In this update, we consider key statistics, trends, developments and highlights regarding U.K. public M&A transactions governed by the U.K. City Code on Takeovers and Mergers (the Takeover Code) that were announced during the first half (H1) of 2021.

Key Statistics and Trends

H1 2021 vs. H1 2020

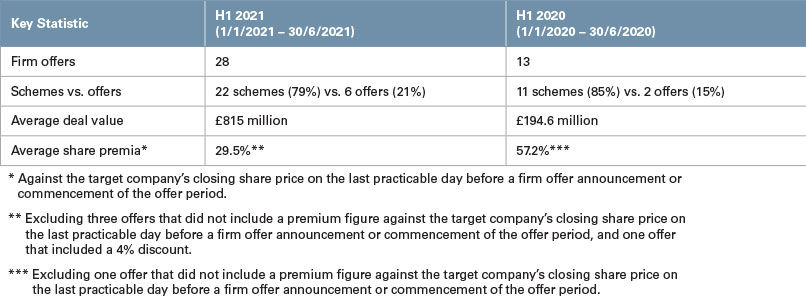

The COVID-19 pandemic certainly had a significant impact on the volume of firm offers announced in H1 2020. However, a comparison of the number and size of deals in H2 2020 and H1 2021 against H1 2020, shows a steady return to pre-pandemic levels of activity, with 28 firm offers announced in H1 2021, compared to 26 offers announced in H2 2020 and 13 offers announced in H1 2020. The most popular offer structure continues to be a scheme of arrangement, accounting for 79% of the offers announced in H1 2021.

Despite continued uncertainty caused by the pandemic, as well as the disruption to necessary formalities such as shareholder meetings and court hearings that are required to approve takeovers structured as schemes of arrangement, we continued to see a steady rise in public M&A activity during H1 2021. Projections for the second half of 2021 reflect cautious optimism from M&A professionals and a continued upward trajectory as the global economy continues to recover from the pandemic.

As compared to H1 2020, in H1 2021 we saw a more even spread in terms of deal value and also a strong revival of larger deals, with seven transactions (or 25% of all offers) valued at above £1 billion. By contrast, H1 2020 was dominated by low-value deals, with 12 deals (or 92.3% of all firm offers) valued at below £500 million and only one deal valued at above £1 billion. The surge in higher value deals commenced in H2 2020, with 17 deals (or over 60% of all firm offers) in H2 2020 valued at over £500 million. Although less pronounced, this upward trajectory of higher value deals has clearly continued into H1 2021 as compared to H1 2020, with 12 deals (or around 43% of all firm offers) being valued at over £500 million. As discussed below, the steady increase in public-to-private transactions and preponderance of cash bids may also indicate that this trend of more higher-value deals will likely continue throughout H2 2021.

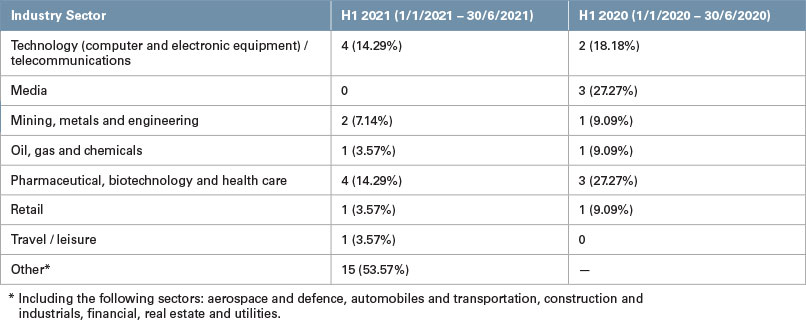

The pandemic has had a continued impact on deal activity in certain industry sectors. As global travel restrictions remain in place, it is unsurprising that deal activity in the travel sector remains low. By contrast, deals involving tech companies have seen an increase in activity, accounting for 36.4% of all offers announced in H1 2021 (versus 15.4% in H1 2020), reflecting the continuing adoption of and reliance on technology resulting from prolonged pandemic-related restrictions.

Key Developments and Highlights

Public-to-Private (P2P) Transactions

Interest from private equity sponsors in acquiring public companies has seen a significant rise over the past year, with P2P transactions accounting for 50% of firm offers in H1 2021 and 71.4% of the deals valued above £1 billion. This remarkable increase in P2P activity, being undertaken in light of COVID-19 and a more cautious approach being taken by corporate buyers, has been driven by a number of factors, including the attraction of a certain cash exit for investors in uncertain equity markets. As PE funds retain access to large amounts of dry powder and with interest rates remaining at historic lows, this is likely to mean P2P transactions will remain a trend for the remainder of 2021.

Changes to the Takeover Code

On 31 March 2021, the Takeover Panel (Panel) published Response Statement 2020/1 (the RS) in response to the Public Consultation Paper 2020/1 published by the Panel on 27 October 2020 (the PCP). The RS confirmed that the Panel will adopt the amendments proposed in the PCP, subject to certain minor modifications, including amendments to the overall offer timetable to accommodate the fact that offers are taking longer due to regulatory approval processes and the removal of the historic anomaly in the Code whereby the ability to invoke U.K. and European Commission antitrust conditions is not subject to the material significance requirement.

The changes set out in the RS were implemented on 5 July 2021.

For more on the amendments set out in the RS, see our 8 April 2021 client alert, “UK Takeover Panel Releases Response Statement on Conditions to Offers and the Offer Timetable.”

National Security and Investment Bill

On 29 April 2021, the National Security and Investment Bill received Royal Assent, becoming the National Security and Investment Act 2021 (the Act). This development reflects the global sentiment that there should be increased scrutiny of transactions involving matters of national security and has led to an increase in power for the U.K. government to “call in” or review acquisitions across a number of specified core sectors deemed likely to raise national security concerns.

The new regime provided for under the Act will commence later in 2021 and the U.K. government can exercise its “call in” power retrospectively with regard to transactions that have taken place on or after 12 November 2020.

For more on the National Security and Investment Act 2021, see our 30 April 2021 client alert, “UK’s National Security and Investment Bill Becomes Law.”

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. The editorial content of this update has been provided by the authors and does not represent the views of Skadden or any one or more of the firm’s other partners or clients. This memorandum is considered advertising under applicable state laws.