Update: The Federal Reserve has made changes and provided additional guidance on some of these programs after publication of this guide. Please see our "Updated Guide to the Main Street Lending Program as of June 10, 2020."

Background

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) became law on March 27, 2020. The economic stimulus package in the CARES Act includes federal funding for business stimulus across three broad categories.

See all our COVID-19 publications and webinars.

First, the CARES Act provides approximately $350 billion to support small businesses through programs administered by the Small Business Administration (SBA), including the Paycheck Protection Program (PPP). To be eligible for a PPP loan, a business must generally have no more than 500 employees. Some banks began accepting applications for PPP loans on April 3, 2020. Rollout of the PPP has been uneven across banks, SBA systems have struggled to handle the initial volume of loans, and the government continues to refine its guidance under the PPP. See Skadden's April 6, 2020, client alert, "COVID-19 Pandemic Small Business Lending Under the CARES Act’s Paycheck Protection Program."

Second, the CARES Act authorizes the U.S. Department of the Treasury (Treasury) to provide more than $45 billion of support in the form of grants and loans to (i) passenger air carriers and certain related businesses, (ii) cargo air carriers and (iii) businesses critical to maintaining national security. Treasury has released guidelines and application forms for these industry-specific programs.

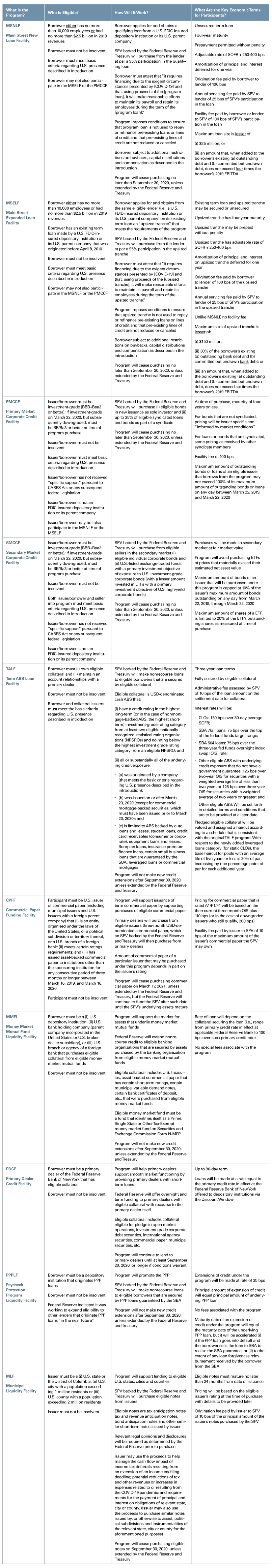

Third, the CARES Act authorizes Treasury to invest more than $450 billion in lending programs to be established by the Federal Reserve. This guide summarizes these Federal Reserve programs. The first three Federal Reserve programs summarized in the table below (Main Street New Loan Facility, Main Street Expanded Loan Facility and Primary Market Corporate Credit Facility) each involve the extension of credit by Federal Reserve vehicles with proceeds to be received directly by individual businesses. The remaining seven programs are more focused on providing liquidity to various areas of the financial markets, including corporate bonds, asset-backed securities, commercial paper, money market mutual funds, and state and municipal obligations.

Reliance on Federal Reserve Emergency Lending Authority

The total dollars available under these Federal Reserve programs will be much greater than the $450 billion authorized for Treasury investment under the CARES Act because these programs will also draw on the Federal Reserve's practically unlimited financial capacity as the U.S. central bank. The Federal Reserve lending into these programs will leverage the total dollars available into the trillions.The Federal Reserve has long-standing authority under Section 13(3) of the Federal Reserve Act to implement broad-based lending programs in "unusual and exigent circumstances."1 However, the Federal Reserve's emergency lending authority under Section 13(3) is subject to certain conditions that affect the design and eligibility of its programs. These conditions, including the three key concepts described below, apply to all of the programs summarized in this guide.

Treasury Investment in Programs Mitigates Credit Risk to Federal Reserve

Section 13(3) limits the Federal Reserve's ability to take credit risk in connection with emergency lending programs. A key purpose of Treasury's investment in certain of these programs is to mitigate credit risk to the Federal Reserve in order to satisfy these legal conditions. Treasury's equity investments in those programs protect the credit extended by the Federal Reserve by absorbing first losses.

Participants Must Not Be Insolvent

The Federal Reserve is not permitted to use its emergency lending authority to lend to parties who are "insolvent." Federal Reserve regulations generally define the term "insolvent" to mean that a party is in bankruptcy or a similar insolvency proceeding or is generally not paying undisputed debts as they come due during the 90 days preceding its participation in the Federal Reserve program. Applicants to participate in these programs will likely be required to provide a certification (and perhaps a financial statement to evidence) that they are not insolvent.

Unable To Secure Adequate Credit Accommodations From Other Banking Institutions

When implementing an emergency lending program, Section 13(3) requires the Federal Reserve to obtain evidence that participants are "unable to secure adequate credit accommodations from other banking institutions." Federal Reserve regulations provide flexibility in how the Federal Reserve can meet this requirement. For example, the Federal Reserve may rely on evidence of economic or market conditions generally or on a simple certification from the participant. The materials released to date do not suggest that the Federal Reserve is going to require each prospective participant in a program to provide individualized evidence of its own efforts or inability to "secure adequate credit accommodations from other banking institutions."

Eligibility Criteria Regarding U.S. Presence

Certain of these Federal Reserve programs, as indicated in the table below, require that their participants meet the following basic criteria related to U.S. presence: (i) be a business created or organized in the United States or under the laws of the United States; (ii) have "significant operations" in the United States; and (iii) have a majority of its employees based in the United States. Nothing in the CARES Act or the Federal Reserve guidance to date suggests that a party who otherwise meets these U.S. presence criteria would be disqualified from participating solely because it has a non-U.S. parent company.

The Main Street Programs and Their Additional Conditions

The Federal Reserve either announced or foreshadowed most of these programs several weeks ago. However, those initial announcements were generally high-level and with few details. On April 9, 2020, the Federal Reserve released additional guidance on many of the programs. Of particular interest to many businesses, the Federal Reserve for the first time outlined the basic eligibility, terms and mechanics of its Main Street programs intended to provide credit to medium-sized businesses.

There are two Main Street programs: the Main Street New Loan Facility and the Main Street Expanded Loan Facility. Both are intended to provide credit to U.S. businesses with either no more than 10,000 employees or no more than $2.5 billion in 2019 revenues. Both Main Street programs rely on banks to originate and service low-interest term loans that meet the criteria outlined in our table below. The originating bank may then sell a 95% participation in the qualifying loans to a special purpose vehicle backed by funding from the Federal Reserve and Treasury. The Federal Reserve has announced that the two Main Street programs will together purchase up to $600 billion of qualifying loans.

The principal substantive difference between the two Main Street programs is the maximum available loan size. Although the maximum loan size for a particular borrower may be lower, the outright maximum loan size under the Main Street New Loan Facility is $25 million; whereas, the outright maximum loan size under the Main Street Expanded Loan Facility is $150 million. In order to qualify for the larger loan size under the Main Street Expanded Loan Facility, the credit under the program must take the form of an "upsized tranche" attached to a pre-existing term loan from a U.S. bank and originated with the borrower prior to April 8, 2020. Importantly, the pre-existing term loan need not itself meet any specific criteria, and the Federal Reserve appears to contemplate that the terms of the "upsized tranche" may differ materially from the terms governing the pre-existing piece of the term loan. We believe the policy rationale for a larger maximum loan size in the context of an "upsized tranche" to an existing bank loan is that the Federal Reserve derives some comfort that its credit risk is mitigated by a federally regulated bank having already underwritten and decided to extend its own credit to the borrower.

The Main Street programs will each use funds provided by Treasury under the CARES Act and involve direct loans. For this reason, borrowers in either Main Street program must adhere to the following additional conditions related to stock buybacks, capital distributions and compensation. These conditions do not apply to participants in the other Federal Reserve programs summarized in the table below.

Prohibition on Certain Buybacks and Capital Distributions

Until 12 months after the date the loan is no longer outstanding, a Main Street borrower may not (i) repurchase equity securities of itself or its parent that were listed on a national exchange while the loan was outstanding, except as otherwise required pursuant to a contract in effect on March 27, 2020, or (ii) pay dividends or make other capital distributions on common stock.

Limits on Compensation

Until one year after the date the loan is no longer outstanding, a Main Street borrower must comply with the following compensation limitations.

An officer or employee of the borrower whose total compensation exceeded $425,000 in calendar year 2019 may not receive (i) total compensation from the borrower during any 12-consecutive-month period exceeding the total compensation that individual received in calendar year 2019 or (ii) severance pay or other benefits upon termination of employment exceeding twice the total compensation that individual received in calendar year 2019. This limitation does not apply to employees whose compensation is determined through an existing collective bargaining agreement entered into prior to March 1, 2020.

An officer or employee of the borrower whose total compensation exceeded $3 million in calendar year 2019 may not receive total compensation from the borrower during any 12-consecutive-month period in excess of the sum of $3 million plus 50% of the total compensation over $3 million the individual received in calendar year 2019.

Main Street Programs Not To Be Confused With Assistance to Mid-Sized Businesses in CARES Act

The CARES Act included provisions requiring Treasury to "endeavor" to establish a program for "Assistance for Mid-Sized Businesses." The CARES Act requires that the receipt of assistance under such a program be conditioned on the borrower making a series of certifications. For example, a borrower under such a program would be required to make certifications about retaining 90% of its workforce, restoration of compensation and benefits, outsourcing and offshoring, collective bargaining agreements and union organizing. Importantly, the Main Street programs are not authorized pursuant to these provisions of the CARES Act, and participation in the Main Street programs does not require the borrower to make these certifications. To date, Treasury has not released any information about, or suggested that it is working on, a program pursuant to the Assistance for Mid-Sized Businesses provisions of the CARES Act.

Implementation

The Federal Reserve faces a daunting task of initiating multiple, complex programs in a short period of time — all while its staff face challenging work conditions. In addition, the Main Street programs depend on banks to originate, service and retain a portion of loans to the borrowing companies. As we have seen with the PPP loans for small businesses, the need for banks to understand, become comfortable with and develop systems for an entirely new government-backed lending program introduces additional complexity. Thus, we expect the implementation of these programs will be uneven and iterative.

_______________

1 See 12 U.S.C. § 343(3); 12 C.F.R. § 201.4(d).

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.