This update provides an overview of key regulatory developments in the past three months relevant to companies listed, or planning to list, on The Stock Exchange of Hong Kong Limited (HKEX), and their advisers. In particular, it covers amendments to the Rules Governing the Listing of Securities on HKEX (Listing Rules) as well as announcements, guidance and enforcement-related news from HKEX and the Securities and Futures Commission (SFC). We do not intend to cover all updates that may be relevant, but we welcome feedback, so please contact us if you’d like to see analysis of other topics in the future.

STAR Market Stocks Included in Stock Connect and Southbound Stock Connect Trading Expanded

SFC Consults on Conduct Requirements for Bookbuilding and Placing Activities

HKEX Revises Guidance Letter Relating to Biotech Company Disclosures

HKEX Publishes New Guidance Letter on Pre-Vetting for Placing to Connected Clients

Takeovers Bulletin

SFC issued a bulletin regarding issues relating to the Codes on Takeovers, Mergers and Share Buybacks (the Takeovers Code), which includes the following highlights:

Identifying All Relevant Regulatory Approvals for Completion of Offers

SFC reminded offerors, offeree companies and their respective advisers that sufficient and thorough due diligence should be conducted at the outset of a transaction so that all regulatory approvals required for the completion of offers are identified early and disclosed appropriately in line with Rule 3.5(e) of the Takeovers Code. Failure to do so can cause numerous problems, for example, unnecessary delays in the offer timetable or locking up shareholder shares pending regulatory approvals (where discovered and disclosed after the shareholders have accepted an offer). Furthermore, if a particular regulatory approval is not specifically disclosed in the firm intention announcement, SFC may not allow such condition to be invoked under Note 2 to Rule 30.1 of the Takeovers Code to cause an offer to lapse. An offeror might risk having to proceed with an offer in breach of other legal or regulatory requirements. Also, SFC may or may not consent to an extension of an offer period to accommodate the time required to obtain the omitted regulatory approval, which may also result in a breach of the timetable requirements under the Takeovers Code.

Additional Disclosure in Delistings of Mainland Issuers Under Rule 2.2

Since a new note to Rule 2.2 was introduced in July 2018 to provide a level playing field for listed companies incorporated in jurisdictions that do not have compulsory acquisition rights, SFC has granted waivers to mainland China issuers seeking to delist by way of voluntary general offer and that were subject to Rule 2.2(c), on the condition that (i) the offer would remain open for acceptance for a longer period than normally required by Rule 15.3 after the offer becomes unconditional (i.e., 14 days), (ii) shareholders who have not accepted the offer would be notified in writing of the extended closing date and the implications of choosing not to accept the offer, and (iii) the offer would be subject to 90% acceptance of the disinterested shares.

SFC now requires all mainland China issuers or issuers incorporated in jurisdictions where compulsory acquisition does not exist and who wish to delist by way of voluntary general offer and are subject to Rule 2.2 to include the following text immediately after the warning to shareholders in Rule 3.5 announcements and offer documents:

“Independent shareholders should also note that if they do not agree to the terms of an offer, they can vote against the delisting proposal at the meetings. If more than 10% of the disinterested shares voted against the delisting proposal, the offer would not become unconditional and the company would remain listed on the Stock Exchange of Hong Kong.”

The warning to shareholders and the text above should be included in bold in both the summary box and the body of a Rule 3.5 announcement and should be repeated in full in the offer document.

HKEX Publishes Results of Latest Review of Annual Report Disclosures

On January 29, 2021, HKEX published a report presenting the findings and recommendations from its review of issuers’ annual reports for financial years ended between January and December 2019, specifically highlighting the following:

- Disclose the Impact of the COVID-19 Pandemic in the Business Review and Management Discussion and Analysis Section: Companies should disclose in their next annual reports (i) the effect of COVID-19 on their operations, and the relevant risks or uncertainties that will materially affect their future performance, (ii) quantitative measures of the financial or operational impact of COVID-19, (iii) assessments of the liquidity positions and working capital sufficiency with reference to their operations and capital commitments, and (iv) measures to manage the impact of COVID-19 (such as cost control, funding and business plan adjustment).

- Financial Statements With Auditors’ Modified Opinion: Companies should continuously review their liquidity positions and funding needs, and formulate and implement action plans to address such needs in a timely manner. Where there are material changes in the reporting items, companies should develop appropriate and supportable estimates for these items, document key judgments made and consider retaining experts if necessary. Companies should also engage in early discussions with their auditors and determine, as early as practicable, the timing, form and approach of the assessment of these estimates.

- Continuing Connected Transactions (CCTs): Companies should have in place appropriate internal controls and mechanisms to monitor and assist independent nonexecutive directors (INEDs) in overseeing their CCTs, and their INEDs should review the appropriateness of these internal control procedures.

- Disclosure on Share Option and Award Schemes: Companies with share award schemes are recommended to follow the same disclosure requirements as for share option schemes under Chapter 17 of the Listing Rules.

- Material Intangible Assets: Companies should perform proper analysis and ensure that key assumptions applied in impairment testing are not overly optimistic, in particular where companies are loss-making or suffering material deterioration in revenue, net profits or gross profit margin. In addition, companies should carefully consider the impact of COVID-19 on impairment tests and update the assumptions used to reflect the latest available information and evidence.

- Material Level 3 Financial Assets: Companies should develop robust disclosure on Level 3 fair value measurements, in particular providing the qualitative and quantitative information to the extent necessary for an understanding of the valuation techniques and the underlying unobservable inputs.

HKEX also noted common areas of omission in issuers’ annual report disclosure, including (i) details about pension schemes, (ii) details about top five customers and suppliers, (iii) details about issuers’ subsidiaries, such as their principal country of operation and legal form, (iv) issuers’ gearing ratios, (v) remuneration of the five highest paid individuals, and (vi) issuers’ reserves available for distribution.

STAR Market Stocks Included in Stock Connect and Southbound Stock Connect Trading Expanded

HKEX, Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) announced the following changes that took effect on February 1, 2021:

- Inclusion of Eligible A-Shares Listed on SSE’s STAR Market Into Stock Connect: STAR Market-listed shares that are constituent stocks of the SSE 180 Index and SSE 380 Index, or have corresponding H-shares listed in Hong Kong for A+H companies, will be eligible for northbound trading under the Shanghai-Hong Kong Stock Connect by institutional professional investors. Their corresponding H-shares will be included in southbound trading of the Stock Connect when the northbound arrangements take effect.

- Expansion of Southbound Stock Connect Trading: For A+H companies with A-shares listed on SZSE, their corresponding H-shares will be tradable through southbound trading of the Shanghai-Hong Kong Stock Connect.

SFC Consults on Conduct Requirements for Bookbuilding and Placing Activities

There are currently no specific requirements governing the conduct of bookbuilding or placing activities by intermediaries in either the equity or debt capital markets in Hong Kong. SFC found that for some offerings, the price discovery process has been hampered by a number of factors, including inflated or opaque demand. Furthermore, SFC noted examples of undesirable intermediary conduct, such as brokers without a mandate “swarming” order books at the last minute with orders of unknown quality. SFC considered that such behavior could be attributable to specific competitive pressures among intermediaries in an environment where fee arrangements affect incentives. Such a state of affairs can impact the fairness and orderliness of the capital markets in Hong Kong and may affect investor confidence and future market development.

In view of the above, SFC formulated a new paragraph 21 in the Code of Conduct for Persons Licensed by or Registered With the Securities and Futures Commission (Code of Conduct) on “Bookbuilding and Placing Activities in Equity Capital Market and Debt Capital Market Transactions” (Proposed Code), which would apply to intermediaries conducting bookbuilding and placing activities in Hong Kong. Key features of the Proposed Code include:

(a) defining the intermediaries involved in these activities as capital market intermediaries (CMIs) and further defining the overall coordinator (OC) as the head of syndicate by the activities it conducts (such as the overall management of an offering, coordination of bookbuilding or placing activities conducted by the syndicate and the provision of advice to the issuer);

(b) setting out the standards of conduct expected of CMIs, covering a wide spectrum of activities — including bookbuilding, allocation and placing — to address issues including inflated or opaque demand, preferential treatment and rebates, misleading “book messages,” proprietary orders that may negatively impact the price discovery process and orders that conceal the identities of investors. Since OCs play a lead role and shoulder greater responsibility, they would be subject to additional conduct requirements, for example, in advising the issuer of pricing, allocation and marketing strategies; and

(c) requiring that syndicate membership and fee arrangements (including the fixed fees and fee payment schedule) be determined at an early stage and formal appointments of CMIs be made through written agreements specifying the roles and responsibilities and fee arrangements, to enhance accountability among syndicate CMIs and discourage undesirable behaviors. Most of this information should be submitted to SFC four days prior to the listing hearing.

Separately, there are regulatory concerns that because the sponsors’ incentives and liabilities were often not aligned, especially in larger initial public offerings (IPOs), a sponsor may compromise its due diligence inquiries in order to become the head of the underwriting syndicate and earn much higher fees to compensate for sponsor costs and responsibilities. In response to this, SFC formulated a “sponsor coupling” proposal, which would require that for IPOs, at least one OC (either within the same legal entity or the same group of companies) also act as a sponsor who is independent of the issuer. SFC considers that an intermediary who plays both the roles of an OC and a sponsor should have a better understanding of the issuer through its due diligence work, thereby being in a better position to give quality advice to the issuer.

The deadline for submitting a response to the consultation paper is May 7, 2021.

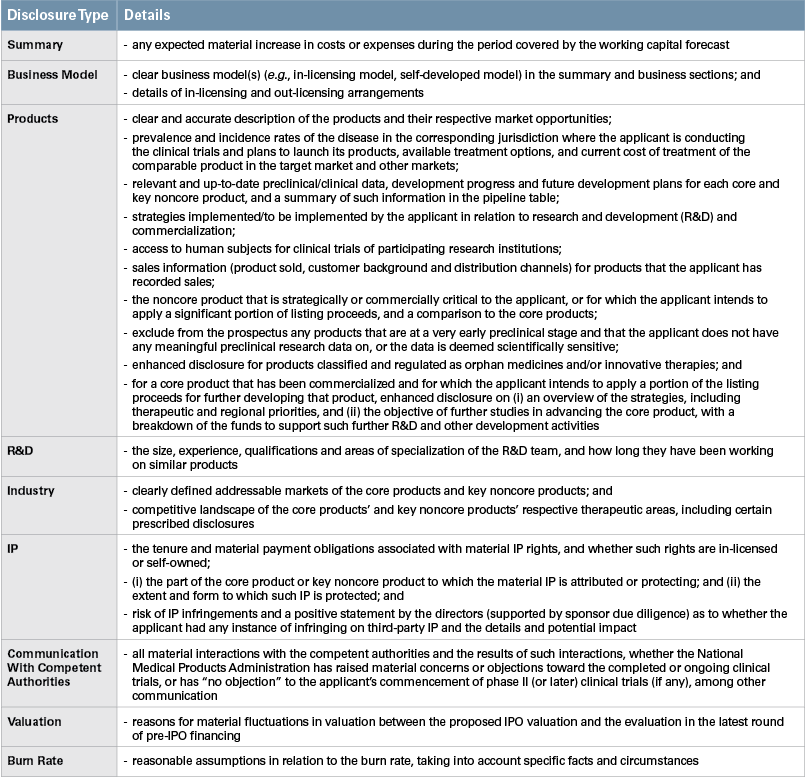

HKEX Revises Guidance Letter Relating to Biotech Company Disclosures

The following have been revised and highlighted in the revised GL107-20 relating to disclosure in listing documents for biotech companies:

- Applicants should present fair, balanced and accurate information to potential investors and avoid marketing language, unsubstantiated descriptions or emotional expressions;

- Diagrams or flowcharts should be used to explain their business models, core products and key noncore products; and

- Applicants should also disclose the following:

HKEX Publishes New Guidance Letter on Pre-Vetting for Placing to Connected Clients

HKEX published GL110-21 specifying that a broker or distributor that intends to place a listing applicant’s securities to its connected clients is encouraged to submit to HKEX a pre-vetting application as soon as the post-hearing information pack has been published. The application is to include:

- the identities of the connected clients and the relationships between the distributor and each of the connected clients (e.g., whether they are members of the same group of companies and/or are collective investment schemes managed by members of the same group of companies);

- where the connected client is a collective investment scheme that is not authorized by SFC or is expected to hold the securities on behalf of such a scheme, the background and details of the scheme, such as (i) the types and values of assets under management, (ii) whether the scheme is publicly marketed, (iii) the scheme establishment date, (iv) identities of the general partner(s) and 20 largest limited partners of the scheme where applicable, (v) the identity of the scheme administrator, and (vi) the relationships among the scheme, the ultimate beneficial owner(s) of the limited partner(s), the controlling shareholder(s) of the listing applicant and the listing applicant;

- where the connected client subscribes for securities on a nondiscretionary basis on behalf of specific independent third parties in the client accounts, the identities of the ultimate beneficial owners of the securities or, where applicable, details of the structured products under which the subscription by the connected client was made (e.g., over-the-counter total return swaps); and

- the basis for seeking the HKEX’s consent under the placing guidelines, which follows the principles and requirements under GL85-16, and the maximum amount of securities expected to be allocated to the connected client.

The allocation of securities to connected clients should be conducted only after the close of the public offer and after HKEX has granted consent under the placing guidelines.

Enforcement Matters

Court Upholds Prison Sentence for Insider Dealing

The Court of First Instance upheld the prison sentence against Mr. Au-Yeung Siu Pang, a former group finance manager of China CBM Group Company Limited (China CBM), for insider dealing but allowed the custodial term of his two convictions to be served concurrently. In granting the appeal, the court rejected all grounds advanced by Mr. Au-Yeung but exercised discretion and, by ordering the prison term to be served concurrently, effectively shortened his imprisonment from four to three months considering it had already been almost nine years since he had committed the offense. The court also ruled that the original fine of HK$120,000 and investigation costs to be paid to SFC in the sum of HK$33,365 remained unchanged.

SFC commenced the proceedings against Mr. Au-Yeung on September 7, 2017, for alleged inside dealing in the shares of China CBM when Mr. Au-Yeung, at the time an employee of China CBM, sold and counseled or procured another person to sell China CBM shares after obtaining information on the unaudited annual results of China CBM and its subsidiaries but before China CBM made its results announcement.

Company Secretary Jailed for Insider Dealing

On January 11, 2021, the Eastern Magistrates’ Court sentenced Mr. Chow Chiu Chi, company secretary of China Automation Group Limited (China Automation), to 45 days of imprisonment after he pleaded guilty and was convicted of insider dealing in the shares of China Automation following an SFC prosecution. Chow was also ordered to pay a fine of HK$45,000 and the SFC’s investigation costs of HK$37,029.51.

On April 11, 2016, Chow purchased a total of 534,000 China Automation shares through his wife’s securities account when he became aware of a possible general offer and was instructed to arrange suspension of trading. Between April 14 and 21, 2016, Chow sold some of the China Automation shares and made a profit of HK$7,417. The notional profit of the shares that remained unsold was HK$36,865.

SFC Disqualifies Former Senior Executives of Far East for Misconduct

The SFC obtained disqualification orders against former senior executives of Far East Holdings International Limited (Far East). Mr. Duncan Chiu, former managing director and CEO of Far East, and Mr. Michael Lui, a former company secretary and financial controller of Far East, were ordered to be disqualified from being a director, or being directly or indirectly involved in the management of Far East or any corporation in Hong Kong, for four years and three years, respectively.

Mr. Chiu and Mr. Lui admitted the following misconduct: (i) the transfer of a total of HK$61 million to the personal bank accounts of the then-chairman without proper authorization by Far East’s board of directors (the funds were purportedly used for the subscription of IPO shares on behalf of Far East), (ii) the lack of any agreement on the apportionment of investments and profits or losses between Far East and its chairman, and (iii) the failure to return the unused monies (i.e., the funds that had not been used for the subscription of IPO shares) to Far East in a timely manner. Mr. Chiu also admitted that he had made a false and/or misleading disclosure of the HK$61 million as an “amount due from a director” when the actual purpose of the transfers was for the subscription of IPO shares.

The disqualification orders were made under Section 214 of the SFO, as Far East’s business or affairs were conducted in a manner involving other misconduct, resulting in its shareholders not having been given all the information they might reasonably expect. Meeting minutes were retrospectively created and purportedly showed that the board resolved to appoint the chairman’s personal assistant as Far East’s “senior investment manager” to handle Far East’s investments when in fact the appointment was not genuine. The minutes were allegedly intended to bolster or support Far East’s explanation for the transfers.

MMT Sanctions Intimate Partner of Meadville’s Chairman and CEO for Insider Dealing

Following proceedings brought by SFC, the Market Misconduct Tribunal (MMT) found Ms. Li Yik Shuen to have engaged in insider trading regarding the shares of Meadville Holdings Limited (Meadville) in 2009. Mr. Tom Tang Chung Yen, Meadville’s former chairman, CEO and executive director, who was in a long-standing intimate relationship with Ms. Li, had tipped her off about a proposed sale of Meadville’s core printed circuit board and laminate businesses, as well as the distribution of a special dividend, MMT determined. Ms. Li then purchased Meadville shares, making a profit in a sum of HK$546,817.43 following her disposal of the Meadville shares when trading of its shares resumed on November 17, 2009, and rose more than 40%.

In connection with Ms. Li’s alleged insider trading, MMT was not satisfied that the former chairman and executive director of Meadville had engaged in market misconduct. Although Mr. Tang had provided Ms. Li with a series of information in his conversations with her about his work, MMT found no evidence that Mr. Tang sought to counsel or procure Ms. Li to deal in Meadville shares, or that he knew or had reasonable grounds to believe that she would use the information to deal in Meadville shares.

MMT found Ms. Li culpable of insider dealing in buying Meadville shares contrary to Section 270(1)(e)(i) of the Securities and Futures Ordinance (SFO), and ordered her to (i) be banned from dealing in securities for two years, starting on February 2, 2021, (ii) cease and desist engaging in insider dealing again in the future, (iii) disgorge HK$546,817.43 in profits, and (iv) pay SFC’s investigation and legal costs, as well as the costs of the MMT proceedings. Though MMT did not find Mr. Tang to have engaged in market misconduct, it refused to make a costs order in his favor, as (i) SFC was justified in pursuing its inquiries in respect of Mr. Tang, and (ii) Mr. Tang’s conduct, in whole or in part, caused the institution of the proceedings against him and MMT to investigate or consider his conduct during the proceedings.

HKEX Criticizes Xinming and Its Executive Director for Failure To Comply With Major Transaction Requirements

Mr. Chen Cheng Shou is an executive director of Xinming China Holdings Limited (Xinming). In December 2018, Mr. Chen, on behalf of a subsidiary of Xinming, entered into seven pledge contracts without notification to or authority from Xinming’s board of directors. According to HKEX, the pledge contracts exposed Xinming to substantial financial risk, and Mr. Chen did not take adequate steps to safeguard the assets of the subsidiary that were pledged.

HKEX found that the pledge contracts constituted a major transaction. HKEX therefore criticized (i) Xinming for failure to comply with the announcement, reporting, circular and shareholders’ approval requirements, and (ii) Mr. Chen for failure to discharge the required standard of skill, care and diligence under the Listing Rules when making investment decisions, as well as for failure to take any steps to ensure Xinming would comply with the applicable procedural requirements after the major transaction was entered into.

HKEX Censures Sandmartin and Its Directors for Breach of Listing Rules

HKEX censured directors and former directors of Sandmartin International Holdings Limited (Sandmartin) for failing to (i) announce the acquisition of a subsidiary and certain loans made to a connected party in a timely manner, (ii) ensure that certain financial disclosures in an announcement and a circular were accurate and complete in all material respects and not misleading, and (iii) report relationships with connected party implications to Sandmartin. These resulted in a failure of the relevant directors to (i) discharge their directors’ duties and undertakings to comply with the Listing Rules to the best of their ability, or (ii) use their best endeavors to procure compliance of the Listing Rules.

Directors are reminded that they are individually and collectively responsible for an issuer’s compliance with the Listing Rules. Merely placing reliance on the company secretary to procure Listing Rule compliance is not considered to be a satisfactory discharge of their duties in this regard. Directors must also be able to demonstrate that they took sufficient interest in the issuer’s compliance, for example, by ensuring that there was supervision of relevant staff, proper reporting to the board, and the provision of regular training.

Sandmartin was required to appoint an independent professional adviser to conduct an internal control review, and the relevant directors were required to attend training.

HKEX Censures Hosa and Its Directors for Failing To Cooperate With or Respond to Listing Division Inquiries

HKEX censured each director of Hosa International Limited (Hosa) for failing (i) in their individual and collective responsibility for Hosa’s compliance with the Listing Rules, and (ii) to take adequate steps to ensure Hosa responded to the Listing Division’s inquiries in a timely and substantive manner. Between January 2019 and May 2020, Hosa failed to provide any timely and/or substantive response to the Listing Division’s inquiries for verification of its compliance with the Listing Rules, HKEX found. In April 2020, after Hosa was delisted, the Listing Division made direct inquiries with each of its five directors, to which only two responded, in breach of their Declaration and Undertaking with regard to directors (Directors’ Undertakings) given to HKEX, which requires them to (i) use best endeavors to procure Listing Rules compliance, and (2) cooperate in any investigation conducted by the Listing Division. HKEX further stated that the retention of office by the directors who did not respond to the Listing Division’s inquiries would have been prejudicial to the interests of investors by reason of their willful and/or persistent failure to discharge their responsibilities under the Listing Rules, had Hosa remained listed.

HKEX Censures Brightoil and Its Directors for Refusing To Announce Delisting Decision

HKEX’s recent censure and public statement against Brightoil Petroleum (Holdings) Limited (Brightoil) and four of its directors highlights the importance for a company to comply with HKEX’s requests to publish announcements, failing which Brightoil deprived its stakeholders and the market of their right to be informed about critical developments in relation to its listing status.

Brightoil has been suspended from trading since October 3, 2017, and was delisted by the Listing Committee on 28 February 2020. Brightoil applied for a review of such decision on March 9, 2020. In March and April 2020, HKEX requested Brightoil to announce the delisting decision and its review application. Brightoil refused on the basis that the delisting decision was under review and publication of the requested announcements were not in its best interests, taking into account the progress being made to its debt restructuring. At a board meeting on April 20, 2020, a majority of the directors voted against the requested announcements being published. Brightoil subsequently published its quarterly update announcement on April 29, 2020, and its business update announcement on May 19, 2020, without disclosing the requested announcements.

HKEX censured Brightoil for (i) refusing to publish an announcement on the delisting decision, and (ii) failing to disclose the delisting decision in its quarterly and business update announcements. HKEX also censured the directors for breaching their Directors’ Undertakings by refusing to procure Brightoil’s compliance with HKEX’s repeated requests, and stated that their retention of office would have been prejudicial to the interests of investors had Brightoil remained listed.

HKEX Censures Former Executive Directors of Inno-Tech and Teamway for Failure To Cooperate With Investigations

HKEX censured former executive directors of Inno-Tech Holdings Limited (Inno-Tech) and Teamway International Group Holdings Limited (Teamway) for failure to cooperate with investigations of the Listing Division of HKEX by not responding to its inquiries despite being aware of its investigations, thereby breaching their undertaking to HKEX to cooperate in any investigation. This highlights the importance of directors to cooperate with the Listing Division’s investigations. Any failure to comply with the HKEX’s requests in connection with an investigation of possible Listing Rule breaches without reasonable excuse will result in the imposition of severe sanctions against the directors.

HKEX Disciplines Directors of Moody for Breach of Duties of Skill, Care and Diligence, Undertakings, and Internal Control Deficiencies

This case highlighted the importance of (i) executive directors taking proactive steps to safeguard company assets, particularly when commencing a new business segment, (ii) independent nonexecutive directors taking an active interest in the issuer’s business and financial performance, and raising risk issues with the management, (iii) all directors taking proactive steps to address the auditors’ concerns to procure the issuer’s financial statements; and (iv) all directors cooperating with HKEX investigations.

In 2016, Moody Technology Holdings Limited (Moody) commenced polyetherimide (PEI) trading by reselling them to overseas buyers, but such trading was suspended in 2017. Moody’s PEI buyers complained about product quality, resulting in Moody offering a 5% discount that the buyers rejected. Before publishing the 2016 annual results, an executive director informed the board that the buyers would be offered a discount with an extension of the credit period, resulting in the board’s decision (which was agreed to by the INEDs) not to provide for any impairment given the receivables were not yet due. In the end, Moody recovered less than 10% of the receivables, with the remaining balance written off in 2017. Separately, Moody had made a high amount of prepayments to its raw materials suppliers from 2015 to 2017, with a significantly high proportion of prepayments paid to the top three major suppliers. These resulted in Moody’s 2016 and 2017 financial statements being subject to a qualified opinion and a disclaimer opinion.

HKEX found failures (i) to safeguard company assets as a result of a lack of both due diligence in identifying PEI buyers and control of prepayment terms and levels, (ii) by the INEDs to follow up after reviewing Moody’s draft 2016 interim results and to take an active interest in Moody’s affairs in respect of the prepayments, (iii) to make a reasonable impairment assessment of the PEI receivables and the prepayments, and (iv) to implement an effective internal control system ensuring that key decisions were escalated to the board, as the INEDs were often uninformed and uninvolved in Moody’s decision-making. As a result, HKEX censured the executive directors and criticized the INEDs for breach of directors’ duties and their undertakings to comply with the Listing Rules to the best of their ability and to cooperate with the investigations of the Listing Division. HKEX also directed Moody to retain an independent professional adviser to conduct a thorough review of and make recommendations to improve its internal controls. All relevant directors were also directed to attend 15 hours of Listing Rules compliance training.

SFC Disqualifies Former Senior Executives and Officers of Shandong Molong for Failure To Present a Fair Picture of the Financial Position

Five former senior executives and two officers of Shandong Molong Petroleum Machinery Company Limited (Shandong Molong) were disqualified from being a director or taking part, directly or indirectly, in the management of any listed or unlisted corporation in Hong Kong, without leave of the court, for a period of seven to nine years, effective February 26, 2021. Such disqualification orders are in connection with their admitted responsibilities for Shandong Molong’s window-dressing of key financial information for the 2015 and 2016 fiscal years, resulting in the failure to present a fair picture of the financial position of the company to its shareholders.

SFC alleged that Shandong Molong’s business or affairs had been conducted in a manner involving defalcation, misfeasance or other misconduct, resulting in the company’s shareholders not having been given all the information they might reasonably expect and/or being unfairly prejudicial to the company’s shareholders.

During the time Shandong Molong was suffering losses for 2015 and 2016, the SFC alleged that the accused five former senior executives and two officers were the instigators or the masterminds of a scheme to inflate the company’s financial position in six results announcements for 2015 and 2016, or were knowingly involved or at least acquiesced and/or turned a blind eye to the same by, among other things, overstating revenue and understating costs for 2015 and 2016. Their actions therefore satisfy the requirements under Section 214 of the SFO for the court to make orders of disqualification against them.

MMT Sanctions Magic and Its Directors for Late Disclosure of Inside Information

MMT fined Magic Holdings International Limited (Magic) and five of its directors a total of HK$4 million after they were found to be culpable of late disclosure of inside information on L’Oréal S.A.’s (L’Oréal) proposed acquisition of Magic in March 2013. On April 27, 2013, L’Oréal’s and Magic’s founders agreed that an offer price of not less than HK$5.5 per share would be proposed to Magic’s board of directors for its consideration. Magic’s founders indicated to L’Oréal that they would contact Magic’s institutional investors to gauge their support for the acquisition proposal and also would recommend that Magic’s board agree to L’Oreal’s request to carry out due diligence.

However, Magic did not publicly disclose the information relating to L’Oréal’s acquisition proposal, which would have had a positive impact on Magic’s share price, until August 2013. The MMT considered that there was a commercial reality to the negotiations between Magic and L’Oréal, that such negotiations had gone beyond testing the waters and that Magic had failed to disclose inside information to the public as soon as reasonably practicable. Investors who sold their Magic shares during that time were hence deprived of the opportunity to access information that they should have been entitled to, MMT determined.

MMT considered that Magic’s breach of the disclosure requirement was all the more serious because it had not taken all reasonable measures to monitor the confidentiality of the proposed acquisition and it had not disclosed it to the public as soon as reasonably practicable after becoming aware that the confidentiality of the proposed acquisition had not been preserved. The directors were disqualified from being a director or being involved in the management of a listed corporation or any other specified corporation for eight to 24 months. MMT further ordered (i) the Hong Kong Institute of Certified Public Accountants to take disciplinary actions against the responsible directors, (ii) Magic and the five directors to pay SFC’s investigation and legal costs, as well as the costs of the MMT proceedings, and (iii) the five directors to attend an SFC-approved training program on the corporate disclosure regime, directors’ duties and corporate governance.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.