Introduction

On May 5, 2022, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency (together the Agencies) released a joint notice of proposed rulemaking (NPRM or Proposal) and request for comment regarding amendments to their regulations implementing the Community Reinvestment Act of 1977 (CRA).

Given the potential for far-reaching implications for institutions of all sizes, banks should seek to gain an understanding of the proposal and assess how it will affect their CRA programs.

The amendments would be the first comprehensive revision to the agencies’ CRA regulations since 1995 and would update how the agencies assess banks’ performance under the CRA. The Proposal comment period closes on August 5, 2022.

Under the Proposal, the agencies would evaluate large banks (i.e., those with assets of at least $2 billion) using four measures: (1) Retail Lending Test; (2) Retail Services and Products Test; (3) Community Development Financing Test; and (4) Community Development Services Test.

- Retail Lending Volume Screen

- Major Product Line Designation

- Geographic Bank and Borrower Bank Metrics

- Performance Thresholds

- Scoring Allotment

- Score Weighting

- Assessment Area Conclusions

- State, Multistate MSA and Institutional Conclusions

II. Retail Services and Products Test

-

Delivery Systems

- Branch Availability and Services

- Remote Service Facility Availability

- Digital and Other Delivery Systems

- Credit and Deposit Products

- Retail Services and Products Test Evaluation

III. Community Development Financing Test

- Facility-Based Assessment Area Community Development Financing Evaluation

- State Community Development Financing Evaluation

- Multistate MSA Community Development Financing Test Conclusions

- Nationwide Score

IV. Community Development Services Test

- Facility-Based Assessment Area Development Services Test Conclusion

- State Community Development Services Test Conclusion

- Multistate MSA Community Development Services Test Conclusion

- Institution Community Development Services Test Conclusion

CRA Tests

I. Retail Lending Test

The Retail Lending Test would evaluate how large banks are serving low- and moderate-income (LMI) borrowers, small businesses and small farms in different assessment areas, including facility-based assessment areas,1 retail lending assessment areas,2 and outside retail lending areas3 (the “assessment areas”). The Retail Lending Test includes a Retail Lending Volume Screen (see below) on the facility-based assessment areas, as well as an evaluation of a bank’s major products lines using distribution metrics and performance standards that standardize the measurement of the bank’s record of lending in LMI census tracts and to LMI borrowers.

Retail Lending Volume Screen

First, banks are subject to a Retail Lending Volume Screen at the facility-based assessment area level only. This consists of measuring a bank’s volume of retail lending4 relative to its deposit base against the performance of other banks in the relevant facility-based assessment area.

This Retail Lending Ratio must meet or exceed 30% of the Market Volume Ratio.5 If this threshold is met, the examiners would proceed to evaluate the distribution of a bank’s retail lending. However, if the bank falls short of 30% of the Market Volume Ratio, before moving on to evaluate the distribution of a bank’s retail lending, the examiners would perform a detailed review of the bank’s performance to determine if there are issues that account for the bank’s insufficient volume of retail lending in that facility-based assessment area.

Major Product Line Designation

Under the next step of the Retail Lending Test, examiners would evaluate a bank’s lending for each category of retail loans that constitute a major product line across the three assessment areas.6 As part of this step, a bank would determine which retail loan product(s) are considered major product lines for a particular area. Major product lines include those retail loans — i.e., closed-end home mortgage loan, open-end home mortgage loans, multifamily loans, small business loans and small farm loans — that individually comprise 15% or more of the dollar amount of all of the Bank’s retail loans in each assessment area.7

Geographic Bank and Borrower Bank Metrics

After determining which retail loan products are considered major product lines in each of the three assessment areas, the examiners would calculate a Geographic Bank Metric and Borrower Bank Metric for each major product line in each assessment area and measure them against corresponding market and community benchmarks.

The Geographic Bank Metric would measure the number (i.e., the volume) of a bank’s loans located in census tracts of distinct income categories, relative to the total number of the bank’s loans. Specifically, examiners would separately calculate the bank’s record of lending in (1) low-income census tracts and (2) moderate-income census tracts, and calculate two Geographic Bank Metrics for each major product line in each assessment area.8

The Borrower Bank Metric, on the other hand, would measure the number of a bank’s loans to borrowers of distinct income/revenue categories relative to the total number of the bank’s loans. There would be two income/revenue categories with respect to each major loan product line.9 For instance, closed-end home mortgage loans, open-end home mortgage loans and automobile loans would be calculated separately for (1) loans to low-income borrowers and (2) loans to moderate-income borrowers.10 Thus, examiners would calculate two Borrower Bank Metrics for each major product line in each assessment area.

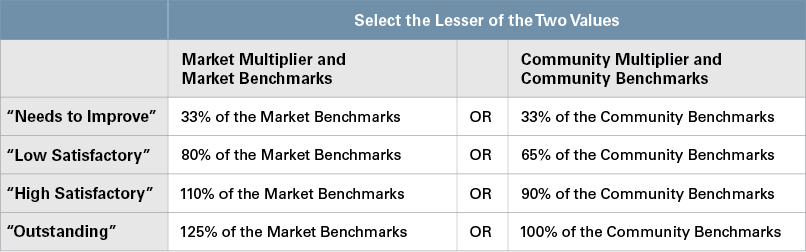

Next, the examiners would compare the metrics for each major product line by assessment area against community benchmarks11 and market benchmarks.12 Based on how the bank’s metrics compare to these benchmarks, the bank would fall into a particular performance threshold for each major product line in each assessment area.

Performance Thresholds

Using the metrics, benchmarks and thresholds described above, the examiners would then assign a score for each major product line by assessment area for each income/revenue category. Thus, each major product line in each area would receive four scores.13 After assigning those, a weighted average of the scores for the two income categories (or revenue categories for small business and small farm borrower distribution metrics) would then be taken to produce an average geographic income score under the Geographic Bank Metric and an average borrower income score for the Borrower Bank Metric for that product line within each assessment area.

Score Weighting

Examiners would weight these two scores against the community benchmarks to make the scores proportional to the population of potential borrowers in each of the assessment areas. For example, for the closed-end home mortgage Borrower Bank Metric, the weights are based on the percentage of families in the assessment area that are either low-income or moderate-income. In a hypothetical assessment area where there are twice as many low-income as moderate-income families, the low-income borrower score would carry twice the weight of the moderate-income borrower score in forming the borrower income average for closed-end home mortgage lending.

For each major product line, the average geographic income score and average borrower income score are then averaged together to arrive at the average product line score. The scores from the Borrower and Geographic Bank Metrics are weighted equally to ensure parity between the two metrics.

Assessment Area Conclusions

All of the average product line scores for all major product lines in an assessment area would then be combined to determine a recommended Retail Lending Test conclusion for the assessment area, weighted by the dollar volume associated with each product line. This conclusion would be derived by taking a weighted average of all the product line scores, weighting each product by the dollar volume of lending in that assessment area. The NPRM does, however, allow the examiners to consider a limited number of additional factors that would allow for adjusting the bank’s recommended facility-based assessment area conclusion(s).14

State, Multistate MSA and Institutional Conclusions

The examiners would combine the performance scores for each assessment area using standardized weighting approach to produce Retail Lending Test conclusions at the state, multistate MSA and institution level. Conclusions at the state, multistate metropolitan statistical areas (MSAs) and institution level would, similarly, be weighted and there would be conclusions at each level.

II. Retail Services and Products Test

The Retail Services and Products Test would qualitatively evaluate delivery systems and credit and deposit products. Examiners would evaluate bank delivery systems by placing an emphasis on branch availability (evaluating branch distribution, branch openings and closings, and banking hours of operation and in-branch services responsive to low- or moderate-income individuals and in low- and moderate-income communities) while increasing their focus on the availability of digital and other delivery channels. Examiners would evaluate the responsiveness of credit and deposit products to the needs of LMI communities, small businesses and small farms. The Retail Services and Products Test would be assessed at the facility-based assessment area, state, multistate MSA and institution levels.

Delivery Systems

The first prong of the test seeks to achieve a balanced evaluation framework that considers a bank’s delivery system in three parts: (1) branch availability and services, (2) remote service facility availability and (3) digital and other delivery systems. For large banks with assets over $10 billion, only the first two components would be evaluated (unless the bank requests additional consideration of, and collects data for, its digital and other delivery systems).

The proposed approach would use quantitative benchmarks to inform the branch and remote service facility availability analysis and provide favorable qualitative consideration for branch locations in certain geographies. This approach would also more fully evaluate digital and other delivery systems in recognition of the trend toward greater use of online and mobile banking.

Branch Availability and Services

First, examiners would evaluate branch availability and services by examining branch distribution, branch openings and closings, and banking hours of operation and services in response to the needs of LMI individuals and communities.

To evaluate a bank’s branch distribution standards, examiners would consider community and market benchmarks. When considering the community benchmarks, examiners would compare a bank’s branch distribution to local data to determine whether branches are accessible to LMI individuals and communities and to businesses in the assessment area. When considering the market benchmarks, examiners would measure the distribution of bank branches in the same facility-based assessment area by census tract income. Banks that open branches in areas that have low or very low branch access would be treated favorably.

Examiners would evaluate branch opening and closing standards by reviewing the bank’s records of opening and closing facilities since the previous examination and assess whether these changes improved or adversely affected the accessibility of delivery systems.

Examiners would evaluate hours of operation and services of a bank by measuring the reasonableness of bank hours in LMI areas compared to the its hours in the middle- and upper-income census tracts. These evaluations would include consideration of the services themselves and how well they are tailored to the needs of that particular community.

Remote Service Facility Availability

Second, examiners would evaluate remote service facilities separately from digital and other delivery systems. Examiners would evaluate three types of benchmarks: (1) percentage of census tracts in a facility-based assessment area by tract income level; (2) percentage of households in a facility-based assessment area by tract income level; and (3) percentage of total businesses and farms in a facility-based assessment area by tract income level.

Benchmarks allow the examiners to compare a bank’s remote service facility availability to local data to determine whether the remote service facilities are comparatively accessible to LMI individuals and communities. Examiners would also consider bank partnerships in their evaluations of their remote service offerings. These include, for example, partnerships with retailers for expanded remote service facility access and participation in remote service facility fee-waiver alliances for out-of-network use.

Digital and Other Delivery Systems

Finally, examiners would evaluate the availability and responsiveness of a bank’s digital delivery systems — like telephone banking and bank-by-mail programs — including to LMI individuals and communities. Examiners would consider factors such as digital activity by LMI individuals, the range of delivery systems and bank strategy, and the ability of the bank’s strategy to meet the needs of low- and moderate-income consumers. The examiners also would compare these factors to the bank’s digital and delivery systems for non-LMI individuals and communities.

Credit and Deposit Products

The second prong of the proposed test aims to evaluate how responsive a bank’s product offerings are to the needs of LMI individuals and communities, small businesses and small farms. This part of the test focuses on (1) availability of credit and (2) deposit products and their responsiveness to LMI individuals and communities.15

For banks with assets of over $10 billion, the responsiveness of deposit products would be assessed based on the availability of products for LMI individuals and communities and small farms and businesses, and the extent to which communities in need are using these deposit products.

Retail Services and Products Test Evaluation

Examiners would reach a single Retail Services and Products Test conclusion for a large bank in each of its facility-based assessment areas. The state and multistate MSA level conclusions for this test would be based exclusively on a bank’s performance in its facility-based assessment areas. It would involve averaging the bank’s conclusions across facility-based assessment areas in each state and multistate MSA and round to the nearest conclusion category point value to determine the conclusion at the state or multistate MSA level.16

For the institution level, examiners would assign a test conclusion for banks based on the conclusions reached for each of the delivery systems and credit and deposit products components of the test. The delivery systems conclusion would be based on the conclusions for each of the three parts of the delivery systems evaluation, as applicable, depending upon the size of the bank. The credit and deposit products conclusion would be based on the conclusions for the applicable parts of the credit and deposit evaluation. Examiners would then reach a combined institution level conclusion using their judgment to determine the appropriate weight between the two parts of the test in recognition of the importance of local community credit needs and the bank’s business model and strategy.

III. Community Development Financing Test

The Community Development Financing Test would consist of community development financing metrics, benchmarks and an impact review. These components would be assessed at the facility-based assessment area, state, Multistate MSA and institution levels, and would inform conclusions at each of those levels. The Community Development Financing Test would not be assessed for retail lending assessment areas.

First, examiners would measure the dollar value of a bank’s community development loans and community development investments together relative to the bank’s deposits. The proposed benchmarks would reflect local context and include, for example, the amount of community development financing activities by other banks in the assessment area. These benchmarks would be compared to the bank’s metrics so that the examiners are able to assess the bank’s performance. The metrics and benchmarks would be consistent across banks and examiners.

After comparing the bank’s metrics to the benchmarks, the examiners would conduct an impact review using a series of specific qualitative factors that would evaluate the impact and responsiveness of a bank’s community development loan and investment activities.17 The impact review would provide appropriate recognition under the Community Development Financing Test of activities that are considered to be especially impactful and responsive to community needs despite being of a relatively small dollar amount.

Facility-Based Assessment Area Community Development Financing Evaluation

Based upon the metrics, benchmarks and impact review, at the facility-based assessment area level, the examiners would then assign a Community Development Financing Test conclusion. Specifically, the conclusion would be reached by considering the bank’s assessment area community development financing metric relative to the local18 and national benchmarks,19 in conjunction with the impact review20 of the bank’s activities.21 The examiners would use their judgment to combine these standardized factors — however, the NPRM suggests that eventually the examiners could develop additional quantitative procedures for determining conclusions.

State Community Development Financing Evaluation

At the state level, examiners would use two components to evaluate a bank’s community development financing performance. First, examiners would average a bank’s Community Development Financing Test conclusions across its facility-based assessment areas in each state. Then, the examiners would assign a statewide score, which would be based on a community development financing metric, benchmark and a statewide impact review.22 Finally, the bank’s weighted average assessment area performance score would be averaged with its statewide score to achieve a state performance score, with weights on both components tailored to reflect the bank’s business model.23

Multistate MSA Community Development Financing Test Conclusions

Examiners would assign Community Development Financing Test conclusions for multistate MSAs where a bank has branches in two or more states. If the bank has delineated an entire multistate MSA as a single facility-based assessment area, the conclusion for the assessment area and for the multistate MSA would be the same. If the bank delineates only part of a multistate MSA as a facility-based assessment area, or delineates multiple facility-based assessment areas within a multistate MSA, then the examiners would employ the same approach as for assigning conclusions for state areas, with the same components as the state evaluation, applied to the geography of the multistate MSA.

Nationwide Score

Examiners would assign Community Development Financing Test conclusions for the institution or national level using a similar approach to that for assigning conclusions for state areas. The approach would combine a weighted average of facility-based assessment area conclusions nationwide and a nationwide score that includes a nationwide metric, a nationwide benchmark and an impact review.

IV. Community Development Services Test

The Community Development Services Test would evaluate a bank’s record of helping to meet the community development services needs in the bank’s assessment areas.

The Proposal would retain the current definition of “community development services,” while also including activities that reflect other areas of expertise of a bank’s employees, such as human resources, information technology and legal services. 24 Generally, community development services activities would be considered when performed by members of a bank’s board or employees of the bank. In nonmetropolitan areas, banks may receive community development services consideration for volunteer activities that meet an identified community development need, even if unrelated to the provision of financial services.

Facility-Based Assessment Area Development Services Test Conclusion

For banks with average assets of under $10 billion, the evaluation would include a qualitative review only. The qualitative review would measure the extent to which a bank provides community development services. According to the Proposal, the review may include consideration of one or more of many types of information.25 In addition, the evaluation would include a review of the impact and responsiveness of the bank’s community development service activities.26

For those large banks, examiners would also measure the average number of community development service hours per full-time-equivalent employee in a facility-based assessment area.27

State Community Development Services Test Conclusion

State level conclusions would be based on two components: a bank’s performance in its facility-based assessment areas and its performance outside its facility-based assessment areas, but within the state. The first component would be the average of a bank’s Community Development Services Test conclusions across its facility-based assessment areas in each state. The point value assigned for each assessment area conclusion would be weighted by a bank's average share of loans and share of deposits within the assessment area, out of all of the bank's loans and deposits in facility-based areas in the state.

The second component, a bank’s performance outside its facility-based assessment area, would consist of an analysis of information including, but not limited to, the number and hours of community development service activities, as well as the impact and responsiveness of these activities.

To assign a final state conclusion, examiners would determine if the score from the first component should be adjusted upward based on the evaluation of the second component.

Multistate MSA Community Development Services Test Conclusion

The examiners propose to assign Community Development Services Test conclusions for multistate MSAs in which a bank has a facility-based assessment area and branches in at least two states. The examiners would employ the same approach applied in assigning conclusions for a state: a combination of (a) a weighted average of facility-based assessment area conclusions and (b) a qualitative review of the bank’s community development service activities outside the facility-based assessment area, but within the multistate MSA.

Institution Community Development Services Test Conclusion

The examiners would assign a Community Development Services Test conclusion for the institution using the same approach as for assigning conclusions for a state. The approach would use a combination of a weighted average of facility-based assessment area conclusions nationwide and a qualitative review of all community development services that occurred outside the bank’s facility-based assessment areas and within the nationwide area, to determine if the weighted average of the facility-based assessment area performance should be adjusted upward based on an evaluation of the significance and impact of outside assessment area activities.

Combining Test Performance Scores To Determine Overall Ratings

As part of the final step of the evaluation, the examiners would determine a bank’s overall CRA ratings at the state, multistate MSA and institution levels. To assign a final score for each level, the examiners would combine a large bank’s raw performance scores for its state, multistate MSA and institution performance under all four tests, weighted as follows: Retail Lending Test (45%); Retail Services and Products Test (15%); Community Development Financing Test (30%); and Community Development Services Test (10%).

Finally, the examiners would assign a rating corresponding with the rating category that is nearest to the state, multistate MSA, or institution performance score.28

In addition to this weighting approach, under the Proposal, there would be two minimum performance thresholds for large banks. The first applies to all large banks and requires that their Retail Lending Test conclusions at the state, multistate MSA, or institution level each be at least “Low Satisfactory” in order for the bank’s overall rating to be “Satisfactory” or better at that level.

The second threshold applies to large banks with 10 or more assessment areas. It requires that a bank achieve an overall performance of “Low Satisfactory” or better in at least 60% of its assessment areas at a level to be eligible to receive a “Satisfactory” or higher rating at that level. Overall performance in a facility-based assessment area would be based on the sum of the weighted scores a large bank received on all four tests in that assessment area.

Conclusion

If the agencies’ proposal is finalized, its effective date would be the first day of the first calendar quarter beginning at least 60 days after publication in the Federal Register. Banks would be subject to various compliance dates, which would allow banks sufficient time to transition from the current regulations to the proposed regulations.

Overall, these amendments represent a substantial revision of the CRA requirements and have major implications for the CRA programs of banks of all sizes. Banks should therefore gain an understanding of the Proposal’s potential impact and consider providing feedback to the Agencies before the comment period ends on August 5, 2022.

_______________

1 Facility-based assessment areas: These are areas where banks have their main office, branches and deposit-talking remote services facilities. There are further requirements for large banks and what their facility-based assessment areas would consist of.

2 Retail lending assessment areas: These are geographic areas where large banks have originated, as of December 31 in each of the two preceding calendar years: (1) at least 100 home mortgage loans outside its facility-based assessment areas; or (2) at least 250 small business loans outside its facility-based assessment area. There are certain further requirements for large banks and what areas must be designated as retail lending assessment areas.

3 Outside retail lending areas: These are areas where retail loans located outside a facility-based or retail lending assessment area are evaluated on an aggregated basis, at the institution level.

4 Retail lending: Retail lending includes, home mortgage (closed-end home mortgage, open-end home mortgage), multifamily, small business, small farm and automobile loans.

5 Market volume ratio: To assess the level of a bank’s retail lending volume relative to local opportunities, examiners would use a Market Volume Ratio that reflects the level of lending by all large banks in the facility-based assessment area. This ratio is defined as (a) the average annual dollar amount of retail originations in the assessment area by all large banks that operate a branch in the assessment area (b) divided by the annual average amount of deposits collected by those same banks from that assessment area.

6 See retail lending categories supra, n. 4.

7 For automobile lending to be a major business line, the 15% threshold for automobile lending would be based on the average of (i) the percentage of automobile lending dollars out of total retail lending dollars and (ii) the percentage of automobile loans by loan count out of total retail loan count in a particular facility-based assessment area, retail lending assessment area, or outside retail lending area.

8 For example, if the bank originated 25 total closed-end home mortgage loans in an area and five of those loans were made in low-income census tracts, then it has a low-income Geographic Bank Metric of 0.2 because 20% of its total closed-end home mortgage loans were made in low-income census tracts.

9 Income/revenue categories: Measurements for closed-end home mortgage loans, open-end home mortgage loans and automobile lending would be calculated separately for (1) loans to low-income borrowers and (2) loans to moderate-income borrowers. Measurements for small business loans would be calculated separately for (1) loans to small businesses with gross annual revenues of $250,000 and (2) loans to small businesses with gross annual revenues above $250,000 and less than or equal to $1 million. Measurements for small farm loans would be calculated separately for (1) loans to small farms with gross annual revenues of $250,000 or less and loans to small farms with gross annual revenues above $250,000 and less than or equal to $1 million.

10 For example, if the bank originated 100 total closed-end home mortgage loans in an assessment area and made 20 of those loans to low-income borrowers, it would have a low-income Borrower Bank Metric of 0.2.

11 These benchmarks reflect the demographics of each of the assessment areas and outside retail lending areas, such as the percentage of owner-occupied units that are in census tracts of different income levels, the percentage of families that are low-income, and the percentage of small businesses or small farms of different levels of revenue in an assessment area.

12 These benchmarks reflect the aggregate lending to targeted areas or targeted borrowers in each of the assessment areas and outside retail lending areas by all reporting lenders. Unlike the Geographic and Borrower Bank Metrics, which include both loan purchases and originations, the market benchmarks are based only on originations by reporting lenders.

13 The two income categories within each of the Geographic Bank Metric and Borrower Bank Metric for each major product line would receive a conclusion ranging from “Outstanding” to “Substantial Noncompliance,” associated with a point value as follows: “Outstanding” (10 points); “High Satisfactory” (7 points); “Low Satisfactory” (6 points); “Needs to Improve” (3 points); “Substantial Noncompliance” (0 points).

14 For example, an assigned conclusion could be lowered where the bank manipulated loan data to obtain better scores under the distribution tests or where geographic lending patterns exhibit gaps in census tracts served that cannot be explained by performance context.

15 There is no specific list of retail lending products and programs that qualify under the NPRM. Examiners would consider relevant information about the retail lending products and programs, including information provided by the bank and from the public. Additionally, the banks would have to demonstrate that its products or programs are provided in a safe and sound manner.

16 The conclusion categories would range from “Outstanding” to “Substantial Noncompliance” and are associated with a point value as follows: “Outstanding” (10 points); “High Satisfactory” (7 points); “Low Satisfactory” (6 points); “Needs to Improve” (3 points); “Substantial Noncompliance” (0 points).

17 These factors include, but are not limited to: (1) activities serving persistent poverty counties, (2) activities serving geographic areas with low levels of community development financing, (3) activities supporting minority depository institutions, women’s depository-institutions, low-income credit unions and community development financial institutions, (4) activities supporting low-income individuals and families, (5) activities supporting certain small businesses or small farms, (6) activities supporting affordable housing in high opportunity areas, (7) activities benefitting Native communities, (8) activities that are a qualifying grant or donation, (9) activities that reflect bank leadership through multi-faceted or instrumental support and (10) activities that result in a new community development financing product or service that addresses community development needs for low- or moderate-income individuals and families.

18 The local benchmark is an assessment area community development financing benchmark. The numerator for the benchmark would be the annual average dollar amount of all large banks’ qualifying community development financing activities (including both the annual average of originations and the annual quarterly average balance sheet holdings, as described above) in the assessment area during the evaluation period. The denominator would be the annual average of the total dollar amount of all deposits held by large banks in the assessment area.

19 The national benchmark is a metropolitan or a nonmetropolitan nationwide community development financing benchmark. The numerator for the benchmark would be the annual average of the total dollar amount of all large banks’ qualifying community development financing activities (in either metropolitan or nonmetropolitan areas, depending on the assessment area) and the denominator would be the annual average of the dollar amount of deposits (again, either in metropolitan or nonmetropolitan areas).

20 The impact review is primarily qualitative in nature. The examiners would consider the percentage of the bank’s qualifying activities that meet each impact factor but would not use multipliers or specific thresholds to directly tie the impact review factors to specific conclusions.

21 The bank would receive a conclusion of “Outstanding,” “High Satisfactory,” “Low Satisfactory,” “Needs to Improve,” or “Substantial Noncompliance.”

22 The analysis for the statewide score is the same as that for the facility-based assessment area level, but at the state level.

23 The greater the percentage of the bank’s in-state deposits and retail loans that are within its facility-based assessment areas, the greater weight placed on its average assessment area performance score.

24 Currently, “community development services” includes activities that have a primary purpose of community development and are related to the provision of financial services.

25 Such information includes the following: i) the total number of community development service hours; (ii) the number and type of community development service activities; (iii) for nonmetropolitan areas, the number of activities related to the provision of financial services; (iv) the number and proportion of community development service hours completed by, respectively, executive and other employees of the bank; (v) the number of low- or moderate-income participants, organizations served, sessions sponsored; or (vi) other evidence that the bank’s community development services benefit low- or moderate-income individuals or are otherwise responsive to a community development need.

26 See impact review factors listed supra, n. 17.

27 Based on an assessment of one or both of these factors, depending on the bank’s size, the bank would receive a conclusion of “Outstanding,” “High Satisfactory,” “Low Satisfactory,” “Needs to Improve,” or “Substantial Noncompliance.”

28 The conclusion categories are as follows: “Substantial Noncompliance:” Score of less than 1.5; “Needs to Improve:” Score of 1.5 or more but less than 4.5; “Satisfactory:” Score of 4.5 or more but less than 8.5; “Outstanding:” Score of 8.5 or more.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.