Since its inception in July 2011, the Consumer Financial Protection Bureau (CFPB) has sought to prove itself as a powerful regulator through significant enforcement actions and settlements. In 2016, the CFPB continued to aggressively enforce federal consumer protection laws, including imposing its largest civil penalty to date — $100 million — in a settlement announced in September. But two developments in 2016 threaten to disrupt the CFPB’s operations: the U.S. Court of Appeals for the District of Columbia Circuit’s PHH decision and the election of Donald Trump.

Enforcement Actions Trending Downward

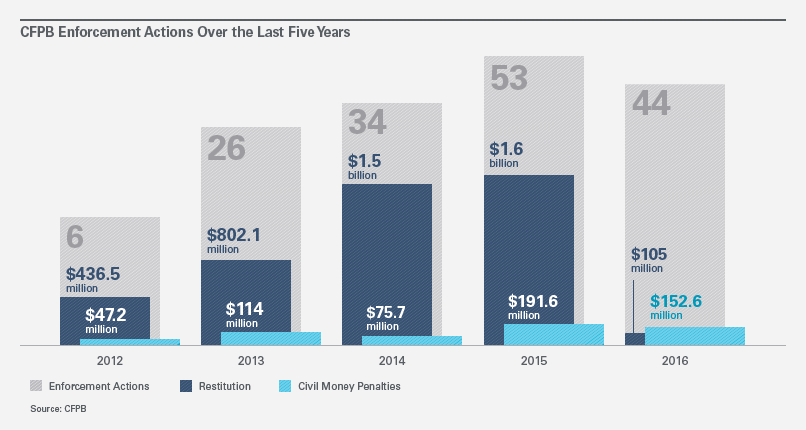

The CFPB has filed more than 160 enforcement matters to date, including more than 40 in 2016 alone. These actions have resulted in restitution to consumers totaling more than $4.4 billion and civil money penalties (CMPs) of more than $580.9 million. The following chart summarizes CFPB enforcement actions over the last five years:

As the chart shows, after a very active 2015, the CFPB’s restitution and civil penalties from enforcement actions decreased in 2016. Moreover, the majority of the total penalties assessed in 2016 related to one case — the CFPB’s September 8, 2016, settlement with Wells Fargo regarding sales practices.

Recent Court Decisions Limit CFPB Power

Two court decisions in 2016 have placed significant constraints on CFPB authority. In CFPB v. Accrediting Council for Independent Colleges and Schools, the U.S. District Court for the District of Columbia held that the CFPB did not have the authority to issue a civil investigative demand (CID), a type of administrative subpoena, to an accreditor of for-profit colleges. This case, decided on April 21, 2016, represents the first time that a federal court has quashed a CFPB CID. In doing so, the court noted that the CFPB’s investigative authority is limited to inquiries regarding potential violations of consumer financial laws, and that there is no "clear nexus" between these laws and the for-profit college accreditation process. The court also warned, “Although it is understandable that new agencies like the CFPB will struggle to establish the exact parameters of their authority, they must be especially prudent before choosing to plow head long into fields not clearly ceded to them by Congress.” The CFPB has appealed this decision to the D.C. Circuit, with a ruling expected in 2017.

A second decision poses an even greater threat to the authority of the CFPB’s director. In October 2016, in PHH Corp. v. CFPB, two of three judges on the D.C. Circuit held that the single-director structure of the CFPB was unconstitutional and a departure from the setup of other independent agencies, which are overseen by multimember commissions. The court stressed that placing so much power in the hands of a single director was particularly concerning because, given the broad scope of the CFPB’s authority and jurisdiction, the agency exercises “massive power.” The court concluded that the provision governing removal of the CFPB director — which authorizes removal by the U.S. president only for cause — violates constitutional separation-of-powers principles. However, rather than shut down the agency, the court severed the removal provision from the rest of the statute, a narrow remedy that would allow the CFPB to continue to operate and give the president the authority to remove the director at will.

The PHH case has a complicated history. In 2014, the CFPB filed an administrative action against PHH alleging that the company’s captive reinsurance agreements violated the anti-kickback provisions of the Real Estate Settlement Procedures Act. After a trial, an administrative law judge ruled against PHH but assessed damages at $6.9 million. Both PHH and the CFPB sought CFPB Director Richard Cordray’s review of that decision. On review, Director Cordray broadened the relief significantly and ordered PHH to pay $109 million in disgorgement. PHH appealed to the D.C. Circuit, arguing in part that the structure of the CFPB was unconstitutional.

The CFPB has since filed a petition for rehearing en banc by the D.C. Circuit, asserting that this “may be the most important separation-of-powers case in a generation.” In the interim, the court has stayed its issuance of a mandate, so the ruling has no immediate legal effect.

Election Brings More Uncertainty to the CFPB’s Future

At the political level, President Trump’s victory and continued Republican majorities in the House and Senate introduce significant uncertainty with respect to the CFPB’s future in three primary ways:

- Removal of the Director. Now that he has taken office, President Trump may take action to remove Director Cordray even before a final ruling in the PHH case. The president could seek to fire Director Cordray for cause — that is, for “inefficiency, neglect of duty, or malfeasance in office” — citing actions Director Cordray has taken during his term that CFPB critics claim exceeded his authority. Alternatively, President Trump may conclude that he has the independent authority to decide whether the CFPB’s structure is constitutional and remove Director Cordray without cause. Either action would be controversial and could lead Director Cordray to sue President Trump to get his job back.

- Legislative Action. On the campaign trail, President Trump promised to “dismantle” the Dodd-Frank Act, which created the CFPB. Although it is unlikely that the law would be repealed in full and the CFPB shut down, the Trump administration and the Republican Congress are expected to support sweeping changes to the statute and the CFPB’s structure and authority. Indeed, in late 2016, House Financial Services Chairman Jeb Hensarling, R-Texas, introduced the Financial CHOICE Act, a bill that would require substantial changes to the Dodd-Frank Act and to the CFPB’s structure and funding, including replacing the CFPB director with a multimember commission and subjecting the agency to the congressional appropriations process.

- U.S. Supreme Court. President Trump will seek to fill the vacancy on the Supreme Court left by Justice Antonin Scalia’s death in early 2016. It is unlikely that any new Supreme Court justice would be particularly sympathetic to the CFPB, and, in any event, such appointment increases the chances that, should the Court review the PHH decision, it would (1) decide that the CFPB’s structure is unconstitutional and (2) possibly reach a broader view of the appropriate remedy, such as invalidating all of Title X of the Dodd-Frank Act, which created the CFPB and introduced the prohibition of unfair, deceptive, or abusive acts or practices.

Looking Ahead

Two CFPB rules have generated significant controversy since they were proposed in 2016 and are likely to be at risk under the new administration and Republican Congress: one that would prohibit certain mandatory arbitration clauses in consumer financial contracts and another that would restrict certain payday, auto title and high-cost installment loans. Despite the challenging political landscape for the CFPB, it has recently indicated that priorities for the new year will include continued focus on redlining, as well as emerging fair lending focus on mortgage and student loan default servicing and small business lending. Undoubtedly, the wide range of the CFPB’s authority, and its exercise of that power, will be scrutinized carefully in 2017 and beyond.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.