Key Points

- Using billions of dollars in new funding, the IRS is prioritizing improvements to taxpayer services, but it will take years to develop and implement its compliance and enforcement initiatives.

- Increased audit activity will target complex partnerships, large corporations and high-net-worth individuals, driven by 3,700 new employees and special task forces, and deep machine learning.

- Renewed IRS focus on programs like the compliance assurance process may provide some taxpayers opportunities to manage risk and efficiently resolve tax issues.

- The IRS is utilizing data analytics and AI in large partnership audits to better select returns and prioritize issues.

New Funding, New Focus

With some $80 billion in initial funding from the Inflation Reduction Act (IRA), the Internal Revenue Service (IRS) began ramping up taxpayer services, issue resolution planning, compliance and enforcement initiatives, and new employee hiring in 2023. Efforts on all fronts have been carefully orchestrated and publicized as part of the IRS’ commitment to greater transparency and stakeholder engagement.

The IRS has launched several transformative service initiatives for individual taxpayers and small businesses. For example, it recently introduced the first phase of the “business tax account,” which permits eligible taxpayers to control the timing of their installment payments and will eventually allow sole proprietor taxpayers to conduct IRS affairs online. For the 2023 filing season, taxpayers have also been able to respond to IRS notices online rather than by mail. These and other service initiatives could meaningfully improve compliance over time.

Of particular note to taxpayers subject to enforcement scrutiny, the IRS has solicited public feedback on opportunities to promote tax certainty and facilitate issue resolution. If the IRS follows through, changes could have a significant positive impact on both the IRS and affected taxpayers. Key to this effort will be resurrecting the compliance assurance process (CAP) and industry issue resolution (IIR) initiatives, and enhancing the advance pricing and mutual agreement (APMA) program. Each of these alternatives is designed to facilitate open communication, cooperation, and proactive resolution of issues between taxpayers and the IRS.

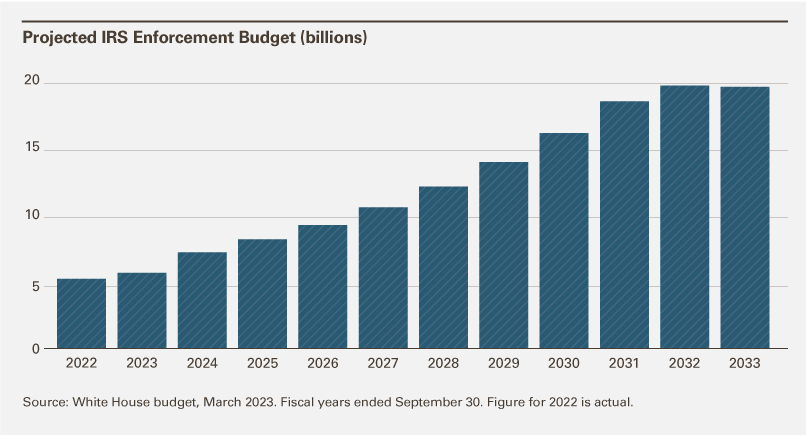

Drawing on the new IRA funding, the White House has budgeted to increase the IRS’ annual enforcement budget almost fourfold over the next decade, to $19.5 billion, and the agency has announced numerous multiyear endeavors in several key areas to increase collections.

In carrying out these plans, recent guidance suggests the IRS is likely to scrutinize complex issues involving:

- Distributions in excess of partners’ tax bases.

- Disguised sales.

- Special allocations.

- Limited partners’ self-employment tax exemptions.

Such scrutiny would follow more than a decade of a challenging environment for partnership tax enforcement1 due to inadequate funding, insufficient information from partnership returns and an incomplete picture of the most complex partnership structures.

The IRS has also announced various initiatives targeting large corporations and high-income earners. These include the issuance of “compliance alerts” to roughly 150 U.S. subsidiaries of large foreign corporations with “losses or exceedingly low margins” in an effort to “reiterate their U.S. tax obligations and incentivize self-correction.”

IRS Commissioner Danny Werfel explained that these compliance alerts are similar to the “soft letters” from past compliance campaigns, and they could lead to transfer pricing audits if there is “strong pushback or no response” from recipients.

Looking ahead, recent and potential legal changes relating to other areas such as green energy investment credits and the implementation of Pillar Two transfer tax regime raise unanswered questions and are likely to attract additional IRS attention beyond the agency’s recently stated initiatives.

The IRS expects to execute its current enforcement initiatives by:

- Hiring more than 3,700 new employees.

- Relying on data analytics.

- Creating a new pass-through entities group.

- Expanding its existing large corporate compliance (LCC) program and global high-wealth unit.

Using New Technology To Address Old Problems

Facing challenges in auditing web-like complex partnership structures, the IRS has invested in data analytics to enhance case and issue selection for partnership examinations. The recently established IRS Office of Research, Applied Analytics and Statistics (RAAS) performs compliance studies and develops tools and techniques to better understand such structures.

The IRS may also leverage the capabilities of its Criminal Investigation division, which has developed robust analytical tools to scrutinize information returned from John Doe summonses and address issues such as money laundering through the use of non-fungible tokens (NFTs). Externally, the IRS can look to private industry for assistance with bulk data processing capabilities. One official recently acknowledged that RAAS spends over $70 million annually on independent contractors for data analytics work.

Feedback Loop

Increased examination of new industries and taxpayers often leads to guidance targeted at substantive issues arising from those audits. Indeed, one goal of compliance campaigns is to learn about issues. While new guidance could improve compliance, any guidance applied retroactively or viewed as a change in law would likely be met with scrutiny, and potentially challenges, by taxpayers.

Facing challenges in auditing web-like complex partnership structures, the IRS has invested in data analytics to enhance case and issue selection for partnership examinations.

For this reason, the recent trend of challenging the validity of tax regulations and other guidance may continue as the IRS expands its knowledge of new industries and issues, and promulgates related guidance.

Implications for Complex Entities and High-Net-Worth Individuals

As complex entities and high-net-worth individuals face increased audit scrutiny and evolving law, taxpayers might consider anticipatory strategies to prepare. In addition to formal programs such as CAP, taxpayers could conduct “mock audits” to evaluate record-keeping and substantiation.

Particularly for taxpayers that have never dealt with an IRS examination, understanding and addressing weaknesses in documentation now can streamline and facilitate the resolution of a future audit. Similarly, IRS compliance letters and alerts can provide insight into specific issues that the agency considers priorities.

The IRS’ latest initiatives will have far-reaching consequences for both taxpayers and the agency itself. Implementation will take years, but taxpayers can take steps now to prepare for increased and evolving enforcement efforts that are already underway.

_______________

1 In a July 2023 report, the Government Accountability Office found that the IRS audited 54 of 20,052 large partnerships in tax year 2019 (0.3% audit rate), representing a decline from 2007 (~1.4%). The report also found that “[m]ore than 80 percent of the audits resulted in no change to the return on average from tax years 2010 to 2018, double the rate of large corporate audits. For those that did change, the average adjustment was negative $264,000.”

See all of Skadden’s 2024 Insights

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.