Key Points

- The OECD envisioned a coordinated rollout of Pillar Two, its model of interlocking rules to establish a global minimum corporate tax rate.

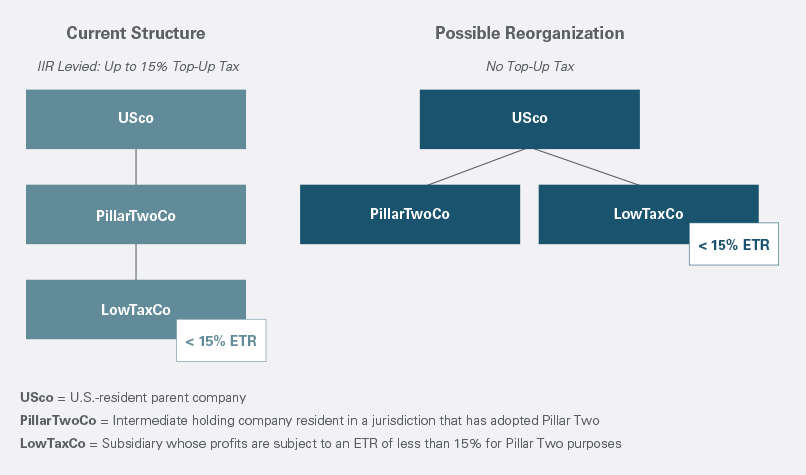

- However, the staggered implementation taking place among participating jurisdictions creates anomalous results for some multinationals. That may create tax incentives for businesses to structure their businesses out of Pillar Two-compliant jurisdictions.

- Although the tax savings of such reorganizations may be short-lived, they may be justified for multinational enterprises with sufficient profits in low-tax jurisdictions.

The Organization for Economic Cooperation and Development’s (OECD’s) Pillar Two model rules (Model Rules) aim to impose a 15% global minimum tax on the earnings of large multinational enterprises (MNEs) with annual revenues of at least €750 million.

The Model Rules contemplate comprehensive implementation of the Model Rules. Due to practicalities of international adoption and implementation, there could be anomalous tax outcomes for some MNEs, which may incentivize them to temporarily revise their holding company structures.

Top-Up Tax

To ensure all MNE income is taxed at the minimum rate, income that is not subject to at least a 15% effective tax rate (ETR) domestically (which may not be the same as the headline rate) is subject to “top-up tax.”

Top-up tax is collected through two interlinked provisions:

|

The Income Inclusion Rule (IIR) requires a parent company to pay top-up tax with respect to its subsidiaries’ income. If the ultimate parent company in a group is resident in a non-Pillar Two jurisdiction, the entitlement to collect top-up tax on subsidiaries passes to the resident jurisdiction of the next “intermediate” parent company in the group structure (and so on). |

Takes effect on December 31, 2023. |

| If an MNE’s top-up tax is not collected by the IIR — for example, because the jurisdiction of the parent (or intermediate parent) has not adopted Pillar Two — the Undertaxed Profits Rule (UTPR) requires any group company (or branch) in a Pillar Two-compliant jurisdiction to pay the outstanding top-up tax. | Takes effect on December 31, 2024. |

The following priority rules establish which jurisdiction is permitted to collect top-up tax:

- First, the low-tax jurisdiction itself, through its domestic taxation (which would include any Qualified Domestic Minimum Top-Up Tax for Pillar Two purposes).

- Second, the jurisdiction of the ultimate parent entity (or intermediate parent entity).

- Finally, as a backstop, any other jurisdiction in which the MNE has a subsidiary or a branch.

Global Implementation State of Play

The Model Rules do not have legal effect: Each participating jurisdiction must introduce domestic implementing legislation. Currently, over 130 countries have signaled their intention to introduce Pillar Two legislation.

Implementation of the Model Rules has been initiated in the following major jurisdictions: the European Union, Australia, Canada, Japan, New Zealand, Norway, South Korea, Switzerland, the U.K. and Vietnam, among others. Even certain tax-neutral jurisdictions such as Jersey and Guernsey have announced implementation. Many jurisdictions are expected to adopt the Model Rules ahead of the year-end December 31, 2023, deadline contemplated by the OECD.

Some common holding company jurisdictions, such as Singapore and Hong Kong, have plans to adopt Pillar Two but have recently pushed back implementation to 2025.

Early Adoption Challenges

Incentive To Restructure Out of Compliant Jurisdictions

Complicating the global implementation is the fact that some key countries are not participating. The U.S. has not adopted the Model Rules and is unlikely to do so for some time for domestic political reasons. Similarly, China and India have not signaled an intention to implement the Model Rules. That means there are many very large MNEs where the parent company will not be subject to the IIR in 2024.

When the UTPR is introduced in other jurisdictions within the group structure, the Pillar Two position of the parent company will cease to be especially relevant to the enterprise’s total Pillar Two liability, because top-up tax will be collected by any participating Pillar Two jurisdiction elsewhere in the group.

However, in the interim, there is a strong incentive to avoid having low-taxed subsidiaries or branches underneath intermediate holding companies in a participating Pillar Two jurisdiction.

Until the widespread adoption of the UTPR in 2025, top-up tax beneath the level of an intermediate holding company may be mitigated in a relatively straightforward manner by either:

- distributing low-taxed companies out from underneath any holding company subject to IIR, or

- transferring the low-taxed companies to another intermediate holding company in a jurisdiction without an IIR.

These arrangements may have a brief shelf life — only until the UTPR is introduced elsewhere in the group structure. But for MNEs with material amounts of low-taxed income beneath intermediate parent companies that will fall within the scope of IIR in 2024, the tax savings in even just one year could be significant. The restructuring could also buy additional time to implement other structuring or more fundamental changes to comply with the Model Rules.

The Uncertain Legal Position of OECD Guidance

There is an additional emerging problem for MNEs dealing with jurisdictions that are early adopters of Pillar Two. As noted above, the Model Rules and related OECD pronouncements do not have legal effect on their own. They require domestic implementation. While the Model Rules were published in December 2021, the OECD continues to publish regular updates in the form of its Commentary and Administrative Guidance. In substance, many aspects of these publications involve rules or exceptions that partially or wholly contradict the original Model Rules.

Until anything is implemented to confirm the position, the rules contained in such guidance occupy a gray area. For instance, the U.K. passed its IIR legislation on July 11, 2023. Two days later, the OECD’s second set of Administrative Guidance was approved. While the U.K. legislation was intended to implement the Model Rules, it’s unclear whether that includes the nuances of the later Administrative Guidance on tax credits and minimum tax safe harbors. A parent company seeking to rely on such measures should tread very carefully unless and until the local tax authority issues some form of reassurance.

In Sum

Tax teams at MNEs parented in jurisdictions that are not adopting Pillar Two would be well advised to model their ETRs across the group and to revisit their intermediate holding company structures ahead of the upcoming IIR deadline. There may be serious advantages — and a lot more certainty — to avoiding this early phase of Pillar Two adoption.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.