Introduction

In 2021, the Department of Health and Human Services Office of Inspector General (HHS-OIG) entered into 30 new corporate integrity agreements (CIAs) with companies and individuals to resolve exclusion authority arising out of health care fraud matters. While this number was down sharply from a high point in 2020 and significantly below the average for the prior five years, the number of CIAs involving a drug or device manufacturer — five out of the 30 CIAs in 2021 — was generally consistent with the number of drug and device manufacturer CIAs in recent years.

For drug and device manufacturers, 2021 featured novel price transparency provisions, a continuing trend of requiring the involvement of independent experts in reviewing compliance programs and a focus on restrictions related to intellectual property arrangements.

Key Takeaways

- Three of the five drug and device manufacturer CIAs entered into in 2021 were tied to False Claims Act (FCA) settlements premised on an alleged conspiracy to fix the prices of various generic drugs; these agreements resulted in the imposition of novel CIA provisions designed to increase transparency regarding the manufacturers’ internal deliberative processes around price increases and contract negotiations.

- Two of the five drug and device manufacturer CIAs entered into in 2021 required the retention of an independent expert to review the effectiveness of the companies’ compliance programs. Whether this requirement will become a mainstay remains to be seen, but the requirement appears to confirm that the HHS-OIG continues to view outside experts as having a role in companies’ efforts to build effective compliance programs.1

- HHS-OIG also entered into four CIA amendments and continued its efforts to enforce existing CIAs, bringing two separate exclusion actions based on a material breach of a CIA and entering into five settlement agreements to resolve misconduct disclosed pursuant to a CIA that triggered HHS-OIG’s Civil Monetary Penalties authorities.

The Year in Numbers: CIA Statistics

The HHS-OIG entered into 30 new CIAs in 2021, which is far below the average of approximately 41 CIAs per year since 2012.2 Of the 34 total agreements in 2021, four were amendments to prior CIAs, 15 were integrity agreements (IAs), and 15 were CIAs.3

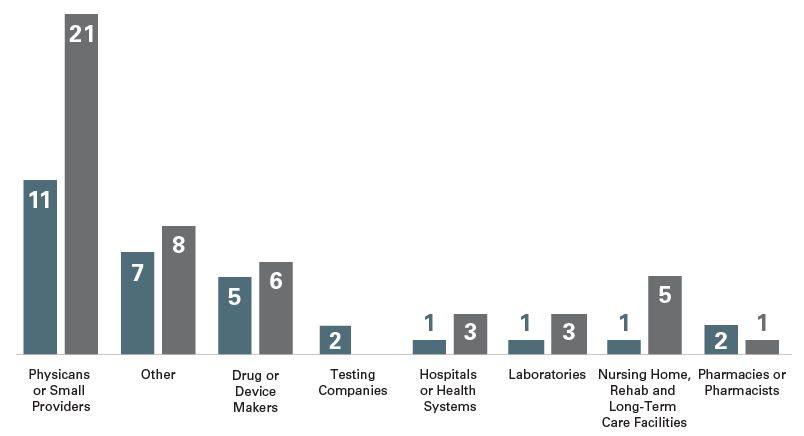

Sector Breakdown of New CIAs4

New CIAs: 2021 v. 2020

As is typical, the 30 new CIAs in 2021 spanned health care sectors. Although the highest number of CIAs involved individuals, small group practices or providers, the total number of such CIAs (11) is lower than in previous years. The “Other” category was the next largest (with seven agreements) and included entities that did not fall neatly into any sector (e.g., a county operating an acute-care hospital as part of a public safety net initiative and a university operating a laboratory and hospital-based facilities). The number of CIAs involving drug and device manufacturers remained fairly consistent, with only one fewer than in 2020 and three fewer than in 2019.5

Key CIA Trends

Novel Price Transparency Provisions: Drug and device manufacturers have faced increasing scrutiny of their product pricing, and the DOJ and HHS-OIG have particularly focused on practices that they believe improperly prop up such pricing.6 Therefore, it is not surprising that HHS-OIG, in keeping with its effort to develop provisions to address new areas of compliance risk not addressed in prior CIAs, entered into three CIAs this year that include previously unseen price transparency provisions. These provisions require both internal monitoring and disclosure (to HHS-OIG) of the internal deliberative processes around price increases and contract negotiations. In particular, the CIAs require the companies to, among other things:

- implement a robust, written review and approval process for contracts with customers for the purchase of government-reimbursed products that includes a review by legal personnel;

- maintain well-documented, centralized files of pricing and contracting activities;

- review a sample of customer contracts to assess whether pricing decisions and approvals were consistent with the company’s policies;

- monitor the interactions of persons engaged in Pricing and Contracting Functions7 with competitors through interviews and a review of records;

- report to HHS-OIG a summary of internal decisions and the decision-making process relating to an increase in list price for the company’s top government-reimbursed products;

- provide pricing trend reports to HHS-OIG; and

- provide to HHS-OIG a list of reports submitted to any government agency or information made public, pursuant to any state or federal law, regarding price or any increase in price of certain products.

Although the contours may change, provisions related to pricing transparency are likely to appear in future CIAs, particularly if the underlying conduct involves pricing-related concerns. Such provisions provide the federal government with more information than is required under various state transparency measures and may furnish regulators with additional fodder as they continue to look for ways to indirectly control rising drug prices.

Compliance Experts: In recent years, a number of drug and device manufacturer CIAs have required the board of directors to engage an external compliance expert to review the effectiveness of the compliance program. This requirement was included in the two drug and device manufacturer CIAs entered into in 2021 that did not address price fixing. Notably, however, one of those took the requirement a step further, requiring the company (rather than the board of directors) to engage an external compliance expert to perform a similar review for each of the five reporting periods.8

Financial Recoupment: HHS-OIG also continued to require drug and device manufacturers to implement financial recoupment programs to put annual performance pay at risk of forfeiture and recoupment if an individual is determined to have engaged in significant misconduct. Although HHS-OIG required recoupment provisions only once per year in 2017, 2018 and 2019, it did so twice in 2020 and three times in 2021.

CIAs Associated With Settlements Under $20 Million: As we have observed in prior alerts, HHS-OIG has not routinely required CIAs in connection with drug and device manufacturer DOJ settlements of under $20 million.9 Notably, however, two of the five drug and device manufacturer CIAs in 2021 were tied to settlements under this threshold. Both of these settlements involved allegations that device manufacturers paid kickbacks in the form of royalty fees, and one also alleged kickbacks through consulting and intellectual property acquisition fees. Not surprisingly, both of these CIAs included detailed controls around the purchase and licensing of intellectual property and royalty payments to ensure such arrangements to purchase or license intellectual property are appropriately documented, vetted by compliance personnel, based on fair market value and meet a legitimate business or scientific need.10

Although speaker programs were not the focus of the underlying settlements, the two CIAs also contained increasingly common speaker program restrictions, including implementation of an annual speaker program budget and the requirement of a well-documented needs assessment reviewed by the compliance department. One of the CIAs also required a centralized system for tracking speaker programs and attendees. The inclusion of these provisions in a CIA that did not arise out of speaker program-related violations suggests that HHS-OIG views the provisions as standard compliance best practices at this point.

COVID-19 Flexibility: As the U.S. enters the third calendar year of the COVID-19 pandemic, HHS-OIG continues to “consider the unique context in which the industry is presently operating.”11 To date, this consideration has resulted in flexibility by HHS-OIG in working with individuals and entities operating under CIAs during the pandemic, including by granting deadline extensions in at least 81 CIAs.12 This type of flexibility is likely to continue during the duration of the pandemic, but is not likely a long-term change in HHS-OIG’s approach.

OIG Enforcement Actions for CIA Violations

In 2021, six entities disclosed conduct under a preexisting CIA that resulted in reportable event settlement agreements with the HHS-OIG. The conduct ranged from the payment of above fair market value for furniture and equipment leases to employing excluded individuals and paying remuneration in the form of discounts to health care professionals. The settlement agreements totaled $1,034,701.27, combined. Separately, in January 2021, the HHS-OIG excluded two individuals for material breach of a CIA for failing to abide by a Departmental Appeals Board decision affirming an order to pay $1,322,500 in stipulated penalties assessed under the CIA. The HHS-OIG also excluded one entity for material breach of an IA for failure to engage an independent review organization.

Conclusion

HHS-OIG continued to adapt CIAs to address factual scenarios underlying DOJ settlements in 2021 by introducing novel price transparency obligations.

In addition, through a recent Request for Information, HHS-OIG announced that it is seeking to modernize the accessibility of its publicly available resources.13 HHS-OIG sought feedback from industry stakeholders about the ways that they have used publicly available information related to CIAs to refine internal compliance programs. Although CIAs are binding only on the party or parties to the agreement, HHS-OIG recognized that companies may review CIAs to identify best practices. This modernization initiative, coupled with HHS-OIG’s continuing imposition of novel CIA requirements, underscores HHS-OIG’s expectation that CIA requirements will drive industry practices that HHS-OIG views as involving significant compliance risk.

_______________

1 As noted in HHS-OIG’s white paper, “Practical Guidance for Health Care Governing Boards on Compliance Oversight,” experts can assist boards and management in a variety of ways, including by identifying risk areas and providing insight into best practices in governance. Accordingly, the presence of experts sends a strong message about a company’s commitment to compliance.

2 In 2020, HHS-OIG entered into 47 new CIAs (figures from previous years are pulled from previous Skadden alerts and should be considered approximate, as the HHS-OIG may have posted additional CIAs after the release of the articles).

3 The figures include the CIAs posted to the HHS-OIG’s website as of February 7, 2022.

4 Placing each company within a single sector is sometimes more art than science. We generally rely on Department of Justice (DOJ) press releases and company websites to determine a company’s primary type of business.

5 One of the five CIAs addressed conduct that was subject to a 2019 DOJ settlement. Based on publicly available data, the reason for the time lag between the settlement and the CIA is unclear.

6 Most notably, since 2016, at least 20 companies have faced governmental investigations or litigation related to the alleged provision of illegal remuneration to Medicare patients in the form of copay subsidies. In those cases, the government has argued (among other things) that the manufacturers’ copay subsidies (through donations to third-party patient assistance programs) were necessitated by high drug prices.

7 As defined by the CIAs, “Pricing and Contracting Functions” include (a) the setting or establishing of prices (including changes in prices) for Government Reimbursed Products, including but not limited to suggested wholesale prices, wholesale acquisition costs, average wholesale price and actual prices at which products are sold or offered for sale to customers in the U.S., and including all activities, systems, processes and procedures relating to market research and other pricing-related research and analysis, the development of pricing strategies and policies, and the approval processes and systems relating to the offering and negotiation of pricing terms with customers; and (b) the offering or selling of Government Reimbursed Products to any potential or current customer, including but not limited to all activities, systems, processes and procedures relating to offering, bidding, negotiating and contracting with customers or potential customers.

8 This requirement is separate from, and in addition to, the standard requirement in all CIAs that the company engage an independent review organization to assess and report on its compliance with aspects of the CIA.

9 See, e.g., our January 21, 2020, client alert “HHS-OIG Year in Review: Pharma and Medical Device CIAs Increase, Include Novel Provisions.”

10 In 2021, four DOJ settlements with drug and device manufacturers exceeded $25 million but did not result in a CIA; three of these involved exclusively non-health care fraud issues and one involved a qui tam suit in which the government declined to intervene.

11 See HHS-OIG Principal Deputy Inspector General Christi A. Grimm’s Keynote Speech at HCCA Compliance Institute (April 19, 2021).

12 Id.

13 OIG Modernization Initiative To Improve Its Publicly Available Resources — Request for Information, 86 Fed. Reg. 53072 (Sept. 24, 2021).

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.