Part II: Electric Vehicles and Battery Materials Processing, Manufacturing and Recycling

The Infrastructure Investment and Jobs Act (IIJA) includes significant funding and program initiatives intended to accelerate the transition from combustion engines to electric motors in the transportation industry. It does so by addressing impediments to the wider adoption of electric vehicles (EVs), such as the need for a nationwide network of charging stations and gaps in the supply chain for key EV components, particularly batteries.

In Part II of our four-part series on key energy and infrastructure provisions of the IIJA, we explore the sections of the law that promote EV adoption and domestic EV-related manufacturing.

EV Charging Networks and Alternative Fuel Corridors

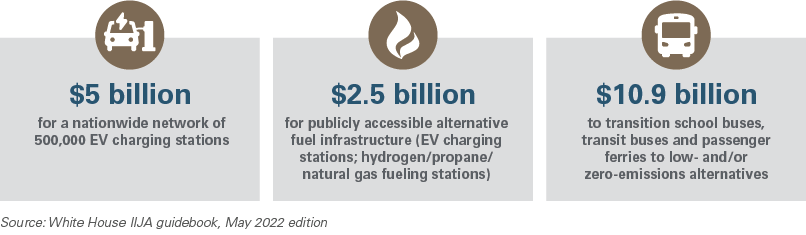

The IIJA authorizes $18.6 billion to fund new and existing EV-related programs, including:

- $5 billion in new funding to develop and build a nationwide network of 500,000 EV charging stations, and

- $2.5 billion for publicly accessible alternative fuel infrastructure (i.e., EV charging stations and hydrogen, propane and natural gas fueling infrastructure along designated Alternative Fuel Corridors and in communities), which are detailed below.

In addition, there is approximately $10.9 billion in funding for transitioning school buses, transit buses and passenger ferries to low- and/or zero-emissions alternatives.1

National Electric Vehicle Infrastructure (NEVI) Formula Program ($5 Billion)

This new formula grant program will provide dedicated funding to states to deploy EV charging infrastructure and establish an interconnected network intended to facilitate data collection, access and reliability. Funding under this program will first be directed to build out a national EV charging station network, principally along interstate highways. Funds may also be used to contract with private entities to install, operate and maintain publicly accessible EV charging facilities. The maximum federal cost-share for NEVI Formula Program projects is 80%. EV charging stations must use open payment systems and charging technology that is not proprietary to a single automaker. These interoperability requirements will help maximize the value of the charging station network.

Implementation Efforts: On February 10, 2022, the Federal Highway Administration (FHWA) published guidance for the NEVI Formula Program. On August 2, 2022, the U.S. Department of Transportation (U.S. DOT) and the U.S. Department of Energy (DOE) announced that all 50 states, the District of Columbia and Puerto Rico had submitted their EV Infrastructure Deployment Plans to the Joint Office of Energy and Transportation (Joint Office). These plans indicate how each state intends to utilize the funding it receives under the NEVI program. Submission of an EV Infrastructure Deployment Plan is a prerequisite to receiving funding under the program. The FHWA and the Joint Office will review the plans and continue to work with the states, with the goal of approving eligible plans by September 30, 2022.

In addition, on June 9, 2022, the FHWA issued a Notice of Proposed Rulemaking (NOPR) on minimum standards and requirements for projects funded under the NEVI program and for EV charger construction projects funded under Title 23 (Highways), United States Code. The NOPR seeks to ensure there will be a nationwide network of EV chargers that can be used by any type of EV and that provide uniform standards with respect to payment systems, display of pricing information, charging speeds, number of chargers and other specifications. On July 6, 2022, the FHWA announced the sixth and latest round of Alternative Fuel Corridor designations. These corridors — which can now be found in all 50 states, as well as in Washington, D.C. and Puerto Rico — will serve as the backbone for the national EV charging network.

New Competitive Grant Programs for Charging and Fueling Infrastructure ($2.5 Billion)

This new competitive grant program is to be divided equally between Corridor Charging (along designated Alternative Fuel Corridors) and Community Charging (in other locations, particularly rural and underserved communities). Eligible public entities may contract with private sector entities to acquire and install publicly accessible alternative fuel infrastructure such as EV charging stations and hydrogen, propane and/or natural gas fueling infrastructure in their designated areas. Grant proceeds may be used to provide entities operating assistance for the first five years following infrastructure installation. The maximum federal cost-share for a project supported by this program is 80%.

Implementation Efforts: On November 29, 2021, the FHWA published an EV-charging request for information (RFI) regarding future guidance for implementation of the NEVI Formula Program and the Charging and Fueling Infrastructure Grants. Responses were due by January 28, 2022. Notices of funding opportunities (NOFO) for both the Corridor Charging and Community Charging grant programs are expected in late 2022.

Domestic Supply Chains for Clean Energy Technologies

Section 40207 of the IIJA creates two new DOE grant programs for battery processing, manufacturing and recycling totaling $6 billion.

Battery Material Processing Grant Program ($3 Billion for FY 2022-26)

Under this program, the energy secretary is directed to award grants to eligible entities (including both public and private entities) to:

- carry out one or more demonstration projects in the U.S. for the processing of battery materials that will help enable domestic processing at a commercial scale. Each grant is at least $50 million;

- construct one or more new commercial-scale battery material processing facilities in the U.S. Each grant is at least $100 million; and

- retool, retrofit, or expand one or more existing battery material processing facilities located in the U.S. and determined qualified by the energy secretary. Each grant is at least $50 million.

The secretary of energy will give priority to eligible entities that (i) are located and operate in the U.S., (ii) are owned by a U.S. entity, (iii) deploy North American-owned intellectual property and content, (iv) represent consortia or industry partnerships, and (v) will not use battery material supplied by or originating from a foreign entity of concern.

Battery Manufacturing and Recycling Grant Program ($3 Billion for FY 2022-26)

Under the program, the energy secretary is directed to award grants to eligible entities (including both public and private entities) to:

- carry out one or more demonstration projects for advanced battery component manufacturing, advanced battery manufacturing and recycling. Each grant is at least $50 million;

- construct one or more new, commercial-scale advanced battery component manufacturing, advanced battery manufacturing or recycling facilities in the U.S. Each grant is at least $100 million; and

- retool, retrofit or expand one or more existing facilities located in the U.S. and determined qualified by the energy secretary for advanced battery component manufacturing, advanced battery manufacturing and recycling. Each grant is at least $50 million.

The secretary of energy will give priority to eligible entities that (i) are located and operate in the U.S., (ii) are owned by a U.S. entity, (iii) deploy North American-owned intellectual property and content, (iv) represent consortia or industry partnerships, and (v) in the case of an advanced battery component manufacturing grant, will not use battery material supplied by or originating from a foreign entity of concern, and/or in the case of a battery recycling grant, will not export recovered critical minerals to a foreign entity of concern.

Implementation Efforts: On August 29, 2022, the DOE, on behalf of the Manufacturing and Energy Supply Chains Office, issued an RFI seeking input regarding priorities, implementation and stakeholder engagement for $335 million of grant funding (through federal fiscal year 2026) for research and demonstration projects to increase the reuse and recycling of lithium-ion batteries. The goal is to help maximize the recovery of critical materials for use in new products and extend the useful life of lithium-ion batteries. Responses to this RFI are due on October 14, 2022.

Previously, on May 2, 2022, the DOE took the following actions:

- The Office of Energy Efficiency and Renewable Energy (EERE) issued a funding opportunity announcement (FOA), “Battery Materials Processing and Battery Manufacturing,” representing $3.16 billion in IIJA funding under Section 40207. Applications for this FOA closed on July 1, 2022, and awards are expected between October 2022 and April 2023.

- The Vehicle Technologies Office issued a complementary FOA, “Electric Drive Vehicle Battery Recycling and Second Life Applications,” representing a separate $60 million in IIJA funding under Section 40208. Applications closed on July 19, 2022, and awards are expected between October 2022 and April 2023.

* * *

Takeaways

The IIJA represents a concerted effort by the U.S. government to accelerate the development of a domestic EV industry. For EV charging infrastructure, the FHWA has provided a framework for the primary EV-related programs in the IIJA. The FHWA and the Joint Office are responsible for the next step in reviewing and approving the state DOTs’ EV Infrastructure Deployment Plans by the end of September 2022. Once each state plan is approved, the state DOTs will be able to start deploying EV charging infrastructure with their share of NEVI Formula Program funds.

With respect to EV batteries, the U.S. DOE’s EERE will spearhead deployment of the $6 billion in grant funds available for battery materials processing and battery manufacturing. Advancing and controlling these resources and technologies will be critical to the success of the U.S. EV industry and for energy storage systems to support intermittent renewable energy facilities. The DOE’s principal objective will be to identify qualified recipients for these grant programs in a compressed time frame and deploy the authorized funding on projects that will measurably impact U.S. battery manufacturing capabilities.

Significant funding for domestic advanced technology automotive manufacturing and for the procurement of zero-emissions vehicles can also be found in the Inflation Reduction Act. Relatedly, the CHIPS and Science Act (which President Joe Biden signed into law on August 9, 2022) provides significant federal support for domestic semiconductor manufacturing.

Coming Up Next

Part III of our four-part series will focus on funding programs under the IIJA for energy, water and broadband infrastructure.

_______________

1 Funding levels reflected in this series are as shown in the May 2022 version of the White House’s “Guidebook to the Bipartisan Infrastructure Law for State, Local, Tribal, and Territorial Governments, and Other Partners.”

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.