Comprehensive federal tax reform likely will be a top priority for the Trump administration and Republicans in Congress in the first half of 2017. Although there are differences between their proposals, President Donald Trump and the House GOP have suggested significant changes to the estate tax as well as to the availability of asset step-up in basis after death and itemized deductions during life. High-net-worth individuals and their estate planners should examine all three issues, in addition to state estate tax consequences, when revising their lifetime and testamentary giving plans in the wake of changes at the federal level.

Tax Reform Plans

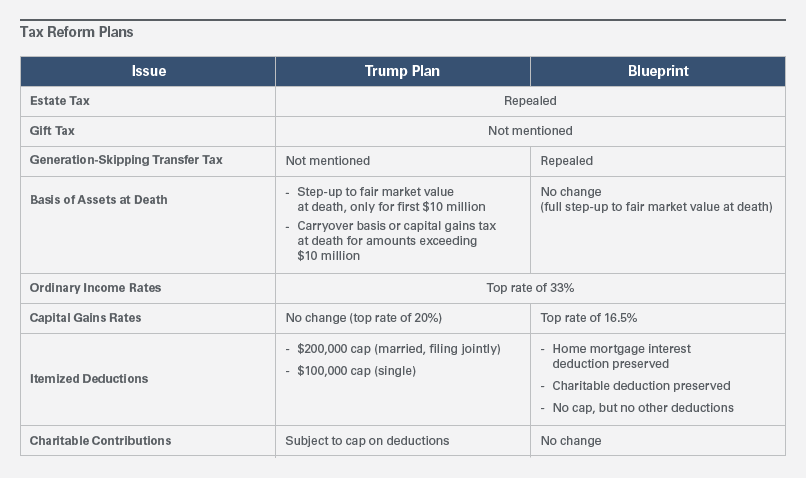

The following table compares President Trump’s statements on tax reform during his campaign with the House Republican proposal, known as the “Blueprint.”

President Trump and the Blueprint offer additional proposals, such as closing the carried interest tax "loophole" (President Trump only) and income tax rate decreases for corporations and pass-through business entities (both plans). However, the issues of estate tax repeal, changes to asset basis step-up and limitations on deductions will have the most significant effects on estate planning in terms of both testamentary plans and lifetime giving.

Estate Tax Repeal

Estate tax repeal has been on the Republican wish list for many years, but previous efforts at permanent repeal failed — even during one period of unified Republican government — because of Democratic political opposition and legislative rules relating to the reconciliation process between House and Senate spending bills. However, political will for estate tax repeal is strong this year, both because it is a stated priority for congressional Republicans and President Trump and because Senate Democrats may cede opposition to estate tax repeal as a filibuster bargaining chip in overall tax reform. The generation-skipping transfer tax, which prevents individuals from avoiding the estate tax through transfers to grandchildren and more remote descendants, would become largely irrelevant with no estate tax in place and would likely be part of any estate tax repeal bill.

Although the 40 percent rate for transfers at death totaling over $5.49 million for an individual and $10.98 million for a married couple in 2017 appears ripe for the legislative chopping block, less certain is the status of the gift tax. Neither plan mentions this tax, which imposes the same rate on transfers exceeding the same amounts during a donor’s lifetime. Although transfer taxes represent only a nominal amount of revenue for the government relative to all tax receipts, the gift tax serves as a backstop to the income tax by preventing high-marginal-rate taxpayers from gifting certain assets to low-marginal-rate taxpayers — often, younger family members — who would sell the assets and gift the proceeds back to the donor. If the gift tax remains in effect, transfer techniques such as grantor-retained annuity trusts would continue to be effective estate planning tools even after a repeal of the estate tax.

Asset Basis Step-Up

A major difference between the two plans is whether assets that appreciate will receive a step-up in basis, or a readjustment in value, at an owner’s death. Current law and the House GOP plan provide that all assets owned by a decedent at his or her death receive a step-up in basis to their fair market value at the time of death. Unless an asset appreciates significantly after the decedent’s death, its recipient will have limited — if any — taxable gain on a later sale or exchange.

However, President Trump’s plan appears to limit the step-up in basis to the first $10 million of built-in gain in assets owned by a decedent at death. If a decedent owned $100 million of assets at death with an aggregate basis of $50 million (in the simplest case, having paid $50 million for those assets, which then appreciated to $100 million), the basis of those assets in the hands of the recipient(s) would be limited to $60 million as opposed to their $100 million fair market value. It is unclear from President Trump’s plan how the $10 million increase in basis would be allocated among multiple built-in gain assets. It also is unclear whether his plan would deem death a capital gains realization event, such that, in the previous example, the decedent’s estate would pay tax (presumably, at capital gains rates) on $40 million of appreciation, and the recipients would take the decedent’s assets with a $100 million fair-market-value basis. In any event, the full, tax-free step-up in basis at death that estate planners and clients have enjoyed would no longer be in effect.

Limitations on Deductions

Finally, President Trump’s plan changes the availability of itemized deductions for all taxpayers, potentially limiting the income tax efficiency of charitable contributions during life for charitably inclined high-net-worth individuals. Although the House GOP plan eliminates most itemized deductions, such as deductions for medical expenses and for state and local taxes, it retains the current charitable deduction, which is unlimited in terms of dollar value but subject to a percentage limitation based on adjusted gross income.

By contrast, President Trump’s plan retains all current itemized deductions but caps them at $100,000 for a single individual and $200,000 for a married couple. An individual whose annual home mortgage interest, medical expenses, and state and local taxes exceed $100,000 would thus receive no additional deduction for amounts contributed to charities, perhaps causing him or her to defer charitable giving to later years or until death.

State Estate Taxes

Even if President Trump and the House GOP implement comprehensive tax reform that eliminates the federal estate tax, state estate taxes would not automatically follow suit. New York, for example, imposes an estate tax with a top rate of 16 percent for transfers at death exceeding $4.187 million (increasing to $5.25 million in April 2017). Eighteen other states have state estate taxes, with top rates ranging from 12 percent to 20 percent. New York residents and residents of other states that continue to have separate estate taxes must remember to consider the state tax efficiency of their estate plans, even if state estate tax rates remain lower than the current top federal rate of 40 percent.

Looking Ahead

At first glance, changes to the transfer tax system at the federal level would seem to simplify estate planning for many individuals. However, because of offsetting changes to the federal income tax consequences of gratuitous transfers and unchanged state transfer tax systems, individuals and their estate planners should take a cautious approach when revising estate planning documents in the coming year.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.