In this update, we consider key statistics, trends, developments and highlights regarding U.K. public M&A transactions governed by the U.K. City Code on Takeovers and Mergers (the Takeover Code) that were announced during the first half of 2020 (H1).

Key Statistics and Trends

H1 2020 vs. H1 2019

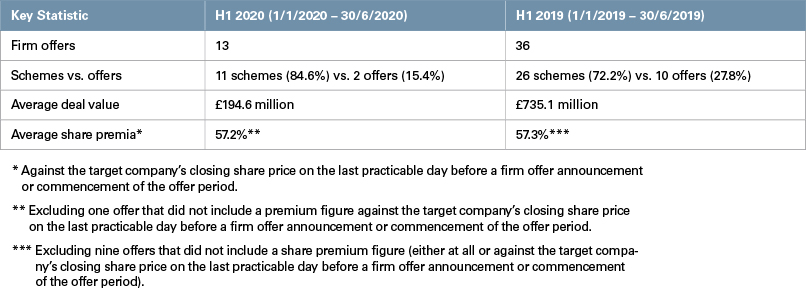

The COVID-19 crisis had a clear impact on the volume of firm offers announced in the first half of 2020, with only 13 offers announced compared to 36 offers announced in the first half of 2019. However, implementing an offer by means of a scheme of arrangement continued to be the most popular offer structure, accounting for 84.6% of firm offers announced in H1 2020 — an increase from H1 2019, when they accounted for 72.2% of firm offers.

Despite the fact that large-scale dips in share prices as a result of the pandemic presented unprecedented opportunities to resourceful bidders, market volatility and a lack of financial information available to accurately value companies contributed to a significant drop-off in the number of bids being made.

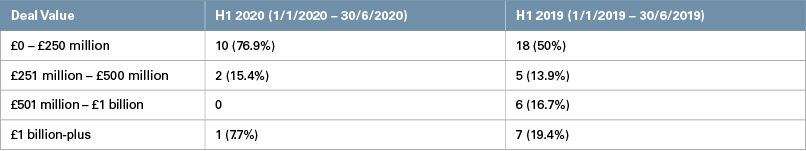

The average deal value of firm offers announced in H1 2020 was — because of the COVID-19 pandemic — approximately £194.6 million, a number significantly lower than H1 2019’s £735.1 million. In particular, H1 2020 was dominated by low-value deals, with 92.3% of firm offers valued at below £500 million and only one deal worth in excess of £1 billion announced. By contrast, H1 2019 saw a more even spread in terms of deal value, including seven deals announced with a value in excess of £1 billion.

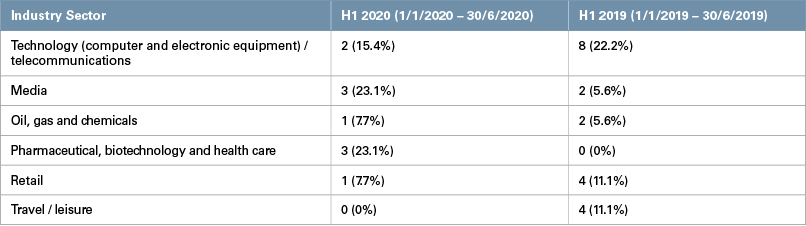

The COVID-19 crisis also appeared to have an acute impact on deal activity in certain industry sectors. In light of the prolonged global travel restrictions and widespread closure of retail stores as a result of the pandemic, it is perhaps not surprising that deal activity in the travel and retail sectors suffered in H1 2020. Deals in those sectors accounted for only 7.7% of all firm offers announced in H1 2020 (H1 2019: 22.2%). In comparison, of the few firm offers that were announced in H1 2020, 23.1% concerned a target in the pharmaceuticals and health care sector, as compared to H1 2019 when zero offers were made in these areas.

Notwithstanding COVID-19, public-to-private transactions (P2Ps), in which a listed target is acquired by an unlisted bidder, continued to prove popular with bidders and accounted for 53.8% of firm offers announced in H1 2020 (H1 2019: 33.3%).

Post-H1 2020: Positive Outlook?

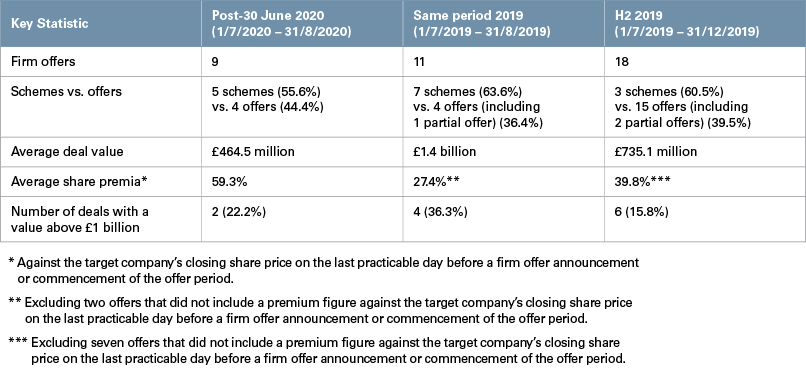

Despite the impact of COVID-19 on U.K. public M&A during H1 2020, deal activity post-30 June 2020, paints a more positive picture for the second half of 2020 (H2) and suggests a possible gradual return to pre-COVID-19 levels of activity. The average value of the nine deals announced since 30 June is £464.5 million, including two offers worth in excess of £1 billion, the first such offers since February 2020, showing a clear uptick in larger M&A activity when compared with H1 2020. However, a comparison against the same period in 2019, and also against H2 2019, shows there is still a way to go until U.K. public M&A activity can be considered to have returned to ”normal.” For instance, during the same period in 2019, 11 firm offers were announced with an average deal value of £1.4 billion.

The interruption of long-term cash flows as a result of the pandemic has complicated valuations for many businesses. However, the interim results season is now underway and might prompt further deal activity in the coming months by providing greater prominence over H1 COVID-affected trading.

Key Developments and Highlights

Moss Bros Group plc

On 12 March 2020, Brigadier Acquisition Company (Brigadier), a vehicle majority-owned by Menoshi Shina, the owner of Crew Clothing, announced a firm offer for Moss Bros Group plc (Moss Bros), a menswear company. The offer was announced at a time when the impact of COVID-19 was increasingly becoming a concern, and the announcement of the offer itself came the day after the World Health Organization labelled the virus a pandemic.

Just two weeks later, Moss Bros was forced to close its stores as a result of the virus and, on 22 April 2020, it was announced that Brigadier was seeking a ruling from the Takeover Panel to invoke certain conditions of its £22.6 million offer for Moss Bros, including the material adverse change (MAC) condition, in order to lapse the offer as a result of the impact COVID-19 was having on Moss Bros. However, on 19 May 2020, the Takeover Panel announced that Brigadier would not be permitted to invoke any conditions of its offer in order to cause it to lapse.

The decision followed the Takeover Panel’s previous seminal decision regarding invoking MAC conditions in the context of U.K. public M&A, in which WPP Group plc was not permitted to invoke the MAC condition of its £434 million offer for Tempus Group plc (Tempus) in light of the financial consequences that the 9/11 attacks were having on Tempus. It therefore remains clear that the Takeover Panel imposes an extremely high threshold in order to invoke a condition of an offer, and that potential bidders face a significant hurdle if they attempt to walk away from a deal once a firm announcement has been made.

For more discussion on MAC conditions and the offer for Moss Bros, see our 20 May 2020, client alert, “Moss Bros: The Difficulty of Invoking MAC Conditions in UK Public Takeovers.”

Re Sirius Minerals plc

In January 2020, mining giant Anglo American plc announced a recommended cash offer for Sirius Minerals plc (Sirius) to be implemented by way of a scheme of arrangement. A significant number of investors held their shares via one or more nominees, meaning that these investors only held a beneficial interest in Sirius while their nominee held full legal title to the shares. Following a meeting of shareholders convened in order to approve the scheme — in which the voting thresholds were only narrowly met — the High Court had to decide whether to sanction the scheme in light of objections raised from a number of Sirius’ beneficial owners. These beneficial owners alleged that the votes cast at the shareholder meeting did not represent their views, particularly given that most nominees had not contacted the beneficial owners to inform them of the offer.

Nonetheless, the court sanctioned the scheme and reaffirmed that the votes and rights of registered members holding legal title to a target’s shares ultimately count, as opposed to those of any beneficial owners. The court ruled that all relevant legal requirements had been satisfied (beneficial owners do not constitute “members” for the purposes of the Companies Act 2006), that Sirius had been under no legal obligation to reach out to the beneficial owners and that, even if they had been obliged, there was no way of confirming how the beneficial owners would have instructed their nominees to vote.

Highland Gold Mining Limited

On 31 July 2020, Fortiana Holdings Limited (Fortiana) announced it had agreed to acquire a 40% interest in Highland Gold Mining Limited (Highland Gold), an AIM-quoted gold producer, for £437 million in cash. 1 As a result of acquiring an interest in more than 30% of Highland Gold, Fortiana was required under the Takeover Code to make an immediate mandatory cash offer for all shareholders, which valued Highland Gold at approximately £1.1 billion.

Due to Russian Federal Antimonopoly Service (FAS) requirements, Fortiana agreed to acquire an initial 24% interest pro rata from a number of shareholders, including Highland Gold’s Chairman Eugene Shvidler and long-term investor Roman Abramovich, with the acquisition of the remaining 16% conditional upon obtaining FAS approval. Fortiana obtained the unanimous recommendation of a committee of independent directors of Highland Gold and accordingly became the first company to be permitted by the Takeover Panel to announce a recommended preconditional mandatory offer.

UK Amends Enterprise Act 2002 To Protect Businesses That Are Critical To Addressing Public Health Emergencies

In response to COVID-19, on 23 June 2020, the U.K. government passed amendments to the Enterprise Act 2002 that provide for an additional public interest ground and allow the government to intervene in relevant merger situations to ensure that the transactions do not threaten the U.K.’s ability to combat a public health emergency. This new power permits intervention if a business directly involved in a pandemic response — such as a vaccine research company or a personal protective equipment manufacturer — becomes the target of a takeover. While the amendments are intended to mitigate any immediate risks associated with COVID-19, the powers also will be in effect in case of any future public health emergency and come in advance of more comprehensive powers to be introduced in the forthcoming National Security and Investment Bill.

For more discussion on increased government intervention powers, see our 24 June 2020, client alert, “UK Amends Enterprise Act 2002 To Protect Businesses Critical to Addressing Public Health Emergencies, Extends Powers To Protect Companies and Technologies.”

_______________

1 Skadden advised Fortiana on this matter.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.