On July 19, 2018, the International Swaps and Derivatives Association (ISDA) and the Securities Industry and Financial Markets Association (SIFMA) published a white paper entitled "Initial Margin for Non-Centrally Cleared Derivatives: Issues for 2019 and 2020" (White Paper)1 The White Paper addresses the "significant challenges" swap dealers2 face in implementing the federal banking regulator (Prudential Regulator)3 and CFTC4 initial margin (IM) regulations for uncleared swaps with their counterparties and urges swap dealers to develop strategies for compliance immediately.5

With swap dealers being required to post and collect IM with additional groups of swap counterparties in September 2018, September 2019 and September 2020, swap dealers are initiating steps to implement IM requirements with those counterparties. As the IM requirements are phasing in, an increasing number of the swap counterparties that (i) are already subject to the regulatory requirement for posting variation margin (VM) and (ii) exceed specified thresholds of swaps trading (covered counterparties) also need to agree to comply with the IM requirements by the applicable phase-in date. Just as swap dealers required their counterparties who were in-scope for the VM requirements to create or update their swap documentation in preparation for the VM requirements in 2017,6 swap dealers (and new in-scope counterparties) are now being encouraged to negotiate IM terms and enter into additional needed documentation addressing how IM will be posted and collected in order to continue trading with covered counterparties once the IM requirements become effective.7

Background. The Prudential Regulator and CFTC Margin Requirements require swap dealers that are registered with the CFTC (Covered Swap Entities (CSEs)) to post IM to, and collect IM from, covered counterparties on or before the business day after execution of a non-cleared swap that was entered into on or after September 1, 2016, when the IM requirements first became effective.8 Thereafter, CSEs must conduct daily calculations to determine whether additional IM should be posted by either counterparty.9

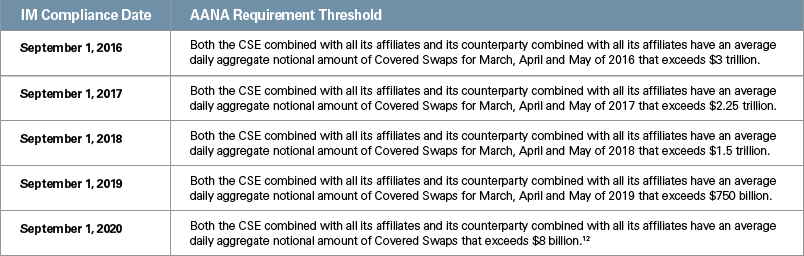

In contrast to the two-phased compliance schedule for VM requirements, U.S. regulators adopted a more graduated IM compliance schedule that began in September 2016. There are five phases that key off the aggregate average notional amount (AANA)10 of both the CSE and its counterparty, together with their affiliates, for non-cleared swaps, non-cleared security-based swaps, foreign exchange forwards and foreign exchange swaps (Covered Swaps).11 The chart below identifies the IM compliance dates and AANA thresholds for each compliance phase.

Unlike the VM requirements, which require swap dealers to exchange VM with other swap dealers and all financial end-users,13 CSEs will only be required to exchange IM with other swap dealers and financial end-users "with material swaps exposure" (i.e., an average daily aggregate notional amount exceeding $8 billion).14 Any entity that does not exceed the $8 billion threshold will not be required to post or collect the IM requirements.

Though the IM requirements have a smaller scope than the VM requirements, the final phases of the IM requirements are expected to have a significant impact on the over-the-counter (OTC) market, as the White Paper explains that a large number of counterparties and trading relationships are within the scope of the requirements. According to data gathered by ISDA, swap dealers have estimated that at least 1,000 additional counterparties and 9,000 new trading relationships will become in-scope during the final phase of the IM requirements.15 Swap dealers also reported that the estimate of in-scope relationships rises to 9,400 when taking into consideration accounts held by investment managers for multiple clients.16

The White Paper concludes that the OTC derivatives market will face substantial challenges resulting primarily from:

- "The large number of counterparties coming within scope;

- The extensive operational and technological builds required to bring the new in-scope counterparty relationships into compliance;

- The expected rush of demand on market resources across participants and service providers; [and]

- The need for organization-wide market participant preparations, including:

- Documentation/legal team negotiation of relevant trading and service agreements.

- Risk team review of processes and collateral eligibility.

- Operation team development and testing of new processes.

- Technology team build-out and testing of crucial data and calculation capabilities; [and]

- Model approval, monitoring, remediation, and operational reviews."17

Key Compliance Questions. The steps CSEs will need to take when preparing to comply with the IM requirements18 include:19 (1) executing documentation to address the IM requirements; (2) reviewing collateral management processes; and (3) establishing IM calculation processes. Regarding at least the second and third steps, the White Paper observes that the IM regulations signify a change in market practices, which previously confined regulatory IM to the interdealer market.20 While the IM requirements only require the counterparties to exchange IM where the amount exceeds the applicable IM threshold,21 the requirements still mandate that the counterparties have the appropriate documentation and operational arrangements in place.22

- Documentation. Similar to the documentation requirements for VM, CSEs must have documentation establishing a contractual right to exchange IM.23 CSEs and their counterparties will need to create documentation that addresses the IM requirements by amending existing documentation with their counterparties or executing new Credit Support Annexes to address the IM requirements. ISDA has published a template Credit Support Annex (CSA) for IM and plans to publish revised templates prior to the September 2019 and September 2020 IM compliance phases. ISDA also expects to have available in early 2019 an online initial margin documentation tool intended to "provide an efficient means for firms to negotiate IM documentation with a large number of counterparties simultaneously, and to deliver and store the documents electronically."24 As part of these discussions, CSEs and their counterparties will also need to determine whether they prefer to use multiple CSAs in order to maintain swaps that were executed prior to the margin requirements or consolidate all of their swaps under a single CSA.25

- Collateral Management. The forms of collateral that may be posted for IM are generally consistent with the VM requirements;26 however, CSEs and their covered counterparties will need to decide issues such as: which of the permitted forms of collateral can be used for IM, haircuts (i.e., discounts) on permitted collateral forms, minimum transfer amounts and IM thresholds. The Final Rules also mandate that CSEs require all IM to be held by one or more custodians that are not the CSE, the counterparty, or affiliates of the CSE or the counterparty.27 Therefore, CSEs and their counterparties will need to identify an unaffiliated custodian and either execute custodial documentation that meets the conditions set out in the Final Rules (and complete any additional onboarding requirements set out by the selected custodian)28 or amend existing custodial documentation to comply with the Final Rules.29 The White Paper states that custodians have generally required execution of control agreements by the June prior to the relevant September compliance date but still often face challenges in setting up all the accounts prior to the compliance date.30

- Calculation of IM. Unlike the VM requirements, the Final Rules set forth two alternative methods that CSEs must use for calculating IM: (1) a standardized margin schedule attached to the Final Rules that expresses IM as a percentage of the notional amount of the swap; or (2) an internal IM model approved by the relevant regulator.31 ISDA has created the Standard Initial Margin Model (ISDA SIMM) in order to help CSEs calculate IM for purposes of complying with the rule,32 which is the only internal model that has been approved and is in use.33

Given the numerous questions raised by the IM requirements, swap dealers (and their counterparties who will be affected by the phase-in of the IM requirements) would benefit from engaging each other on IM implementation well in advance of the relevant compliance date.

__________________

1 See ISDA and SIFMA, Initial Margin for Non-Centrally Cleared Derivatives: Issues for 2019 and 2020.

2 Use of the term "swap dealer" here includes reference to major swap participants, who also are subject to the margin requirements.

3 See Margin and Capital Requirements for Covered Swap Entities, 80 Fed. Reg. 74,839 (Nov. 30, 2015) (codified at 12 C.F.R. 45, 237, 349, 624, 1221) [hereinafter "PR Rule"]. For additional information, see November 2, 2015, Skadden client alert "Prudential Regulators Finalize Margin Requirements for Non-Cleared Swaps"; June 3, 2016, Skadden client alert "CFTC Finalizes Cross-Border Margin Rules for Uncleared Swaps"; and August 9, 2016, Skadden client alert "Prudential Regulators Extend Swaps Clearing Exemptions and Exceptions to Non-Cleared Swap Margin Requirements."

4 See Margin Requirements for Uncleared Swaps for Swap Dealers and Major Swap Participants, 81 Fed. Reg. 635 (Jan. 6, 2016) (codified at 17 C.F.R. 23, 140) [hereinafter "CFTC Rule"]; Margin Requirements for Uncleared Swaps for Swap Dealers and Major Swap Participants-Cross-Border Application of the Margin Requirements, 81 Fed. Reg. 34,817 (May 31, 2016) (codified at 17 C.F.R. 23).

5 See White Paper at 5.

6 VM became effective for all covered entities in 2017. See December 2, 2016, Skadden client alert "Non-Cleared Swap Variation Margin Requirements to Spark Credit Support Annex Amendments for Financial End Users"; and February 24, 2017, Skadden client alert "Regulators Provide Some Flexibility on the Swaps Variation Margin Compliance Deadline."

7 The White Paper cautions that swap dealers may need to allocate more time to the IM negotiation and drafting process than in the past because the final phases of the IM requirements will include counterparties that are less familiar with the processes that are integral to exchanging IM. White Paper at 8-9. Further, the lower AANA thresholds in the final phases are expected to include a more diverse set of counterparties, which is likely to result in more complex negotiations for swap dealers. White Paper at 12-13.

8 17 C.F.R. 23.152; 12 C.F.R. 237.3.

9 See id.

10 The Prudential Regulators and CFTC provided the following example to explain how to calculate AANA: "As a specific example of the calculation, consider a U.S.-based financial end user (together with its affiliates) with a portfolio consisting of two non-cleared swaps (e.g., an equity swap, an interest rate swap) and one non-cleared security-based credit swap. Suppose that the notional value of each swap is exactly $1 trillion on each business day of March, April and May of 2016. Furthermore, suppose that a foreign exchange forward is added to the entity’s portfolio at the end of the day on April 29, 2016, and that its notional value is $1 trillion on every business day of May 2016. On each business day of March and April of 2016, the aggregate notional amount of non-cleared swaps, security-based swaps and foreign exchange forwards and swaps is $3 trillion. Beginning on May 1, 2016, the aggregate notional amount of non-cleared swaps, security-based swaps and foreign exchange forwards and swaps is $4 trillion. The daily average aggregate notional value for March, April and May 2016 is then (23x$3 trillion + 21x$3 trillion + 21x$4 trillion)/(23+21+21)=$3.3 trillion ... ." See PR Rule at 74850 n. 82; CFTC Rule at 676 n. 323.

11 The U.S. compliance schedule is consistent with the approach taken by other jurisdictions. See White Paper at 7.

12 See the definition of "material swaps exposure," infra note 14.

13 See 17 C.F.R. 23.151 (definitions); 17 C.F.R. 23.153 (variation margin); 12 C.F.R. 237.2 (definitions); 12 C.F.R. 237.4 (variation margin). Under the Final Rules, the term "financial end-user" includes: nonbank financial institutions supervised by the Board of Governors of the Federal Reserve System, depository institutions, foreign banks, state-licensed or registered credit or lending entities (but excluding entities registered or licensed solely on account of financing the entity’s direct sales of goods or services to customers), broker-dealers, floor brokers, floor traders, introducing brokers, registered investment companies, business development companies, private funds, securitization vehicles, commodity pools, commodity pool operators, employee benefit plans, insurance companies, cooperatives that are financial institutions, U.S. intermediate holding companies established or designated for purposes of compliance with Regulation YY of the Board of Governors of the Federal Reserve System, and entities that are or would be a financial end-user or swap entity if they were organized under the laws of the U.S. or any state.

14 See 17 C.F.R. 23.151; 12 C.F.R. 237.2. "Material swaps exposure" means, with certain exclusions, that an entity and its affiliates have an average daily aggregate notional amount of non-cleared swaps, non-cleared security-based swaps, foreign exchange forwards and foreign exchange swaps with all counterparties for June, July, and August of the previous calendar year that exceeds $8 billion, where such amount is calculated only for business days.

15 White Paper at 7-8.

16 White Paper at 8.

17 White Paper at 4.

18 ISDA has prepared a fact sheet recommending actions for in-scope entities, see ISDA "Getting Ready for Initial Margin (IM) Regulatory Requirements: What Steps Do I Need to Take?"

19 The White Paper also addresses challenges such as (1) determining whether a counterparty is in-scope for purposes of the IM requirements, see White Paper at 10-11; (2) determining how to structure trade portfolios and netting sets based on which products are in-scope under the U.S. requirements versus other jurisdictions, see id. at 17-18; (3) determining how to structure trade portfolios and netting sets based on which products are in-scope under the U.S. requirements versus products that are out of scope of the requirements, see id. at 18-19; and (4) determining operational and procedural approaches to address scenarios where swap dealers call for regulatory IM as well as non-regulatory IM for other purposes (i.e., to address potential closeout risks), see id. at 19.

20 White Paper at 8.

21 See 17 C.F.R. 23.151 (definitions); 23.154 (initial margin); 12 C.F.R. 237.2 (definitions); 237.3 (initial margin).

22 Id.

23 See 17 C.F.R. 23.158; 12 C.F.R. 237.10.

24 See April 25, 2018, ISDA Press Release "ISDA Partners with Linklaters on Online Margin Document Negotiation Tool."

25 White Paper at 11-12.

26 See 17 C.F.R. 23.156, 12 C.F.R. 237.6.

27 See 17 C.F.R. 23.157; 12 C.F.R. 237.7.

28 White Paper at 13.

29 See 17 C.F.R. 23.157(c); 12 C.F.R. 237.7(c).

30 White Paper at 14.

31 See 17 C.F.R. 23.154; 12 C.F.R. 237.8.

32 See September 7, 2017, ISDA Press Release "ISDA Launches Latest Version of ISDA SIMM."

33 White Paper at 19.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.