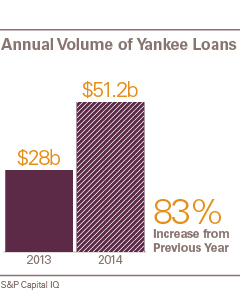

There has been a steadily increasing trend of European borrowers with little or no specific business in the U.S. raising financing under so-called “Yankee loans” — where the credit facility is syndicated to U.S. investors, is governed by New York law, and has typical U.S.-style incurrence covenants and few, or no, financial covenants. In terms of volume, European borrowers raised in excess of $28 billion in 2013 under such loans, which was an increase of over 30 percent from 2012; that figure nearly doubled in 2014, totaling $51.2 billion.

European sellers in competitive M&A transactions expect bidders to demonstrate certainty of funding (including debt funding) before choosing a winning bidder and entering into a sale and purchase agreement (SPA), so the inability to provide “certain funds” puts a potential buyer at a significant disadvantage. U.S. sellers, too, have come to expect a degree of certainty with respect to the funding available to bidders and have, therefore, sought to limit the conditionality of debt financing as much as possible. But is "limited conditionality" under a U.S. debt commitment as certain as "certain funds" under a European debt commitment?

The City Code and European 'Certain Funds'

“Certain funds” provisions in European credit agreements originate from the requirements of the City Code on Takeovers and Mergers, which governs the takeover of any entity whose registered office is in the U.K. and whose securities are listed on any applicable U.K. exchange. The City Code requires that a bidder must announce a bid only after ensuring that it can fulfill in full any cash consideration (if any is offered) and after taking all reasonable measures to secure the implementation of any other type of consideration. A financial adviser also must stand behind any bid and confirm that the relevant bidder has certain funds — i.e., that the funding will be available on the completion of the acquisition of the securities to pay the full amount due.

Sellers long ago adopted a similar approach in private M&A transactions. In particular, private equity institutions — which typically require deal certainty on any exit — require that SPAs not include financing conditionality, i.e., once signed there can be no out for the purchaser (or the lenders) other than as specifically negotiated in the SPA.

English law does not impose a duty to negotiate in good faith. For that reason, parties must enter into (or agree to) full credit documentation at the time they sign an SPA to have true “certain funds” under a European credit facility. Parties also must satisfy (or have solely within the borrower's control) all material conditions to the availability of the financing under the credit agreement at the time of signing the SPA. The credit agreement will provide that the breach of only a very limited number of representations and covenants (limited only to the borrower’s status and capacity (not the target’s) and covenants that are solely within the borrower’s control) will be conditions to the availability of funding. However, European credit agreements also will provide that the borrower cannot waive any conditions under the SPA without the lenders’ consent, so lenders are protected from any change to the transaction being negotiated without their consent. Any material adverse change (MAC) protection for the lenders in relation to the target business would only come through the SPA (e.g., the requirement that the borrower cannot waive any MAC without the lenders’ consent), though it should be noted that MAC provisions are very rarely present in European SPAs.

Absent the failure to satisfy an SPA or credit agreement condition, lenders will be required to fund on completion of the acquisition.

Limited Conditionality in US Acquisition Financing

If a European bidder chooses to finance a European acquisition with a U.S. credit facility, would the bidder be at a disadvantage vis-à-vis those choosing to utilize a European credit facility?

New York law imposes a duty to negotiate in good faith, which means that, in U.S. credit facilities, it is typical for an SPA to be signed in reliance upon commitment papers rather than a signed credit agreement. Those commitment papers will make reference to a defined set of documentation principles (often a previous precedent transaction) and any other key commercial terms and, more importantly, set out a specific — and limited — set of conditions to the availability of the funding. Given the duty to negotiate in good faith, the U.S. market perceives the resulting documentation risk to be low and the conditionality limited to the specific conditions set out in the commitment papers. However, in recent European transactions that have been financed with U.S. credit facilities, some sellers have not been prepared to rely on commitment letters and have pushed to have full credit documentation in place at signing, in line with typical European practice.

The differences between a European certain funds transaction and a U.S. limited conditionality transaction are more optical than substantive. U.S. credit agreements typically give lenders the direct protection of a "no MAC" provision in relation to the target business — but, importantly, in the same form as provided to the bidder in the SPA. The European approach — that any condition in the SPA cannot be waived without lender consent — offers little practical difference assuming a MAC clause is included in the U.S. SPA, which is almost universally the case.

U.S. credit agreements also typically contain a condition that certain representations relating to the target must be true. However, to achieve limited conditionality, those representations must be aligned with any representations in relation to the target made in the SPA. A breach under the credit agreement allowing the lender to refuse to fund the transaction would occur only if breach of any those representations would give the purchaser the right not to complete under the SPA.

Provided that U.S. credit agreements appropriately reflect the underlying SPA, no material difference appears to exist between European-style certain funds and U.S. limited conditionality protections. Therefore, the need to use full credit documentation for a European transaction where the financing is governed by New York law is driven more by the perception of a documentation risk in Europe rather than any real risk.

In fact, U.S. protections are usually stronger on the issue of potential lender default. Once the arrangers under an English law facility have executed the credit agreement and syndicated the debt (i.e., other lenders have taken on part of the commitments), the arrangers' exposure is limited to whatever portion of commitments they retain. Because syndication typically occurs prior to closing, a borrower is exposed to the credit risk of a wider syndicate of investors (which may also include investment funds and other nonbank entities) rather than just that of the arrangers.

Under U.S. commitment papers that is not the case — even if the debt is syndicated by the arrangers, should a lender subsequently not fund at closing, the arrangers must step in and do so. Therefore, there is some added protection under U.S. commitment papers from lender default, which may be important, particularly in a large transaction with a long closing period.

Given the more favorable covenants and marginally better pricing, it is likely that the volume of Yankee loans will continue to increase during 2015, particularly for high-value M&A transactions.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.