The existing financial regulatory regime limits the inroads fintech companies can make in banking. That could change with decentralized finance and cryptocurrencies.

Takeaways

- Financial technology companies have driven innovation in the ways consumer financial services are delivered.

- But regulatory and structural considerations mean that fintech companies still depend on traditional banks for key functions.

- The rise of blockchain-based decentralized finance and cryptocurrencies challenge the status quo.

The rise of fintech disruption

Technology companies enable our communication, facilitate our social interaction, provide our entertainment, help us get around and shape our buying habits. The past decade has also seen rapid technology-driven innovation in consumer financial services: peer-to-peer payments; new methods to spend in-person and online; online borrowing for a home, car, education or general spending; decentralized finance; and digital investment, retirement planning and insurance services.

Forty percent of U.S. financial decision-makers report having at least one fintech account, according to McKinsey. This penetration of technology poses a risk of major disruption to traditional financial services firms. According to PwC, almost 90% of global financial services firms fear losing revenue to fintech challengers.

For many technology companies, expansion into financial services offers not only the prospect of new revenue streams but a valuable window into a consumer’s interests and behaviors.

Regulatory and structural obstacles for tech companies seeking to offer bank-like services

The existing bank regulatory regime creates significant barriers for technology companies looking to challenge traditional banks. In the United States and Europe, the core function of holding customer deposits may be performed only by bank. In addition, access to traditional payments systems and cards networks is generally limited to banks.

But banks are subject to a comprehensive and ongoing regulatory regime affecting virtually every aspect of operations. That is hard to square with the fast-moving, trial-and-error, higher-risk-appetite approach common at young technology companies. And, in most cases, owning a bank is not even an option. For example, U.S. law generally prohibits a bank from being owned by, or affiliated with, any company that is engaged in non-financial activities. This is based on the longstanding U.S. policy to keep banks separate from general commerce.

To avoid these regulatory constraints, many U.S. fintech companies offer consumers banking services indirectly by collaborating with banks. These partnerships often take the form of "white label" arrangements where the branding, user interface and customer experience is driven by the technology company, but the underlying financial "plumbing" of the bank account resides with a bank. If you read the fine print, you will often see that, behind the fintech brand, the deposit and lending products are being provided by a bank unaffiliated with the brand. This allows the technology company to gain many benefits of the customer relationship without subjecting itself to the regulatory restrictions imposed on banks. But it means that ultimate control of the relationship and some portion of the economics belong to the unaffiliated bank.

More recently, a few fintech companies have taken the plunge and formed or acquired their own banks. Doing so entails significant time and investment and the uncertainty of the regulatory approval process. Other fintech companies have sought to form or acquire quasi-bank entities, such as industrial banks, industrial loan companies, trust companies and other limited-purpose charters. These can engage in certain types of banking activities, including some forms of deposit-taking, but the parent does not face the wide-reaching regulatory implications it would owning a full-fledged bank.

Blockchain technology could displace the status quo

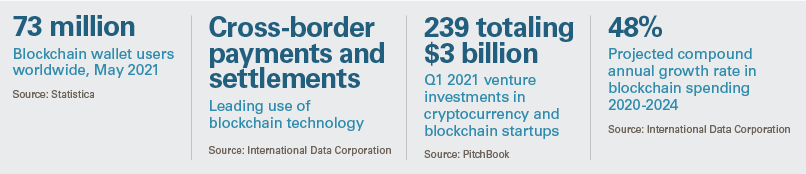

The blockchain technology underlying cryptocurrencies can support a broad range of decentralized finance (DeFi) services that could upend the central function that traditional, regulated banks play. It could lead to widespread disintermediation of financial institutions.

DeFi encompasses a wide range of services traditionally provided by financial institutions, including decentralized exchanges (DEXes); decentralized borrowing and lending applications (DApps); yield farming; and liquidity mining. Using DeFi applications and the cryptocurrencies that run through them, users can engage in financial transactions that would otherwise require a trusted central party, such as a financial institution. For example, lenders and borrowers can transact business through decentralized pools that are cross-border and, to date, unregulated.

As a result, participants can hold and exchange value outside the plumbing of the traditional bank-centric payments system. This has the potential to be cheaper, faster and more efficient. It can also be anonymous—which can be appealing to participants, but worrying to policy makers, regulators and law enforcement.

Established financial institutions are keenly aware of both the upside and the potential threat from DeFi. A research paper by ING Bank cites advantages to DeFi, including flexibility, speed of transactions, accessibility, interoperability, borderlessness and transparency. Those could make DeFi a rival to traditional banking, but could also spur innovation by traditional financial institutions, the authors said.

Today there are still practical barriers to DeFi transactions and cryptocurrencies penetrating the mainstream economy. DeFi transactions provide high yields because they remain highly risky and unregulated. Cryptocurrencies still require, in almost all cases, a traditional bank or payment source as an entry or exit ramp. For example, if you run a restaurant, you might allow diners to pay with cryptocurrency using a mobile app, but you would still need to exchange the cryptocurrency into traditional fiat currency in order to pay your employees and suppliers, who are unlikely to accept cryptocurrency at present. The current need to exchange cryptocurrency remains a sticking point in the evolution of payments away from the traditional banking system.

Governments are struggling to adapt their regulatory regimes to the rise of cryptocurrencies and other blockchain technology. The regulation of cryptocurrencies and DeFi more broadly will determine the role played by banks and other traditional financial institutions.

What to watch

With technology developments and innovation, the boundaries between traditional banks and fintech companies will continue to blur and evolve. Here are key things to watch:

- The shape of continued partnerships and collaboration between technology companies and banks

- Increased willingness of fintech companies to pursue bank and quasi-bank charters

- Potentially explosive growth of DeFi and cryptocurrency that would erode the historical position of banks as the structural center of payments flow

- Continued efforts by governments and regulators to interpret, adapt and expand traditional regulatory regimes to encompass DeFi and cryptocurrencies.

View other articles from this issue of The Informed Board

- Four Questions on Directors’ Minds as the World Returns to Work

- What the Exxon Mobil Shareholder Votes Mean

- Is Tax Competition Dead?

- Interlocking Boards: The Antitrust Risk You May Never Have Heard Of

See all the editions of The Informed Board

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.