In this issue, we cover regulatory developments impacting the investment management sector, including updates on closed-end fund activism and various new and revised SEC rules.

Closed-End Fund Activism Update

- Recent Bylaw Cases Should Not Affect Control Share Statutes

- Activist Success in Recent Case Demonstrates Need for Vigilant Corporate Hygiene

SEC Rules and Amendments

- Restructured Mutual Fund/ETF Shareholder Reports and Amended Advertising Requirements

- Proposed Rule on Outsourcing by Investment Advisers

- Proposed Changes to Open-End Fund Liquidity Framework

- T+1 Standard Settlement Times for Most Securities Transactions

- Amended Rules on Proxy Vote and Executive Compensation Vote Reporting

- Guidance Update: Differential Fee Waivers

- Amendments to 10b5-1 Trading Plan Rules and New Disclosure Requirements

- Compensation Recovery Listing Standards and Disclosure Rules

- Division of Examinations Initiatives

SEC Enforcement

SEC Appointments

Closed-End Fund Activism Update

Recent Bylaw Cases Should Not Affect Control Share Statutes

On January 21, 2023, a Massachusetts Superior Court granted in part and denied in part cross motions for summary judgment in Eaton Vance Senior Income Trust v. Saba Capital Master Fund, Ltd., No. 2084-cv-01533-BLS2 (Jan. 21, 2023).

In the case, Saba challenged two bylaw amendments adopted by the trustees of four Eaton Vance closed-end funds (the Funds) in 2020:

- A control share amendment (the Control Share Amendment).

- An amendment increasing the number of votes needed to prevail in a contested trustee election to a majority of the outstanding shares (the Majority Amendment).

The trustees and the Funds sought a court declaration that the bylaw amendments were legal and valid. In response, Saba sought a declaration that the amendments were illegal, a breach of contract insofar as they violated the Funds’ Declarations of Trust, a breach of the trustees’ fiduciary duties, and a determination that they must be rescinded.

The parties each moved for partial summary judgment in mid-2022.

How the Court Ruled

The court entered summary judgment in favor of Saba and against the trustees and the Funds on Saba’s claim that the Control Share Amendment violated Section 18(i) of the Investment Company Act of 1940 (1940 Act) and must be rescinded.

The court’s reasoning draws heavily from Saba Capital CEF Oppors. 1, Ltd. v. Nuveen Floating Rate Income Fund, Case No. 21-cv-327 (JPO), 2022 WL 493554 (S.D.N.Y. Feb. 17, 2022) (Nuveen), a recent case where the U.S. District Court for the Southern District of New York found a similar bylaw provision illegal.

In particular, the Eaton Vance court held that “[u]nder the plain language of [Section 18(i)], all common shares of stock must be ‘voting’ and have voting rights that are ‘equal’ to the voting rights of all other shares. … [and] [t]he Control Share Amendment violates this unambiguous requirement.” The court further held that rescission of the Control Share Amendment is appropriate under the 1940 Act because Section 18(i) is a fundamental requirement of the statute.

The court also:

- Denied summary judgment on Saba’s claim that the Majority Amendment breached the Funds’ Declarations of Trust because they make it effectively impossible to mount a challenge to the reelection of a trustee.

- Entered summary judgment in favor of the trustees and the Funds and against Saba on Saba’s claim that the trustees breached their fiduciary duties, rejecting Saba’s attempts to infer bad faith or self-interest without any evidentiary support and expressly holding that “[t]he fact that the Control Share Amendment violated the [1940 Act] does not necessarily mean the Trustees acted in bad faith when they adopted it.”

The court did not decide whether the Majority Amendment is legal because neither party moved for summary judgment on that basis. Thus, that issue, along with Saba’s breach of contract claim, will likely proceed to an as-of-now unscheduled trial.

Control Share Bylaw Provisions

The control share bylaw provisions in the Eaton Vance case, and in the Nuveen case it drew from, are distinguishable from those applicable to Delaware statutory trusts and Maryland corporations. The funds in those cases are organized as Massachusetts business trusts.

Delaware has a statutory control share provision that is automatically applicable to registered closed-end funds and business development companies (BDCs) organized as Delaware statutory trusts.

Similarly, Maryland has a statutory control share provision that is applicable to any Maryland corporation. It is automatically applicable to BDCs (unless they opt out), and registered closed-end funds may opt in to it.1

The Delaware and Maryland statutes are significant because the 1940 Act’s “one share, one vote” provision in Section 18(i) has a caveat that it applies “[e]xcept … as otherwise required by law.” There is no similar statute applicable to Massachusetts business trusts; indeed, in the Nuveen and Eaton Vance cases, the control share provisions were enacted by bylaw amendments not specifically grounded in a state statute.

While courts have not specifically considered the applicability of this caveat in the case of the Delaware and Maryland statutes, those statutes, on their face, fall within the exception contained in Section 18(i).

In this regard, the Eaton Vance case is quite helpful in making clear that, “[i]n interpreting a statute, a court begins with the language of the statute and determines whether the language at issue has a plain and unambiguous meaning with regard to the particular dispute in the case. If there is no ambiguity, then judicial inquiry is complete.”2

Section 18(i) unambiguously allows for exceptions grounded in law, and that is what the Delaware and Maryland statutes provide. Moreover, Section 1(b) of the 1940 Act expressly provides that the provisions of the 1940 Act should be construed in accordance with its purposes. One of those purposes is to protect investors from insiders and from other investors with concentrated share ownership who can control funds to benefit themselves.

These are the very tactics and objectives that activists pursue, and the Delaware and Maryland statutes were designed — and serve — to protect investors from these types of abuses. A court might find it difficult to conclude that federal preemption applies in light of this statutorily expressed congressional intent.

Additionally, the Securities and Exchange Commission (SEC) staff has stated that the “staff would not recommend enforcement action to the [SEC] against a closed-end fund under section 18(i) of the [1940] Act for opting in to and triggering a control share statute if the decision to do so by the board of the fund was taken with reasonable care on a basis consistent with other applicable duties and laws and the duty to the fund and its shareholders generally.”

The SEC staff position is significant in that it:

- Recognizes SEC enforcement action is not warranted in the case of the application of state law control share statutes.

- Reverses a prior position that had asserted the “except as otherwise required by law” caveat was irrelevant.3

Boards and advisers should be aware, however, that the SEC staff has recently been asking funds to add disclosure to their offering documents noting the uncertainty around the application of control share statutes under the 1940 Act in light of these recent court decisions.

On more technical grounds, Section 18(i) applies to shares, not shareholders. While both the Nuveen and Eaton Vance cases considered and rejected this distinction, it remains an argument to be made in other jurisdictions because cases from Delaware (and elsewhere) have acknowledged that restrictions that prevent shareholders from exercising certain rights do not necessarily mean that the rights of the shares themselves are restricted.

As one federal district court in Maryland put it, restrictions on certain shareholder rights in a poison pill had “nothing to do with the voting rights of the shares themselves.”4

Activist Success in Recent Case Demonstrates Need for Vigilant Corporate Hygiene

On January 31, 2023, the Southern District of New York denied a preliminary injunction sought by Templeton Global Income Fund (GIM) and a shareholder against Saba Capital Management, arising out of a disputed trustee election at GIM’s 2022 annual meeting.

At the time of the annual meeting, Saba-nominated trustees already occupied four board seats. Saba mounted a proxy contest at the annual meeting to seat four more Saba-nominated trustees and take majority control of the board.

In the litigation, GIM alleged that Saba failed to disclose material facts in connection with its proxy solicitation. When Saba’s trustee nominees putatively won the 2022 shareholder vote for trustees, GIM sought a preliminary injunction enjoining the certification of the putative results of the 2022 shareholder vote for trustees, preventing Saba’s trustee nominees from being seated or otherwise taking office as trustees, requiring Saba to distribute corrective disclosures to shareholders and ordering a shareholder meeting to be scheduled to consider the issues of the 2022 annual shareholder meeting on a fully informed basis.

In its opinion denying GIM’s motion for a preliminary injunction, the court made no finding on the merits of GIM’s arguments about Saba’s disclosures. Rather, it denied GIM’s request for a preliminary injunction on the grounds that there was insufficient evidentiary support of irreparable harm without the injunction. (Irreparable harm is one element of the standard that courts use to determine whether a preliminary injunction is warranted.)

On February 13, 2023, GIM announced that it was withdrawing the litigation and, as such, the results would be certified and Saba’s trustee nominees would be seated as trustees of the fund. According to GIM, “In the best interests of shareholders, the Fund has taken action to discontinue the litigation, considering the length of time that has already elapsed and the additional time expected to be needed to finally resolve the litigation, during which shareholders remain subject to significant ongoing costs and continued uncertainty as to the Fund’s future.”

GIM also announced that the remaining non-Saba nominated independent trustees would be resigning from GIM’s board. And it noted that, based on the preliminary results of GIM’s 2022 annual meeting, over 90% of the voted shares — other than those owned by Saba or those that Saba privately agreed to purchase in the days immediately prior to GIM’s 2022 annual meeting to secure votes in Saba’s favor — were voted in favor of GIM’s nominees.

Furthermore, according to GIM, all three leading independent proxy advisory firms — Institutional Shareholder Services Inc., Glass, Lewis & Co. and Egan-Jones Proxy Services — recommended that shareholders vote with GIM’s recommendations for all of GIM’s trustee nominees in connection with the annual meeting and against Saba’s shareholder proposal to terminate GIM’s investment management agreement.

Our takeaways from GIM’s situation are the following:

- Saba’s strategy is now to pursue full takeovers of funds in addition to continuing its strategy of seeking close-to-net-asset-value (or even above-NAV) “liquidity events.” Advisers and boards should be cognizant that, with another full takeover success, this new strategy is now very much a live threat and has the ability to remove investment options from the marketplace that retail investors can only obtain exposure to in a registered closed-end fund format.

- Continuous attention to “corporate hygiene” is critically important for closed-end funds. Boards should carefully review provisions in their funds’ governing documents addressing director/trustee elections, annual and special meetings, director/trustee qualifications, shareholder voting rights and proposals, as well as the applicability of any control share provisions discussed above. They should consider whether the collective effect of these provisions provides adequate protection to the fund’s shareholders from a vocal minority investor exerting undue influence to either (i) secure transactions or changes to the fund that are beneficial to that investor but not necessarily to all shareholders, or (ii) secure a full takeover of the fund without providing shareholders with adequate information on its plans for the fund.

- Funds should devote attention to getting to know their shareholder bases and should communicate with that base early and often, before a proxy contest occurs. Individualized outreach to large holders should be a priority.

SEC Rules and Amendments

Restructured Mutual Fund/ETF Shareholder Reports and Amended Advertising Requirements

On October 26, 2022, the SEC adopted rule and form amendments to:

- Change shareholder reporting requirements (Reporting Requirements) for open-end management investment companies registered on Form N-1A (OEFs).

- Prescribe express disclosure standards for the presentation of fees and expenses in registered investment company and business development company advertisements, sales literature and other offering-related communications (Advertisements).

Amended Shareholder Reporting Requirements

According to the adopting release (Release), the amendments will bifurcate existing Reporting Requirements for OEFs (with the additions and modifications discussed below) into:

- “Concise and visually engaging annual and semi-annual reports to shareholders that highlight key information that is particularly important for retail investors” (Shareholder Reports).

- “Information that may be more relevant to financial professionals and investors who desire more in depth information … available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR [with Inline XBRL tagging]” (Regulatory Disclosures).

In addition, amended Rule 30e-3 (Rule 30e-3) under the 1940 Act now expressly excludes OEFs from the scope of registered investment companies5 permitted to satisfy their shareholder reporting transmission requirements via online availability and the delivery of a notice of online availability.

In other words, under amended Rule 30e-3, OEFs will now be required to provide the new Shareholder Reports directly to investors either in paper form or, if opted in, electronically, without exception.

According to SEC Chair Gary Gensler, the amendments to Reporting Requirements are designed to, by requiring OEFs to “get to the heart of the matter” in Shareholder Reports delivered directly to shareholders, eliminate the need for retail investors to have to “sift through extensive” Regulatory Disclosures.

Shareholder Reports: Series and Class Scope

Under the amended Reporting Requirements, multiseries and multiple-class OEFs will now be required to provide separate Shareholder Reports specifically tailored to each such series and class in which the shareholders are invested.

According to the Release, permitting multiple, combined Shareholder Reports is “inconsistent with [the SEC’s] goal of creating concise … disclosure that shareholders can more easily use to assess and monitor their ongoing fund investments.”

Shareholders will therefore only receive reports applicable to the particular fund (i.e., series) and share class in which they invest.

Shareholder Reports: Information and Presentation Requirements

The amendments to annual Reporting Requirements will generally require OEFs to reorganize the presentation of currently required information into Shareholder Reports delivered directly to investors and Regulatory Disclosures filed on Form N-CSR and made available online. More specifically, new Item 27A of Form N-1A (Item 27A) will replace the comprehensive Reporting Requirements provisions in current Item 27 of Form N-1A with expressly enumerated content requirements and restrictions.

All other information currently required or permitted in an annual report not expressly required or permitted in the new Shareholder Reports under Item 27A will be prohibited from the Shareholder Reports and provided solely as Regulatory Disclosures online, in semiannual filings on Form N-CSR and by prospectus.

Most notably, financial statements provided under the current requirements will no longer be included in Shareholder Reports.

Content Restrictions: Prohibited Information

The Release illustrates the Shareholder Reports’ amended content restrictions by discussing certain traditional disclosure items the SEC would now deem “unnecessary” or “duplicative” and therefore prohibited.

Shareholder Reports delivered to the retail investors of a single share class should not include, for example, disclosure related to such share class’ purchase eligibility requirements, as such disclosure would be unnecessary, according to the Release.

Similarly, certain information already included in a prospectus or prospectus update required to be delivered to investors, such as a description of an OEF’s investment objective, is now prohibited from Shareholder Reports (if not expressly permitted or required) because, according to the Release, it would “unnecessarily increase the length of the [S]hareholder Report.”

Content Restrictions: Required and Optional Information

Under new Item 27A, the contents of Shareholder Reports will be restricted to the following:

Expense example (required in annual and semiannual reports). Item 27A(c) replaces the current expense example presentation requirements set forth in Item 27(d)(1). At present, Item 27(d)(1) requires OEFs to present a narrative preamble and two separate expense examples designed to illustrate the cost of an investor’s investment in the OEF over the reporting period. One table shows the actual cost in dollars for a $1,000 investment in the OEF over the period based on the OEF’s actual return, and another table shows the cost in dollars for a $1,000 investment in the OEF over the prior period based on a hypothetical 5% annual return.

In addition, OEFs are also currently required to include figures showing the starting and ending account values for the covered period, and the OEF’s annualized expense ratio (and accompanying disclosure).

Under new Item 27A(c), OEFs will now present just one concise and simplified expense example. The new presentation is limited to the fund/class name and the costs associated with a hypothetical $10,000 investment, expressed in both dollars and as a percentage of the investment amount. Additionally, OEFs will not need to include return information in the expense presentation.

The new expense example should be presented as follows, according to the Release.

Management’s Discussion of Fund Performance (required in annual reports; optional in semiannual reports). According to the Release, Item 27A(d) largely maintains the performance presentation and discussion requirements set forth in current Item 27(b)(7).

The changes adopted under Item 27A(d) are “targeted changes” to Management’s Discussion of Fund Performance (MDFP) designed to (i) promote more concise MDFP disclosures and (ii) increase comparability of MDFP performance presentations.

- To promote more concise MDFP disclosures. New Item 27A(d) instructs OEFs to use graphics, images and text features and to only “briefly summarize” the “key factors that materially affected the [OEF’s] performance during the last fiscal year, including the relevant market conditions and the investment strategies and techniques used by the … investment adviser.” In addition, the new instructions prohibit OEFs from including any additional information, such as a lengthy, generic or overly broad discussion of the factors that generally affected market performance during the reporting period.

- To increase comparability of MDFP performance presentations. OEFs will be required to modify the presentation of performance figures and the performance line graph currently included in annual reports. Under the new requirements for performance figures, OEFs will need to include “additional performance-related information that is available in fund prospectuses, including certain performance information and comparative information showing the average annual total returns of one or more relevant benchmarks.” Under the new requirements for performance line graphs, OEFs will no longer be permitted to cover periods longer than 10 years and must present the performance for the share class covered by the Shareholder Report.

In addition, the definition of an “appropriate broad-based securities market index” required in the overall comparative presentation has been amended to include only those benchmarks that are sufficiently representative of the overall applicable domestic or international debt or equity markets. An OEF will continue to be permitted, however, to “compare its performance to other indexes, including more narrowly based indexes that reflect the market sectors in which the fund invests.”

Fund statistics (required in annual and semiannual reports). New Item 27A(e) will require OEFs to disclose (i) net assets, (ii) total number of portfolio holdings, (iii) portfolio turnover rate, and (iv) the total advisory fees paid by an OEF during the reporting period.

Graphical representation of holdings (required in annual and semiannual reports). Item 27A(f) replaces Item 27(d)(2) and requires one or more tables, charts or graphs depicting the portfolio holdings of the fund, as of the end of the reporting period, by reasonably identifiable categories (e.g., type of security, industry sector, geographic regions, credit quality or maturity) showing the percentage of (i) net asset value, (ii) total investments, or (iii) total exposure (depicting long and short exposures to each category, to the extent applicable) attributable to each. The categories and the basis of the presentation should be disclosed in a manner reasonably designed to clearly depict the types of investments made by the OEF, given its investment objectives.

Item 27A(f) also permits the OEF to list, in a table or chart that appears near the graphical representation of holdings, the fund’s 10 largest portfolio holdings. An OEF that includes a list of its 10 largest portfolio holdings may also show, as part of this presentation, the percentage of the OEF’s (i) net asset value, (ii) total investments, or (iii) total exposure, as applicable, attributable to each of the holdings listed.

Material fund changes (required in annual reports; optional in semiannual reports). Item 27A(g) requires disclosure of material changes to: (i) fund name; (ii) investment objectives or goals; (iii) annual operating expenses, shareholder fees, account fees and the introduction or termination of expense/fee waiver and reimbursement agreements; (iv) principal investment strategies; (v) principal risks; and (vi) change in adviser and/or subadviser(s).

Changes in and disagreements with accountants (required in annual and semiannual reports). Item 27A(h) replaces Item 27(b)(4) and provides for a concise disclosure only discussing the status of the arrangement (resigned, declined, dismissed, etc.) and a plain English description of any disagreement(s) during the two most recent fiscal years. (The full disclosure must be included on Form N-CSR.)

Availability of additional information (required in annual and semiannual reports). Item 27A(i) replaces Item 27(d)(3) through (5) and will require OEFs to reference the availability of certain additional information on websites, including references to prospectuses, financial information, holdings and proxy voting information.

Householding disclosure (optional). OEFs that continue to rely on Rule 30e-1 to household Shareholder Reports will be able to include the required notice on the Shareholder Report.

Formatting and Presentation Standards

Item 27A(a) encourages OEFs to use investor-friendly formats, language and different text and graphics features designed to promote simplicity and improve readability for retail investors.

Item 27A(b) prescribes the presentation of specific identifying information that:

- Identifies the OEF.

- Identifies the report as an annual or semiannual Shareholder Report.

- Identifies material fund changes discussed in the report.

- Orients the reader, such as legends and template language.

Item 27A also sets out detailed instructions governing electronic annual reports, which include:

- Ordering and presentation requirements for reports that appear on a website or are otherwise provided electronically.

- Instructions offering additional flexibility for funds to add tools and features to reports that appear on a website or are otherwise provided electronically.

- Required links or other means for immediately accessing information referenced in reports available online.

Finally, OEFs will be required to tag the information in shareholder reports using Inline XBRL.

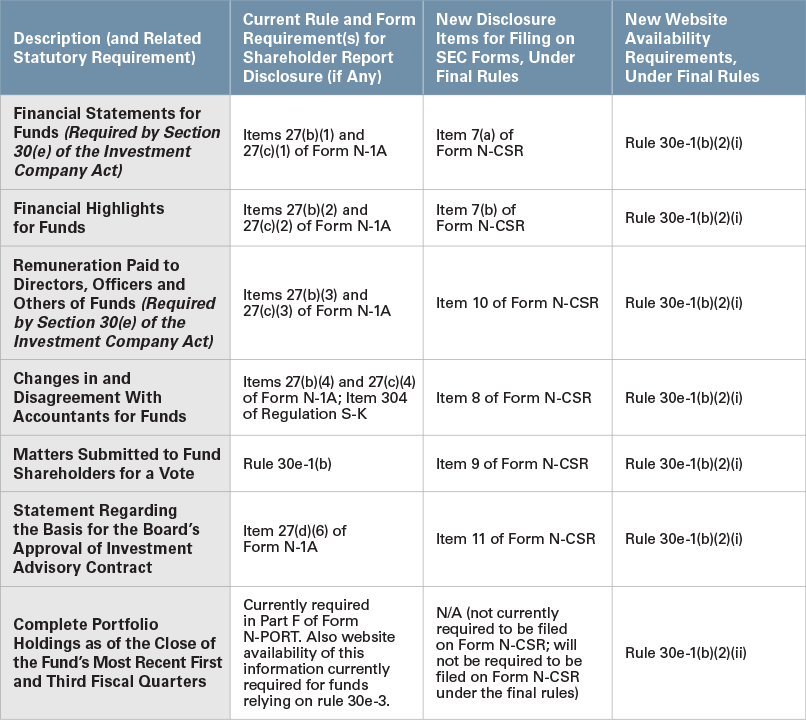

Form N-CSR and Website Availability Requirements

All other information required to be made available pursuant to Section 30 of the 1940 Act that is no longer permitted in Shareholder Reports (in addition to certain other additional information) must be filed under the final rules and form amendments, as shown in the following table, reproduced from the Release.

Amended Advertising Rules: Fees and Expenses

Presentation and Timeliness Requirements

Amended advertising rules 482 (Rule 482) and 433 (Rule 433) under the Securities Act of 1933 (Securities Act) and corresponding amendments to Rule 34b-1 under the 1940 Act (collectively, Advertising Rules) will require registered investment companies and business development companies (Funds) that highlight, present or otherwise make statements about their fees and expenses in advertisements to include standardized fee and expense figures in a manner “consistent with relevant prospectus fee table presentations.”

Amended Rule 482 establishes the new requirements for the presentation of fees and expenses in all Advertisements. Under the amendment, Advertisements that provide fee and expense figures must also include — and present at least as prominently as such fee and expense figures — “the maximum amount of any sales load, or any other nonrecurring fee” and the “total annual expenses without any fee waiver or expense reimbursement arrangement.”

Such figures must be based on the computation methods for a prospectus prescribed by the Fund’s 1940 Act or Securities Act registration statement.

These mandatory figures, as well as any narrative accompanying fee-related information, must be as of the date of the Fund’s most recently filed prospectus or (in the case of Funds that no longer have an effective registration statement) most recent annual report. An Advertisement, however, would not need to include the required fee and expense figures if it only discussed general, narrative information about fee and expense considerations and did not present any numerical fee or expense amount figures.

Advertisements are permitted to continue showing fees and expenses net of certain waivers or expense reimbursement arrangements, but such figures must not be presented more prominently than the mandatory figures prescribed by Rule 482. In addition, the presentation of figures net of waivers and reimbursements must include the expected termination date of the arrangement.

According to the Release, the SEC believes requiring standardized fee and expense figures meeting the timeliness and prominence requirements of the Advertising Rules is important for retail investors considering a Fund’s overall costs and to “promote consistent fee and expense computations across investment company advertisements, particularly within the same fund category.”

Rule 34b-1, which sets forth the requirements applicable to a Fund’s use of supplemental sales literature, and Rule 433, which establishes the conditions to permissible post-filing free writing prospectuses used by closed-end funds and BDCs, have been amended to expressly incorporate the presentation and timeliness requirements for fees and expenses adopted under amended Rule 482.

Additionally, under amended Rule 34b-1, supplemental sales literature that omits any of the information required under Rule 482 may be deemed materially misleading, according to the Release.

Amended Rule 156: Factors To Evaluate Materially Misleading Statements and Representations in Advertisements

Rule 156 under the Securities Act, which establishes standards for evaluating whether Fund Advertisements are materially misleading, has been amended to include factors that Funds and intermediaries should consider when evaluating whether statements and representations made about a Fund’s fees and expenses in an Advertisement could be materially misleading for purposes of federal securities laws.

While current Rule 156 broadly prohibits materially misleading statements in Advertisements, the Release indicates the amendments are necessary to expressly address the increase in Funds advertising to retail investors on the basis of cost, such as Funds that market themselves prominently as low or “no expense” Funds, without adequately disclosing (with equal prominence) other costs investors would incur as a result of their investment.

More specifically, the Release states that amended Rule 156 is designed to address the SEC’s concerns that Funds and intermediaries marketing on the basis of cost may be “incentivized to understate or obscure the costs associated with a fund investment.”

Consistent with the pre-amended Rule 156 framework, amended Rule 156 adds language designed to require evaluation of the entire context in which a particular “description, representation, illustration, or other statement involving a [F]und’s fees and expenses statements or representations” was made. Specifically, new paragraph (b)(4) of Rule 156 provides:

(b)(4) Representations about the fees or expenses associated with an investment in the fund could be misleading because of statements or omissions made involving a material fact, including situations where portrayals of the fees and expenses associated with an investment in the fund omit explanations, qualifications, limitations, or other statements necessary or appropriate to make the portrayals not misleading.

The Release indicates the new “factors also could assist such intermediaries when they consider whether a presentation of fee and expense information in investment company sales literature is materially misleading under any other principles-based rule regarding investment company sales literature to which such intermediaries may be subject, such as FINRA rule 2210(d)(1)(A).”

Taken as a whole, the amended Advertising Rules are designed, according to the Release, to “promote comparability” of a Fund’s fee and expense information with similarly situated Funds and to apply the same overall standards and content requirements currently prescribed for the presentation of a Fund’s performance information and performance-related disclosures.

Compliance Dates

- The amendments were all effective as of January 24, 2023 (Effective Date).

- Compliance with amended Rule 156 is mandatory as of the Effective Date and without a transition period.

- The compliance date for the amended shareholder reporting requirements for OEFs, and amended Advertising Rules 482, 433 and 34b-1 for all regulated Funds, is July 24, 2024.

Proposed Rule on Outsourcing by Investment Advisers

On October 26, 2022, the SEC proposed a new Rule 206(4)-11 and amendments to Rule 204-2 under the Investment Advisers Act of 1940 (Advisers Act), as well as amendments to Form ADV, regarding the use of third-party service providers by investment advisers who are registered or required to be registered under the Advisers Act (advisers). (See the full text of the proposal, including the proposed rule.)

The proposed rule is designed to prohibit advisers from outsourcing “covered functions” to “service providers” (each as described further below) without meeting minimum requirements, including the following:

- Due diligence. Conduct due diligence on service providers prior to outsourcing.

- Monitoring. Periodically monitor service providers’ performance.

- Books and records. Make and keep books and records related to diligence and monitoring.

- Third-party record-keeping. Conduct diligence on and monitor third-party record-keepers, and obtain reasonable assurances that they will meet certain standards.

- Form ADV. Report service providers on Form ADV.

“Covered function” means a function or service that is necessary for the investment adviser to provide its investment advisory services in compliance with federal securities laws, and that, if not performed or performed negligently, would be reasonably likely to cause a material negative impact on the adviser’s clients or on the adviser’s ability to provide investment advisory services.

The SEC provides the following nonexclusive checklist of covered functions in proposed amendments to Form ADV:

- Adviser/subadviser.

- Client servicing.

- Cybersecurity.

- Investment guideline/restriction compliance.

- Investment risk.

- Portfolio management (excluding adviser/subadviser).

- Portfolio accounting.

- Pricing.

- Reconciliation.

- Regulatory compliance.

- Trading desk.

- Trade communication and allocation.

- Valuation.

However, the proposal excludes “clerical, ministerial, utility, or general office functions or services” from the definition of covered function.

A “service provider” is a person or entity that performs a covered function and is not a “supervised person” of the adviser.

The SEC’s adviser outsourcing proposal has been met with significant industry concerns. A December 23, 2022, comment letter from the Investment Company Institute encapsulates what appears to be the basic objection:

As the Proposal repeatedly notes, advisers are already performing oversight functions as required under their fiduciary duty. Providing the SEC an additional course of action to sanction an adviser for violating its fiduciary duty is unnecessary and will not enhance investor protection. In support of a rulemaking, the Commission should, at a minimum, conduct an informed assessment of existing regulations and how such regulations are working, including actions that can be taken to redress a problem once identified, studied, and understood by the Commission and staff. As demonstrated by the SEC’s own regulatory analysis, the SEC has authority to sanction advisers for inadequate oversight of their service providers.

For a full discussion of the SEC’s adviser outsourcing proposal, please see our November 22, 2022, client alert.

Proposed Changes to Open-End Fund Liquidity Framework

On November 2, 2022, the SEC voted to propose significant amendments to Rules 22e-4 and 22c-1 under the 1940 Act, as well as amendments to related reporting and disclosure forms (the Proposal). The Proposal was approved by a 3-2 vote, with Commissioners Hester Peirce and Mark Uyeda dissenting.

The SEC stated that the amendments are intended to mitigate liquidity risks in times of market crisis, similar to circumstances funds faced in March 2020 at the beginning of the COVID-19 pandemic. Among other things, the Proposal would:

- Change how certain open-end funds classify the liquidity of their investments and require such funds to determine and maintain a minimum amount of highly liquid assets of at least 10% of net assets.

- Require open-end funds, other than money market funds and exchange-traded funds (ETFs), to use swing pricing and to implement a “hard close” to facilitate swing pricing.

- Provide for faster, more frequent and more detailed reporting to the public of fund information, including information relating to funds’ liquidity and use of swing pricing.

Liquidity Risk Management – Rule 22e-4

In 2016, the SEC adopted Rule 22e-4 under the 1940 Act. The rule requires registered open-end funds, including ETFs but not money market funds, to establish a written liquidity risk management program that is “reasonably designed to assess and manage the fund’s liquidity risk,” with the fund board’s oversight.

The rule further establishes four liquidity classification categories, a highly liquid investment minimum requirement and a 15% limitation on funds’ purchases of illiquid investments. The SEC also adopted Form N-LIQUID, which requires a fund to confidentially notify the SEC if its illiquid investment holdings exceed 15% of its net assets or if its highly liquid investments fall below its highly liquid investment minimum for more than a brief period of time.

The Proposal would amend Rule 22e-4 by:

- Revising the current liquidity categories.

- Establishing new minimum standards for making liquidity determinations.

- Requiring daily liquidity classifications.

Amendments to Liquidity Classification Categories

The Proposal would:

- Amend the existing rule to require funds to assume the sale of a set stressed trade size equal to 10% of each portfolio investment (i.e., a vertical slice) rather than the current approach, which allows funds to assume the sale of a reasonably anticipated trade size in current market conditions.

- Mandate that classifications must be investment-specific, which would eliminate a fund’s ability to classify and review portfolio investments according to asset class.

- Remove the “less liquid” investment category and require funds to treat all such investments as illiquid. The Proposal also would expand the scope of the illiquid investment category by specifically including investments whose fair value is measured using unobservable inputs that are significant to the overall measurement (i.e., level 3 investments).

- Change the definition of “moderately liquid” to mean any investment that is neither highly liquid nor illiquid.

- Require a fund to classify all of its portfolio investments each business day instead of at least monthly.

Under the current rule, funds making liquidity classifications are required to analyze whether a sale or disposition of an investment would significantly change the market value of that investment.

The Proposal would require funds to consider the size of the sale or disposition relative to the depth of the market for the instrument when determining whether such sale or disposition would significantly change the market value of the investment.

Specifically:

- For shares listed on a national securities exchange or a foreign exchange, any sale or disposition of more than 20% of the security’s average daily trading volume would indicate a level of market participation that is significant.

- For any other investments, such as fixed-income securities and derivatives, any sale or disposition that the fund reasonably expects would result in a decrease in sale price of more than 1% would indicate a level of market participation that is significant.

Highly Liquid Investment Minimums

The Proposal would require open-end funds, other than money market funds and in-kind ETFs, to determine a highly liquid investment minimum and adopt and implement policies and procedures for responding to a shortfall in the fund’s highly liquid investments below its established minimum.

Additionally, the Proposal establishes that a minimum of at least 10% of the fund’s net assets must be highly liquid investments. When calculating its highly liquid investments, a fund must subtract both the value of such assets that are posted as collateral in connection with any derivatives transaction that is classified as moderately liquid or illiquid and any fund liabilities.

Limit on Illiquid Investments

The Proposal also provides that the value of margin or collateral that a fund could receive only upon exiting an illiquid derivatives transaction would itself be treated as illiquid when such fund is determining its compliance with Rule 22e-4’s prohibition on acquiring any illiquid investments if, immediately after the acquisition, the fund would have more than 15% of its net assets in illiquid investments.

Compliance deadline. If adopted, compliance with the liquidity rule and reporting changes would be required 12 months after the effective date of the amendments.

Swing Pricing – Rule 22c-1

In 2016, the SEC adopted Rule 22c-1 under the 1940 Act. The rule permitted, but did not require, registered open-end funds (other than money market funds and ETFs) to use swing pricing. Swing pricing is meant to enable funds to more equitably allocate portfolio transaction costs attributable to large shareholder purchase and redemption orders, such as in March 2020 during the market crisis associated with the onset of the COVID-19 pandemic.

Through adjustments to a fund’s per-share net asset value, swing pricing causes a purchasing or redeeming shareholder, rather than the fund and long-term shareholders, to bear the estimated portfolio transaction costs attributable to their activity. While swing pricing has been allowed for certain funds since 2016, no U.S. open-end fund has opted to utilize it.

The SEC suggests that the lack of adoption is due to insufficient incentives, which would be overcome if swing pricing were required rather than merely permissive.

Accordingly, the Proposal would require registered open-end funds to implement swing pricing under certain circumstances, a significant shift from the current optional approach. Funds subject to the rule would be required to establish and implement swing pricing policies and procedures that adjust the fund’s per-share net asset value by a “swing factor” if the fund has net redemptions or net purchases exceeding 2% of the fund’s net assets.

Under the Proposal, a fund’s board must:

- Establish and implement board-approved swing pricing policies and procedures.

- Designate a “swing pricing administrator” to review investor flow information on a daily basis and make determinations regarding the extent of net purchases or net redemptions.

- Review, no less frequently than annually, a written report prepared by the swing pricing administrator.

The annual written report must describe the administrator’s review of the adequacy of the fund’s swing pricing policies and procedures, any material changes thereto and an assessment of the fund’s swing factors.

The swing pricing administrator:

- May be the fund’s investment adviser, an officer or a group of officers designated as responsible for administering the fund’s swing pricing policies and procedures.

- Cannot be a fund’s portfolio manager.

- Must be reasonably segregated from portfolio management.

The swing pricing administrator must determine the swing factor by making good faith estimates, supported by data, of the costs the fund would incur if it purchased and sold a vertical slice of its portfolio (i.e., a pro rata amount of each investment in the portfolio) equal to the amount of net purchases or net redemptions.

If the fund has net redemptions or net purchases exceeding:

- 1% of the fund’s net assets, such good faith estimates must include spread costs, brokerage commissions, custody fees and other charges, fees and taxes associated with portfolio investment purchases.

- 2% of the fund’s net assets, such good faith estimates must also include market impact costs.

To facilitate the timely receipt of investor flow information on a daily basis and to operationalize the swing pricing requirement, the Proposal provided that funds must implement a hard close at the time the fund has established for calculating its net asset value (typically, 4 p.m. Eastern time).

This hard close would prohibit a fund from executing any orders it receives after 4 p.m. using the current day’s net asset value; such orders would be executed using the next business day’s net asset value.

This change would put pressure on intermediaries to process orders quickly or otherwise implement policies to address the hard close framework.

Compliance deadline. If adopted, compliance with the swing pricing and hard close requirements would be required 24 months after the effective date of the amendments.

Form N-PORT

The SEC expressed some concern that investment advisers may be incentivized to overestimate costs when calculating swing factors to improve fund performance. Accordingly, the Proposal requires funds to report their swing factor adjustments publicly on Form N-PORT.

Additionally, the Proposal would require a fund to report what percentage of assets fall into specific liquidity categories, as determined by Rule 22e-4, and to file Form N-PORT within 30 days of month-end, rather than within 60 days of fiscal quarter-end as is currently allowed.

T+1 Standard Settlement Times for Most Securities Transactions

On February 15, 2023, the SEC adopted new Rule 15c6-2 and amendments to Rule 15c6-1 (Settlement Rules) under the Securities Exchange Act of 1934 (Exchange Act) to:

- Shorten standard settlement times for most securities transactions from T+2 to T+1.

- Shorten settlement times for after-hours firm commitment offerings from T+4 to T+2.

- Impose new requirements on broker-dealers and investment advisers related to affirmations, confirmations and allocations following execution of certain institutional transactions (Post-Trade Process).

T+2 to T+1

Under amended Rule 15c6-1(a), broker-dealers will be prohibited from entering into securities transactions (other than for exempt securities) that provide for settlement later than T+1, i.e., that result in the payment of funds and delivery of securities later than one business day after the transaction date.

This is the case unless the broker-dealer and counterparty expressly agree at the time of the transaction to a different settlement date.

Firm Commitment Offerings After 4:30 p.m.

Under amended Rule 15c6-1(c), broker-dealers will be prohibited from entering into firm commitment offerings priced after 4:30 p.m. Eastern time that provide for settlement later than T+2, i.e., that result in the payment of funds and delivery of securities later than two business days following the transaction date.

This is the case unless the BD and counterparty expressly agree at the time of the transaction to a different settlement date.

New Record-Keeping and Compliance Requirements

Under new Rule 15c6-2, broker-dealers that participate in institutional agency transactions, such as with investment managers and custodian banks, that necessitate a Post-Trade Process will be required to either:

- Enter into written agreements with the institutional counterparties to ensure each Post-Trade Process is completed as soon as technologically practicable (and no later than the end of the day on the trade date), or

- Adopt policies and procedures reasonably designed to enforce the same objective, i.e., to ensure timely completion of each Post-Trade Process.

On the other side, investment advisers that enter into institutional transactions subject to new Rule 15c6-2 will be required to make and keep records demonstrating compliance with each Post-Trade Process, including date-and-time-stamping each confirmation, allocation and affirmation sent or received as a Post-Trade Process.

Compliance Date

The final Settlement Rules will become effective 60 days following the date of publication in the Federal Register. The mandatory compliance date for each of the final Settlement Rules is May 28, 2024.

For more on the SEC’s adoption of the T+1 settlement cycle, see our February 20, 2023, client alert.

Amended Rules on Proxy Vote and Executive Compensation Vote Reporting

On November 2, 2022, the SEC adopted previously proposed amendments to Form N-PX, which is used by mutual funds, ETFs and certain other registered funds (Covered Funds) to disclose certain proxy voting practices.

The Commission initially adopted Form N-PX in 2003 to enable shareholders to monitor their Covered Funds’ involvement in the governance activities of portfolio companies. This rulemaking implements certain provisions of the Dodd-Frank Act of 2010.

Institutional investment managers (Managers) will also be required to report how they voted on “say-on-pay” executive compensation topics.

Specifically, the rulemaking will make the following changes:

Identification of proxy voting matters. The new Form N-PX will require Covered Funds to use the same language as the issuer’s proxy card to identify the matters that they vote on and to present them in the same order as the matters appear in the proxy card. Covered Funds will be permitted to report on their respective Form N-PX on behalf of a series or a manager. The amended form permits Covered Funds that did not hold any securities they were entitled to vote, and therefore do not have any proxy votes to report, to indicate this by checking a certain box on the amended form.

The amended form will require Covered Funds to file their reports using a customized structured data language and, if such covered fund has a website, to make publicly available free of charge the information disclosed in the covered fund’s most recently filed report on Form N-PX.

Quantitative disclosures and securities lending. The amendment will require funds to disclose the number of shares voted or instructed to be cast (if the fund had not received confirmation of the actual number of votes cast) and how those shares were voted (e.g., for or against proposal or abstain). The amended form will also require funds to disclose the number of shares loaned but not recalled and, therefore, not voted by the fund.

Categorization of voting matters. Under the adopted rule amendments, Covered Funds will be required to categorize the votes that they report by selecting from a set of categories that appear on the new Form N-PX. Examples of the categories available include votes related to director elections, extraordinary transactions, Exchange Act Section 14A say-on-pay, shareholder rights and defenses, and the environment or climate.

Say-on-pay vote disclosure for institutional investment managers. In addition, the adopted amendments include a new rule under the Exchange Act requiring Managers subject to the reporting requirements of Exchange Act’s Section 13(f) to report annually on Form N-PX each say-on-pay vote over which they exercised voting power.

Dissent

The amendments were adopted by a 3-2 vote. In a public statement, Commissioner Mark Uyeda criticized the process by which the commission adopted the rules and expressed skepticism as to whether the amendments achieve the stated goal of streamlining disclosure.

Commissioner Uyeda asserted that the amendment would “complicate[ ] the decisions that funds and Managers must make in considering whether to recall securities on loan. Every disclosure has a cost, and it may be more efficient for firms to curtail their securities lending programs as a result.”

Compliance Date

Covered Funds and Managers will be required to file their first reports on amended Form N-PX by August 31, 2024, with these reports covering the period of July 1, 2023, to June 30, 2024.

Guidance Update: Differential Fee Waivers

On February 2, 2023, the staff of the SEC’s Division of Investment Management (Staff) released an information bulletin (Bulletin) highlighting Section 18 of the 1940 Act and Rule 18f-3 (Rule 18f-3) thereunder to:

- “Remind mutual funds, their boards of directors/trustees and their legal counsel about the implications under the [1940 Act] of fee waiver and expense reimbursement arrangements that result in different advisory fees being charged to different share classes of the same fund.”

- Outline different steps that boards should consider undertaking as part of both their general oversight of Rule 18f-3 compliance and specific evaluations of whether such differential advisory fees fall outside the permitted scope of Rule 18f-3.

Background

Mutual funds relying on Rule 18f-3 are permitted to issue multiple classes of voting stock representing interests in the same portfolio that each pays the expenses of its separate shareholder servicing and/or distribution arrangements and that may pay a different share of other expenses (not including advisory or custodial fees or other expenses related to the management of the company’s assets) if:

- These expenses are actually incurred in a different amount by that class, or

- The class received services of a different kind or to a different degree than other classes.

Additionally, under Rule 18f-3(b), a fund’s adviser, underwriter and any other service provider (Service Provider) may waive or reimburse expenses incurred by the fund related to that Service Provider’s services to the fund.

According to the Bulletin, however, the SEC explicitly stated in its Rule 18f-3 adopting release that such waivers and reimbursements were never intended to act as a de facto modification of the fund’s advisory fees or as “a means for cross-subsidization between classes.”

The SEC stated that fund boards have a responsibility, consistent with their oversight and fiduciary obligations, to “monitor the use of [such] waivers or reimbursements to guard against cross-subsidization between classes.” According to the Bulletin, this is because one of the key principles of Rule 18f-3 is that advisory fees charged to shareholders receiving the same advisory services should generally be consistent irrespective of what class of a fund such shareholders invest.

Updated Guidance: Factors To Consider in Evaluating Fee Waivers and Board Oversight Measures

According to the Bulletin, the Staff takes the position that whether differential advisory fee waivers constitute prohibited cross-subsidization between classes “is a facts-and-circumstances determination that the mutual fund’s [b]oard in consultation with the investment adviser and legal counsel should consider making and documenting after considering all relevant factors.”

The Staff states that boards may wish to consider, specifically within the context of Rule 18f-3, whether:

- Such waivers present a means for cross-subsidization.

- The steps they are taking to monitor such waivers to guard against cross-subsidization are (and continue to be) effective.

- Alternative fee arrangements may be appropriate.

The Staff also states that funds should consider the extent to which the board’s consideration of these issues under Rule 18f-3 should be disclosed to the fund’s shareholders.

Amendments to 10b5-1 Trading Plan Rules and New Disclosure Requirements

On December 14, 2022, the SEC adopted amendments and additional disclosure requirements in connection with Rule 10b5-1 plans. The amended rules are intended to curb what the SEC perceives as abusive trading practices by insiders, including the selective cancellation of trades and the adoption of multiple overlapping plans.

The amendments limit the use of the Rule 10b5-1 affirmative defense and:

- Require a “cooling-off” period after a 10b5-1 plan is adopted or amended, delaying subsequent trades.

- Expand the good faith requirement to apply through the duration of the plan, not just in connection with entering the plan.

- Limit the use of multiple overlapping Rule 10b5-1 plans.

Notably, the amendments do not address issuer Rule 10b5-1 plans for share repurchases by issuers. The SEC proposed rules on issuer share repurchases in December 2021, and final rules are expected to be adopted in 2023.

For a full discussion of the Rule 10b5-1 amendments and additional disclosure requirements, see our December 20, 2022, client alert.

Compensation Recovery Listing Standards and Disclosure Rules

On October 26, 2022, the SEC adopted rules implementing the Dodd-Frank Act’s incentive-based compensation recovery provisions (Clawback Provisions), which require listed companies to establish policies that allow for the recovery of wrongly received incentive-based compensation.

These policies are in addition to the existing clawback provisions of the Sarbanes-Oxley Act of 2002. If a company fails to adopt such a policy, it could be subject to delisting. Additionally, the Clawback Provisions require these policies to be filed as an exhibit to annual reports, and detailed disclosure about the policy is required.

Notably, these provisions apply to BDCs, and they also apply to registered closed-end funds unless the fund has not awarded incentive-based compensation to any current or former executive officer of the fund in any of the last three fiscal years (or, in the case of a fund that has been listed for less than three fiscal years, since the initial listing).

We expect that most registered closed-end funds will be exempt from the Clawback Provisions.

The Clawback Provisions will be implemented through exchange listing standards and, as part of this rulemaking, the SEC stated that exchanges will not have discretion to exempt classes of issuers from the Clawback Provisions.

Stock exchanges have until February 26, 2023, to propose new listing standards, and those only need to become effective by November 28, 2023. Following the effective date of the new listing standards, listed companies will have 60 days to adopt the required clawback policy.

If the listing standards become effective on November 28, 2023, this means a clawback policy will need to be adopted by January 27, 2024. This date could be earlier if listing standards are effective earlier than November 28, 2023. A listed company must recover all erroneously awarded incentive-based compensation that is received on or after the effective date of the applicable listing standard.

For a full discussion of the Clawback Provisions, including what companies should do to comply with these rules, see our November 2, 2022, client alert.

Division of Examinations Initiatives

On February 7, 2023, the SEC’s Division of Examinations (the Division) announced its 2023 examination priorities (the Alert). The Division annually publishes these priorities to give insight into what the SEC staff perceives to be potential risks to investors.

These priorities include, among others not addressed in this newsletter:

- Compliance with recently adopted rules.

- Registered investment advisers (RIAs) to private funds.

- Standards of conduct.

- Environmental, social and governance (ESG) matters.

- Information security and operational resiliency.

- Crypto assets and emerging financial technology.

Significant Focus Areas

Compliance With Recently Adopted Rules

The Division will review compliance with rules that were recently adopted under both the Advisers Act and the 1940 Act. Specifically, the Division will evaluate compliance with the Derivatives Rule (Investment Company Act Rule 18f-4) and the Fair Valuation Rule (Investment Company Act Rule 2a-5).

In addition, the new Marketing Rule (Advisers Act Rule 206(4)-1) is a key area of review for the Division in 2023 and was previously the focus of sweep exams. The Division will assess whether RIAs have adopted and implemented policies and procedures designed to comply with and prevent violations of the new rule.

The Division will also examine substantive compliance with the Marketing Rule, and in particular whether RIAs have a reasonable basis for believing they can substantiate material statements of fact.

RIAs to Private Funds

According to the Alert, more than $12 trillion in gross assets are currently managed by private fund RIAs. Because of this, the Division will examine private fund RIA:

- Conflicts of interests.

- Calculation and allocation of fees and expenses.

- Compliance with the Marketing Rule and the Custody Rule (Advisers Act Rule 206(4)-2).

- Use of alternative data.

The Division will pay particular attention to conflicts and disclosure regarding portfolio strategy and risk management. In addition, the Division will examine RIAs to private funds with heightened risk characteristics, including highly leveraged private funds, private funds managed alongside BDCs and private funds holding hard-to-value investments.

Standards of Conduct

The Division will review standards of conduct under Regulation Best Interest for broker-dealers and fiduciary requirements for investment advisers. The Division will focus on:

- Investment advice and strategy.

- Whether all material facts are disclosed to investors.

- The process used for determining what is in an investor’s best interest.

- The sufficiency of conflict of interest disclosure.

Additionally, the Division will prioritize compliance with Form CRS.

Environmental, Social and Governance (ESG)

The Division remains focused on ESG issues. Specifically, it will evaluate ESG-focused advisory services and fund offerings and review whether fund ESG disclosure mirrors fund operations.

Additionally, the labeling of ESG products and the extent to which investor’s best interests are considered when recommending these products will be assessed.

Information Security and Operational Resiliency

The Alert indicates that in the wake of recent market and geopolitical events, cybersecurity risks remain heightened. Therefore, the Division will focus on broker-dealer and RIA practices designed to protect investor information, assets and records.

The Division will also examine whether broker-dealers and RIAs have methods to protect against interruptions to mission-critical services in the event of a cyber-related incident. Special focus will be placed on third-party vendors and whether registrants can sufficiently assess third-party security measures.

Crypto Assets and Emerging Financial Technology

Finally, the Division intends to critically observe emerging financial technologies and crypto assets. This includes review of broker-dealers and RIAs that utilize new financial technology or new practices, such as technological or on-line solutions to investor needs and automation of investment tools.

The Division’s examinations of crypto-related assets will focus on the offer, sale, recommendation of and advice regarding these assets. The Division will particularly consider whether market participants:

- Meet standards of care (discussed above) when providing investment advice regarding crypto-related assets.

- Regularly review and update disclosure regarding such assets.

- Maintain compliance and risk management practices related to these assets.

SEC Enforcement

Enforcement Actions in 2022: A Focus on Financial Fraud and Materially Inaccurate Disclosure

On November 15, 2022, the SEC announced the results of its enforcement efforts for fiscal year 2022. During the year, the SEC filed 760 enforcement actions, a 9% increase over the previous year.

Among the enforcement actions filed in fiscal year 2022 were:

- 462 new or stand-alone enforcement actions.

- 129 actions against issuers who were allegedly delinquent in making required filings with the SEC.

- 169 “follow-on” administrative proceedings seeking to bar or suspend individuals from certain functions in the securities markets based on criminal convictions, civil injunctions or other orders.

Civil penalties, disgorgement and prejudgment interest ordered in SEC enforcement actions totaled $6.439 billion in fiscal year 2022, the most on record in SEC history and an approximately 60% increase compared to fiscal year 2021.

Civil penalties were also the highest on record at $4.194 billion, while disgorgement decreased by 6% from fiscal year 2021, to $2.245 billion. In addition, the SEC issued approximately $229 million in 103 awards to whistleblowers in fiscal year 2022, its second-highest amount ever in terms of both the number of individuals and the total dollar amounts awarded to whistleblowers.

In bringing enforcement actions, the SEC’s Division of Enforcement noted how it leveraged sophisticated analytic work by staff across its divisions to detect and investigate a range of misconduct.

Enforcement actions during the year focused on financial fraud and materially inaccurate disclosure by issuers, including regarding:

- ESG concerns.

- Failures by gatekeepers to the securities markets — including auditors, lawyers, transfer agents and broker-dealers — to meet their heightened trust and responsibility to investors.

- Misconduct in the crypto asset securities space.

- Record-keeping and cybersecurity compliance violations.

- Misconduct by private fund advisers.

- Other market abuses.

Additionally, the SEC brought its first-ever enforcement action in the municipal bond space, its first action against a broker-dealer for violating a municipal adviser registration rule and its first action enforcing Regulation Best Interest.

The SEC’s fiscal year 2022 enforcement program was marked by the imposition of penalties designed to:

- Deter future violations.

- Establish accountability from major institutions.

- Order undertakings that provide guidance for firms’ compliance.

More than two-thirds of the SEC’s stand-alone enforcement actions during fiscal year 2022 involved individual defendants or respondents, including senior public company executives and senior officers in the financial services industry. These actions included charges brought against senior executives under Section 304 of the Sarbanes-Oxley Act of 2002 resulting in orders to return bonuses and compensation following misconduct at their firms, even though the executives were not personally charged with misconduct.

The Division of Enforcement’s Trial Unit also conducted the most trials in a single year in the past decade in fiscal year 2022, winning favorable verdicts in 12 of the 15 trials conducted during the year.

The Division also secured liability for those charged at the summary judgement stage in an additional nine matters.

SEC Appointments

SEC Divisions Name New Deputy Directors

On December 21, 2022, the SEC announced that Sarah ten Siethoff had been named deputy director of the Division of Investment Management. Ms. ten Siethoff will also continue serving as the associate director of the Division’s Rulemaking Office, a position she has held since 2018.

On November 7, 2022, the SEC named Keith Cassidy and Natasha Vij Greiner as deputy directors of the Division of Examinations.

Associates Katherine (Katy) Berk, Joshua N. Breen, Meg Lloyd and Dylan Tillman contributed to this newsletter.

_______________

1 For a full discussion of the Delaware control share statute, see our August 1, 2022, client alert.

2 Eaton Vance at 13 (citations and internal quotations omitted) (citing Barnhart v. Sigmon Coal Co., Inc., 534 U.S. 438, 450 (2002) and Connecticut Nat’l Bank v. Germain, 503 U.S. 249, 254 (1992)).

3 See Boulder Total Return Fund, Inc. SEC Staff Correspondence (Nov. 15, 2010), at n.17 (“A CEF is not required to opt in to the statute’s provisions; the MCSAA is an optional defensive device, and there is no requirement under Maryland law that a CEF avail itself of its protection. Similarly, BDCs may opt out of the MCSAA, and are not required to remain subject to its terms. The ‘otherwise required by law’ qualification therefore does not affect our analysis.”) (internal cross-references omitted) (withdrawn by the SEC Division of Investment Management’s May 27, 2020, Staff Statement “Control Share Acquisitions Statutes”).

4 Neuberger Berman Real Estate Income Fund, Inc. v. Lola Brown Trust No. 1B, 342 F. Supp. 2d 371 (D. Md. 2004) (“Although the triggering of the poison pill will result in a reduction of the Acquiring Person’s ownership interest, this is an issue of dilution of economic interest and corresponding voting power and has nothing to do with the voting rights of the shares themselves.”)

5 Closed-end funds may still rely on amended Rule 30e-3 to satisfy their delivery, availability and notice requirements.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.