View our full U.S. Capital Markets coverage from 2019 Insights.

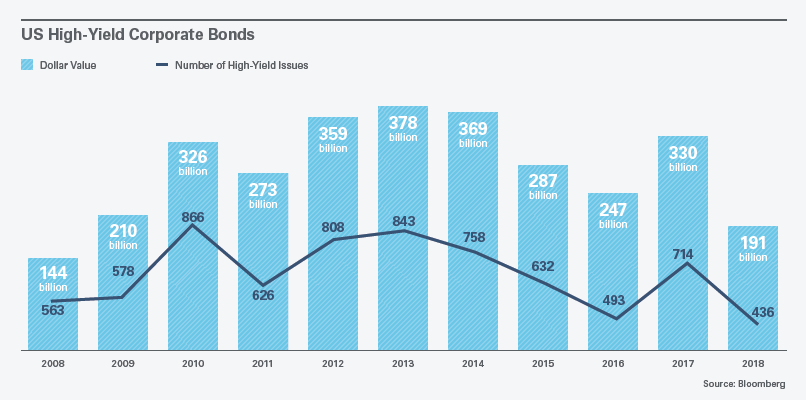

The U.S. high-yield debt market ended 2018 42 percent lower by dollar volume and 39 percent lower by number of issuances than 2017. The $191 billion in total issuance was the lowest since 2008 ($144 billion), and the number of issuances fell to 436, the lowest in two decades. (High-yield activity in 2018 was frequently replaced with term loan B issuances, which are more attractive to investors when interest rates are rising and provide borrowers with covenant packages that are increasingly bond-like in flexibility.) Proceeds from U.S. high-yield bond offerings were largely used for refinancings (67 percent of issuances), with only 16 percent used for M&A activity. For the first time since 2008, in 2018 there were no issuances in December — a period of over 40 days without an issuance that continued until January 10, 2019.

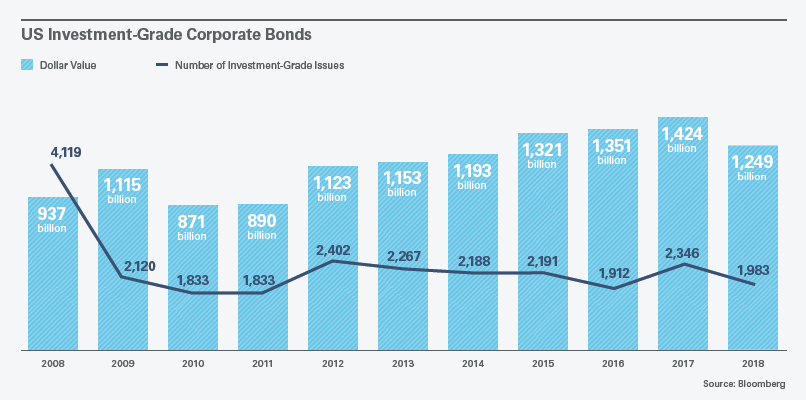

U.S. investment-grade debt market volume in 2018 was $1.25 trillion (1,983 issuances), ending seven consecutive years of increases after a record volume of $1.42 trillion (2,346 issuances) in 2017. Increasing interest rates and market volatility combined with the December 2017 tax reform, which encouraged repatriation of overseas cash and reduced the tax benefits of issuing debt, caused the decline. The largest issuer by volume was CVS Health Corp., with $40 billion raised in connection with its acquisition of Aetna, representing the third-largest U.S. corporate bond transaction in history. Overall, investment-grade issuances related to M&A increased in 2018 by dollar volume, totaling $226 billion by year-end.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.