In May 2018, President Donald Trump signed into law the Economic Growth, Regulatory Relief and Consumer Protection Act. Sometimes called the Crapo bill after its sponsor Sen. Michael Crapo, R.-Idaho, the act eliminated or eased a number of regulatory burdens on superregional, regional and larger community banking organizations. Also in 2018, the appointment and confirmation process for Trump nominees to lead the Federal Reserve Board, the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) was completed. Under their new leadership, the regulators have begun implementing the Crapo bill and taking other administrative steps to provide some measure of regulatory relief to most types of banking organizations.

A general easing of the intense regulatory environment that has existed since the financial crisis is expected to lead to lower compliance costs, greater flexibility in managing capital and perhaps incrementally higher tolerance among supervisors for the risk-taking inherent in the banking business. We expect that these developments will result in greater interest and willingness among banking organizations to pursue mergers and acquisitions as a means of enhancing shareholder value.

Crapo Bill and Other Regulatory Relief

In the wake of the financial crisis, the Dodd-Frank Act was enacted in 2010 to impose stricter oversight and burdensome regulatory requirements on the industry. Among other changes, the Dodd-Frank Act created new requirements for banking organizations with $50 billion or more of total consolidated assets. This $50 billion threshold became a key break point for regional and superregional banks evaluating growth opportunities through M&A. The Crapo bill increased this key threshold to $100 billion, effective upon the bill’s enactment, and it will rise to $250 billion by November 2019.

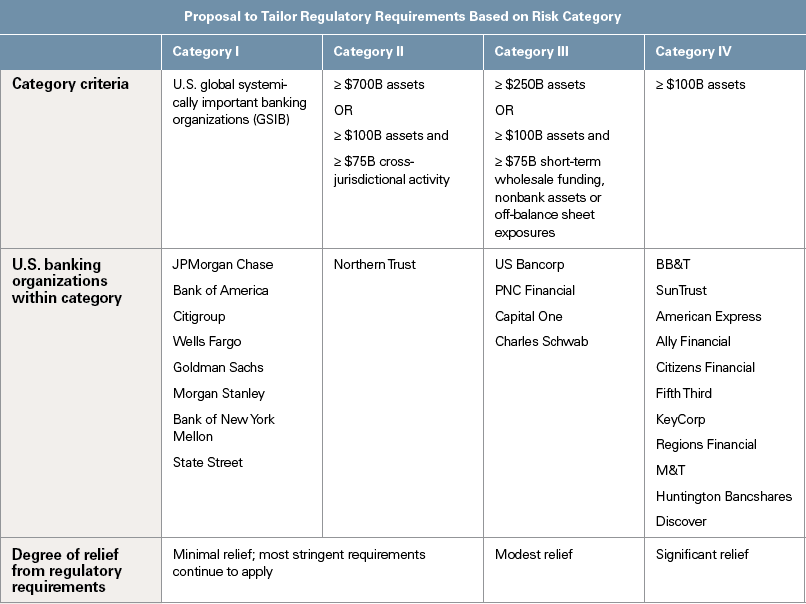

In addition, the banking agencies have taken parallel steps to ease regulatory requirements. For example, one industry criticism of the post-crisis system was its imposition of a relatively uniform package of significant additional requirements on institutions that met the single, relatively low ($50 billion) asset-size threshold. To address this concern, in October 2018, the banking regulators proposed a framework that would instead place the largest U.S. banking organizations into one of four risk categories based not only on asset size but also on certain other characteristics. Institutions in the lower-risk categories will see significant relief from a number of requirements related to capital and leverage, liquidity, stress testing, risk management, counterparty exposure limits and other areas. Institutions in the highest risk categories will see only minimal relief. The table below shows the risk categories, the institutions within them and the degree of relief they can expect.

Banking regulators also are pursuing discrete areas in which the agencies can be more flexible. For example, they are working on revisions to the Volcker Rule, capital planning, resolution and recovery planning, and community bank capital requirements. The OCC has led efforts to modernize implementation of the Community Reinvestment Act, including to better reflect technological innovations and to move away from reliance on a physical geographic footprint. The FDIC has been looking for ways to make its application process for new banks faster and more transparent, and it has expressed a willingness to approve deposit insurance for newly formed industrial loan companies, which are bank-like entities attractive to many financial services firms with nontraditional business plans or ownership structures. The Federal Reserve is considering a more transparent, and perhaps less restrictive, approach for evaluating “control” for bank regulatory purposes, which would have broad implications for M&A and investment activity involving banking organizations.

Effect on Bank M&A Activity

The segment of the industry likely to see the biggest boost in M&A activity is banking organizations with $10 billion to $50 billion in assets. The increased compliance costs and regulatory scrutiny that came with exceeding the $50 billion threshold under Dodd-Frank acted as a significant disincentive for M&A. Rarely did two banking organizations each below $50 billion in assets merge as a company with combined assets above that threshold, and market reaction to the few that did tended to be negative. The threshold increase under the Crapo bill lifts the regulatory disincentive to growth through M&A for the approximately 80 banking organizations with $10 billion to $50 billion in total assets.

The threshold increase under the Crapo bill lifts the regulatory disincentive to growth through M&A for the approximately 80 banking organizations with $10 billion to $50 billion in total assets.

Banking organizations with more than $50 billion in total assets also may be in a better position to explore M&A opportunities, to the extent that the market rewards these companies with higher trading values as a result of the relaxed regulatory burdens and reduced compliance and capital costs.

The combined effect of these regulatory developments should allow banking organizations to consider and pursue M&A transactions based on their business and financial merits, rather than being driven by somewhat arbitrary, asset-size regulatory thresholds.

Competing Factors

Nevertheless, the regulatory environment is only one important factor for banking organizations considering M&A opportunities. Bank M&A activity is significantly affected by environmental considerations, including the general economic outlook, the interest rate yield curve, market volatility and political uncertainty. Two additional factors present possible headwinds for a more widespread wave of M&A activity among banking organizations.

First, many of these organizations remain subject to regulatory enforcement action and ongoing remediation obligations arising from deficiencies in their compliance infrastructure, particularly in the areas of anti-money laundering, economic sanctions and consumer protection laws. Significantly, outstanding compliance issues generally preclude a banking organization from pursuing substantial expansionary acquisitions or investments, which reduces the universe of potential buyers.

Second, a historical driver of M&A activity among banking organizations was the objective of expanding scale and geographic footprint. However, banking organizations are reconsidering the value of traditional brick-and-mortar banking franchises. Many of the largest banking organizations are actively rationalizing their physical branch networks and eliminating less profitable branches. In addition, technological advances have changed the manner in which many banking and payments services can be delivered. Younger generations have moved away from traditional branch banking toward alternative delivery channels, such as online banking and mobile payment methods. In lieu of acquiring traditional branch-based banks, many banking organizations are more actively pursuing acquisitions of, and investments in, and partnerships with providers of, technology platforms to keep pace with these developments. These industry shifts may affect the buyer universe and valuation for multistate or regional banking franchises with broad branch-banking footprints.

For a number of years following the financial crisis, the regulatory environment represented a significant challenge and source of uncertainty for M&A activity among banks. Other than for the very largest institutions, the Crapo bill and other recent actions by the banking regulators will meaningfully ease the burdens of the post-crisis regulatory environment. Although their near-term impact may be muted by countervailing economic and industry considerations, these regulatory developments will make M&A opportunities more attractive for many banking organizations.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.