The election of three directors nominated by a climate-focused activist fund and shareholder support for detailed lobbying disclosures highlight the ESG forces boards now face.

Takeaways

- Large mutual fund managers, public pension funds and proxy advisory firms supported activist board nominees.

- The outcome may embolden other ESG activist funds.

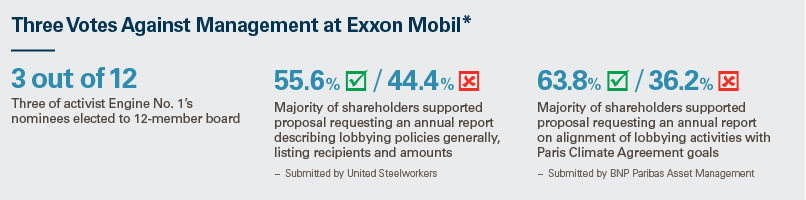

In one of the most high-profile and expensive proxy fights in recent years, Engine No. 1, a relatively small activist hedge fund, won three of 12 board seats at Exxon Mobil’s annual meeting last month, based on preliminary voting results. In addition, two shareholder-sponsored measures requesting fuller disclosures about the company’s lobbying won support.

This contest, which focused on Exxon’s shift away from fossil fuels, has been much remarked upon – and for good reason:

- This was the first time that a board election truly turned on environmental, social and governance (ESG) issues.

- Engine No. 1 held only a 0.02% stake – a relatively low ownership percentage for a successful proxy fight.

- Engine No. 1 was successful notwithstanding the outsized retail ownership at Exxon (reported to be 40%), a shareholder base that usually supports management.

- Vanguard, Blackrock and State Street all supported the election of at least two of Engine No. 1’s candidates, as did a number of large state public pension funds, including the California State Teachers’ Retirement System (CalSTRS), the California Public Employees’ Retirement System (CalPERS) and the New York State Common Retirement Fund.

- Institutional Shareholder Services supported three of Engine No. 1’s four candidates and Glass Lewis, another proxy adviser, recommended in favor of two of the four candidates. Pensions & Investment Research Consultants supported all four Engine No. 1 nominees.

- Given Engine No. 1’s small stake and enormous fees paid in the proxy fight (reported to be $30 million), many commentators have questioned the economics of this fight for Engine No. 1.

- This may well be a portent of things to come, encouraging the formation of more activist funds focusing on ESG issues and emboldening existing ESG funds. Just prior to the fight, Exxon named Jeff Ubben, the founder of the prominent traditional activist fund ValueAct who now runs a social impact fund, to its board.

- The rise in the importance of ESG considerations among investors, including institutional investors that have traditionally supported management, provides activist shareholders new campaign themes that could have a significant impact on corporations.

- In addition to Engine No. 1’s board win, two shareholder proposals won majority support. One calls for an annual report on lobbying generally, while the second requests a report describing how the company’s lobbying efforts align with the goal of limiting global warming. The board had recommended a vote against both measures.

- Engine No. 1’s victory underscores the need for shareholder engagement and for boards to stay alert to the ever-evolving themes and concerns of shareholders, especially on ESG topics and other political hot buttons.

While some may view the Exxon/Engine No. 1 fight as sui generis, the Securities and Exchange Commission has been taking steps to emphasize the increasing importance of ESG disclosure by public companies. In March, the commission established a Climate and ESG Task Force, initially focused on identifying “any material gaps or misstatements in issuers’ disclosure of climate risks under existing rules” and it is seeking public comment on the standardization of ESG disclosures.

Clearly, ESG and the related disclosure around it is a topic that is here to stay, and boards should closely monitor developments in this area, on both the shareholder and regulatory fronts.

* Updated preliminary results to June 2. Sources: Exxon Mobil 2021 Proxy Statement, June 2, 2021 Form 8-K and June 2, 2021 press release (updated preliminary results).

View other articles from this issue of The Informed Board

- Four Questions on Directors’ Minds as the World Returns to Work

- Is Tax Competition Dead?

- Fintech Disruption: It’s Not That Simple

- Interlocking Boards: The Antitrust Risk You May Never Have Heard Of

See all the editions of The Informed Board

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.