In response to the ongoing market turmoil created by the coronavirus/COVID-19 pandemic, the Federal Reserve has established a number of market stability and liquidity programs, many of which may be of interest to funds (both registered investment companies and private funds) and business development companies (BDCs). We continue to monitor these developments and remain committed to helping funds and BDCs navigate this volatile market environment. If a specific topic listed below is of interest to you and you would like to discuss in further detail, please contact any of the below partners or counsel or your usual Skadden contact.

See all our COVID-19 publications and webinars.

Background

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) became law on March 27, 2020. The economic stimulus package in the CARES Act includes federal funding for business stimulus across three broad categories: (i) grants and direct lending dedicated to specific sectors, such as airlines and national security businesses; (ii) expanded eligibility and payroll support for small businesses through programs administered by the Small Business Administration; and (iii) Department of the Treasury funding for several lending programs administered with the Federal Reserve. More than $450 billion of the allocated funds is directed toward this last category, which is the focus of this summary. The discussion below summarizes six programs recently announced, expanded or expected by the Federal Reserve in response to the COVID-19 pandemic that could be of interest to funds and BDCs.

Implementation

The CARES Act required Treasury to promulgate regulations by April 6, 2020, to implement some of these stimulus initiatives. However, Treasury and Federal Reserve are faced with the daunting task of setting up multiple, complex programs, in a short time, with scrutiny and second-guessing both in real time and in hindsight — all while the agency staff are facing challenging work conditions. Thus, we expect the implementation of these programs will be uneven and iterative, with questions and ambiguities addressed over time rather than in a single set of comprehensive final regulations to be issued in the next week or two.

Generally Applicable Conditions

The direct lending programs summarized below are generally available only if the recipient is solvent and unable to secure adequate credit from other banking institutions. The Federal Reserve has discretion to make a determination of inadequate credit availability based on generally applicable considerations related primarily to market conditions, rather than on an individual recipient basis.

If a program below derives any portion of its funding from Treasury under the CARES Act, then the recipient generally must be a business that (i) is created or organized in the United States or under the laws of the United States; (ii) has significant operations in the United States; (iii) has a majority of its employees based in the United States; (iv) has not otherwise received adequate economic relief in the form of loans or loan guarantees provided under the CARES Act; and (v) is consistent with certain conflict of interests provisions prohibiting participation by entities in which elected federal officials, the heads of executive branch departments or their family members have a controlling influence.

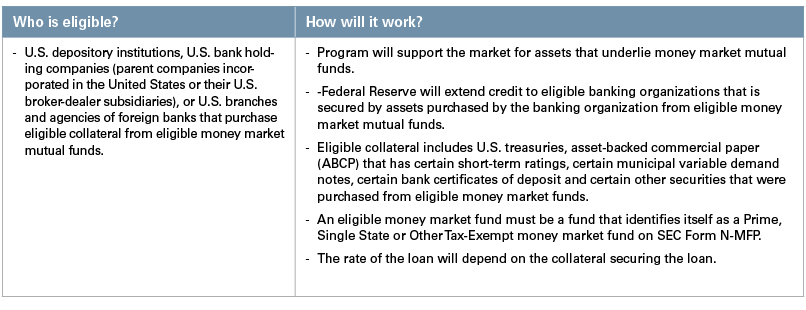

Money Market Mutual Fund Liquidity Facility (MMLF)

The MMLF (described in further detail here) is designed to benefit money market mutual funds by providing financial institutions (e.g., U.S. banks) with loans secured by eligible collateral purchased by such financial institutions from eligible money market mutual funds. As a result, money market mutual funds may increasingly limit the types of securities they are willing to buy in order to ensure that such securities qualify as eligible collateral for purposes of the MMLF. To the extent that a fund or BDC issues securities that have traditionally been purchased by money market mutual funds, it may be necessary to conform those issuances to the eligible collateral requirements of the MMLF in order to continue to attract money market mutual fund buyers. Below is a brief summary of key terms of the MMLF:

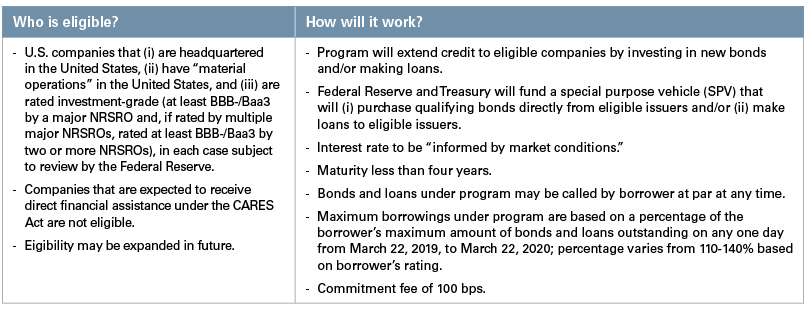

Primary Market Corporate Credit Facility (PMCCF)

The PMCCF (described in further detail here) will extend credit to eligible companies by (i) purchasing qualifying bonds directly from eligible issuers and (ii) making loans to eligible issuers. Eligible funds and BDCs may be able to issue notes to, or borrow directly from, the PMCCF. There also is the possibility, although difficult to predict, that Treasury through implementing regulations could determine to include bond-like instruments structured as preferred stock under this program. This facility could be of particular interest to funds or BDCs seeking to redeem or refinance existing senior securities that have contractual asset coverage, redemption or other terms that are more restrictive than those required by the Investment Company Act of 1940 (the 1940 Act) and less favorable than those available under the PMCCF. Helpful to registered funds and BDCs, Section 18(e) of the 1940 Act (made applicable to BDCs by Section 61 of the 1940 Act) exempts senior securities issued for the purpose of refinancing outstanding senior securities of the same type (i.e., indebtedness or preferred stock) from the provisions of Section 18. Though this provision has rarely been interpreted by the SEC staff, the application of this provision to refinancing of existing senior securities through issuances to the PMCCF may represent an opportunity to maintain existing amounts of leverage in excess of 1940 Act asset coverage requirements while continuing to pay dividends to common stockholders. Below is a brief summary of key terms of the PMCCF:

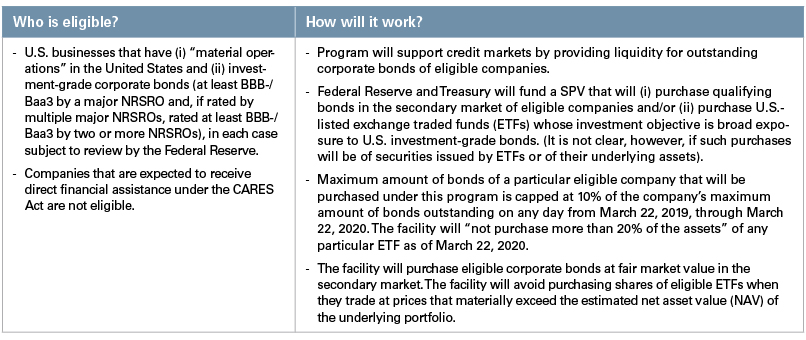

Secondary Market Corporate Credit Facility(SMCCF)

The SMCCF (described in further detail here) will provide enhanced liquidity for corporate bonds of eligible issuers in the secondary market by purchasing such bonds directly from holders. Funds and BDCs who hold or purchase eligible assets may be able to sell those assets directly to the SMCCF. Unlike the other programs discussed herein, foreign entities may be able to participate in this program if they hold eligible assets. Below is a brief summary of key terms of the SMCCF:

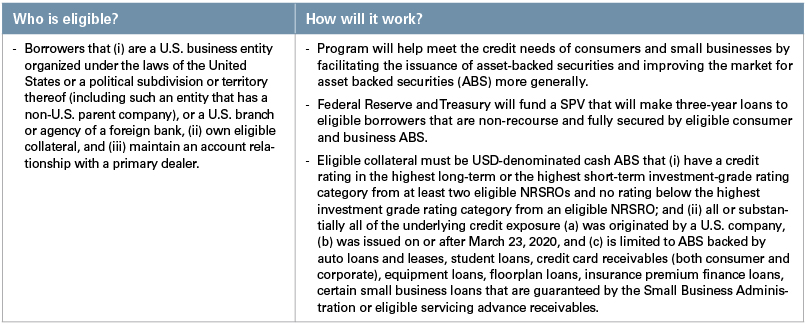

Term Asset-Backed Securities Loan Facility (TALF)

The TALF (described in further detail here) will provide liquidity for asset-backed securities (ABS) by making three-year, non-recourse loans to eligible borrowers secured by eligible ABS. Eligible borrowers who are funds or BDCs, may want to consider ensuring that their future portfolio security purchases of ABS qualify for purchase under this program so as to ensure an ability to raise liquidity from the program in the future. Below is a brief summary of key terms of the TALF:

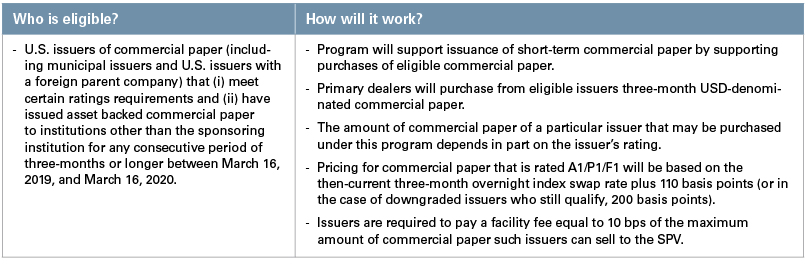

Commercial Paper Funding Facility (CPFF)

The CPFF (described in further detail here) will provide liquidity to eligible issuers who issue short-term commercial paper. Funds or BDCs who have issued asset-backed commercial paper in the past year may be able to issue short-term commercial paper directly to the CPFF. Below is a brief summary of key terms of the CPFF:

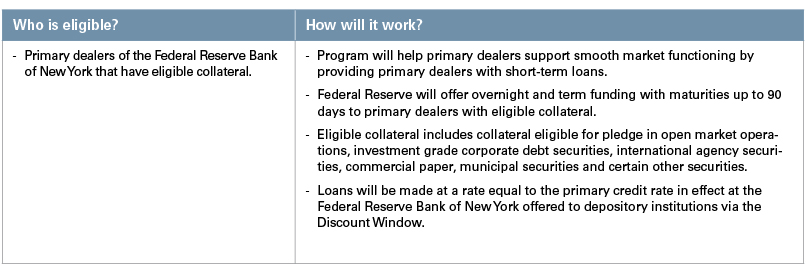

Primary Dealer Credit Facility (PDCF)

The PDCF (described in further detail here) will enhance market liquidity by extending loans to certain primary dealers secured by eligible collateral, including investment grade debt, municipal bonds and a range of equity securities. As a result, funds and BDCs may want to consider ensuring that future portfolio security purchases include assets that would qualify as eligible collateral under this program so that they can help meet future liquidity needs by selling those assets to primary dealers. Below is a brief summary of key terms of the PDCF:

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.