Since the beginning of 2020, the U.S. Department of the Treasury (Treasury) has issued numerous regulations to implement fully the Foreign Risk Review Modernization Act of 2018 (FIRRMA) on behalf of the Committee on Foreign Investment in the United States (CFIUS). Most recently, on May 21, 2020, Treasury announced a proposed rule that would modify provisions related to mandatory declarations. Written comments must be received by CFIUS by June 22, 2020.

This proposed rulemaking follows a flurry of other recent announcements regarding limits on inbound investments, technology and materials, as well as more specific restrictions regarding whether and how U.S. export-controlled technology can be provided to or support Chinese interests. In short, over the past several months broad efforts have been made by the Trump administration to address numerous national security-related trade and investment issues with China.

Mandatory Declaration Provisions Updated

As expected based on commentary by Treasury during previous rulemaking processes, the proposed new rule (a) modifies the approach to mandatory declarations for critical technology1 by eliminating requirements based on North American Industry Classification System (NAICS) codes to an approach based solely on export-licensing requirements and (b) clarifies the definition of a “substantial interest” as it relates to government ownership in a transaction in U.S. businesses involving critical technology, infrastructure or bulk U.S. personal data (TID U.S. business).

Mandatory Critical Technology Declarations Expanded Beyond Specific Industries

CFIUS previewed the shift away from a NAICS code-based approach in its January 13, 2020, final rulemaking implementing FIRRMA, and the proposed rule clarifies their export control-focused approach.2 Under the proposed rule, declarations would be required for transactions involving a U.S. business that produces, designs, tests, manufactures, fabricates or develops one or more critical technologies that would require a license or authorization to be exported, re-exported, transferred (in country) or retransferred to certain transaction parties and persons in the ownership chain of the foreign person. The regulations clarify that CFIUS will determine whether such a license would be required based on the foreign investor’s principal place of business or the foreign individual’s nationality or nationalities.3 Applicable license and authorization regimes include:

- a license or other approval issued by the Department of State under the International Traffic in Arms Regulations (ITAR) (even if a license exemption may be available);

- a license from the Department of Commerce (Commerce) under the Export Administration Regulations (EAR) (even if a license exception may be available, other than certain elements of license exception ENC (encryption); license exception TSU (technology and software-unrestricted); and certain elements of license exception STA (strategic trade authorization)4);

- a specific or general authorization from the Department of Energy (Energy) under the regulations governing assistance to foreign atomic energy activities at 10 CFR part 810 other than the general authorization described in 10 CFR 810.6(a); or

- a specific license from the Nuclear Regulatory Commission under the regulations governing the export or import of nuclear equipment and material at 10 CFR part 110.

A U.S. business will need to determine how its products would be classified — even if the company does not currently export some or all of its products. In determining the appropriate export control-licensing requirement, under the proposed rule, parties will need to analyze not only the acquiring entity itself, but also persons in the acquirer’s ownership chain. The new rule clarifies that parties will need to analyze all foreign persons holding a 25% voting interest, direct or indirect, in the entity. In the case of entities whose activities are primarily directed, controlled or coordinated by or on behalf of a general partner (GP), managing member or equivalent, the applicable threshold is a 25% interest in an entity’s GP, managing member or equivalent. The proposed rule also makes clear that for purposes of determining the percentage of interest held indirectly by one person in another, a parent entity will be deemed to hold a 100% interest in a subsidiary entity.

The new approach will not be implemented until the effective date of the final rule — expected no earlier than mid-summer 2020 (following the 30-day comment period). Importantly, the rules in effect as of February 13, 2020, will remain so for transactions for which certain actions (e.g., completion of the transaction, execution of a binding document establishing the material terms of the transaction, a public offer to buy shares, solicitation of proxies, request for conversion of contingent equity interest) occurred between February 13, 2020, and the effective date of the final rule implementing the new export control-based approach.

The removal of all NAICS code criteria in this proposed approach will significantly expand the universe of critical technology mandatory filings. Although this approach may capture more transactions overall, we expect it will provide industry with greater investment certainty than did the use of self-identified NAICS codes. We also expect the universe of covered transactions will continue to grow even more significantly as Commerce moves forward with the implementation of the Export Control Reform Act of 2018, including by issuing long-awaited rules to identify and control emerging and foundational technologies.

Additional Clarity for Investment Funds With Foreign Government Ownership

With respect to transactions by investors with foreign government ownership, the proposed rule narrowly modifies the definition of “substantial interest” with regard to the calculation of ownership interests that trigger a mandatory filing. Currently, any government-controlled substantial interest transaction (i.e., a transaction in which a foreign government holds a (direct or indirect) 49% or greater voting interest in an entity that obtains a 25% or greater interest in a TID U.S. business) results in a mandatory filing requirement.

First, the rule clarifies that when a foreign investment involves a foreign person with a GP, the foreign government ownership interest will only trigger a mandatory filing if the GP primarily directs, controls or coordinates the activities of the entity. If the GP does not perform these functions (e.g., if a management company actively manages the fund), the foreign government ownership interest in the GP will not itself mandate a CFIUS filing.

Second, as in the revised critical technology regulations, the proposed rule clarifies that, for purposes of determining the interest a parent holds in a subsidiary, in the case of both direct and fund investments, a parent is deemed to hold a 100% interest in any entity of which it is a parent.

Other Recent National Security Developments

In sum, the past three months have seen a flood of activity regulating both inbound foreign investment (through CFIUS changes and beyond) and outbound flows of technology. Some of these actions have specifically targeted Chinese companies, such as restrictions on the supply of certain export controlled technology to Huawei Technologies Co., Ltd. and several of its non-U.S. affiliates (collectively, Huawei), while others are more generic — at least by their text — in their application. Taken together, all of these steps reflect significantly more assertive and muscular processes, largely but not entirely aimed at China, that will require careful consideration by both U.S. and overseas businesses and investors.5 Following is a brief summary of the most significant recent developments on this front.

CFIUS and Team Telecom

Filing Fees

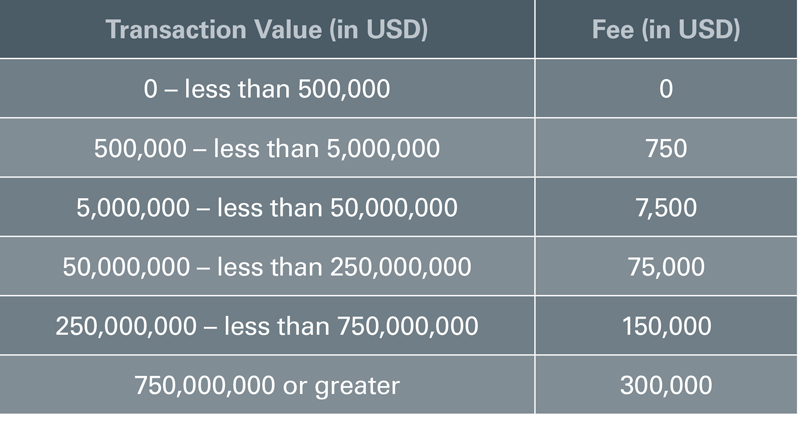

CFIUS instituted filing fees on May 1, 2020.6 The fee structure depends on the value of the transaction and can range up to $300,000:

The interim rule provides for a 30-day comment period, but, under the interim rule, most notices for which a final filing is made on or after May 1, 2020, will be subject to fees. CFIUS will not formally accept a notice, or begin review of a proposed transaction, until the fee is paid. Declarations, whether voluntary or mandatory, are not subject to fee requirements, and neither are refilings of notices, unless CFIUS determines that a material change to the transaction has occurred. The rule indicates that CFIUS will issue refunds in limited circumstances if it determines that a transaction is not subject to CFIUS’ jurisdiction.

2018 Annual Report

On May 19, 2020, CFIUS published its 2018 Calendar Year Annual Report.7 The report showed a consistent level of activity between 2017 and 2018 in terms of notices (237 and 229, respectively), investigations (172 and 158, respectively) and withdrawals (74 and 66, respectively). However, in summary statistics for 2019 also released,8 while CFIUS continued to have a consistent level of filings (231), there were marked decreases in investigations (111) and withdrawals (30, only eight of which were withdrawn and abandoned due to national security concerns). We expect the increased number of transactions clearing in the initial review period stems from the extended CFIUS statutory timeframe granted by FIRRMA (45-day review, as opposed to 30 days pre-November 2018). We also expect the extended timeframe has led to the significant decrease in notices withdrawn and refiled (30 in 2019 versus 44 and 42 in 2017 and 2018, respectively). Interestingly, compared with 24 and 18 transactions withdrawn and abandoned by parties in 2017 and 2018, respectively, the withdrawal and abandonment of only eight transactions in 2019 is striking. CFIUS has not yet released its full calendar year annual report for 2019, however, the widely discussed slowing of Chinese investment in the United States9 over the course of the last two years may have contributed to this sharp decline in “soft” blocks by CFIUS.

The end of 2018 also provided the first look at CFIUS’ reviews of mandatory declarations. From November 10-December 31, 2018, CFIUS received 21 declarations — of which only two were cleared. The remainder were required to file a full notice (five), informed CFIUS determined it could not conclude action (11), not subject to Pilot Program jurisdiction (1) and withdrawn for business reasons (1). The very few approvals likely reflect the inherent national security sensitivity of critical technology transactions as well as challenges associated with a shortened (30-day) period for review.10 Although official statistics have not been released for 2019, we understand from CFIUS leadership that approximately one-third of the declarations submitted in 2019 were approved. We expect this higher clearance rate to increase steadily as CFIUS receives more voluntary declarations, some involving less sensitive sectors or allied-country investors.

Filing Portal

On May 20, 2020, CFIUS began the transition to a new online portal for parties to file declarations and notices. The portal, and associated Case Management System (CMS), is expected to increase CFIUS’ efficiency in processing filings and standardize the submission and communication processes with CFIUS for parties and their counsel. Parties may currently submit draft notices through the portal, but until June 1, 2020, all final notices and declarations must continue to be submitted via email. After June 1, 2020, all draft and final notices and declarations must be submitted via the portal. The portal does not change any substantive aspects of the CFIUS process.

Formalizing Team Telecom

On April 4, 2020, President Donald Trump signed an executive order clarifying and formalizing the role of Team Telecom, an executive branch group comprising the U.S. Departments of Justice, Defense and Homeland Security charged with reviewing the national security risks associated with foreign ownership for entities with pending applications before, or licenses granted by, the Federal Communications Commission.11 Although Team Telecom has a mandate that parallels its perhaps better known counterpart CFIUS, its operation has been much less structured in comparison. Accordingly, the order is the culmination of a years-long effort to formalize Team Telecom and its processes. Agencies implicated by this order have until July 3, 2020, to enter into a memorandum of understanding regarding their plans to implement the order.

Export Controls

On April 28, 2020, Commerce’s Bureau of Industry and Security (BIS) published two final rules — both of which will take effect on June 29, 2020 — and one proposed rule — for which comments are due by June 29, 2020 — that have the potential to severely curtail export activities with respect to China, among others.12 The first final rule dramatically modifies the export, re-export and in-country transfer controls set forth in the EAR for military end uses and military end users in China, Russia and Venezuela. BIS also published a second final rule removing License Exception CIV, which authorizes the unlicensed export of a number of items controlled for national security reasons “provided the items are destined to civil end-users for civil end-uses in Country Group D:1,” which includes China, Russia and Venezuela, among others. Finally, BIS has proposed to modify License Exception APR to no longer permit unlicensed re-exports from Country Group A:1 (the countries participating in the multilateral Wassenaar Arrangement, with the exception of Russia, Ukraine and Malta) and Hong Kong to Country Group D:1, which includes China, Russia and Venezuela, among others.

Further Restrictions on Huawei

Effective May 15, 2020, Commerce made certain changes to the so-called foreign direct product rule that will greatly inhibit Huawei’s ability to design semiconductors and to procure chipsets produced by non-U.S. foundries to Huawei’s design specifications if such activities implicate certain manufacturing equipment, software or technology that is subject to the EAR.13 The approach adopted by BIS seemingly spares U.S. chipmakers — which also routinely make use of non-U.S. foundries — but over time potentially could accelerate efforts by non-U.S. semiconductor manufacturers to source necessary manufacturing equipment from non-U.S. suppliers. Comments on the rule are due to BIS by July 14, 2020.

Energy-Specific Actions

Trump Administration Restricts Sourcing of Bulk Power Equipment

On May 1, 2020, the Trump administration issued an executive order prohibiting the acquisition and installation of “bulk-power system electric equipment” (such as generators, circuit breakers, metering equipment, generation turbines and industrial control systems) supplied by foreign adversaries and persons subject to their control and establishing the creation of a task force to monitor threats to the U.S. power system from foreign adversaries.14 This executive order — which is almost identical to the Trump administration’s May 15, 2019, executive order that similarly limited the acquisition and use of certain information and communications technology (the ICT executive order15) — requires the secretary of Energy to conduct rulemaking by September 28, 2020, to implement the president’s direction and could ultimately have a major impact on the power industry’s ability to use China-sourced equipment.

Initiation of Section 232 Investigation Into Imports Related to Transformers

On May 11, 2020 — based on inquiries and requests from interested parties in the United States, including members of Congress, a Grain-Oriented Electrical Steel manufacturer, and producers of Power and Distribution Transformers — the secretary of Commerce initiated an investigation to determine the effects of imports of Laminations for Stacked Cores for Incorporation into Transformers, Stacked Cores for Incorporation into Transformers, Wound Cores for Incorporation into Transformers, Electrical Transformers and Transformer Regulators on U.S. national security.16 Commerce has solicited comments from interested parties that are due by June 9, 2020.17

_______________

1 CFIUS defines “critical technologies” to include (a) defense articles or defense services included on the United States Munitions List (USML) set forth in the International Traffic in Arms Regulations (ITAR) (22 CFR parts 120– 130); (b) items included on the Commerce Control List (CCL) set forth in Supplement No. 1 to part 774 of the Export Administration Regulations (EAR) (15 CFR parts 730–774), and controlled — (1) pursuant to multilateral regimes, including for reasons relating to national security, chemical and biological weapons proliferation, nuclear nonproliferation, or missile technology; or (2) for reasons relating to regional stability or surreptitious listening; (c) specially designed and prepared nuclear equipment, parts and components, materials, software and technology covered by 10 CFR part 810 (relating to assistance to foreign atomic energy activities); (d) nuclear facilities, equipment and material covered by 10 CFR part 110 (relating to export and import of nuclear equipment and material); (e) select agents and toxins covered by 7 CFR part 331, 9 CFR part 121, or 42 CFR part 73; and (f) emerging and foundational technologies controlled under Section 1758 of the Export Control Reform Act of 2018 (50 U.S.C. 4817).

2 See our January 16, 2020, client alert “CFIUS’ Final Rules: Broader Reach, Narrow Exceptions and Foretelling Future Change.”

3 For ITAR-controlled critical technologies, export licensing determinations for individuals of multiple nationalities may be analyzed on the basis of any one or more such nationalities, whereas export licensing determinations for EAR-controlled critical technologies generally will be based on the individual’s most recent citizenship or legal permanent resident alien status.

4 Importantly, for license exceptions ENC, TSU and STA, all restrictions on the use of such license exceptions found in 15 CFR 740.2 apply and must be considered in analyzing whether a transaction triggers a mandatory filing.

5 On May 20, 2020, the Trump administration delivered a report, “U.S. Strategic Approach to the People's Republic of China” to members of Congress in accordance with the 2019 National Defense Authorization Act. The report includes an overview of the security challenges presented by China and notes many of the developments highlighted below.

6 See our April 29, 2020, client alert “Despite Pandemic, CFIUS Continues FIRRMA Implementation and Activities.”

9 See additional information here.

10 Prior to the implementation of FIRRMA (pre-November 2018), the initial review period for a CFIUS notice was only 30 days, as opposed to the now 45-day period.

11 See our April 9, 2020, client alert “Executive Order Seeks to Modernize 'Team Telecom' After Years-Long Effort.”

12 See our May 4, 2020 client alert “Bureau of Industry and Security Further Restricts Exports to Countries of Concern, Including China.”

13 See our May 18, 2020, client alert “Commerce Department’s New Export-Related Restrictions Inhibit Semiconductor Design by and Manufacturing for Huawei.”

14 See our May 5, 2020, client alert “Trump Administration Limits Acquisitions and Use of Bulk-Power System Electric Equipment From Foreign Adversaries.”

15 See our April 9, 2020, client alert “Executive Order Seeks to Modernize 'Team Telecom' After Years-Long Effort” and our May 16, 2019, client alert “Trump Administration Limits US Purchase and Use of Certain Technology From Foreign Adversaries, Sale of US Technology to Huawei.”

16 See here. Subsequently, Commerceannounced a Section 232 national security investigation into imports of mobile cranes – which marks the sixth such investigation under the Trump administration (steel and aluminum, automobiles and associated parts, uranium ore and titanium sponge).

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.