In recent weeks, the U.S. Securities and Exchange Commission (SEC) and market participants have dealt with the current and potential impact of the novel coronavirus COVID-19 pandemic. To help market participants remain in compliance with the SEC’s various regulatory requirements during this crisis, the SEC and its staff have issued guidance and several exemptive orders, much of which provides regulatory flexibility to registered open-end funds (OEFs), registered closed-end funds (CEFs) and unit investment trusts (UITs, and collectively with OEFs and CEFs, registered funds) and business development companies (BDCs, and collectively with registered funds, funds).

See all our COVID-19 publications and webinars.

For your convenience, we have summarized the relevant guidance and orders released through April 7, 2020, that provide regulatory relief specific to funds or that generally provide relief to market participants and are relevant and applicable to funds:

- SEC Targeted Action to Assist Funds in Meeting Investment Company Act Regulatory and Filing Requirements

- BDC Relief From Exchange Act Filing Requirements

- Disclosure Considerations for All Public Companies, Including Funds

- Shareholder Meetings and Proxy Delivery

- Providing Liquidity to OEFs and Separate Accounts Through Certain Lending Arrangements

- Additional SEC Action Related to OEF Liquidity

- NYSE Proposed Relaxation of Dollar Price Continued Listing Requirement

a. In-Person Board Meeting Voting Requirements

b. Forms N-CEN and N-PORT Filing Requirements; Transmittal of Annual and Semiannual Reports

c. Timing for Filing Form N-23C-2

d. SEC Statement Regarding Prospectus Delivery

a. Shareholder Meetings

b. Mailing Proxy Materials

a. Permitting Secured Borrowing From Affiliated Persons

b. Expanding Existing Interfund Lending Arrangements

c. Permitting New Interfund Lending Arrangements

d. Permitting Deviation From a Fund’s Fundamental Policies

a. No-Action Relief Permitting Affiliated Purchases of Debt Securities From Certain OEFs

SEC Targeted Action to Assist Funds in Meeting Investment Company Act Regulatory and Filing Requirements

On March 13, 2020, the SEC issued an order, which was subsequently amended on March 25, 2020, granting relief to funds from specified provisions of the Investment Company Act of 1940 (the 1940 Act) and certain rules thereunder amid concerns about COVID-19. The order comes in response to inquiries from industry representatives regarding the ability of funds to comply with all of the 1940 Act’s requirements given the imposition of quarantines around the world, disruptions to transportation, and personnel concerns stemming from illness or remote workforces.

Specifically, the order responds to industry concerns regarding:

- the ability of funds’ boards of directors to travel in order to meet in-person voting requirements under the 1940 Act;

- challenges if personnel that prepare, transmit and file a fund’s periodic reports become unavailable;

- the ability for certain CEFs and BDCs to provide the advance notice for redemptions of senior securities required under Rule 23c-2; and

- the ability to timely deliver a fund’s prospectus.

The specific relief granted and certain conditions are outlined below.

In-Person Board Meeting Voting Requirements

Relief

Through August 15, 2020, funds are exempt from the in-person voting requirements to approve investment advisory agreements, principal underwriting agreements, auditors and plans regarding distribution-related payments from fund assets under Section 15(c) and 32(a) of the 1940 Act and Rules 12b-1(b)(2) and 15a-4(b)(2)(ii) under the 1940 Act.

Conditions

(a) Reliance on the order is necessary or appropriate due to circumstances related to current or potential effects of COVID-19;

(b) Votes are cast at a meeting in which all directors may participate and hear each other simultaneously; and

(c) The board, including a majority of the directors who are not interested persons of the fund, ratifies the approval at the next in-person meeting.

Forms N-CEN and N-PORT Filing Requirements; Transmittal of Annual and Semiannual Reports

Relief

Registered funds required to file Form N-CEN pursuant to Rule 30a-1 under the 1940 Act or Form N-PORT pursuant to Rule 30b1-9 under the 1940 Act are temporarily exempt from such filing requirements if the conditions are met.

Registered funds are temporarily exempt from the requirements of Section 30(e) of the 1940 Act and Rule 30e-2 thereunder to transmit annual and semiannual reports to shareholders if the following conditions are met.

Conditions

(a) The original filing or transmittal deadline was on or after March 13, 2020, (e.g., this includes Form N-CEN filings for a fund with a December 31 fiscal year-end) but on or prior to June 30, 2020;

(b) The registered fund is unable to meet the filing deadline or prepare or transmit the related report due to circumstances related to current or potential effects of COVID-19;

(c) The registered fund promptly notifies the SEC staff via email at IM-EmergencyRelief@sec.gov stating that it is relying on the order;

(d) The registered fund includes a statement on its public website stating that it is relying on the order;

(e) The registered fund files such Form N-CEN or Form N-PORT, or prepares and transmits such annual or semiannual report, as soon as practicable but not later than 45 days after the original due date (e.g., Form N-CEN filings for registered funds with a December 31 fiscal year-end must be made prior to April 29, 2020);

(f) Any Form N-CEN or Form N-PORT filed pursuant to the order includes a statement that the registered fund relied on the order and the reasons why it could not file its reports on a timely basis; and

(g) Annual or semiannual reports must still be filed on Form N-CSR within 10 days after transmission to shareholders.

Timing of Filing Form N-23C-2

Relief

Through August 15, 2020, CEFs and BDCs are temporarily exempt from the 30 days’ advance notice requirement under Sections 23(c) and 63, as applicable, of the 1940 Act and Rule 23c-2 thereunder if the fund files a Form N-23C-2 with the SEC prior to, including the same business day as, the company’s call or redemption of securities of which it is the issuer where the following conditions are met.

Conditions

(a) The fund promptly notifies the SEC staff via email at IM-EmergencyRelief@sec.gov stating that it is relying on the order;

(b) The fund ensures that filing Form N-23C-2 on an abbreviated timeframe is permitted under relevant state law and the fund’s governing documents; and

(c) The fund files a Form N-23C-2 that contains all of the information required by Rule 23c-2 prior to:

(i) any call or redemption of existing securities;

(ii) the commencement of any offering of replacement securities; and

(iii) providing notification to the existing shareholders whose securities are being called or redeemed.

SEC Statement Regarding Prospectus Delivery

Relief

The SEC does not consider a registered fund’s failure to timely deliver to investors a current fund prospectus because of circumstances related to COVID-19 to be a basis for SEC enforcement action if the following conditions are satisfied.

Conditions

(a) The sale of shares to the investor was not the investor’s initial share purchase in the registered fund;

(b) The registered fund notifies the SEC staff via email at IM-EmergencyRelief@sec.gov that it is relying on the order;

(c) The registered fund publishes on its public website that it intends to rely on the SEC’s position;

(d) The registered fund publishes its current prospectus on its public website; and

(e) The original delivery deadline was on or after March 13, 2020, but on or prior to June 30, 2020, and the prospectus is delivered to investors as soon as practicable and not later than 45 days after the date originally required.

The original order applied to the period from March 13, 2020, to March 24, 2020, and the subsequent order extended the relief through June 30, 2020.

BDC Relief From Exchange Act Filing Requirements

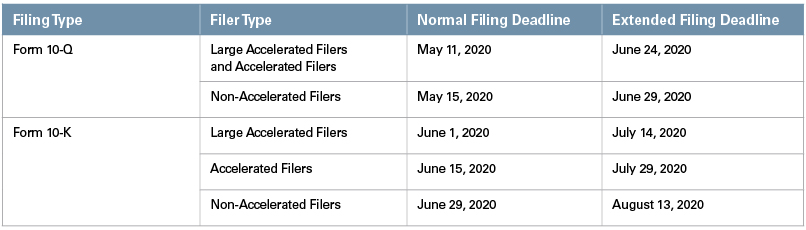

On March 4, 2020, the SEC issued an order, which was subsequently amended on March 25, 2020, granting relief to publicly traded companies, including BDCs, from certain filing obligations under the federal securities laws. Specifically, the order provides BDCs with an additional 45 days to file certain disclosure reports required by the Securities Exchange Act of 1934 (the Exchange Act) (e.g., Form 10-K, Form 10-Q and Form 13F filings) that otherwise would have been due between March 1, 2020, and July 1, 2020, subject to certain conditions.

For example, for BDCs with a quarter or fiscal year ending March 31, 2020:

To qualify for relief, a BDC must be unable to meet a filing deadline due to circumstances related to COVID-19 and must furnish to the SEC a current report on Form 8-K by the report’s deadline which: (1) states that the BDC is relying on the SEC’s order; (2) contains a brief description of why the company could not file its required material on a timely basis; (3) includes an estimate of when the filing is expected to be made; (4) includes a company-specific risk factor or factors explaining the impact, if material, of COVID-19 on the business; and (5) if the reason the BDC cannot timely file relates to the inability of a person other than the registrant to furnish a required opinion, report or certification, the Form 8-K must include as an exhibit a statement signed by such persons stating the specific reasons why they are unable to furnish such document prior to the filing date. Additionally, when the filing is ultimately made, the BDC must disclose in that filing that it is relying on the order and state the reason why it could not make such filings on a timely basis.

Any such delayed filing must include information as of the most recently completed fiscal quarter or year-end, as applicable. Therefore, BDCs will have more time to determine net asset value and prepare and file their financial statements with the SEC, but the financial information is still required to be provided as of March 31, 2020.

Any BDC intending to rely on the order should assess the potential market reaction, especially if most other BDCs release earnings, file their Form 10-Qs and conduct analyst calls on a timely basis. The BDC also should continue to comply with the information reporting requirements under its credit agreement and bond covenants.

Additionally, a BDC that relies on the order but elects to release more limited financial information at or around the time the BDC would normally release earnings together with a related analyst call would need to carefully evaluate the limited financial information and analyst call to ensure it does not present materially misleading information.

The original order applied to the period from March 1, 2020, to March 30, 2020, and the subsequent order extended the relief through July 1, 2020.

Disclosure Considerations for All Public Companies, Including Funds

As noted in the press release accompanying the SEC’s March 25, 2020, orders, all public companies should consider their activities in light of their disclosure obligations under federal securities laws.

- The SEC notes that where a company has become aware of a risk related to COVID-19 that would be material to its investors, it should refrain from engaging in securities transactions with the public and discourage directors and officers from initiating such transactions until investors have been appropriately informed about the risk.

- To the extent the company or insiders are engaged in transactions, or circumstances otherwise warrant it, the company should consider what disclosures are required in order to inform the public of its financial condition.

- Companies that disclose material information related to the impacts of COVID-19 should avoid selective disclosures and disseminate such information broadly.

- Depending on a company’s particular circumstances, it should consider whether it may need to revisit, refresh or update previous disclosure to the extent that the information becomes materially inaccurate.

Shareholder Meetings and Proxy Delivery

Shareholder Meetings

On March 13, 2020, the SEC staff announced guidance, which was subsequently amended on April 7, 2020, to assist public companies, including funds, with upcoming shareholder meetings. The guidance provides regulatory flexibility to companies seeking to change the date and location of their shareholder meetings and use new technologies, such as “virtual” shareholder meetings in light of the health, transportation and other logistical challenges of holding in-person meetings given the spread of COVID-19.

- Changing the Date, Time or Location of a Shareholder Meeting. An issuer that has mailed and filed its definitive proxy materials can notify shareholders of a change in the date, time or location of its annual or special shareholder meeting without mailing additional soliciting materials or amending its proxy materials if it (1) issues a press release announcing such change, (2) files the announcement as definitive additional soliciting material on EDGAR and (3) takes all reasonable steps necessary to inform other intermediaries in the proxy process and other relevant market participants, such as a stock exchange, of such change.

- Virtual Shareholder Meetings. The ability to conduct a virtual meeting is governed by state law, where permitted, and the issuer’s governing documents. To the extent a fund expects to conduct a virtual meeting, the fund must notify its shareholders, intermediaries in the proxy process and other market participants of such plans in a timely manner and disclose clear directions as to the logistical details of the virtual meeting, including how shareholders can remotely access, participate in and vote at such meeting. Issuers that have already mailed and filed their definitive proxy materials can notify shareholders of the change to a virtual meeting by following the steps described in the above bullet.

- Presentation of Shareholder Proposals. In light of the possible difficulties for shareholder proponents to attend annual meetings in person to present their proposals, the SEC staff encourages funds, to the extent feasible under state law, to provide shareholder proponents or their representatives with the ability to present their proposals through alternative means, such as by phone, during the 2020 proxy season. Furthermore, to the extent a shareholder proponent is not able to attend the annual meeting and present the proposal due to COVID-19, the SEC staff would consider this to be “good cause” under Rule 14a-8(h) should the issuer assert Rule 14a-8(h)(3) as a basis to exclude a proposal submitted by the shareholder proponent for any meetings held in the following two calendar years.

Mailing Proxy Materials

On March 4, 2020, the SEC issued an order, which was subsequently amended on March 25, 2020, granting relief from certain provisions of the Exchange Act and the rules thereunder related to furnishing proxy materials including, as applicable, proxy statements, annual reports and other soliciting materials. The order provides relief where a fund’s security holder has a mailing address in an area where, as a result of COVID-19, delivery service has been suspended and the fund or other person making a solicitation has made a good faith effort to furnish applicable materials to the security holder.

The original order applied to the period from March 1, 2020, to April 30, 2020, and the subsequent order extended the period through July 1, 2020.

Further, the SEC staff guidance regarding shareholder meetings summarized above also provides flexibility for issuers to use the “notice-only” delivery option permitted by Rule 14a-16 under the Exchange Act when delays in printing and mailing proxy materials are unavoidable due to COVID-19. Specifically, the SEC staff will not object to an issuer using the “notice-only” delivery option in a manner that, while not meeting all aspects of the notice and timing requirements of Rule 14a-16, including the 40 calendar days’ advance notice requirements, will nonetheless provide shareholders with the proxy materials sufficiently in advance of the meeting so that they may review the materials and vote on the proposals in an informed manner. Issuers must announce the change in the delivery method by following the steps described above for announcing a change in the meeting date, time or location.

Providing Liquidity to OEFs and Separate Accounts Through Certain Lending Arrangements

On March 23, 2020, the SEC issued an order granting relief to OEFs (other than money market funds) and insurance company separate accounts registered as UITs (qualifying funds) to obtain short-term funding by (1) borrowing money from affiliated persons on a collateralized basis, (2) engaging in interfund lending on terms beyond those included in such fund’s existing interfund lending orders (if any) and (3) deviating from fundamental policies.

Permitting Secured Borrowing From Affiliated Persons

Relief

From March 23, 2020, through at least June 30, 2020, qualifying funds are permitted to borrow from their affiliated persons (or affiliated persons of such persons) on a collateralized basis, irrespective of whether that affiliate is a bank or a registered investment company, notwithstanding provisions of the 1940 Act that would otherwise prohibit such arrangement. This relief will terminate pursuant to a future public notice from the SEC staff indicating a termination date at least two weeks from the date of such notice and not earlier than June 30, 2020 (the OEF lending relief period). Additionally, no relief is required to permit a fund to borrow money from an affiliate on an unsecured basis.

Conditions

(a) The board of the OEF, including a majority of the independent directors, or the insurance company on behalf of the separate account, reasonably determines that such borrowing:

(i) is in the best interest of the qualifying fund and its shareholders or unitholders, and

(ii) will serve the purpose of satisfying shareholder redemptions; and

(b) The OEF notifies the SEC staff via email at IM-EmergencyRelief@sec.gov prior to relying on the relief for the first time, stating that the qualifying fund is relying on the order.

Expanding Existing Interfund Lending Arrangements

Relief

Over the years, the SEC has issued orders permitting certain fund complexes to loan assets among different funds, which is generally prohibited as a joint transaction under Section 17(d) of the 1940 Act and Rule 17d-1 thereunder. During the OEF lending relief period, a fund currently able to rely on such an order (an existing interfund lending (IFL) order) may (1) make loans through the facility in an aggregate amount that does not exceed 25% of its current net assets at the time of the loan, notwithstanding any lower limitation in the existing IFL order and (2) borrow (if permitted under the existing IFL order to be a borrower) or make loans through the facility for any term, notwithstanding any conditions limiting the term of such loans, provided that: (i) the term of any interfund loan made in reliance on the order does not extend beyond the OEF lending relief period; (ii) the fund’s board, including a majority of the independent directors, reasonably determines that the maximum term for such interfund loans is appropriate; and (iii) the loans will remain callable and subject to early repayment on the terms described in the existing IFL order.

Conditions

(a) Any loan under the facility is otherwise to be made in accordance with the terms and conditions of the exiting IFL order;

(b) The fund notifies the SEC staff via email at IM-EmergencyRelief@sec.gov prior to relying on the relief for the first time, stating that the fund is relying on the order; and

(c) Prior to relying on the relief for the first time, the fund discloses on its public website that it is relying on the order and that the order modifies the terms of the fund’s existing IFL.

Permitting New Interfund Lending Arrangements

Relief

During the OEF lending relief period, funds without an existing IFL order may establish an interfund lending facility and engage in interfund lending as set forth in an exemptive order permitting such a facility issued by the SEC since March 23, 2019 (recent IFL precedent).

Conditions

(a) The fund satisfies the terms and conditions for relief in the recent IFL precedent (including with respect to whether it may participate as a borrower), except that:

(i) The fund may rely on the same relief, including the conditions, provided to funds and separate accounts with existing interfund lending orders, as described above;

(ii) The fund need not satisfy the recent IFL precedent’s requirement to include disclosure noting the fund’s reliance on an interfund lending order in the fund’s registration statement or shareholder report; and

(iii) Money market funds may not participate as borrowers in any interfund facility;

(b) The fund notifies the SEC staff via email at IM-EmergencyRelief@sec.gov prior to relying on the relief for the first time, stating that the fund is relying on the order and identifying the recent IFL precedent on which it intends to rely;

(c) Prior to relying on the relief for the first time, the fund discloses on its public website that it is relying on the order to utilize an interfund lending or borrowing facility; and

(d) The fund includes disclosure regarding the material facts about its participation or intended participation in the facility in any prospectus supplement or a new or amended registration statement or shareholder report it files while it is relying on this relief.

Permitting Deviation From a Fund’s Fundamental Policies

Relief

During the OEF lending relief period, an OEF is exempt from Sections 13(a)(2) and 13(a)(3) of the 1940 Act to the extent necessary to permit it to enter into otherwise lawful lending or borrowing transactions that deviate from any related policy recited in its registration statement without prior shareholder approval.

Conditions

(a) The board of the fund, including a majority of the independent directors, reasonably determines that such lending or borrowing is in the best interest of the fund and its shareholders;

(b) The fund promptly notifies its shareholders of the deviation by filing a prospectus supplement and including a statement on the fund’s public website; and

(c) The fund notifies the SEC staff via email at IM-EmergencyRelief@sec.gov prior to relying on the relief for the first time, stating that the fund is relying on the order.

Additional SEC Action Related to OEF Liquidity

No-Action Relief Permitting Affiliated Purchases of Debt Securities From Certain OEFs

On March 26, 2020, the SEC staff issued a no-action letter granting relief under Section 17(a) of the 1940 Act for affiliated purchases of debt securities from OEFs that are not ETFs or money market funds.1 The incoming letter from the Investment Company Institute requesting relief noted a COVID-19-related short-term dislocation in the market for a variety of debt securities (including, without limitation, commercial paper, corporate debt securities, certificates of deposit, asset-backed debt securities and municipal obligations). Certain affiliates of an OEF may wish to purchase such debt securities from the fund in order to enhance the fund’s liquidity and to enable it to fund shareholder redemptions, but are unable to do so due to the restrictions on affiliated transactions contained in Section 17(a) of the 1940 Act. Such purchases would not result in an SEC staff recommendation of enforcement action, subject to the following conditions:

- The purchase price is paid in cash;

- The purchase price equals the debt security’s fair market value (provided this price is not materially different from the fair market value indicated by a reliable third-party pricing service);

- Any profit realized by the affiliated purchaser from a subsequent sale of such security is paid back to the fund, subject to certain banking regulations applicable to certain affiliated purchasers;

- Within one business day of any such purchase, the fund publicly posts on its website, and informs the SEC staff via email at IM-EmergencyRelief@sec.gov of, the name of the fund, the name of the affiliated purchaser, the securities purchased (including a legal identifier if available), the amount purchased and the total price paid; and

- The relief is temporary and will cease to be in effect upon notice from the SEC staff.

NYSE Proposed Relaxation of Dollar Price Continued Listing Requirement

On April 3, 2020, the New York Stock Exchange (NYSE) submitted a proposed rule to the SEC to waive the NYSE’s $1 continued listing requirement, pursuant to which a listed company may face delisting if its shares trade at a price less than $1 for 30 or more consecutive days, through and including June 30, 2020. The proposal explains that companies would not be notified of new events of noncompliance with the $1 continued listing requirement during the suspension period. The proposal further explains that following the temporary rule suspension, any new events of noncompliance with the $1 continued listing requirement would be determined based on a period of 30 consecutive trading days commencing on or after July 1, 2020. If the SEC approves the NYSE’s proposed rule, it would become effective immediately.

Associate Cameron Jordan contributed to this alert.

_______________

1 Money market funds may rely on a similar no-action letter issued to the Investment Company Institute on March 19, 2020, to the extent Rule 17a-9 under the 1940 Act would not cover the affiliated purchase.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.