U.S. authorities have been increasingly aggressive in their law enforcement and regulatory actions against multinational corporations and financial institutions, as well as individuals, in areas including market manipulation and foreign public corruption. There is no reason to expect that activity will abate this year.

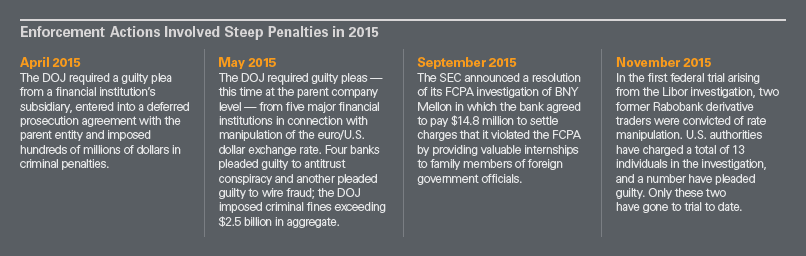

Recent announcements indicate that U.S. authorities plan to continue their focus on Foreign Corrupt Practices Act (FCPA) enforcement in the coming year. In a November 2015 speech, Andrew J. Ceresney, director of the Securities and Exchange Commission's (SEC) Division of Enforcement, emphasized the SEC's lead role in combating corruption worldwide, reflected on actions taken in the past year and predicted that 2016 would be another active year for FCPA enforcement. Leslie R. Caldwell, assistant attorney general for the Criminal Division of the Department of Justice (DOJ), also spoke in November about the DOJ's efforts throughout the year to increase the resources devoted to FCPA prosecutions; the FBI has added three new squads focused on FCPA investigations, and the DOJ has committed to add 10 new prosecutors — a 50 percent increase — to the FCPA unit. With these additional resources, the DOJ can be expected to increase its FCPA cases this year, in parallel with foreign counterparts, which have ramped up their own corruption enforcement efforts in recent years.

Both the DOJ and SEC also have stated their intentions to prosecute more individuals for corporate misconduct. Statements from those agencies, including the guidance outlined in the September 2015 memo by Deputy Attorney General Sally Quillian Yates (Yates Memorandum), indicate that the federal government expects to devote substantial resources to building criminal and civil cases against individuals this year. In his speech, SEC Enforcement Director Ceresney said that over the last five years, 80 percent of the SEC's enforcement actions have involved charges against individuals (including but not limited to FCPA actions). He noted that FCPA cases present particularly formidable challenges to establishing individual liability because, among other things, they involve foreign defendants and witnesses and documentary evidence located overseas. He stressed, however, that the SEC will bring cases against individuals where there is evidence to do so, including in conjunction with cases against corporate entities.

The DOJ's recent public statements have gone even further. The Yates Memorandum purported to partly change the DOJ's approach to corporate investigations in order to facilitate individual prosecutions. (See September 15, 2015, Skadden client alert "DOJ Issues Guidance to Prosecutors to Facilitate Individual Prosecutions in Corporate Investigations.") The guidance in the memo makes plain the DOJ's intentions to focus on individuals from the inception of civil or criminal corporate investigations. The Yates Memorandum also states both that companies under investigation must provide all relevant facts to the DOJ about individuals involved in alleged corporate misconduct in order to receive cooperation credit, and that corporate cases may not be resolved without a clear plan to resolve related individual cases. In November 2015, the DOJ amended the U.S. Attorneys' Manual to reflect the principles outlined in the memo.

It remains to be seen how the DOJ will apply the Yates Memorandum and whether the principles it articulates will result in an increase in individual prosecutions. In most instances, it is very difficult to single out individual corporate actors for criminal prosecution and, in our view, the DOJ's inability to prosecute corporate managers in the past has been the result of a lack of evidence, not a lack of focus or will. For example, since late 2011, the DOJ has successfully settled FCPA cases against individuals but taken only a handful of cases to trial, all of which ended poorly for the government — either with acquittals or mistrials (such as in the so-called Africa Sting case), dismissals of indictments post-trial (as in a case against executives of an electrical products company) or case resolutions midtrial with plea deals favorable to the defense (as in the recent case against Joseph Sigelman, the former co-CEO of PetroTiger). In that case, the government's case faltered most significantly when its critical cooperating witness made false statements in his trial testimony. Despite extensive cooperation and assistance from PetroTiger, Sigelman — who initially faced up to 20 years' imprisonment — ultimately received a sentence of probation.

Deputy Attorney General Yates noted in a recent speech that "as a matter of basic fairness, we cannot allow the flesh-and-blood people responsible for misconduct to walk away, while leaving only the company's employees and shareholders to pay the price." While her statement, on its face, raises questions as to whether the DOJ might refrain from taking action against a corporation if it anticipates insurmountable challenges in a case against individual employees, we do not expect fewer prosecutions of corporations.

The government's public statements in connection with the Libor and foreign exchange resolutions make clear that the DOJ's efforts to hold financial institutions accountable for complex financial crimes, including market manipulation, are ongoing. There is every reason to conclude that those efforts will continue into 2016 regardless of the feasibility of individual prosecutions. In light of the DOJ's aggressive enforcement efforts in 2015 and its apparent commitment to continue those efforts in 2016, we do not see the Yates Memorandum as signaling a decrease in prosecutions of companies. To the contrary, the memo may raise the bar for institutional cooperation — getting companies to provide even more incriminating information about individuals in order to obtain credit for their assistance to the government.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.