Over the past couple of years, heightened awareness of and activism about pay inequity has resulted in public commitments from major companies to take steps to address the issue, both in the U.S. and in Europe.

In the U.S., the White House under President Barack Obama called for companies to publicly vow to take action to achieve equal pay when it launched the Equal Pay Pledge in 2016. Over 100 companies, collectively employing tens of millions of people, signed the pledge, which requires a commitment to review pay practices (including conducting an annual companywide pay analysis) and to take steps to address any pay inequality discovered. The Trump administration since has removed the Equal Pay Pledge from the White House website, but that has not stopped companies that signed it from continuing to pursue equal pay policies and practices, and others from focusing on equal pay issues.

Equal pay returned to the spotlight in the wake of the #MeToo movement and the Time’s Up initiative beginning in 2017. While known for their efforts to tackle sexual harassment, both movements also created a forum for women and their champions to speak out about gender inequality in the workplace and fight for fair pay. The momentum of these efforts, along with the considerable media attention that followed, have brought renewed focus to pay equity issues in many boardrooms.

In Europe, effective April 2018, the U.K. began to require employers with 250 or more employees to report to the government annual gender pay gap statistics. France adopted similar legislation in September 2018 that, effective January 1 in 2019 or 2020 — depending on the number of employees — will require employers to report gender pay gap statistics and impose a potential fine of up to 1 percent of total payroll costs on employers that do not effectively remediate reported pay gaps within three years.

Although no federal proposals in the U.S. exist at this time for legislation requiring similar types of analysis and disclosure, and none are anticipated, a number of states — including California, Maryland, Massachusetts, New Jersey, New York, Oregon and Washington — recently have expanded their equal pay laws and placed stringent requirements on employers. Given the current climate and media attention surrounding the topic, we anticipate further developments and enforcement in this area.

State Law Expansion of Federal Equal Pay Act

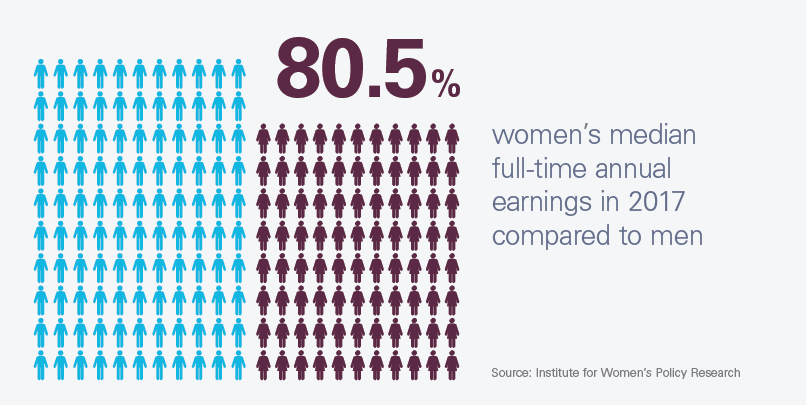

According to a September 2018 report released by the Institute for Women’s Policy Research, women’s median annual earnings were 80.5 percent of men’s median annual earnings for full-time, year-round workers in 2017, unchanged since 2016. The report also highlights a marked disadvantage for minority women, with Hispanic women earning 53 percent, and black women 60.8 percent, of white men’s median annual earnings in 2017.

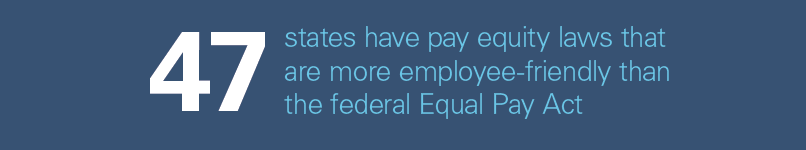

Currently, 47 states have pay equity laws in effect that typically are more employee-friendly than the federal Equal Pay Act (EPA). The EPA prohibits sex-based wage discrimination for “equal work” in the same establishment. Recently enacted or amended state pay equity laws generally have put more onerous burdens on employers than the EPA, such as by covering other protected classes in addition to women, extending the statute of limitations for bringing claims (and, likewise, the lookback period for damages), making it more difficult for employers to satisfy affirmative defenses, increasing penalties for violations, and even making violations criminal offenses. One key difference between the EPA and many state pay equity laws is the standard applied for comparing employees. The EPA requires “equal pay for equal work” (i.e., work requiring equal measure of skill, effort and responsibility), while a number of states require equal pay for “substantially similar” or “comparable” work. Moreover, a number of recent state law enactments or amendments, including in California, New Jersey and New York, provide that wage comparisons will be based on wage rates in all of the employer’s operations or facilities. It remains to be seen whether or not employers in these jurisdictions will be able to use cost-of-living data across various geographic regions to justify pay differentials.

New Jersey’s Diane B. Allen Equal Pay Act (NJ EPA), effective July 1, 2018, is considered one of the most broadly sweeping state equal pay laws in the country and may set a trend for other states to follow. The NJ EPA protects employees from wage discrimination across 17 protected classes recognized under the state’s anti-discrimination law, including sex, race, national origin and age. Unlike the EPA, the New Jersey law creates a presumption of illegal discrimination whenever an employee of a protected class is paid less in wages, benefits or other compensation than a similarly situated employee who is not a member of that protected class. The NJ EPA also includes a six-year statute of limitations — compared to the EPA’s two-year cap — and therefore employers may be held liable for up to six years of back pay in addition to mandatory treble damages, attorneys’ fees, and costs and punitive damages (if the employer’s conduct was willful).

Salary History Bans

Stemming from the latest focus on equal pay, legislation banning salary history inquiries also has been enacted in a growing number of states and localities, including California, Connecticut, Delaware, Hawaii, Massachusetts, Oregon, Puerto Rico, Vermont and New York City. This trend is expected to continue. The goal of salary history bans is to break the cycle of potential prior wage discrimination by prohibiting employers — including through agents such as outside recruiters — from asking job applicants about their compensation history. Several jurisdictions, including California and New York City, also prohibit employers from relying on an applicant’s pay history to set compensation if discovered or volunteered.

Notably, consistent with this legislation, on April 9, 2018, the U.S. Court of Appeals for the Ninth Circuit ruled in Rizo v. Yovino that it is a violation of the EPA for an employer to use an employee’s past salary, either alone or in combination with other factors, to justify pay disparities. This decision is at odds with rulings by other circuits, including the U.S. Court of Appeals for the Seventh Circuit, which have said salary history can be considered to justify a pay disparity. A petition for writ of certiorari seeking the U.S. Supreme Court’s review of the Rizo decision is pending.

Takeaways

Shareholder and consumer activism regarding equal pay will continue to call for companies and boards of directors to focus on these issues. Companies, and specifically general counsels, should be prepared for mounting pressure to address pay disparities, including through an equal pay audit. Given the increasingly stringent state laws and heightened focus on pay equity generally, companies also can expect, and should be prepared for, a greater number of class actions as well as a renewed court focus on equal pay.

Employers should make equitable compensation practices a priority in 2019 by considering:

- Conducting a thorough review of job positions to assess which employees are performing similar or comparable work across all operations and facilities. The review should take into account the skills, effort and responsibility required for each position, such as the amount of revenue overseen and the number of employees managed.

- Reviewing compensation practices to ensure that only relevant nondiscriminatory factors, such as education or experience, account for pay differentials among employees performing similar or comparable jobs. If equally situated individuals who perform similar jobs receive disparate compensation, employers should work with legal professionals and human resources to create and implement equitable compensation.

- Reviewing and, if needed, updating application documents to eliminate questions seeking salary history information. Employers should set parameters for internal and external recruiters to avoid disclosure of applicants’ compensation history and implement procedures to be followed if compensation information is disclosed.

- Training human resources professionals and other employees who will be making compensation decisions to ensure they are knowledgeable of applicable equal pay laws.

- Examining existing policies related to starting compensation, pay increases and bonuses to ensure such policies are not negatively impacting a protected class. For example, employers should ensure that any merit-based pay system measures performance against uniformly reviewed, legitimate, job-related criteria and that any seniority-based pay system does not reduce seniority for time spent on leave due to pregnancy, or statutorily protected parental or family and medical leave.

- Developing and implementing policies that prohibit pay secrecy and eliminate penalties for discussing pay.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.