Skadden M&A partners Steve Arcano, Tom Kennedy (moderator), Jeremy London, Amr Razzak and Rodd Schreiber discussed their perspectives on M&A activity in 2015 and the outlook for 2016. The conversation covered the current environment, the role of activism, board process and the impact of regulatory activity. The discussion took place prior to recent market volatility following developments in China. We will continue to monitor the impact of these developments in future communications.

Tom: Let's start by looking at the overall M&A environment as we head into 2016. Is there depth to the market? What is driving the pace of activity?

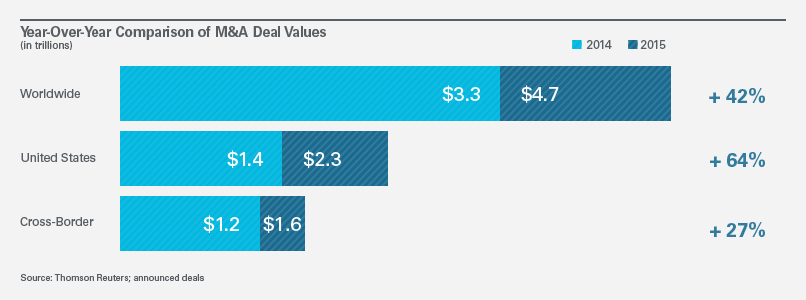

Steve: The environment continues as of year-end to be conducive to M&A activity, particularly in the U.S. The economy has continued on its slow-growth trajectory. Corporate balance sheets are in good shape, equity markets have been relatively stable for most of the year, and access to debt financing has been generally available on attractive terms, though there has been some dislocation recently in the high-yield market. (See “Volatility Continues in US and European High-Yield Markets.”) Many of these trends have been present beyond the U.S. as well.

There is still sufficient confidence in the boardroom about longer-term prospects to support strategic M&A. Corporations face a continued imperative to grow at a rate that exceeds economic growth — and M&A is an important tool to achieve that. The robust market has been driven by strategic transactions in response to forces that likely will remain the reality for the foreseeable future. At the same time, there are risks and uncertainties in the global economy and equity markets, and other factors that could impact activity levels.

Tom: What are the factors that might restrict activity? And how do you assess their impact on the market?

Jeremy: I don't think the factors that exist have had an overall impact on the pacing, but they definitely affect the market in terms of the specifics. For example, finding financing on acceptable terms has become more difficult for lower-rated issuers. Despite record levels of M&A activity last year, leverage loan volume was down considerably. Asset prices, competition from strategics and regulatory restrictions all may contribute to that. I do expect continued use of stock as currency in strategic M&A.

On the regulatory front, I see continued, robust antitrust enforcement and scrutiny, but boards and advisers have shown resilience to sign deals, allocate risk and ultimately get deals done. Especially in the health care space, individual states and state AGs are taking a more active role in this area. (See “Antitrust and Competition: Trends in US and EU Merger Enforcement.”)

The stock price reaction to announced deals also is interesting. In a strategic deal, if a company goes after a target with lower margins or a lower growth rate, the acquirer stock can take a hit. Acquirers have to do their homework and have a good handle on what their shareholders think — not necessarily only about the target and the deal, but what they think about the acquirer too.

Rodd: As for other issues, I don't see volatility or rising interest rates as creating an impediment to deal-making right now, but that could change as the new year unfolds.

Many of the biggest deals that have been driving the market have been stock-for-stock transactions, so financing considerations haven't been at the forefront. Likewise, investment-grade and the better ranked high-yield issuers have continued to have access to the credit markets at pretty favorable pricing. Private equity firms, which accounted for approximately 6 percent of global M&A activity in 2015, and other acquirers that rely on leverage were not key drivers of M&A activity last year and are not likely to be in 2016.

Tom: What geographies or industries showed particular strengths last year, and which ones might be stronger or weaker going into 2016 with regard to M&A activity?

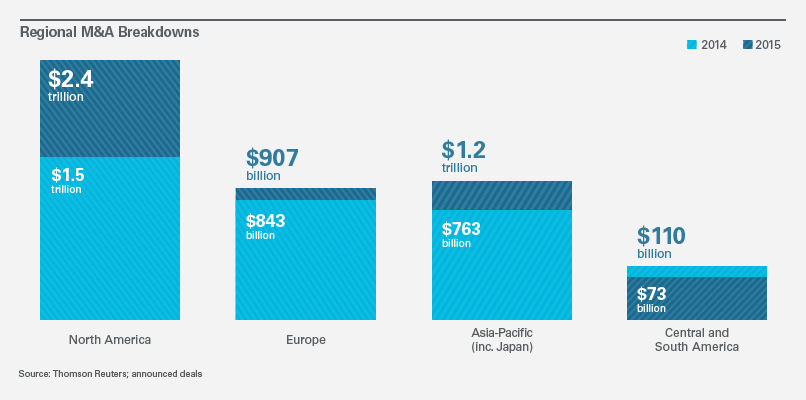

Amr: Geographically, M&A activity has generally been robust across the board. As Steve noted earlier, the U.S. has been particularly strong this year, but Europe and Asia also have picked up. Latin America was a bit of a slow spot.

In terms of industries, technology and health care have both been very strong. Within tech, the semiconductor space has been a real standout, with long-anticipated consolidation finally happening. The market imperatives for M&A remain strong, so I would expect the activity to continue in the coming year. With technology, products and markets evolve quickly. Folks who were your best friends last year may be your biggest competitors this year. Whole industries emerge and disappear within a span of just a few years, so even very large, established companies have to constantly reinvent themselves and that continues to be a driving force for M&A. In health care we've seen mega pharma deals, like Pfizer-Allergan, as well as lots of interest in biotech companies. Pharmaceutical companies face the challenge of patents expiring on big drugs in coming years, so biotech companies, particularly at current price levels and with only spotty capital market windows, present attractive buying opportunities.

On the private equity front, others have noted that PE firms haven't been as prominent in the current M&A landscape, but they've still been involved, perhaps in different roles. For example, Silver Lake played a significant role in the Dell-EMC deal. To a certain extent, we're going back to a world where synergies and strategic imperatives are driving deals and valuations. That's an environment which probably favors strategic over financial buyers. In the coming year, it will also be important to see how the debt markets evolve and the extent to which relatively cheap financing remains available.

Activism

Tom: Rodd, what about the impact of activism on the landscape?

Rodd: Activists are a catalyst for M&A activity. These funds have substantial capital and must deliver returns to their limited partners. As a result, they frequently focus on short-term, stock price-lifting outcomes like mergers, divestitures or spin-offs. Activists also have begun to join up with strategic investors to attempt to force significant transactions.

As long as these funds can generate attractive returns employing this type of strategy, activism generally, and activist-instigated M&A activity specifically, will continue. Whether it's board activity, encouraging hostile activity or causing strategic reassessments, activism will remain a facilitator of transactions for the foreseeable future.

Jeremy: Echoing what Rodd said, the vast majority of the Standard & Poor's 500 index has one or more investors with a noted activist bent or previous activity. The impact is such that boards often are addressing the issues even before the agitation begins — something that may not have happened a couple of years ago.

Steve: In today's market, traditional "long" institutional investors such as mutual funds are already in regular dialogue with management and in certain cases with outside members of the board of directors. Those institutional investors have been beating the drum on capital allocation and on looking at what else to do with the business to improve the stock price. Boards are looking at these types of initiatives, not just because of activists but because that is what the market is demanding of them. At times, activists may be catalysts for the adoption of these types of initiatives; at other times, they may be making well-timed investments.

Board Process

Tom: Steve, let's stick with the concept of board duties and process. When there is a bid on the table, what's the proper process and response with regard to target reaction? Where do we stand in Delaware with Revlon duties these days?

Steve: The Delaware courts, including the Delaware Supreme Court in C&J Energy, have again made clear that well-motivated directors have a great deal of flexibility in how they approach any proposal or plan to sell the company. (See “Delaware Supreme Court Clarifies Earlier Rulings, Chancery Court Stakes Out New Positions.”)

Today's public company boards are very conscious of their fiduciary duties and aware of the implications of the enhanced scrutiny courts apply to a sale process. Directors understand that a high proportion of M&A transactions are subject to litigation challenging the board's process. Accordingly, most boards are very careful and focused on the structure of the sales process. However, in any deal, there are some very difficult situations that boards have to face in terms of how they seek to maximize value for shareholders. The recent case law in Delaware recognizes the fact that directors, not courts, are best situated to make those difficult decisions.

Jeremy: When you are advising an acquirer with a stock component that will require a vote under the NYSE/Nasdaq rules, it's important not to underestimate the target's reaction. Targets can be very skittish about a vote on the acquirer's side. Last year, several Delaware decisions focused on appropriately vetting bankers and banker conflicts, and the target board's responsibility for looking into those situations. These issues seem to be getting as much judicial focus as questions on the quality of the process that was run after the engagement.

Tom: Do you think hostiles work? Does the buyer try to position itself as friendly or is there a spectrum in between?

Rodd: Broadly speaking, if you look at the percentages, hostile transactions are difficult to complete but are increasing. The deal volume and transaction value for hostile transactions in 2015 were at their highest levels in more than five years. Clearly, the governance trend of limiting defensive provisions in company charters has made companies more vulnerable. The tactics haven't changed all that much on the defense side. It is often a question of what the buyer is prepared to do and how successfully it can rally the target shareholders in favor of a transaction.

Tom: Amr, obviously the Delaware Supreme Court has focused recently on control shareholder transactions in MFW and Swomley. What are your thoughts on what those cases are telling us?

Amr: The Delaware court is clearly giving controlling shareholders a road map: An independent and empowered special committee coupled with the nonwaivable approval of a properly informed majority of the minority is the path to the business judgment rule. MFW opened the door with a ruling outlining the steps necessary to rely on business judgment, but there was a question as to whether it could be applied on a motion to dismiss at the pleading stage. Swomley seems to have settled that question by saying that it can. It will, of course, still be up to controlling stockholders to determine whether they are willing to take the route the court has laid out.

Impact of Regulatory Activity

Tom: Can deals be completed in the current antitrust environment?

Rodd: Our antitrust colleagues might say today isn't much different than it was, say, 18 months or two years ago in terms of the aggressiveness of the regulators in challenging transactions. The answer likely depends on the industry you are talking about and what consolidation has already taken place. There clearly is a premium on preplanning and understanding what the remedies, including potential dispositions, are and offering potential fixes earlier rather than later, because it could be too late at the end of the review process.

Steve: While there has not been a shift in the substantive antitrust analysis applied, there has been greater governmental willingness to pursue enforcement actions in the recent past. However, I don’t think this is having any meaningful impact on overall M&A activity.

Tom: As you approach antitrust and regulatory risk, what is the role of reverse termination fees?

Steve: I see them being discussed in an increasing number of situations. In part, that may be a function of the regulatory issues associated with some of the notable deals in the past couple of years. Reverse termination fees can provide a seller comfort that the buyer will work to get regulatory approvals as well as offer some compensation if approval is not obtained. (Editor's note: We are aware of at least 24 transactions in 2014 and 2015 that contained such provisions.)

Rodd: Reverse termination fees are a useful way to allocate regulatory risk, particularly in larger deals. Nevertheless, the numbers can be very large in an absolute sense. So you are still making big bets on antitrust and have to be comfortable with the potential outcomes.

Concluding Thoughts

Tom: Anyone care to predict what the environment might generally look like if we sat down and had this conversation again in six months?

Steve: My expectation is that there is a stratum of transactions that will remain difficult to get done, and that private equity activity will continue to be constrained. Those leveraged transactions that Jeremy referred to before are likely to be constrained if current conditions persist given where the high-yield markets seem to be, at least for now. But absent adverse developments, strategic corporate transactions should continue because the needs for growth, consolidation and a global footprint aren't going away.

Rodd: I agree, and I would add that it may not become more attractive in the near future to make acquisitions. Valuations are ticking up, interest rates will continue to increase for those who need to borrow, and the U.S. and European economies seem to be improving or stabilizing. That indicates to companies whose avenues for organic growth are limited that they may be better off doing something in the shorter term rather than the longer term.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.