On June 18, 2020, the Consumer Financial Protection Bureau (CFPB or Bureau) announced the pilot of a new Advisory Opinion process, offering a potentially useful tool for those seeking guidance on compliance issues. The new process complements the CFPB’s existing Project Sandbox and No-Action Letter policies, while offering certain advantages over those programs, which are also designed to reduce uncertainty and encourage innovation in consumer financial services. In particular, the Advisory Opinion process is less likely to involve a time-consuming factual inquiry by the Bureau and — in some cases — may allow for anonymous requests. Thus, while the Advisory Opinion process has some limitations, it is likely to be a helpful tool.

The CFPB’s policies in this regard date back to November 2012, when the Bureau announced the launch of Project Catalyst, “an initiative designed to encourage consumer-friendly innovation and entrepreneurship in markets for consumer financial products and services.”1 In February 2016, the Bureau adopted a formal No-Action Letter policy. However, only one letter was issued under this policy, relating to fair lending issues associated with non-traditional credit variables.2 From December 2018 to September 2019, the CFPB revamped its program with the announcement of Project Sandbox and a revised No-Action Letter policy,3 which streamlined the application process and expanded the types of issues subject to, and afforded protection by, a no-action letter.

The announcement of the pilot phase of the Advisory Opinion process, and related proposed rule and request for comment, builds on these previous initiatives.4 In particular, the CFPB stated that the Advisory Opinion process “will focus primarily on clarifying ambiguities in the Bureau’s regulations, although AOs may clarify statutory ambiguities.”

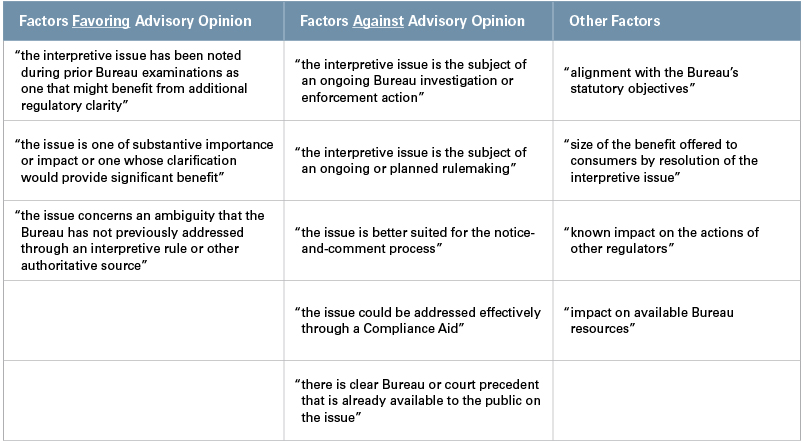

When determining whether to issue an Advisory Opinion, the CFPB will consider these factors:

The proposed Advisory Opinion process has some advantages over the existing No-Action Letter process, which may result in greater use of this method, particularly regarding:

- Third-party requests: In its pilot phase, the program will not accept applications from third parties on behalf of an unnamed entity. However, the proposal for the final rollout of the policy does allow for entities such as trade organizations and law firms to submit requests on behalf of anonymous members or clients.5

- Factual investigations. Under the new process, the Bureau “will not normally investigate the underlying facts of the requestor’s situation,” which will likely result in more applications and faster turnaround.

There are, however, certain limitations to the Advisory Opinion process. For instance, the Bureau generally will not issue Advisory Opinions with respect to “[h]ighly fact-intensive applications of general standards, such as the statutory prohibition on unfair, deceptive, or abusive acts or practices,” which “pose particular challenges for issuing advisory opinions.” Moreover, as noted in the chart above, there will be a strong presumption against issuing an Advisory Opinion when an institution is subject to an investigation or enforcement proceeding — a time when institutions may be most interested in obtaining such an opinion. Finally, even though such opinions potentially may be requested on an anonymous basis once the program completes the pilot phase, an unfavorable opinion might increase both enforcement and litigation risk regarding the practice at issue.

While it remains to be seen whether institutions will participate in the pilot, among the promising candidates for an opinion reducing “regulatory uncertainty” are:

- efforts to increase minority penetration for COVID-19-related relief programs, such as the Paycheck Protection Program;

- Limited English Proficiency practices, or “English only” language policies;

- the use of social media advertising platforms that have been criticized or subject to government enforcement; and

- the use of nontraditional data elements and machine-learning processes in lending and marketing models.

In sum, the Advisory Opinion process provides a useful new tool for reducing uncertainty, and is well worth consideration by institutions that are seeking clarity or the resolution of recurring ambiguities that arise in connection with the regulation of consumer financial services.

_______________

1 CFPB press release, “CFPB Launches Project Catalyst to Spur Consumer Friendly Innovation” (November 12, 2012).

2 Bureau of Consumer Financial Protection Policy on No-Action Letters, 81 FR 8686 (February 22, 2016); CFPB press release, “CFPB Announces First No-Action Letter to Upstart Network” (September 14, 2017).

3 Policy on No-Action Letters and the BCFP Product Sandbox, 83 FR 64036 (December 13, 2018); CFPB press release, “CFPB Issues Policies to Facilitate Compliance and Promote Innovation” (September 10, 2019).

4 CFPB press release, “Consumer Financial Protection Bureau Launches Pilot Advisory Opinion Program To Provide Regulated Entities Clear Guidance And Improve Compliance” (June 18, 2020).

5 A party requesting an Advisory Opinion on behalf of an unnamed third party “must provide a statement on whether the unidentified third party is the subject of an ongoing public Bureau enforcement action or an ongoing Bureau enforcement investigation conducted by the Bureau’s Office of Enforcement.”

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.