role in the context of the CJIP. The Guidelines clarify that the AFA can advise the PNF on the:

- state of the company’s compliance program;

- amount of the fine;

- length of the monitorship; and

- costs that the company will cover for the AFA to retain experts during its monitorship.

According to the Guidelines, in case of AFA monitorship, the PNF will organize annual meetings with the company to discuss the enhancements made to its compliance program. In the case of joint settlements with foreign authorities, the PNF will inform those authorities of the progress the company has made in connection with its remediation plan.

The Guidelines preview that the AFA will issue guidelines on its monitorship reviews in 2023.

Statement of Facts

With respect to the content of the CJIP itself, the Guidelines note that a clear and precise statement of facts will have to be included in the CJIP, in order for the judge to conduct his/her review of the terms of the transaction. Statements of facts in U.S. and U.K. DPAs are similarly detailed. And, while U.K. statements of facts must be reviewed by the court in order for the court to approve the DPA, judicial review of DPAs in the U.S. is much more circumscribed.

The Guidelines note that a “non-equivocal” recognition of the facts by the company during the investigation phase will be taken as a sign of good faith and considered as a mitigating factor in the calculation of the fine. (See chart above.) As a result, companies will be compelled to balance the benefit of a fine reduction against the risk of derivative actions in France or abroad.

Public Statements

Further, the Guidelines require that companies not publicly “denigrate” the legal qualifications of the facts described in the CJIP. Similarly, in the U.K., one of the conditions of a DPA is that the company will not authorize any present or future lawyers, officers, directors, employees, agents, parent company, subsidiaries or shareholder or any other person authorized to speak on the company’s behalf to make any public statement contradicting the matters described in the statement of facts.

In U.S. DPAs, companies must also often commit to not contradict the facts described in the statement of facts and provide the DOJ with advance notice of any public statements regarding the DPA.

Reporting Obligations

Lastly, the Guidelines note that, as part of its obligations under a CJIP, a company can be required to report new misconduct identified during the duration of the CJIP. For example, in 2020, Airbus committed to continue cooperating with the PNF during the term of the CJIP, including by reporting to the PNF any new information relating to facts — either included in the CJIP or that Airbus would become aware of following the validation of the CJIP — that would constitute corruption or tax-related offenses committed in the context of the company’s activities.

In the U.S., it is a standard term in all DPAs that companies must commit to continue cooperating with the DOJ during the DPA period, including by reporting new allegations of misconduct.

Victim Compensation

The Guidelines expand the compensation of victims, which is a requirement under Sapin II. The Guidelines explain that, in its decision to offer a CJIP, the PNF will take into account the extent to which a company sought to identify the victims of the misconduct.

Moreover, as noted above, the compensation of victims before the conclusion of a CJIP is now used as a significant mitigating factor in the fine calculation (40%). Given the weight assigned to this factor, when they identify misconduct, companies should consider not only taking internal measures to remediate the misconduct but also taking external steps to identify and compensate victims.

This could prove difficult, however, in particular in corruption-related cases, where a number of parties (competitors, administrations, etc.) could potentially claim damages. In tax fraud matters, the French state is typically considered the victim of the misconduct, and the Guidelines invite companies to disgorge the proceeds of tax frauds to it before the conclusion of a CJIP.

The amount of victim compensation included in the CJIP is calculated separately from, and comes in addition to, the fine amount (unless victims have been fully compensated before the conclusion of the CJIP). Victims that are compensated in the context of a CJIP, which can include certain associations such as Transparency International France,5 retain the right to start civil proceedings against the company after, and notwithstanding, the signing of the CJIP.

In criminal matters in the U.S., a judge may order restitution upon entering a conviction or a plea deal. DPAs that are successfully resolved, however, result in the DOJ withdrawing the criminal charges and terminating the criminal proceedings. Recent statements by DOJ officials have made clear that the agency will focus on compensating parties harmed by corporate crime, stating that “considering victims must be at the center of our white-collar cases.”

In particular, the DOJ expects companies under investigation to set forth in resolution discussions the steps being taken to address the “victim issues” arising from the corporate wrongdoing.

In the U.K., the Sentencing Council guidelines place consideration of compensation as the first stage of the sentencing exercise and states that compensation has priority over payment of any financial penalty. The Serious Fraud Office (SFO) aims to obtain financial compensation for overseas victims where possible, taking into account a series of factors including:

- whether the victim can be identified;

- whether the relevant wrongdoing has caused loss;

- whether any loss is quantifiable and therefore can be used as a basis for compensation;

- what steps the victim may have taken to recover their loss;

- the risk that payment of compensation to any overseas victims might lead to the funds being vulnerable to corruption again; and

- whether it is practicable to obtain the views of victims.

The SFO does not seek a compensation order from the court when it enters a DPA. Rather, compensation is a required term of the DPA. Where it is not possible to agree on compensation, the DPA application must state the reasons why. However, to date, only two of the U.K. DPAs have included compensation for overseas victims of corruption.

The Treatment of Newly Uncovered Facts

The effects of a CJIP only apply to the facts stated therein. Therefore, facts of the same nature that are not included in the CJIP can lead the PNF to open a new investigation, whether or not the company was aware of them at the time of the CJIP was signed. However, the Guidelines explain that the PNF will treat facts that were uncovered after the signing of the CJIP as falling within the scope of the CJIP if they are of a similar nature to those covered by the CJIP, unless they were willfully concealed by the company during the CJIP negotiation.

In order for new facts to be covered under an existing CJIP, the CJIP must contain a paragraph stating that the company will report such misconduct to the PNF immediately upon becoming aware of it. Per the Guidelines, the inclusion of such a paragraph will require “exemplary” cooperation and diligence from the company. It will nonetheless trigger an increase of the fine.

International Cooperation

International companies can face criminal exposure in different countries for the same set of facts. Given the uneven application of the ne bis in idem principle (which prohibits double jeopardy) by French and foreign courts, the Guidelines explain that the PNF will coordinate its enforcement actions with foreign authorities (e.g., DOJ, SFO, etc.) or international organizations (e.g., World Bank), where applicable.

As part of their cooperation, the PNF and foreign authorities will agree on the scope, time period and facts covered by their investigations, thus sparing French companies from being prosecuted twice for the same conduct. Should a monitor be considered in the context of a coordinated settlement, the PNF will favor the appointment of a single monitor — AFA — if enforcement authorities agree to include the monitorship penalty in the French resolution.

The Guidelines also note that legal assistance requests the PNF receives from a foreign authority after a CJIP is signed will only be granted in exchange for the foreign authority’s commitment not to prosecute the company for the facts covered by the CJIP. This is particularly relevant knowing that, in 2022, the PNF received 42 legal assistance requests.

Individual Prosecution

As Sapin II did not provide for CJIPs to be offered to individuals, the Guidelines remain consistent with their previous version by noting that the PNF:

- will continue to assess whether to prosecute individuals involved in the misconduct (including the managers of the company) on a case-by-case basis; and

- expects companies to identify all relevant personnel involved in the misconduct.

This emphasis on identifying individuals involved in or responsible for the misconduct at issue is similar to the DOJ’s expectation for cooperation credit.

The updated guidance does not resolve the conflict of interest issues raised by the fact that CJIPs are not available to individuals, and that as a result, members of senior management are no more incentivized to self-report matters in which they may have personal exposure than under the previous Guidelines.

The Guidelines only address this issue by recommending that:

- where managers of the company under investigation appear to have been involved in the misconduct, the company appoint an ad hoc management team; and

- parallel resolutions for companies and individuals be favored, through a CJIP for the former and a guilty plea for the latter. However, in the past, these types of parallel resolutions have not passed judicial scrutiny.

Attorney-Client Privilege

The previous version of the Guidelines contained a paragraph on the attorney-client privilege that (i) left it to companies and their counsel to decide which documents they wished to produce to the PNF, (ii) noted that not all components of an internal investigation report are necessarily privileged, and (iii) recalled that clients are not bound by the attorney-client privilege.

The former guidelines added that, in cases where companies refused to produce certain material, the PNF would determine whether such refusal was justified in light of applicable laws and whether it had a negative impact on the company’s cooperation. Such assessment would take into account the implications that a privilege waiver would have in other countries.

This paragraph was deleted from the updated guidance. However, footnote 20 of the Guidelines states that companies are expected to share with the PNF interview summaries and documents, which French and U.S. practitioners usually consider to be covered by the attorney-client privilege.

Similarly, the Guidelines include attorney notes in the list of documents that the PNF expects companies to produce in the context of a CJIP negotiation. These statements raise potential privilege waiver issues, which the Guidelines no longer seem to cure.

It remains to be seen whether this issue will be addressed in the upcoming internal investigation guidelines that the PNF and AFA will publish later this year.

__________________________

1 Specifically, the French criminal procedure code states that, should CJIP negotiations fail, documents or statements provided by the company to the PNF after the CJIP was formalized can be used by the PNF in future criminal proceedings. In practice, the PNF and the company will agree on the date when the CJIP was “formalized” for the purpose of identifying the starting point of the application of this provision.

2 Companies that engaged in misconduct that caused serious harm to individuals will not, however, be offered a CJIP.

3 Or, in environmental matters (which are not in the remit of the PNF), under the supervision of the appropriate services of the Ministry of the Environment and the services of the French Office for Biodiversity.

4 Or compensating victims for any environmental damages, where applicable.

5 For example, Airbus agreed to pay damages to the associations Anticor and Sherpa to compensate for their losses in the second CJIP it signed with the PNF. (CJIP AIRBUS 2, 17 November 2022).

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.