On July 10, 2017, the Division of Market Oversight (DMO) of the Commodity Futures Trading Commission (CFTC or Commission) announced the launch of a comprehensive review of the swap data reporting regulations1 adopted by the Commission under the Dodd-Frank Act.2 The review is a response to ongoing issues related to swaps data collected by swap data repositories (SDRs) and provided to the CFTC.3 In connection with its announcement, DMO released a “Roadmap to Achieve High Quality Swaps Data” (DMO Roadmap) to communicate DMO’s planned timetable for reviewing and making recommendations to the Commission in support of proposing and finalizing revisions to the reporting rules.4 DMO said it plans to engage with SDRs, swap dealers, clearinghouses, swap execution facilities, end users and other entities using swaps to hedge risk, and third-party service providers in order to understand how changes to reporting might impact them. As a first step in its outreach efforts, DMO is soliciting comments on the DMO Roadmap, which it will use to evaluate how to change the current requirements. The comment period is open until August 21, 2017.

Although it will be separate from the “Project KISS” rule simplification and modernization effort launched earlier this year by the CFTC,5 DMO’s swap reporting review is consistent with the Commission’s stated goal of simplifying regulatory requirements where possible.6 The goals for the DMO review are as follows:

- to ensure that the CFTC receives accurate, complete and high-quality data on swaps transactions for its regulatory oversight role;

- to streamline reporting, reduce messages that must be reported and right-size the number of data elements that are reported to meet the priority use-cases of the CFTC; and

- to identify provisions that need updating or changing to meet these goals and clarify obligations for reporting counterparties and SDRs.7

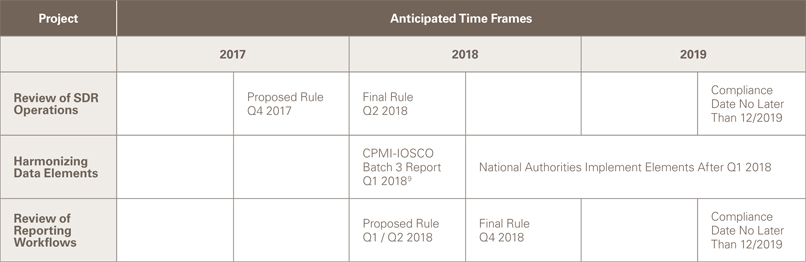

DMO plans to approach its review in phases. The DMO Roadmap sets out a review schedule, which first identifies SDR operations for review, in particular SDRs’ validation of incoming swaps data and swap counterparties’ confirmation of swap data accuracy. DMO then will turn to standardizing and harmonizing data fields (both across SDRs and internationally). The final phases of the review will focus on how to improve reporting workflows — for example, by reducing the number of messages required to be reported on each swap and exploring whether delayed reporting deadlines could improve data quality. The implementation chart below summarizes DMO’s estimates on when it will make rule revision recommendations to the Commission.8

CFTC Acting Chairman J. Christopher Giancarlo underscored the importance of improving swap data reporting, stating “[w]e look forward to working with all stakeholders — including market participants, SDRs, and our fellow regulators — to ensure that we have the optimal data and swap reporting regime to identify and address potential problems in the global systemically important derivatives market.”10

________________________

1 The swap reporting requirements are in Parts 43, 45 and 49 of the CFTC’s rules. Part 43 governs real-time reporting and public dissemination of swap transaction and pricing data. Part 45 addresses the reporting of cleared and uncleared swaps. For background information about the Parts 43 and 45 requirements, see “The CFTC’s New Swap Reporting and Recordkeeping Requirements,” Skadden client alert, January 17, 2012; “Impending Swap Reporting Requirements to Impact All Swap Market Participants,” Skadden client alert, April 4, 2013. Part 49 contains various reporting requirements specific to SDRs.

2 See CFTC Staff Letter, CFTCLTR No. 17-33 (July 10, 2017).

3 See, e.g., CFTC Public Comments, “CFTC Requesting Comments on Draft Technical Specifications for Certain Swap Data Elements”; see also CFTC, Office of the Inspector General, “A Review of the Cost-Benefit Consideration for the Margin Rule for Uncleared Swaps” (June 5, 2017).

4 See supra note 2.

5 See Project KISS, 82 Fed. Reg. 23,765 (proposed May 24, 2017).

6 See e.g., Testimony of J. Christopher Giancarlo, acting chairman, CFTC, before the U.S. Senate Committee on Appropriations Subcommittee on Financial Services and General Government (June 27, 2017).

7 See DMO Roadmap at 3.

8 See DMO Roadmap at 4.

9 (See table above) As part of the G-20 summit, global regulators agreed that all over-the-counter (OTC) derivatives contracts should be reported to trade repositories. International regulators also determined that aggregation of the data being reported is necessary to ensure a comprehensive view of the global OTC derivatives market. The Committee on Payments and Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO) formed a working group to focus on best methods to harmonize key OTC derivatives data elements and provide guidance on the key data elements to ensure globally consistent aggregation of data on OTC derivatives transactions. The CPMI-IOSCO working group created the first batch of critical data elements in a first consultative report in September 2015 and released the second batch in its second consultative report in October 2016.

10 See CFTC (Press Release No. 7585-17), “Division of Market Oversight Announces Review of Swaps Reporting Regulations” (July 10, 2017).

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.