The list of events for which 2020 will be remembered continues to grow and we are only two thirds of the way through the year. Environmental, social and governance (ESG) issues have come into focus in the financial community, with different stakeholders taking varying positions on factors within the three limbs. Consider, for example, the recent data from Morningstar that shows assets under management of ESG funds has grown to exceed $1 trillion globally. In the private funds community, ESG considerations are not a new issue. Many institutional investors, particularly those from Europe, have for some time included ESG-related requests as part of their due diligence of fund sponsors, and set out their expectations regarding ESG factors in side letters or other agreements with sponsors. These expectations have often been linked with the UN Principles for Responsible Investment or other similar benchmarks. Many fund sponsors have also gone to great lengths to advertise their ESG credentials, recognizing the prominence of private capital in the global economy and the accompanying responsibilities.

Nevertheless, ESG standards and policies vary greatly and, until now, no legal requirement existed in Europe for fund sponsors to factor ESG into any part of their business. It is perhaps timely that as part of its sustainable finance action plan, the European Union has adopted two new regulations — the Sustainability-Related Disclosure Regulation1 and the Taxonomy Regulation2 — which will be relevant to any private fund sponsors that are managing or marketing funds in Europe.

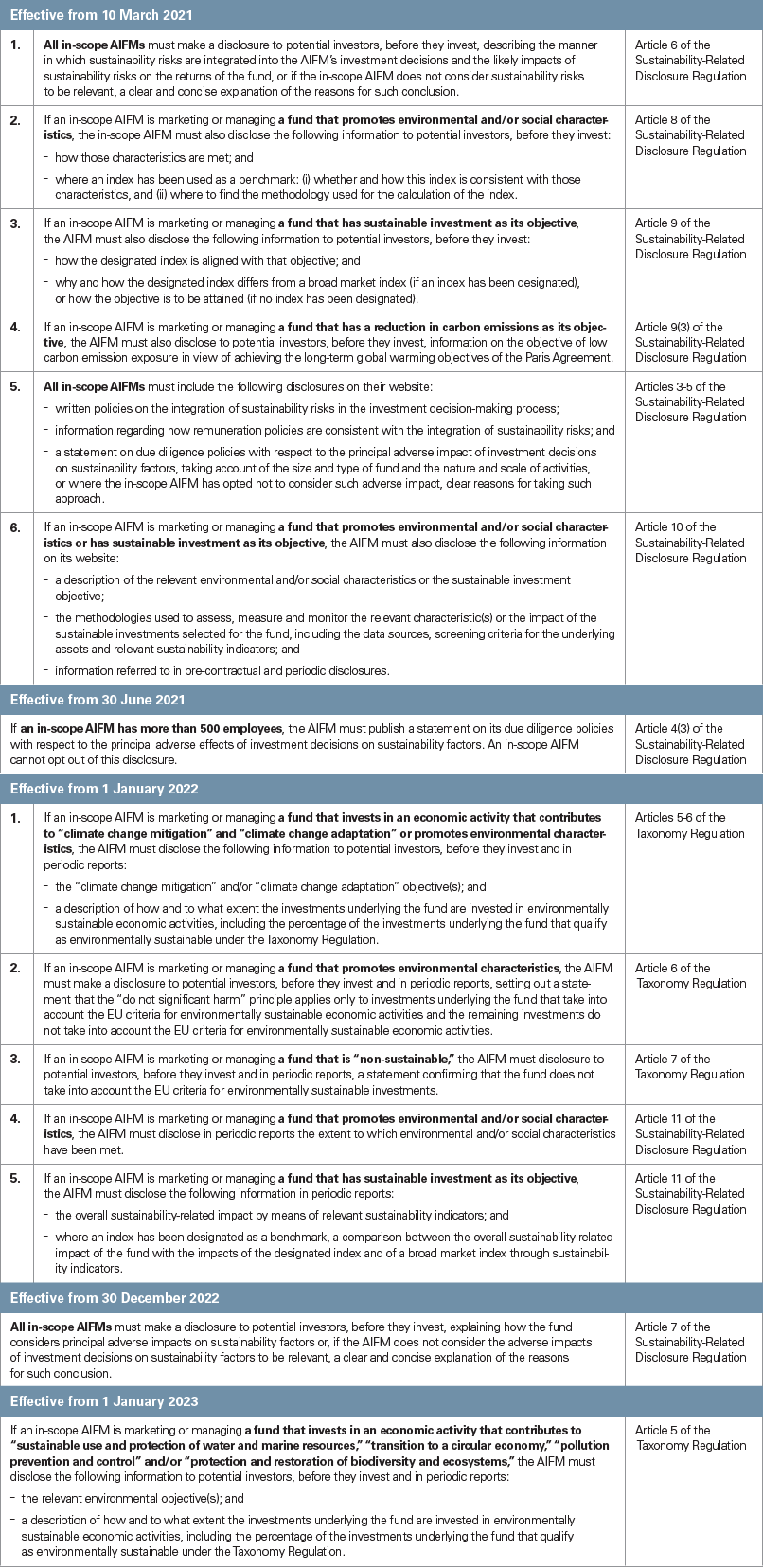

In this article, we consider the impact of the new regulations on private fund sponsors, and in the appendix we set out further detail on the disclosure obligations arising from the new rules.

Sustainability-Related Disclosure Regulation

The Sustainability-Related Disclosure Regulation came into force in December 2019 and financial market participants will be required to comply with certain operative provisions starting on 10 March 2021. “Financial market participants” includes alternative investment fund managers (AIFMs) that are authorized in an EU member state (EU AIFMs) and AIFMs from outside the EU that market or offer funds to investors in the EU (non-EU AIFMs).

At a high level, the Sustainability-Related Disclosure Regulation will require in-scope entities to implement policies and make certain periodic and pre-contractual disclosures as to how ESG factors are being integrated into investment decisions and internal processes, and to ensure marketing communications are consistent with such disclosures. One such requirement, effective from 10 March 2021, will require EU AIFMs and non-EU AIFMs to make pre-contractual disclosures to prospective investors describing the manner in which sustainability risks are integrated into the AIFM’s investment decision-making process, and an equivalent disclosure will be required on the AIFM’s website. Further, the three European supervisory authorities are preparing regulatory technical standards which will contain details about the content and presentation of information to be disclosed; however, these reporting specifications are not due to be submitted in final form until 30 December 2020.

Taxonomy Regulation

The Taxonomy Regulation came into force on 12 July 2020, and is designed to create a benchmark for “green products,” thereby alleviating the need for investors to conduct their own due diligence with regard to a financial product’s environmental sustainability. The scope of the Taxonomy Regulation matches that of the Sustainability-Related Disclosure Regulation and any in-scope AIFM will need to use the Taxonomy Regulation if it wishes to market a fund as having environmentally sustainable credentials. In order to classify a fund’s investment as an “environmentally sustainable economic activity,” the investment must make a “substantial contribution” to one of the environmental objectives detailed in the Taxonomy Regulation (set out below) and comply with certain technical screening criteria and minimum safeguards that will be set out in further delegated legislation. The AIFM must also demonstrate that the fund does not cause harm to any of the named environmental objectives.

The Taxonomy Regulation recognizes the following six environmental objectives:

1. climate change mitigation;

2. climate change adaptation;

3. sustainable use and protection of water and marine resources;

4. transition to a circular economy;

5. pollution prevention and control; and

6. protection and restoration of biodiversity and ecosystems.

Next Steps

Although many private fund sponsors will already have considered these disclosures, the requirement to make the disclosures in a uniform presentation format is likely to mean that in-scope AIFMs will have a relatively short timeline to prepare compliance disclosures once the technical standards are finalized. Those that are fundraising during 2021 should pay particular attention to timings to ensure that any pre-contractual disclosures are able to be made prior to closing. AIFMs will also need to review their investment processes and policies as part of this exercise to consider whether changes or improvements are needed — although negative disclosures are permitted, whether the private fund market adopts this as the best approach remains to be seen. Some AIFMs may look to technological solutions to address some of the obligations, particularly for the purposes of gathering and reporting on ESG data from underlying investments of their funds. Some professional service providers are already starting to market products and solutions to address these aggregation and reporting requirements, and more will likely follow.

Private fund sponsors should also be aware that the new regulations form just one part of the EU’s sustainable finance action plan, while institutional investors appear also to be finding their voice on these issues, as highlighted in our recent article “ESG in 2020: A Half-Year Review.” Private fund sponsors that have funds that invest in shares traded on an EU regulated market will need to consider the revised Shareholder Rights Directive,3 the final provisions of which are due to be transposed into law by EU member states and the U.K. by 4 September 2020. Additionally, the European Commission is expected to publish amendments to the EU's Markets in Financial Instruments Directive II (MiFID II)4 that would require MiFID-marketed firms to ask retail investors about their sustainability preferences.

For private fund sponsors operating in the U.K., the impact of Brexit on the regulations remains unclear — as the new rules do not apply before 31 December 2020, they will not all form part of the “retained EU law” under the European Union (Withdrawal) Act 2018 (although the broader taxonomy framework does apply from 12 July 2020, and therefore will be retained). The U.K. government has yet to confirm its position on the transposition of the remainder of the new regulations, although any significant divergence, for AIFMs at least, would be surprising.

Appendix

_________________________

1 Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector

2 Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment

3 Directive (EU) 2017/828 of the European Parliament and of the Council of 17 May 2017 amending Directive 2007/36/EC as regards the encouragement of long-term shareholder engagement

4 Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.