On March 14, 2018, the Securities and Exchange Commission (SEC) proposed new Rule 610T of Regulation NMS, which would establish a pilot program to study the effects of potential changes considered by the SEC on certain transaction fees and rebates paid by exchanges to broker-dealers and market makers. The pilot program would subject stock exchange transaction fee pricing, such as the common “maker-taker” pricing model, to temporary restrictions across three test groups and require certain exchanges to prepare and publicly post data on the effects, if any, of the pilot program. The program is intended to help the SEC evaluate the need for regulatory action in this area and may be modified, perhaps materially, prior to implementation in response to comments.

The pilot program recently received heightened scrutiny, spurred on in part by an email sent in June 2018 by the New York Stock Exchange (NYSE) to listed issuers raising concerns with the program. The NYSE email encouraged listed companies to lodge concerns to the SEC through comment letters or request exclusion from the pilot program altogether (although there does not appear to be any mechanism for opting out). In contrast to the criticism from the NYSE and other exchanges, other parties, such as large institutional investors, have taken a more favorable view of the pilot program. This debate between market participants has left many issuers wondering whether they should take action. Issuers with concerns on the pilot program may wish to submit comment letters, but pending the adoption (if any) of final rules, there is little for issuers to do but wait and see what shape the program takes.

Background

The predominant fee model in U.S. equities markets is the “maker-taker” model, in which an exchange or other trading center pays broker-dealer participants a per-share rebate to provide (i.e., “make”) liquidity in securities and assesses those participants a fee to remove (i.e., “take”) liquidity. Under this model, exchanges and trading centers realize revenue from the difference between the fee paid by the “taker” and the rebate paid to the “maker.” Other trading centers use an inverted “taker-maker” model, in which they charge the provider of liquidity and pay a rebate to the taker of liquidity.

The SEC currently regulates exchange access fees, including by prohibiting exchanges and trading centers from imposing (or permitting to be imposed) any fees for the execution of an order that exceed $0.0030 per share. Nevertheless, market participants have expressed concerns about the maker-taker model, arguing that it presents conflicts of interests for broker-dealers and that access fees undermine market transparency, introduce unnecessary market complexity and increase market fragmentation. Others contend that the maker-taker model has positive effects on the market by encouraging competition.

The pilot program aims to provide a source of data to analyze the need for regulatory action to address any potential negative effects of fees on order-routing behavior, execution quality or market quality through a large sample size and over an extended period of time.

Features of the Pilot Program

The pilot program will apply to all equities exchanges, including both maker-taker and taker-maker systems, but not to options exchanges or alternative trading systems. The SEC proposes to include in the pilot program all National Market System (NMS) stocks, including common stocks and exchange-traded products with an initial share price at commencement of the pre-pilot period of at least $2, an unlimited duration or a duration beyond the end of the post-pilot period and no restrictions on market capitalization. Throughout the duration of the pilot program, including the pre- and post-pilot program periods, if a security in one of the test groups closes below $1, it would be removed from the test group and be no longer subject to pricing restrictions.

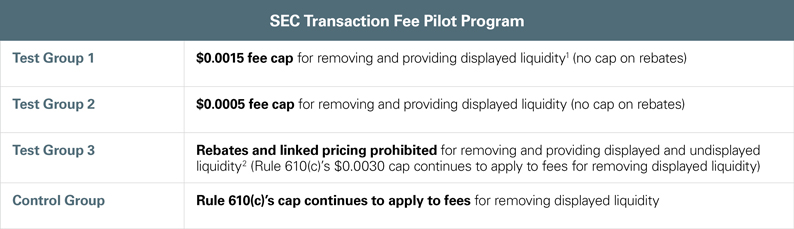

The pilot program would feature three test groups, with each containing 1,000 stocks. Each test group would employ varying levels of access fees and rebates as described in the table below. Stocks not selected for inclusion in a test group would comprise a control group. The SEC intends to publish on its website the list of securities subject to the pilot program. The composition of each test group would remain constant for the duration of the program, except for changes due to mergers, delistings or removal due to a share price drop below $1.

The pilot program would last for two years with an automatic sunset at one year unless renewed by the SEC. There would be a six-month pre-pilot program period and a six-month post-pilot program period. The chart below outlines the proposed test groups:

Response From Market Participants

Both the NYSE and the Nasdaq Stock Market have voiced significant opposition to the pilot program. The NYSE submitted a comment letter to the SEC arguing that it had substantially underestimated the burdens and costs of the pilot program and that the pilot program is likely to result in increased costs to both issuers and investors. Nasdaq similarly submitted a critical comment letter, arguing that the pilot program lacks a solid foundation and that alternatives should be evaluated. The above-mentioned NYSE email urges issuers to write their own letters to the SEC arguing against the pilot program because it could “impact trading in [issuer’s] stock.” Institutional investors such as Vanguard and BlackRock, on the other hand, have generally supported the pilot program.

Conclusion

The impact of access fees and rebates on U.S. equity markets continues to be the subject of significant and sharp debate, and it is not yet clear what the SEC’s final program may look like. The pilot program could be modified from the proposal or entirely abandoned based on public comments. Although the deadline for comments has officially passed, the SEC often considers comments submitted after the official comment period closes and may welcome additional perspectives of investors and issuers. Issuers evaluating whether to submit their own comments should carefully review the proposal along with the points raised by the exchanges, institutional investors and broker-dealers.

Summer associate Christina A. Phan assisted in the preparation of this alert.

_______________

1 A source of market liquidity that is visible to the broader market, and which reflects available trading volume at a specific moment.

2 A source of market liquidity created through dark pools, constituting the trading volume not revealed to the market (and hence not visible to the public), though it is up for execution

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.