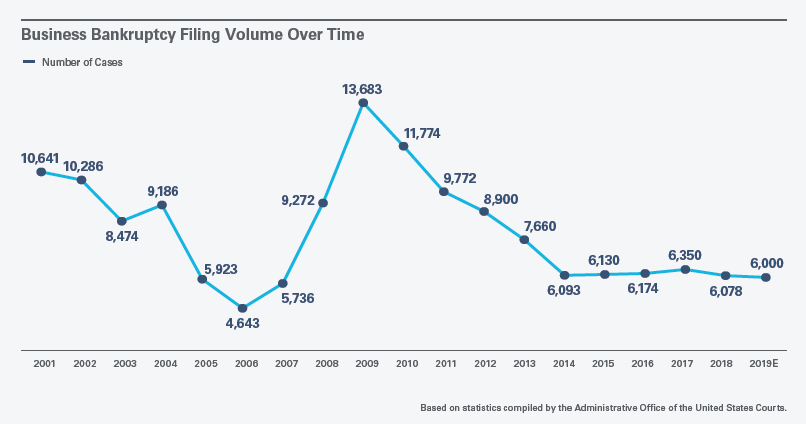

The number of corporate Chapter 11 filings in the United States remained relatively low in 2019. An estimated 6,000 business bankruptcies were filed (based on the data available at the time of writing), which, if it holds up as the data is finalized, is essentially flat from 2018 and down 56% from the peak reached in 2009, following the Great Recession. The chart immediately below depicts corporate Chapter 11 filing volume over time.

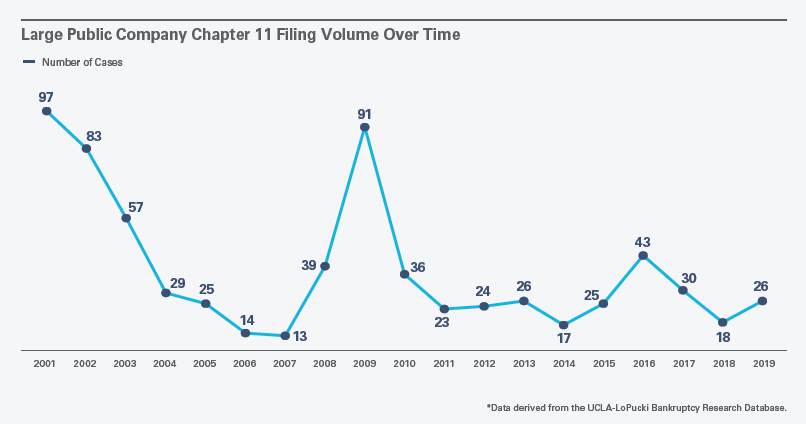

Large public company Chapter 11 filings (i.e., public companies with assets greater than $300 million) follow similar trends. Only 26 large public companies filed for Chapter 11 in 2019, up from 18 filings in 2018, but well below the more than 90 filings of large companies in 2001 and 2009. The chart immediately below shows the volume of large public company Chapter 11 cases over time.

Companies from the energy (primarily oil and gas), retail and health care industries have accounted for nearly half the Chapter 11 cases filed annually since 2016. While each of these sectors has benefited in recent years from a strong U.S. economy, they remain a focus of restructuring activity and are particularly vulnerable as economic growth slows. Unsurprisingly, most of the year’s high-profile filings are in these industries.

2020 Outlook

After years of record growth, the U.S. economy appears to be cooling, and some economists believe a recession is looming. The U.S. Bureau of Economic Analysis estimates that U.S. economic growth slowed to 2.1% in Q3 2019. (Q4 2019 results have not been released at the time of writing.) The slowdown is attributable to several factors, including the escalating trade war between the United States and China, the uncertainty associated with Britain’s exit from the European Union and fluctuating energy prices. Should a slowdown in the U.S. economy occur, the level of Chapter 11 filings may increase.

The government has made efforts to combat the weak economic growth by lowering interest rates. The federal funds rate was lowered to 1.75% in October 2019 after starting the year at 2.5%, and last month the Federal Reserve indicated that it intends to hold rates steady with no action likely in 2020 amid low inflation. Low interest rates mean that many distressed companies will be able to obtain financing on favorable terms, potentially permitting them to avoid comprehensive restructurings. Nonetheless, signs exist that the next cycle of financial restructurings may be approaching.

The United States’ record-high corporate debt levels have been news for several years now, yet the amount of corporate debt only continues to rise. Large companies in the U.S. owe approximately $10 trillion in corporate debt, which is 47% of the country’s GDP (the highest ratio of corporate debt to GDP in U.S. history). This represents a rise of 52% from its last peak in 2008, when corporate debt was at $6.6 trillion, approximately 44% of GDP. Approximately $5 trillion of this corporate debt will become due in the next five years. Even though many companies have taken advantage of low interest rates to refinance their debt, this amount of leverage poses a potential challenge if the economy weakens. Corporate debt as a percentage of GDP, a closely watched measure for distress, has risen sharply before each of the last three economic downturns.

Another possible sign of future financial distress is the trend in recent years toward weakened borrower covenants in debt securities and instruments. Historically, financial covenants have provided lenders with early warning signs of a borrower’s distress, enabling them to engage in restructuring negotiations with the borrower before its business deteriorates. Covenant quality improved slightly in Q1 2019 but remained weak overall, with a rating of 3.9 out of 5, where 1 means covenants are extremely strong (in favor of lenders), and 5 means they are extremely weak (in favor of borrowers). While companies have been successful in negotiating “covenant-lite” borrowing terms from investors, the prevalence of “cov-lite” loans and non-investment grade bonds may reflect that lenders are underpricing risk, which could result in a wave of borrower defaults without advance covenant breaches when economic conditions change. If these trends continue, an uptick in restructuring activity in the coming year is possible.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.