On February 10, 2022, the U.S. Securities and Exchange Commission (SEC) voted 3-1 to approve proposed changes to public company beneficial ownership reporting requirements. The SEC has long considered such changes to the rules it adopted pursuant to Exchange Act Sections 13(d) and 13(g), which require that beneficial owners of more than 5% of a company report such beneficial ownership on either a Schedule 13D or a Schedule 13G. If adopted, these new rules will make significant changes to beneficial ownership disclosure obligations in an effort by the SEC to update reporting requirements to provide more timely and complete information for the modern market.

SEC Chairman Gary Gensler has stated that the proposed amendments “would reduce information asymmetries and promote transparency, thereby lowering risk and illiquidity.” However, lone dissenting SEC Commissioner Hester M. Peirce believes they fail to “contend fully with the realities of today’s markets.” Key aspects of the proposed changes are described in further detail below.

Accelerated Schedule 13D and 13G Filing Deadlines1

Under the current reporting regime, beneficial owners must file a Schedule 13D within 10 days after acquiring more than 5% of a class of registered voting equity securities and must “promptly” thereafter file an amendment to report any material changes. The SEC’s proposed rules shorten the initial deadline for Schedule 13D filings to five days and require amendments to be filed within one business day of any material change in previously reported beneficial ownership.

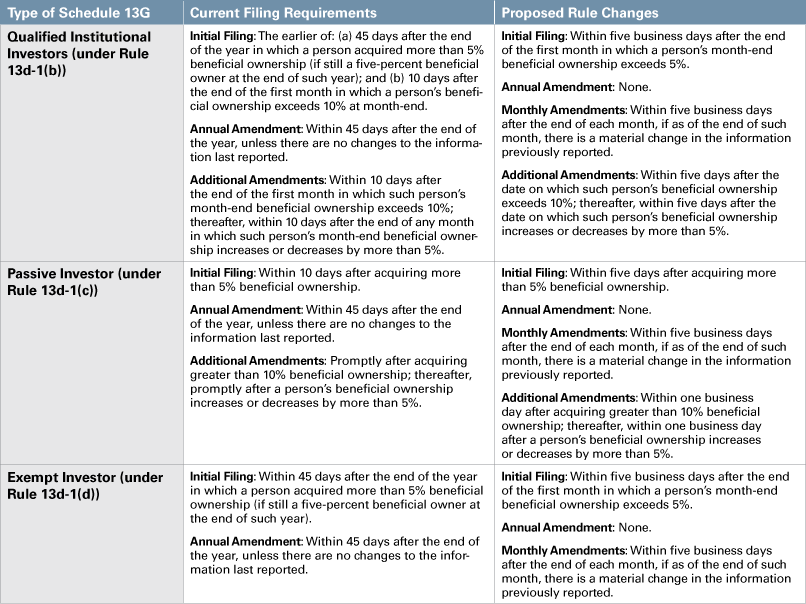

The proposed rules also shorten the deadlines for initial and amended filings by beneficial owners who are eligible to file the more abbreviated Schedule 13G. The current deadlines for Schedule 13G depend on whether a person files as a qualified institutional investor (pursuant to Rule 13d-1(b)), passive investor (pursuant to Rule 13d-1(c)) or exempt investor (pursuant to Rule 13d-1(d)). The table set forth in Annex 1 at the end of this alert summarizes the current Schedule 13G filing deadlines and the SEC’s proposed changes.

Expansion of ‘Deemed’ Beneficial Ownership and Disclosure of Derivative Securities

The proposed changes expand the current regulatory framework to include that holders of cash-settled derivative securities, other than security-based swaps, would be “deemed” beneficial owners of the reference equity securities if the derivatives are held with the purpose or effect of changing or influencing the control of the issuer of the reference securities, or in connection with or as a participant in any transaction having such purpose or effect.2 This update may cause certain holders of such derivatives to become five-percent beneficial owners subject to Schedule 13D/G reporting and/or ten-percent beneficial owners subject to Section 16 (which holders previously may not have been defined that way).

In addition, the proposed changes would revise Item 6 of Schedule 13D to clarify that a person is required to disclose, among other things, “any class of [an] issuer’s securities used as a reference security, in connection with … call options, put options, security-based swaps or any other derivative securities.” Beneficial owners would be required to disclose interests in all derivative securities (including cash-settled derivative securities) that use the issuer’s equity security as a reference security. This clarification under the proposed rules will align disclosure requirements with the approach currently taken by many practitioners.

Updated Requirements for Group Formation

Sections 13(d)(3) and 13(g)(3) of the Exchange Act and Rule 13d-5 under the Exchange Act provide that two or more persons or entities beneficially owning shares of registered securities may be deemed to have formed a “group,” which acts as a “person” for purposes of beneficial ownership reporting. However, as the SEC has explained, “the determination of whether coordinated efforts” among such “persons constitutes a group subject to regulation as a single ‘person’” has largely been a “question of fact.”

The SEC is proposing amending Rule 13d-5 to align it more with the text of Sections 13(d)(3) and 13(g)(3) of the Exchange Act. These changes intend to remove the implication that an express agreement by two parties to act together is a requirement for formation of a group.

The SEC’s proposed changes also clarify the circumstances under which two or more persons have formed a “group” to include, among other things, “tipper-tippee” relationships in which a person shares nonpublic information about an upcoming Schedule 13D filing with another person who subsequently purchases the issuer’s securities based on such information. The proposed amendments also expressly attribute “acquisitions made by a group member after the date of group formation … to the group once the collective beneficial ownership among group members exceeds [5%] of a covered class.”

Additionally, the proposed changes clarify certain circumstances under which two or more persons may engage in conduct without becoming subject to group reporting requirements. Notably, the proposed amendments exempt investors that communicate with other shareholders, or the issuer, from “group” status when such communications are not undertaken with the purpose or effect of changing or influencing control of the issuer.

Next Steps

The public comment period will remain open for 60 days following publication of the proposing release on the SEC’s website or 30 days following publication of the proposing release in the Federal Register, whichever period is longer.

More information on the proposed changes is available in the SEC’s proposing release and accompanying press release.

Annex I

Associate Danielle T. Joe contributed to this article.

_______________

1 To ease administrative challenges resulting from shortened filing deadlines, the proposed changes extend the filing “cutoff” times for Schedules 13D and 13G from 5:30 p.m. to 10:00 p.m. Eastern time.

2 The SEC has explained that security-based swaps are excluded from the proposed changes because recently proposed Rule 10B-1 “would provide sufficient information regarding holdings of security-based swaps such that additional regulation under Regulation 13D-G … would be unnecessarily duplicative,” as detailed in our January 21, 2022, client alert “SEC Proposes New Disclosure Rule for Security-Based Swap Positions.”

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.