The U.S. Securities and Exchange Commission (SEC) has issued an order intended to facilitate the ability of business development companies (BDCs) to borrow under their existing credit agreements and issue new debt and preferred stock, provided they meet certain requirements. The order also makes it easier for BDCs and their affiliated private funds to make follow-on investments in portfolio companies. The relief is temporary and is available only from April 8, 2020, (the date it was issued) until December 31, 2020. The full text of the order is available here.

See all our COVID-19 publications and webinars.

Leverage Under the Order

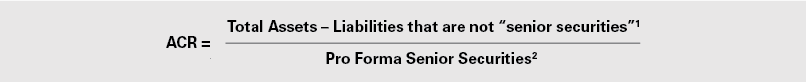

A BDC generally is required to have an asset coverage ratio, or ACR, of at least 200% (or 150% provided certain conditions have been met) immediately after it draws down its revolving credit facility or issues new debt securities or preferred stock. The formula used to calculate the ACR is:

Importantly, when calculating its ACR, a BDC is required to use the current fair value of its total assets, calculated as of a time no more than 48 hours prior to the time it draws down its revolving credit facility or issues other debt securities or preferred stock. If the ACR would be greater than 200% (or 150% as applicable) immediately after incurring the additional leverage, then the company may incur the additional leverage.

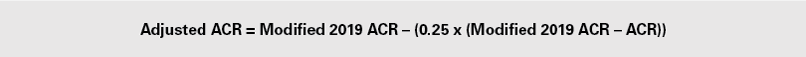

Under the order, a BDC can use a modified formula to calculate an Adjusted ACR and, in doing so, can rely in part on the fair value of its assets as of December 31, 2019. The formula to calculate the Adjusted ACR is:

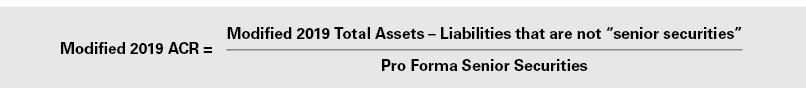

For purposes of this formula, the company must use the same formula it normally does, as set forth above, to calculate its regular ACR. The formula to calculate Modified 2019 ACR is:

For purposes of calculating its Modified 2019 Total Assets, a BDC can use the fair value of an asset as of December 31, 2019, if it (1) continues to own the asset and (2) has not recognized a realized loss that is not recoverable with respect to the asset after December 31, 2019. The company must use the current fair market value of an asset when calculating its Modified 2019 Total Assets if the asset is a new asset that was not owned on December 31, 2019, or if the company has recognized a realized loss on the asset after December 31, 2019.3

If a BDC’s Adjusted ACR would be greater than 200% (or 150% as applicable) immediately after drawing down its revolving credit facility or issuing new debt or preferred stock, then the company can incur the additional leverage in reliance on the relief. Importantly, however, the relief only applies to the issuance or sale of senior securities; it does not apply to the declaration or payment of any dividend or any other distribution.

A BDC must comply with a number of conditions to rely on the relief and use an Adjusted ACR to incur additional leverage:

- The BDC must file a Form 8-K announcing its election to rely on the relief and to withdraw from the relief.

- For 90 days from the date of its election to rely on the relief, a BDC may not make an initial investment in a portfolio company in which it was not already invested as of April 8, 2020, unless at the time of investment the BDC’s regular ACR is greater than 200% (or 150% as applicable) without relying on the relief.4

- Prior to making the election to rely on the relief and prior to each incurrence of additional leverage in reliance on the relief, the BDC’s board (including a required majority as defined in Section 57(o) of the 1940 Act) must determine that such issuance is in the best interests of the BDC and its shareholders. Regarding each incurrence of additional leverage in reliance on the relief:

- The board must obtain and consider a certification from the BDC’s adviser that the additional leverage is in the best interests of the BDC and its shareholders.

- The certification must state the reasons for the adviser’s recommendation, including whether the adviser has considered other reasonable alternatives that would not result in the issuance of a senior security.

- The board must obtain advice from an independent evaluator regarding whether the terms and conditions of the proposed additional leverage are “fair and reasonable compared to similar leverage, if any, by unaffiliated third parties in light of current market conditions.”5

- The board must receive and review monthly reports prepared by the adviser assessing the efforts that the adviser has undertaken and the progress the BDC has made towards achieving, by December 31, 2020, compliance with the asset coverage requirements normally applicable to the BDC.

- Any BDC not in compliance with the asset coverage requirements normally applicable after December 31, 2020, must immediately6 file a Form 8-K which states:

- the BDC’s current asset coverage ratio;

- the reasons why the BDC was unable to comply with the asset coverage requirements;

- the time frame within which the BDC expects to come into compliance with the asset coverage requirements; and

- the specific steps the BDC will undertake to bring itself into compliance with the asset coverage requirements.

- The BDC must make and preserve for six years minutes describing the board’s deliberations, including the factors considered in connection with such determinations, as well as the related information, documents and reports provided to the board.

- For BDCs relying on this exemption, no affiliated person of the company may receive any transaction fees or other remuneration from an issuer in which the BDC invests through December 31, 2020,7 except as permitted by Section 57(k) of the 1940 Act, or for payments or distributions made to all holders of a security in accordance with its terms. It is not clear whether "other remuneration" is limited to transaction-based remuneration, or whether it would also apply to remuneration that affiliates of a BDC may receive in connection with providing managerial assistance to portfolio companies on behalf of the BDC. Also, unlike language typically included in co-investment orders, the relief does not permit pro rata sharing of transaction fees among a BDC and its affiliated funds, which may make it difficult for BDCs to rely on the relief.

Expansion of Relief for BDCs With Existing Co-Investment Orders

Many BDCs have obtained exemptive relief permitting them and affiliated private funds to co-invest in companies. Such co-investment orders generally prohibit affiliated private funds from participating in a so-called follow-on investment in a company in which the BDC holds an investment, unless the private fund participated in the initial investment in the portfolio company.

The order permits an affiliated private fund to co-invest with the BDC in a follow-on investment even if the private fund did not participate in the original investment. This relief is intended to facilitate the ability of an adviser that manages both BDCs and private funds to provide additional capital to portfolio companies in which the BDC has invested at a time when the BDC’s ability to do so may be constrained. The relief is available through December 31, 2020, and is subject to the following conditions:

- The BDC must have a co-investment order permitting it to co-invest with affiliated funds.

- If the affiliated fund seeking to participate in the follow-on investment is a regulated fund, it must have previously participated in a co-investment transaction with the BDC involving the issuer.

- If the affiliated fund seeking to participate in the follow-on investment is a private fund, it must have either previously participated in a co-investment transaction with the BDC involving the issuer or not invested in the issuer.

- Any such transaction must otherwise be effected in accordance with the terms and conditions of the existing co-investment order.

- Non-negotiated follow-on investments do not require prior approval of the board but are subject to the periodic reporting requirements under the existing co-investment order.

- For negotiated follow-on investments, in connection with making the findings required by the existing co-investment order, the BDC’s board, including a required majority, must review the proposed follow-on investment on both a stand-alone basis and in relation to the total economic exposure of the BDC to the issuer.

The order does not expressly state that a follow-on investment made by a private fund in reliance on the relief will be treated as having been made under a BDC’s existing order so that, when the exemption period provided by the relief ends, the BDC and all of its affiliated private funds invested in an issuer at such time may make subsequent follow-on investments in the issuer under the BDC’s co-investment order. However, this seems to be the intent of the SEC, or the relief would be of limited to no assistance to BDCs.

Associate Justin Hebenstreit contributed to this article.

_______________________

1 Such liabilities include all liabilities that are not borrowings or preferred stock and also include borrowings deemed not to be senior securities, such as temporary private loans incurred under Section 18(g) of the 1940 Act and liabilities under derivatives for which assets have been segregated in accordance with Release 10666 under the 1940 Act and various subsequent staff positions.

2 Pro Forma Senior Securities generally include all borrowings and issuances of preferred stock outstanding immediately after the issuance of the new debt or preferred stock other than temporary private loans incurred under Section 18(g) of the 1940 Act.

3 What price or prices should be used if a BDC owned an asset on December 31, 2019, and subsequently acquired more of the same asset at a different price at a later date remains unclear. The language of the order, on its face, suggests the BDC would use the value as of December 31, 2019, for the portion of the asset owned on that date and the current fair value for the portion of the asset acquired after December 31, 2019.

4 Whether this requirement terminates upon the filing of a Form 8-K withdrawing from the relief remains unclear, though presumably a BDC would not withdraw from the relief unless its regular ACR was greater than 200% (or 150% if applicable), in which case it could make new investments.

5 How BDCs, their boards and potential independent evaluators will interpret this language is unclear, particularly for debt drawn on preexisting revolving credit agreements. The independent evaluator is required to have expertise in the valuation of securities and other financial assets and must not be an interested person of the BDC within the meaning of Section 2(a)(19) of the 1940 Act.

6 It is unclear how a BDC will be able to determine its NAV and ACR “immediately” after December 31, 2020, to comply with this requirement because valuations for its assets will not be immediately available. It may be required to file the Form 8-K immediately upon learning it is not in compliance as of December 31, 2020, which presumably would be after it determines the value of its assets as of December 31, 2020, in the ordinary course. The language, however, can be read to require the BDC to file the Form 8-K on the first business day of 2021 if it is out of compliance on December 31, 2020.

7 Whether this condition is meant to apply only to new investments or to any investment in the portfolio, even if owned prior to relying on the relief, is unclear.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.