On March 5, 2021, the Financial Conduct Authority (FCA) announced the future cessation or loss of representativeness of the 35 LIBOR benchmark settings currently published by ICE Benchmark Administration (IBA), the authorized and regulated administrator of LIBOR. While the one-week and two-month U.S. dollar LIBOR settings ceased to be available as of December 31, 2021, the remaining U.S. dollar LIBOR settings also will be no longer representative, after June 30, 2023 (the End Date). As a result, all LIBOR-based credit facilities will need to be amended and an alternative benchmark will need to be chosen to replace LIBOR prior to the End Date. For credit facilities that already have hardwired Secured Overnight Financing Rate (SOFR) provisions to replace LIBOR, either the SOFR-based rate (with the credit spread adjustments recommended by the Alternative Reference Rate Committee (ARRC) of 11.448 bps for one-month SOFR, 26.161 bps for three-month SOFR and 42.826 bps for six-month SOFR) would automatically replace LIBOR on the End Date, or the borrower and administrative agent can jointly elect to transition to the applicable SOFR-based rate prior to the End Date, in each case without needing the consent of any lenders. For credit facilities with alternate rate provisions that permit amendments to transition from LIBOR to another benchmark, the borrower and administrative agent can jointly choose the benchmark to replace LIBOR and the applicable credit spread adjustment, but in those cases, required lenders holding the majority of loans and commitments typically would have a negative consent (i.e., the amendments would become effective a certain number of days after being posted to lenders unless such required lenders object). For credit facilities without any LIBOR transition provisions, any amendments to replace LIBOR with another benchmark would require the consent of all lenders.

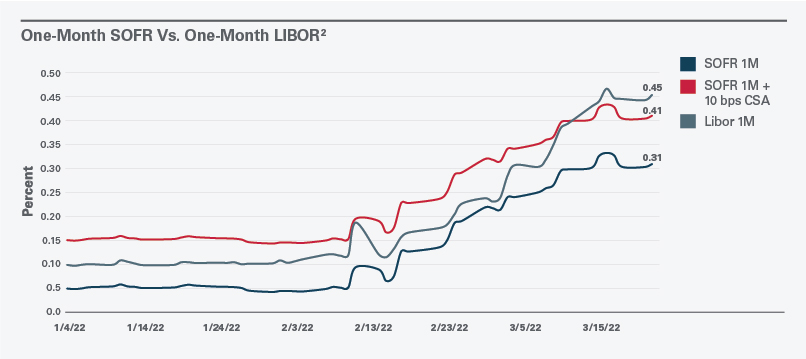

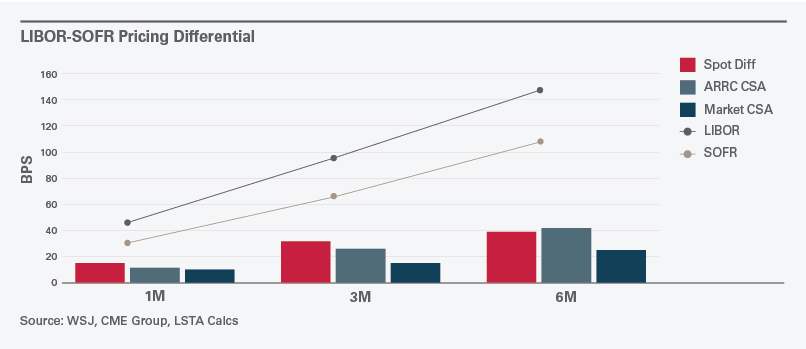

Many borrowers and banks already have started to incorporate alternative benchmarks, such as Term SOFR, to replace previous LIBOR-based rates (typically in conjunction with refinancing or other amendments to their existing credit facilities), and the vast majority of new loan issuances since the beginning of this year have shifted to SOFR-based rates.1 For companies still taking a wait-and-watch approach with respect to transitioning their LIBOR-based credit facilities, the time may be right to opt into SOFR-based rates prior to the End Date, especially if such credit facilities already contain LIBOR replacement provisions. Current increases in the LIBOR rates as a result of market conditions have made SOFR the cheaper alternative as compared to LIBOR. Indeed, based on rate indicators from March of this year, one-month SOFR (even with a 10-bps credit-spread adjustment) was lower than one-month LIBOR (see Chart A below, from the LSTA). Even for credit facilities that require incorporation of the ARRC-recommended credit spread adjustments, the SOFR-based rates recently have dipped below the equivalent LIBOR-based rates (see Chart B below, from the LSTA). Given the recent higher LIBOR rates and the fact that the End Date is a little over a year away, borrowers may want to act now to make an earlier election to SOFR as the replacement benchmark for LIBOR in their credit facilities.

Changing market conditions may impact LIBOR and SOFR rates, and you should consult with a qualified attorney before deciding to make an early election to SOFR as the replacement benchmark for LIBOR.

_______________________________

1 Based on data from the Loan Syndication & Trading Association (LSTA).

2 Charts provided by LSTA.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.