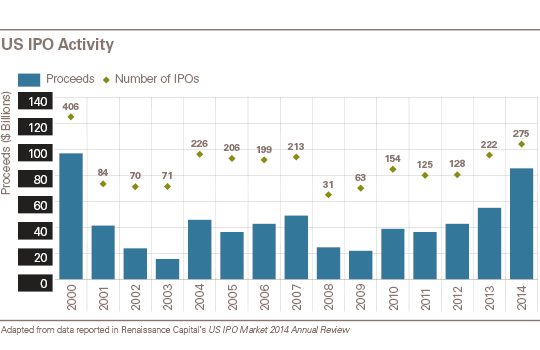

The 2014 U.S. initial public offering market was the most active for new issues since 2000. The market began to recover from the recession in 2010 and took off in 2013 with 222 offerings raising an aggregate of $55 billion,1 and the pace accelerated in 2014 with 275 offerings raising $85 billion. U.S. listings in 2014 led the global IPO market, with initial listings of companies on U.S. stock exchanges generating approximately 37 percent of IPO proceeds raised globally and accounting for approximately 73 percent of all offerings.

U.S. IPO activity was fueled by pent-up supply, a strong M&A market and favorable valuations on stock exchanges. The outlook for 2015 appears positive as fundamental U.S. economic indicators remain strong, the M&A market continues to be robust, returns from IPOs in 2014 have been attractive and market valuations remain healthy. Given the strength of the M&A market and solid market valuations, we expect to continue to see the trend of companies pursuing dual-track processes, in which a private company simultaneously pursues an IPO and a sale of the company to a strategic or financial buyer, as a strategy to maximize valuations. However, the pace of IPOs may slow due to rising interest rates expected in 2015, low energy prices and large inflows into venture capital funds that are investing in later-stage private companies.

Health Care and Technology Lead Activity by Industry

The health care and technology industries led the U.S. IPO market in 2014, as low interest rates drove investors to seek returns in new issues in sectors with opportunities for significant growth. Health care companies were the most active issuers, with 102 health care companies representing 37 percent of all U.S. IPOs and raising an aggregate of approximately $9.2 billion of proceeds. This was driven in part by a boom in biotech company IPOs. However, average proceeds raised per offering in the second half of the year versus the first declined significantly, signaling that investors’ appetite for health care new issues may be waning.

With the $25 billion Alibaba IPO, technology companies raised the most proceeds, an aggregate of $32.3 billion through 55 offerings. Venture capital investments in nascent technology companies continued in 2014 and may lead to further IPO exits in 2015.

Excluding the Alibaba IPO, financial companies led the field by proceeds, raising an aggregate of $18.6 billion through 36 offerings, including the financial information provider Markit, which raised almost $1.3 billion in its June IPO.

Foreign-Issuer Listings on US Exchanges Continue to Grow

The ability to access global investment capital and stronger equity markets appears to have made U.S. listings more attractive to foreign companies in recent years, reversing a trend where foreign securities exchanges were considered more attractive. U.S. exchanges led the global IPO market — NASDAQ by number of IPOs and the NYSE by capital raised — in 2014. According to a study by E&Y, U.S. exchanges attracted 52 percent of the cross-border listings in 2014 (including 26 from Europe, 16 from China and 12 from Israel), and 80 percent by capital raised.

Representing this trend, Alibaba, China’s largest e-commerce company, went public in September 2014 through a listing on the New York Stock Exchange. Alibaba also set a new global record for the largest IPO by raising approximately $25 billion of proceeds through its initial listing on the NYSE. Alibaba’s stock has performed well since its IPO; at year-end, it was up 53 percent from its IPO price.

The flexibility offered to “emerging growth companies” under the JOBS Act, including the deferral of the auditor attestation report required by Section 404(b) of the Sarbanes-Oxley Act, may make a U.S. listing more attractive to foreign private companies. Interestingly, Alibaba chose to list on the NYSE rather than in Hong Kong in order to preserve its founders’ ability to hold super-voting stock and maintain control after offering a majority of the company’s equity to the public.

Financial Sponsor-Backed IPOs Drive Increase in Volume

In 2013, private equity and venture capital firms began to take advantage of stronger equity markets and attractive valuations in order to exit their pre-recession investments through IPOs. This trend continued in 2014 and drove a significant portion of the increase in the volume and number of offerings as compared to 2013. Private equity-backed IPOs accounted for 26 percent of offerings and 29 percent of proceeds in 2014. IPOs backed by venture capital firms accounted for 46 percent of offerings and 41 percent of proceeds in 2014. We expect this trend to continue. The Wall Street Journal

While IPOs remain an attractive option, the volume of VC-backed IPOs in 2015 may not match the last three years, as the robust private placement market may allow private companies to delay their IPOs. In 2014, Uber, Xiaomi and many other companies were able to raise significant amounts of capital in the private institutional markets. The recent trend of company insiders able to cash out a portion of their investments through these private placements also is reducing the pressure on private companies to go public sooner. As a result, private companies may grow without the scrutiny and expense of being a public company, and this may make them a more attractive merger or IPO candidate in the future.

Energy companies represented approximately $12.7 billion (15 percent) of the proceeds raised and 30 of the IPOs (11 percent) in the U.S. market this year. Use of the master limited partnership (MLP) structure, in which an entity that generates income from qualifying natural resource activities can be publicly traded and not be subject to federal income taxes at the entity level, has become a prevalent strategy for a number of energy companies. In 2014, energy companies employing the MLP strategy raised almost $6 billion of gross proceeds in IPOs. Among alternative energy companies, an emerging IPO strategy is the yieldco structure, in which an entity owns and may acquire contracted generation and thermal infrastructure assets that do not qualify for pass-through tax treatment applicable to the MLP structure. (See "'Yieldcos' Present a New Growth Model for Renewable Energy Companies.") Although energy IPOs attracted investor interest in 2014, the steep drop in oil prices that began in late 2014 may make new issues in the energy sector less attractive in 2015. In addition, dividend payments at certain MLPs are dropping so companies can preserve cash, which may hurt companies’ ability to access capital in a rising interest rate environment.

Although the number and proceeds raised by REIT IPOs in 2014 did not match 2013 levels, the $2.3 billion IPO of Paramount Group, an office building landlord, in November 2014 set a new record for the largest U.S. REIT IPO. With over $1.7 trillion in commercial real estate debt maturing between 2014 through 2018, according to Trepp, and traditional banks reducing their lending to the real estate market, nonbank financial institutions such as mortgage REITs have been filling the void. However, whether mortgage REITs will be able to access the capital markets in order to meet this demand remains to be seen. As investors expect interest rates to rise later in 2015, new-issue REITs may confront challenging markets in the second half of the year.

Although U.S. economic fundamentals remain strong, it will be difficult for 2015 to match the record U.S. IPO volumes of 2014.

Energy IPOs Utilize MLP Structure

REIT IPO Outlook Uncertain for 2015

_________________

1 Unless otherwise noted, the source of all quantitative data is from the US IPO Market 2014 Annual Review of Renaissance Capital (a manager of IPO-focused ETFs). All offering statistics include IPOs with a market cap of at least $50 million and exclude closed-end funds and SPACs.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.