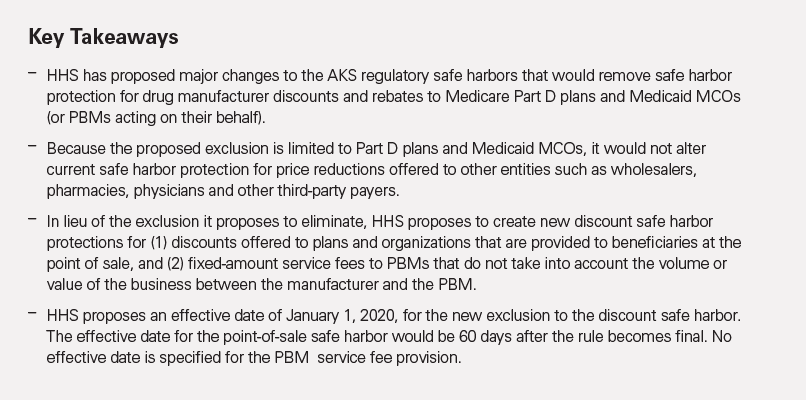

The Department of Health and Human Services (HHS) has published a proposed rule that would make sweeping changes to the discount and rebate arrangements between drug manufacturers on the one hand and Medicare Part D plans and Medicaid managed care organizations (MCOs) (and pharmacy benefit managers (PBMs) on the behalf of such plans or organizations) on the other.1 The intent of the proposed rule is to exclude from regulatory safe harbor protection such discounts and rebates and replace them with discounts provided directly to federal health care program beneficiaries.

HHS has said it believes the amount of such point-of-sale discounts would be greater than the likely increased Part D premiums that beneficiaries would face due to the loss of rebates by PBMs and Plan D sponsors. It is not clear, however, whether the proposed rule would have the full effect intended by HHS; the statutory discount exception to the federal Anti-Kickback Statute (AKS) would still be available to drugmakers, and throughout the explanation to the proposed rule, HHS expressed uncertainty about its scope and actual impact. Nevertheless, HHS’ interpretation of the current discount safe harbor (as reflected in the preamble accompanying the proposed rule) and the changes in the proposed rule are significant given that discount and rebate arrangements with Part D plans, Medicaid MCOs and PBMs acting on their behalf may run afoul of the AKS if they fall outside the regulatory safe harbor and statutory discount exception. Drugmakers and other industry participants should carefully assess their existing discount and rebate arrangements in light of both HHS’ views of the current safe harbor and the proposed rule.

Current Statutory and Regulatory Framework

Discounts and certain other price reductions offered by prescription drug manufacturers are not considered prohibited remuneration under the AKS if they are structured to comply with either the statutory discount exception to the statute (42 U.S.C. § 1320a-7b(b)(3)(A)) or the regulatory discount safe harbor promulgated by the HHS Office of Inspector General (HHS OIG). HHS’ new proposal would exclude from the regulatory safe harbor discounts and rebates paid to Medicare Part D plans, Medicaid MCOs and PBMs acting on their behalf. Importantly, HHS’ proposed rule would not alter the regulatory safe harbor protection for drug discount arrangements with other entities (e.g., wholesalers). And HHS’ regulatory action would not change the statutory exception protecting certain discounts in 42 U.S.C. § 1320a-7b(b)(3)(A).

HHS Proposal

The proposed rule has two basic components. First, it would exclude certain drug discounts and rebates from safe harbor protection. Second, and in lieu of such exclusion, it would create new safe harbors for discounts offered at the point of sale and for bona fide service fees paid by drug manufacturers to PBMs.2

Safe Harbor Exclusion for Discounts and Rebates to Part D Plans, Medicaid MCOs and PBMs Acting on Their Behalf

HHS has stated that the proposed rule is intended to exclude from the current discount safe harbor any price reductions (whether in the form of upfront discounts or later-reconciled rebates) from drug manufacturers to Medicare Part D plans or Medicaid MCOs, either directly or through PBMs acting under contract with such plans or organizations, in connection with the sale or purchase of prescription pharmaceutical products, unless such reduction is required by law. As drafted, the proposed rule does not apply to discounts and rebates on pharmaceutical products under other HHS programs (e.g., Medicare Part B), but HHS is soliciting comments on whether it should do so.3

While the proposed rule is limited to discounts under these HHS programs, the preamble includes a reminder of the HHS OIG’s long-standing concern about “carve out” arrangements that exclude federal programs from discount arrangements offered to private plans. To this end, HHS emphasizes that the proposed rule would not alter the discount safe harbor’s exclusion for price reductions offered to one payer but not to Medicare or Medicaid, particularly when such discounts serve as inducements for the purchase of federally reimbursable products. HHS provides an example of an arrangement that would trigger such concern: a discount on a product to an insurer for its private pay plans conditioned (explicitly or implicitly) on the product’s favorable formulary placement across all its plans (including Part D plans). HHS states that such an arrangement would involve prohibited remuneration that would implicate the AKS and not be protected under the current or proposed changes to the discount safe harbor.

The proposed rule would create new definitions for purposes of the discount safe harbor for the terms “manufacturer,” “wholesaler,” “distributor,” “pharmacy benefit manager” and “prescription pharmaceutical product.” This would be the first time such terms are incorporated into and defined in the discount safe harbor — an astonishing fact given that the discount safe harbor was established in 1991 and has been modified several times in the ensuing years.

New Safe Harbor for Point-of-Sale Discounts

In lieu of discounts to plan sponsors and PBMs, HHS is proposing a new safe harbor for point-of-sale price reductions that meet certain criteria. To qualify for such protection, three criteria must be met.

- The price reduction must be set in advance, which is defined to mean fixed and disclosed in writing by the time of initial purchase by the beneficiary.

- The price reduction may not involve a rebate (other than if required by law) unless the full value of the reduction in price is provided to the dispensing pharmacy through a chargeback. (Of note, HHS believes the current rebate frameworks under which manufacturers pay Part D plans and Medicaid MCOs — including through PBMs — would not meet this criteria unless the dispensing pharmacy receives the full value of the reduction in price.)

- The reduction in price must be completely reflected in the price the pharmacy charges to the beneficiary at the point of sale. Under these criteria, HHS intends to exclude from protection arrangements that mimic rebates but are described in other ways in the underlying contracts (e.g., fees that are on a percentage of a pharmaceutical product’s list price). HHS states that it intends for the point-of-sale safe harbor to protect price reductions regardless of the portion of cost the beneficiary is responsible for, and it requests comment on how it would apply during periods of 100 percent beneficiary cost-sharing.

New Safe Harbor for PBM Service Fees

The final component of the proposed rule is a new discount safe harbor provision for certain fixed fees paid by drug manufacturers to PBMs. To be protected under the new safe harbor, the arrangement would need to be pursuant to a written agreement that covers all services the PBM provides to the manufacturer for the term of the arrangement and specifies the services to be provided and the compensation associated with such services. In addition, the compensation paid to the PBM must be consistent with fair market value, fixed in amount (i.e., not based on a percentage of sales) and not determined in a manner that takes into account the volume or value of any business between the parties. To be eligible for the safe harbor, PBMs must disclose in writing to each health plan, at least annually, the services the PBM provides to each manufacturer (and disclose the same to HHS upon request). HHS says the proposed PBM service fee safe harbor is not intended to curtail or discourage “value-based” contracting arrangements and invites comment on whether the proposed safe harbor would, in fact, stifle innovative and nonabusive value-based arrangements.

Implications for Drug Manufacturers, PBMs and Drug Plan Sponsors

HHS’ proposed rule and comments in the preamble thereto pose significant compliance challenges for drug manufacturers, Part D plans, Medicaid MCOs and PBMs acting on their behalf. In particular, the preamble suggests that HHS believes some existing drug discounting and rebate arrangements between and among these entities may not be lawful, and goes on to say that such arrangements will be excluded from safe harbor protection in the future.

With respect to the proposed rule, HHS recognizes the inherent complexity of its proposed changes and is soliciting comments on whether they would accomplish HHS’ objectives. Nevertheless, the department proposes that the rule take effect on January 1,2020 — a mere 11 months from now, and notwithstanding the fact that HHS may make further changes before the rule is finalized. Perhaps to encourage industry participants to move more quickly to provide point-of-sale discounts, HHS also proposes that the new point-of-sale safe harbor take effect 60 days after the rule is finalized. Given the long lead time for drugmakers to negotiate discount and rebate agreements, HHS should provide a much longer effective date for the proposed safe harbor exclusions (e.g., a minimum of 12 to 18 months from when the rule is finalized). Industry participants should emphasize the need for a longer phase-in schedule when commenting on the proposed rule.

In the meantime, companies involved in arrangements covered by the proposed rule should consider taking a number of practical compliance steps in the near future.4

First, companies should review their current contracts and arrangements in light of HHS’ commentary that certain price reductions from drug manufacturers to Plan D sponsors and Medicaid MCOs (and PBMs acting on their behalf) may not qualify for protection under the existing discount safe harbor. For example, the preamble to the proposed rule states that where arrangements provide a discount to private health plans for formulary placement that applies (explicitly or implicitly) to both private and federal health program plans, the discounts constitute prohibited remuneration under the AKS. Equally importantly, HHS also suggests that retrospective rebate arrangements may not qualify for protection under the discount safe harbors. Even if these interpretations prove to be wrong, efforts to review contractual arrangements will help to identify those that might need to be modified if the rule is finalized.

Second, companies should begin assessing the business opportunities and legal and compliance risks associated with point-of-sale discounts and PBM service fee arrangements. In particular, pharmaceutical companies should review their contractual arrangements with PBMs to identify any revisions that might be necessary to comply with the proposed rule, if finalized.

Finally, companies should consider the legal and compliance implications — whether intended by HHS or not — in other areas, such as government price reporting requirements and how the proposed rule might impact such activities (from both a business and legal perspective).

_______________

1 The text of the proposed rule would remove safe harbor protection for certain price reductions to “a plan sponsor under Medicare Part D, a Medicaid Managed Care Organization as defined in section 1903(m) of the Act, or to a pharmacy benefit manager acting under contract with a plan sponsor under Medicare Part D, or Medicaid Managed Care Organization.” For brevity, these entities are referred to herein as “Part D plans, Medicaid MCOs and PBMs acting on their behalf.” See the attached appendix (also below) for the proposed changes.

2 The preamble to the proposed rule includes a useful history of the establishment and subsequent modifications to the discount safe harbor, and the HHS OIG’s evolving interpretation of the safe harbor’s provisions. See Proposed Rule (pp. 29-34).

3 Interestingly, while the proposed rule calls for removal of safe harbor protection for drug discounts and rebates to Part D plans and Medicaid MCOs, a footnote in the preamble questions whether such arrangements are even protected under the existing discount safe harbor:

We recognize that the payments manufacturers retrospectively make to PBMs under rebate arrangements would not constitute discounts or other reductions in price to the extent such payments are retained by the PBM and not passed through to any buyer. We do not intent to imply through the issuance of this proposed rule that such payments qualify for safe harbor protection under 42 CFR § 1001.952(h).

4 A nonexhaustive list of HHS OIG advisory opinions interpreting the safe harbor discount in the context of pharmaceuticals and related products include: Adv. Op. 14-05 (concerning a pharmaceutical manufacturer’s direct-to-patient product sales program that allows eligible patients to purchase one of the manufacturer’s brand-name products for a fixed cash price from an online retail pharmacy vendor outside of any applicable prescription drug insurance benefit); Adv. Op. 13-07 ( concerning a tiered rebate program in which the rebate tiers would be reached based on the combination of purchases of both federally reimbursable products and nonfederally reimbursable products); Adv. Op. 98-2 (concerning certain pharmaceutical discount pricing arrangements that are limited to arrangements between a manufacturer and wholesaler); and Adv. Op. 02-10 (concerning the offering of discounts to customers, based on their purchases of dialysis equipment and supplies).

_______________

Appendix

Proposed Changes to 42 C.F.R. §1001.952(h) (“Discounts”) and New Subsections 1001.952(c)(c) and (d)(d)

Code of Federal Regulations

Title 42 - Public Health

Title: Section 1001.952 - Exceptions.

§ 1001.952 Exceptions.

The following payment practices shall not be treated as a criminal offense under section 1128B of the Act and shall not serve as the basis for an exclusion:

…..

(h) Discounts. As used in section 1128B of the Act, “remuneration” does not include a discount, as defined in paragraph (h)(5) of this section, on an item or service for which payment may be made in whole or in part under Medicare, Medicaid or other Federal health care programs for a buyer as long as the buyer complies with the applicable standards of paragraph (h)(1) of this section; a seller as long as the seller complies with the applicable standards of paragraph (h)(2) of this section; and an offeror of a discount who is not a seller under paragraph (h)(2) of this section so long as such offeror complies with the applicable standards of paragraph (h)(3) of this section.

(1) With respect to the following three categories of buyers, the buyer must comply with all of the applicable standards within one of the three following categories—

(i) If the buyer is an entity which is a health maintenance organization (HMO) or a competitive medical plan (CMP) acting in accordance with a risk contract under section 1876(g) or 1903(m) of the Act, or under another State health care program, it need not report the discount except as otherwise may be required under the risk contract.

(ii) If the buyer is an entity which reports its costs on a cost report required by the Department or a State health care program, it must comply with all of the following four standards—

(A) The discount must be earned based on purchases of that same good or service bought within a single fiscal year of the buyer;

(B) The buyer must claim the benefit of the discount in the fiscal year in which the discount is earned or the following year;

(C) The buyer must fully and accurately report the discount in the applicable cost report; and

(D) the buyer must provide, upon request by the Secretary or a State agency, information provided by the seller as specified in paragraph (h)(2)(ii) of this section, or information provided by the offeror as specified in paragraph (h)(3)(ii) of this section.

(iii) If the buyer is an individual or entity in whose name a claim or request for payment is submitted for the discounted item or service and payment may be made, in whole or in part, under Medicare, Medicaid or other Federal health care programs (not including individuals or entities defined as buyers in paragraph (h)(1)(i) or (h)(1)(ii) of this section), the buyer must comply with both of the following standards—

(A) The discount must be made at the time of the sale of the good or service or the terms of the rebate must be fixed and disclosed in writing to the buyer at the time of the initial sale of the good or service; and

(B) the buyer (if submitting the claim) must provide, upon request by the Secretary or a State agency, information provided by the seller as specified in paragraph (h)(2)(iii)(B) of this section, or information provided by the offeror as specified in paragraph (h)(3)(iii)(A) of this section.

(2) The seller is an individual or entity that supplies an item or service for which payment may be made, in whole or in part, under Medicare, Medicaid or other Federal health care programs to the buyer and who permits a discount to be taken off the buyer’s purchase price. The seller must comply with all of the applicable standards within one of the following three categories—

(i) If the buyer is an entity which is an HMO a CMP acting in accordance with a risk contract under section 1876(g) or 1903(m) of the Act, or under another State health care program, the seller need not report the discount to the buyer for purposes of this provision.

(ii) If the buyer is an entity that reports its costs on a cost report required by the Department or a State agency, the seller must comply with either of the following two standards—

(A) Where a discount is required to be reported to Medicare or a State health care program under paragraph (h)(1) of this section, the seller must fully and accurately report such discount on the invoice, coupon or statement submitted to the buyer; inform the buyer in a manner that is reasonably calculated to give notice to the buyer of its obligations to report such discount and to provide information upon request under paragraph (h)(1) of this section; and refrain from doing anything that would impede the buyer from meeting its obligations under this paragraph; or

(B) Where the value of the discount is not known at the time of sale, the seller must fully and accurately report the existence of a discount program on the invoice, coupon or statement submitted to the buyer; inform the buyer in a manner reasonably calculated to give notice to the buyer of its obligations to report such discount and to provide information upon request under paragraph (h)(1) of this section; when the value of the discount becomes known, provide the buyer with documentation of the calculation of the discount identifying the specific goods or services purchased to which the discount will be applied; and refrain from doing anything which would impede the buyer from meeting its obligations under this paragraph.

(iii) If the buyer is an individual or entity not included in paragraph (h)(2)(i) or (h)(2)(ii) of this section, the seller must comply with either of the following two standards—

(A) Where the seller submits a claim or request for payment on behalf of the buyer and the item or service is separately claimed, the seller must provide, upon request by the Secretary or a State agency, information provided by the offeror as specified in paragraph (h)(3)(iii)(A) of this section; or

(B) Where the buyer submits a claim, the seller must fully and accurately report such discount on the invoice, coupon or statement submitted to the buyer; inform the buyer in a manner reasonably calculated to give notice to the buyer of its obligations to report such discount and to provide information upon request under paragraph (h)(1) of this section; and refrain from doing anything that would impede the buyer from meeting its obligations under this paragraph.

(3) The offeror of a discount is an individual or entity who is not a seller under paragraph (h)(2) of this section, but promotes the purchase of an item or service by a buyer under paragraph (h)(1) of this section at a reduced price for which payment may be made, in whole or in part, under Medicare, Medicaid or other Federal health care programs. The offeror must comply with all of the applicable standards within the following three categories—

(i) If the buyer is an entity which is an HMO or a CMP acting in accordance with a risk contract under section 1876(g) or 1903(m) of the Act, or under another State health care program, the offeror need not report the discount to the buyer for purposes of this provision.

(ii) If the buyer is an entity that reports its costs on a cost report required by the Department or a State agency, the offeror must comply with the following two standards—

(A) The offeror must inform the buyer in a manner reasonably calculated to give notice to the buyer of its obligations to report such a discount and to provide information upon request under paragraph (h)(1) of this section; and

(B) The offeror of the discount must refrain from doing anything that would impede the buyer’s ability to meet its obligations under this paragraph.

(iii) If the buyer is an individual or entity in whose name a request for payment is submitted for the discounted item or service and payment may be made, in whole or in part, under Medicare, Medicaid or other Federal health care programs (not including individuals or entities defined as buyers in paragraph (h)(1)(i) or (h)(1)(ii) of this section), the offeror must comply with the following two standards—

(A) The offeror must inform the individual or entity submitting the claim or request for payment in a manner reasonably calculated to give notice to the individual or entity of its obligations to report such a discount and to provide information upon request under paragraphs (h)(1) and (h)(2) of this section; and

(B) The offeror of the discount must refrain from doing anything that would impede the buyer’s or seller’s ability to meet its obligations under this paragraph.

(4) For purposes of this paragraph, a rebate is any discount the terms of which are fixed and disclosed in writing to the buyer at the time of the initial purchase to which the discount applies, but which is not given at the time of sale.

(5) For purposes of this paragraph, the term discount means a reduction in the amount a buyer (who buys either directly or through a wholesaler or a group purchasing organization) is charged for an item or service based on an arms-length transaction. The term discount does not include—

(i) Cash payment or cash equivalents (except that rebates as defined in paragraph (h)(4) of this section may be in the form of a check);

(ii) Supplying one good or service without charge or at a reduced charge to induce the purchase of a different good or service, unless the goods and services are reimbursed by the same Federal health care program using the same methodology and the reduced charge is fully disclosed to the Federal health care program and accurately reflected where appropriate, and as appropriate, to the reimbursement methodology;

(iii) A reduction in price applicable to one payer but not to Medicare, Medicaid or other Federal health care programs;

(iv) A routine reduction or waiver of any coinsurance or deductible amount owed by a program beneficiary;

(v) Warranties;

(vi) Services provided in accordance with a personal or management services contract; or

(vii) Other remuneration, in cash or in kind, not explicitly described in this paragraph (h)(5) of this section.; or

(viii) A reduction in price or other remuneration from a manufacturer in connection with the sale or purchase of a prescription pharmaceutical product to a plan sponsor under Medicare Part D, a Medicaid Managed Care Organization as defined in section 1903(m) of the Act, or to a pharmacy benefit manager acting under contract with a plan sponsor under Medicare Part D, or Medicaid Managed Care Organization, unless it is a price reduction or rebate that is required by law.

(6) For purposes of this paragraph (h), the term manufacturer carries the meaning ascribed to it in Social Security Act section 1927(k)(5).

(7) For purposes of this paragraph (h), the terms wholesaler and distributor are used interchangeably and carry the same meaning as the term “wholesaler” defined in Social Security Act section 1927(k)(11).

(8) For purposes of this paragraph (h), the term pharmacy benefit manager or PBM means any entity that provides pharmacy benefits management on behalf of a health benefits plan that manages prescription drug coverage.

(9) For purposes of this paragraph (h), a prescription pharmaceutical product is either a drug or a biological as those terms are defined in Social Security Act section 1927(k)(2)(A), (B), and (C)

(10) For purposes of this paragraph (h), the term Medicaid Managed Care Organization or Medicaid MCO carries the meaning ascribed to it in section 1903(m) of the Social Security Act.

…..

(cc) Point-of-sale reductions in price for prescription pharmaceutical products.

(1) As used in section 1128B of the Act, “remuneration” does not include a reduction in the price charged by a manufacturer for a prescription pharmaceutical product that is payable, in whole or in part, by a plan sponsor under Medicare Part D or a Medicaid Managed Care Organization, provided the manufacturer meets the following conditions with regard to that reduction in price:

(i) The reduced price must be set in advance with a plan sponsor under Medicare Part D, a Medicaid MCO, or the PBM acting under contract with either;

(ii) The sale does not involve a rebate unless the full value of the reduction in price is provided to the dispensing pharmacy through a chargeback or series of chargebacks, or is required by law; and

(iii) The reduction in price must be completely applied to the price of the prescription pharmaceutical product charged to the beneficiary at the point of sale.

(2) Definitions.

(i) For purposes of this paragraph (cc), the terms manufacturer, pharmacy benefit manager or PBM, prescription pharmaceutical product, rebate, and Medicaid managed care organization or Medicaid MCO have the meanings ascribed to them in paragraph (h) of this section.

(ii) For purposes of this paragraph (cc), a chargeback is a payment made directly or indirectly by a manufacturer to a dispensing pharmacy so that the total payment to the pharmacy for the prescription pharmaceutical product is at least equal to the price agreed upon in writing between the Plan Sponsor under Part D, the Medicaid MCO, or a PBM acting under contract with either, and the manufacturer of the prescription pharmaceutical product.

(dd) PBM service fees. As used in section 1128B of the Act, “remuneration” does not include any payment by a pharmaceutical manufacturer to a pharmacy benefit manager (PBM) for services the PBM provides to the pharmaceutical manufacturer related to the pharmacy benefit management services that the PBM furnishes to one or more health plans as long as the following conditions are met:

(1) The PBM must have a written agreement with the pharmaceutical manufacturer that covers all of the services the PBM provides to the manufacturer in connection with the PBM’s arrangements with health plans for the term of the agreement and specifies each of the services to be provided by the PBM and the compensation associated with such services.

(2) The compensation paid to the PBM must:

(i) Be consistent with fair market value in an arm’s-length transaction;

(ii) Be a fixed payment, not based on a percentage of sales; and

(iii) Not be determined in a manner that takes into account the volume or value of any referrals or business otherwise generated between the parties, or between the manufacturer and the PBM’s health plans, for which payment may be made in whole or in part under Medicare, Medicaid, or other Federal health care programs.

(3) The PBM must disclose in writing to each health plan with which it contracts at least annually, and to the Secretary upon request, the services rendered to each pharmaceutical manufacturer related to the PBM’s arrangements to furnish pharmacy benefit management services to the health plan.

(4) For purposes of safe harbor in this paragraph (dd), the terms manufacturer, pharmacy benefit manager or PBM, and prescription pharmaceutical product have the meanings ascribed to them in paragraph (h) of this section, and health plan has the meaning ascribed to it in paragraph (l) of this section.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.