In this issue, we cover regulatory developments impacting the investment management sector, including proposed legislation supported by the Investment Company Institute to address challenges for closed-end funds; the Securities and Exchange Commission’s regulatory agenda and various rules and proposals regarding proxy matters and securities lending transactions; and risk alerts addressing, among other compliance and disclosure topics, advisory fees, cross trades and wrap fee programs.

- Update on Activism

- SEC Announces Annual Regulatory Agenda

- SEC Staff Issues New Shareholder Proposal Guidance, Rescinding 2017-2019 Guidance

- SEC Excludes Registered Investment Companies and BDCs From Application of Universal Proxy Rules

- SEC Proposes To Rescind Portions of 2020 Proxy Voting Advice Rulemaking

- SEC Proposes Rule Requiring the Reporting of Material Terms of Securities Lending Transactions

- Obeslo v. Great-West Capital Management, LLC

- SEC Chair Discusses Cryptocurrencies at Aspen Security Forum

- Over 60 of the Nation’s Leading Law Firms Respond to Investment Company Act Lawsuits Targeting the SPAC Industry

- SEC Approves Inflation Adjustment of the Dollar Amount Tests for Qualified Clients Under Advisers Act Rule 205-3

- SEC Modernizes Filing Fee Disclosure and Payment Methods

- SEC Outlines Observations From Examinations in Registered Investment Company Initiatives

- SEC Outlines Observations From Examinations in Advisory Fee Calculation Initiative

- SEC Issues Risk Alert Regarding Fixed Income Principal and Cross Trades by Investment Advisers

- SEC Proposes To Enhance Proxy Voting Disclosure by Investment Companies and Require Disclosure of ‘Say-on-Pay’ Votes for Institutional Investment Managers

- SEC Issues Risk Alert Regarding Investment Advisers Managing Client Accounts That Participate in Wrap Fee Programs

- SEC Approves Nasdaq’s Board Diversity Rule

- FINRA Issues Guidance Encouraging Firms To Prepare for Forthcoming Anti-Money Laundering Rules

- SEC Heightens Focus on Cybersecurity

- SEC Charges 27 Financial Firms for Form CRS Filing and Delivery Failures

- SEC Charges Mutual Fund Executives With Misleading Investors Regarding Investment Risks in Funds That Suffered $1 Billion Trading Loss

Update on Activism

On August 11, 2021, the Investment Company Institute (ICI) published an article entitled “Closed-End Funds at a Crossroads,” which discusses two major challenges currently affecting closed-end funds (CEFs) and proposed legislation that seeks to address both challenges.

Closed-End Fund Challenges

The ICI noted that the first challenge is a restriction on the ability of closed-end funds to invest in privately offered funds. The ICI explained:

In recent years, the SEC staff has taken an informal view — generally communicated to closed-end fund registrants during the registration process — that an exchange-listed closed-end fund may not invest in privately offered funds and that no closed-end fund may invest more than 15 percent of its net assets in such funds, unless it sells shares only to larger, professional investors.

The SEC has never issued a formal rule imposing these restrictions — nor published any guidance on the subject — yet closed-end funds must adhere to the staff’s informal positions as part of their compliance responsibilities. The SEC staff’s positions limit retail investors’ opportunities and ability to diversify their portfolios — acting as a major roadblock to achieving the Commission’s goal of providing retail investors with greater access to private markets.

The ICI explained that the second challenge stems from current law that allows activist investors to acquire large positions, even a controlling interest, in a closed-end fund and use their positions to force the fund into a liquidity event at the expense of the fund’s long-term shareholders. The ICI noted that this arbitrage tactic “undermines the core features that retail investors value in closed-end funds — such as exposure to a specific investment strategy or the ability to capture ongoing dividend income.”

Increasing Investor Opportunities Act

The ICI emphasized its support for proposed new legislation, the Increasing Investor Opportunities Act (IIOA).

U.S. Rep. Anthony Gonzalez (R-OH) first introduced the IIOA on November 19, 2020, and then reintroduced it as a new bipartisan bill with U.S. Rep. Gregory Meeks (D-NY) on June 30, 2021, to the House of Representatives.

The IIOA, among other things, would prohibit the Securities and Exchange Commission (SEC) from limiting a CEF’s investment in private funds “solely or primarily because of the private funds’ status as private funds” and prohibit a national securities exchange from restricting the listing or trading of a CEF’s securities “solely or primarily by reason of the amount of the company’s investment of assets in private funds.” The IIOA, if enacted, is intended to give retail investors greater access to private fund investment opportunities while retaining the protections of the 1940 Act. See our December 2, 2020, client alert “Proposed Legislation Seeks To Prevent Regulatory Limitations on Closed-End Fund Investments in Private Funds” for a detailed discussion of the effect of these proposed changes.

The IIOA would also require private funds to comply with the 10% limitation on investment in registered CEFs and business development companies (BDCs) contained in Section 12(d)(1)(C) of the 1940 Act. The effect of this requirement would obligate one or more private funds with the same investment adviser to limit their aggregate holdings of a registered CEF or BDC to no more that 10% of that fund’s outstanding voting stock. See our December 1, 2020, client alert “Proposed Legislation Would Enhance Closed-End Fund Protections by Closing the Private Funds Loophole Under Section 12(d)(1) of the Investment Company Act,” for a detailed discussion of the effect of this requirement.

See the Increasing Investor Opportunities Act here.

SEC Announces Annual Regulatory Agenda

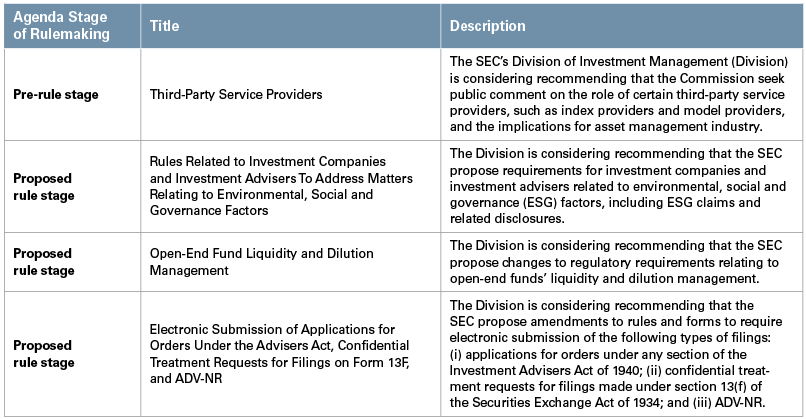

On June 11, 2021, the SEC’s Office of Information and Regulatory Affairs released the Spring 2021 Unified Agenda of Regulatory and Deregulatory Actions. The agenda contained the following new items specifically relevant to the investment management industry:

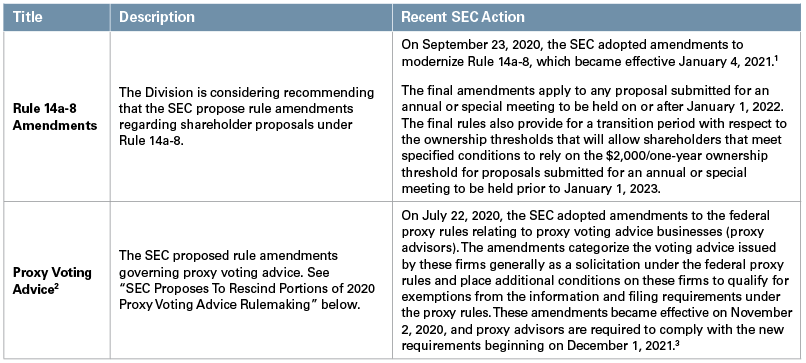

The agenda also included certain recently finalized rulemakings as new items in the “proposed rule stage,” including, for example:

The updated agenda also lists “universal proxy” as a “final rule state” item. See “SEC Reopens Universal Proxy Comment Period” in our June 2021 Investment Management Update and “SEC Excludes Registered Investment Companies and BDCs From Application of Universal Proxy Rules” below.

In response to the updated agenda, on June 14, 2021, Commissioners Hester Peirce and Elad Roisman issued a joint public statement entitled “Moving Forward or Falling Back? Statement on Chair Gensler’s Regulatory Agenda” addressing certain missing rulemakings and the SEC’s revisiting of recently finalized rulemakings. They stated:

The Agenda is missing some other important rulemakings, including rules to provide clarity for digital assets, allow companies to compensate gig workers with equity, and revisit proxy plumbing. Perhaps the absence of these rules is attributable to the regrettable decision to spend our scarce resources to undo a number of rules the Commission just adopted.

The Agenda makes clear that the Chair’s recent directive to SEC staff to consider revisiting recent regulatory actions taken with respect to proxy voting advice businesses was not an isolated event, but just the opening salvo in an effort to reverse course on a series of recently completed rulemakings … We are disappointed that the Commission would dedicate our scarce resources to rehashing newly completed rules.

See the SEC’s spring 2021 agenda and the joint public statement of Commissioners Hester Peirce and Elad Roisman.

SEC Staff Issues New Shareholder Proposal Guidance, Rescinding 2017-2019 Guidance

On November 3, 2021, the Division of Corporation Finance staff of the SEC published Staff Legal Bulletin No. 14L (SLB 14L), which explicitly rescinds Staff Legal Bulletin Nos. 14I, 14J and 14K (SLB 14I, 14J and 14K) (issued in 2017, 2018 and 2019, respectively) and effectively resets the staff’s approach to the “ordinary business” and “relevance” exclusions for shareholder proposals to the pre-November 2017 approach.

The rescinded Staff Legal Bulletins introduced and expounded on the concept of a board analysis to support no-action requests to exclude shareholder proposals relating to a company’s “ordinary business” or lacking “relevance.” SLBs 14J and 14K also provided guidance concerning the micromanagement prong of the “ordinary business” exclusion.

The new SLB 14L restates (with technical updates) portions of the rescinded guidance relating to the use of images in shareholder proposals and proof of ownership letters. In addition, SLB 14L provides guidance on the use of email with respect to shareholder proposals.

Significant Policy Exception to ‘Ordinary Business’

Rule 14a-8(i)(7) permits a company to exclude a proposal that “deals with a matter relating to the company’s ordinary business operations.” Under this exclusion, companies may exclude proposals relating to matters that are “so fundamental to management’s ability to run a company on a day-to-day basis that they could not, as a practical matter, be subject to direct shareholder oversight” unless, in the staff’s view, the proposal focuses on policy issues that are sufficiently significant because they transcend ordinary business and would be appropriate for a shareholder vote.

The rescinded Staff Legal Bulletins established that the significance of an issue should be viewed in the context of the particular company and encouraged companies to provide a board analysis assessing whether the particular policy issue raised by the proposal was sufficiently significant to the company.

SLB 14L rejects that approach, and instead the staff will focus on whether the proposal raises issues with broad societal impact such that they transcend ordinary business. As an example, SLB 14L provides that “proposals squarely raising human capital management issues with a broad societal impact would not be subject to exclusion solely because the proponent did not demonstrate that the human capital management issue was significant to the company.”

Micromanagement

Under the ordinary business exclusion, companies may exclude a proposal that “micromanages” the company “by probing too deeply into matters of a complex nature,” which may occur if the proposal “involves intricate detail, or seeks to impose specific time frames or methods for implementing complex policies.” In SLB 14K, the staff expressed a view that its micromanagement determinations would turn on the prescriptiveness of a proposal.

SLB 14L reverses course on this approach and, going forward, the staff will take a “measured approach” to micromanagement arguments. SLB 14L specifically notes that proposals seeking detail or seeking to promote timeframes or methods “do not per se constitute micromanagement” and that the staff will focus on “the level of granularity sought in the proposal and whether and to what extent it inappropriately limits discretion of the board or management.” In addition, SLB 14L explains that in order to assess whether a proposal probes matters “too complex” for shareholder consideration, the staff may consider “the sophistication of investors generally on the matter, the availability of data, and the robustness of public discussion and analysis on the topic” as well as “references to well-established national or international frameworks when assessing proposals related to disclosure, target setting, and time frames.”

SLB 14L further notes that the staff will not concur with exclusion of climate change proposals that “suggest targets or timelines so long as the proposals afford discretion to management as to how to achieve such goals.”

Relevance

Rule 14a-8(i)(5) permits a company to exclude a proposal that “relates to operations [that] account for less than 5 percent of the company’s total assets at the end of its most recent fiscal year, and for less than 5 percent of its net earnings and gross sales for its most recent fiscal year, and is not otherwise significantly related to the company’s business.”

SLB 14I encouraged companies to submit a board analysis to support the argument that the proposal topic was not “otherwise significantly related to the company’s business.” The new guidance rejects the need for a board analysis and reverts to the prior approach of not excluding proposals that “raise issues of broad social or ethical concern related to the company’s business” even if the relevant business falls below the economic thresholds of Rule 14a-8(i)(5).

Images in Proposals; Proof of Ownership Letters

The rescinded Staff Legal Bulletins contained guidance on the topics of images in proposals and proof of ownership letters. SLB 14L reissues that prior guidance, generally, with technical updates. This guidance expresses the staff’s view that the use of graphs and/or images to convey information about a proposal is not prohibited by the 500-word rule. In addition, SLB 14L updates suggested language concerning broker letters to reflect the revised ownership thresholds adopted in the September 2020 amendments to Rule 14a-8(b) and reiterates that the staff generally does not find overly technical arguments regarding broker letters persuasive.

Further, SLB 14L expresses a new staff view that companies should identify any specific defects in the proof of ownership letter, even if the company previously sent a deficiency notice prior to receiving proof of ownership.

Use of Email

SLB 14L encourages proponents wishing to submit a proposal by email to contact the company to obtain the correct email address, and for companies to provide an appropriate email address upon request. The staff also encourages senders of email to seek confirmation of receipt from the recipient and for recipients to provide such confirmation when using email to transmit shareholder proposals, deficiency letters and responses to deficiency letters.

For additional information, see our November 5, 2021, client alert “SEC Staff Issues New Shareholder Proposal Guidance, Rescinding 2017-2019 Guidance.” A copy of SLB 14L is available here.

SEC Excludes Registered Investment Companies and BDCs From Application of Universal Proxy Rules

On November 17, 2021, the SEC adopted amendments to the proxy rules mandating the use of universal proxy cards in contested elections. The new rules require both companies and dissidents to list on their proxy cards all duly nominated director candidates: the board’s nominees, the dissident’s nominees and any proxy access nominees.

Whether universal proxy cards will increase companies’ exposure to activist campaigns and proxy fights, as suggested by some, remains to be seen.

The rules were adopted largely as proposed in 2016, with the main change requiring a dissident to represent that it will solicit holders of at least 67% of the voting power entitled to vote in the election of directors. The new rules take effect for shareholder meetings held after August 31, 2022, and will not apply to elections held by registered investment companies and BDCs (funds).

The SEC noted that funds were not included in the original rule proposal and stated, “In light of developments since 2016, as well as the comments that we have received, we believe further consideration of the application of a universal proxy mandate to some or all funds before deciding how to proceed with respect to funds is appropriate.” Fund industry participants, in particular registered closed-end funds and BDCs, should remain in active dialogue with the SEC to continue to explain the fundamental differences between activism in an operating company context and activism in a fund context, along with fund activism’s harmful impact on long-term fund shareholders.

For additional information, see our November 19, 2021, client alert “SEC Mandates Universal Proxy Cards in Election Contests” and the SEC’s adopting Release No. 34-93596.

SEC Proposes To Rescind Portions of 2020 Proxy Voting Advice Rulemaking

On November 17, 2021, the SEC, by a 3-2 vote, proposed amendments to the rules governing proxy voting advice businesses (proxy advisors). The amendments would rescind two portions of the proxy rules adopted in 2020 (2020 Amendments) governing (i) the exemptions from the proxy information and filing requirements and (ii) the anti-fraud provisions.

Proxy voting advice provided by a proxy advisor generally is a “solicitation” under the proxy rules. This long-standing SEC position was codified by the 2020 Amendments and is not affected by the current proposal. A solicitation under the proxy rules is subject to information and filing requirements, unless an exemption applies. To qualify for such exemptions, the 2020 Amendments require, among other things, that proxy advisors adopt and disclose written policies and procedures reasonably designed to ensure that:

(i) proxy advisory firms make available to companies that are the subject of proxy voting advice such advice before or at the same time that it is disseminated to the clients of such proxy advisory firm; and

(ii) proxy advisory firms provide their clients with a means of becoming aware of any written statements regarding the proxy advisory firms’ advice by the companies that are the subject of the advice before a shareholders’ meeting takes place.

The proposed amendments would rescind those requirements, as well as the related safe harbors and exclusions. The requirement added by the 2020 Amendments that the proxy advisor disclose material conflicts of interest and steps taken to address those conflicts would remain in place.

All soliciting material, including proxy voting advice, is subject to the proxy rules’ anti-fraud provisions, which prohibit false or misleading soliciting material. The 2020 Amendments added to the proxy rules’ anti-fraud provisions a note setting forth nonexclusive examples of when failing to disclose certain information in proxy voting advice may be considered misleading. The proposed amendments would rescind that note, although the proposing release reaffirms that proxy voting advice is subject to the prohibition on false and misleading soliciting material.

Comments on the proposal are due on December 27, 2021.

See the SEC’s proposing Release No. 34-93595, as well as our November 22, 2021, client alert “SEC Proposes Rescinding 2020 Amendments to Rules Governing Proxy Advisors” and our July 27, 2020, client alert “SEC Adopts Proxy Rule Amendments Relating to Proxy Voting Advice Businesses.”

SEC Proposes Rule Requiring the Reporting of Material Terms of Securities Lending Transactions

On November 18, 2021, the SEC proposed a new rule, Exchange Act Rule 10c-1, to increase transparency in the securities lending market and ensure regulators have access to timely and comprehensive information about the market for securities lending.

The proposal, if adopted, would require lenders of securities to provide the material terms of securities lending transactions to a registered national securities association (RNSA), which, in turn, would make the terms available to the public. The terms of a securities lending transaction that would be made public include:

- the legal name of the issuer of the securities to be borrowed;

- the ticker symbol of those securities;

- the time and date of the loan;

- the name of the platform or venue, if one is used;

- the amount of loaned securities;

- rates, fees, charges and rebates for the loan, as applicable;

- the type of collateral provided for the loan and the percentage of the collateral provided to the value of the loaned securities;

- the termination date of the loan, if applicable; and

- the borrower type.

The RNSA would also collect the following information that would not be made available to the public:

- the legal names of the parties to the loan;

- when the lender is a broker-dealer, whether the security loaned to its customer is loaned from the broker-dealer’s inventory; and

- whether the loan will be used to resolve a failure to deliver either pursuant to Rule 204 of Regulation SHO or outside of Regulation SHO.

The RNSA would assign a unique identifier to each securities lending transaction in order to update the listing if any of the above terms are modified.

The proposed rule would also require that the RNSA would receive information concerning securities on a loan or available to loan by the end of each business day. The RNSA would then make all such information publicly available on an aggregated basis.

Comments are due 30 days after the proposal’s publication in the Federal Register.

See the proposing Release No. 34-93613 here.

Obeslo v. Great-West Capital Management, LLC

In Obeslo v. Great-West Capital Management, LLC, filed on January 29, 2016, in the District Court of Colorado, the plaintiffs alleged that an investment adviser breached its fiduciary duties under Section 36(b) of the Investment Company Act of 1940 (1940 Act) by charging excessive advisory fees to 17 Great-West funds. On September, 28, 2019, the court denied the defendants’ motion for summary judgment. This is one of the few cases where board deference was not granted at summary judgment, and the plaintiffs focused almost their entire case on this factor. The bench trial before Judge Christine Arguello began on January 13, 2020, and lasted 11 days. On August 7, 2020, the district court ruled in favor of the defendants and dismissed all of the plaintiffs’ claims. The U.S. Court of Appeals for the Tenth Circuit affirmed the dismissal of plaintiffs’ claims on July 26, 2021, and held that the plaintiffs failed to prove a breach of fiduciary duty under Section 36(b).

The Tenth Circuit noted that “two basic patterns pervade Plaintiffs’ arguments and tilt each [Gartenberg] factor in Defendants’ favor.” First, the court concluded that plaintiffs could not “overcome the standard of review they face on appeal,” as the record was “so flush with support for the district court’s factual findings that Plaintiffs are left with little recourse beyond relitigating facts decided in district court.” Second, the court concluded that, “even putting aside this arduous standard of review,” plaintiffs were not able to “satisfy their burden under § 36(b).”

The Tenth Circuit applied these “two basic patterns” to each of the Gartenberg factors and held that “the district court did not err on any factor.”

Board Deference: The court began its analysis with the “most important” factor: board deference. The Tenth Circuit held that the board members were independent and conscientious and their process was robust. Relying on other 36(b) decisions — including BlackRock, Harbor Capital, and JPM/Goodman — the court rejected the plaintiffs’ primary arguments that (i) the adviser “understated the profitability on its advisory fee by including [recordkeeping fees] in the [fee] calculation” and (ii) “a more robust board process or conscientious board would have necessarily pursued lower fees or employed more aggressive tactics.”

Comparative Fees: The Tenth Circuit held that the district court appropriately considered comparative fees (including Lipper comparisons) of peer funds and rejected the plaintiffs’ argument that the fee comparisons were improper “because they compared funds’ total expense ratios instead of advisory fees or administrative fees.” The Tenth Circuit further held that the district court properly found that the at-issue funds’ advisory fees were “within the range of comparable funds.”

Economies of Scale: The court summarily dismissed the plaintiffs’ economies of scale argument, reasoning that the plaintiffs failed to “present any evidence proving [the adviser] achieved economies of scale.”

Fall-Out Benefits: The plaintiffs did not contest this Gartenberg factor — which addresses potential ancillary benefits of the advisory relationship to the adviser — on appeal.

Profitability: The Tenth Circuit held that the plaintiffs failed to meet “their statutory burden” and “offer persuasive evidence demonstrating Defendants’ profits exceeded the outer bounds of arm’s-length bargaining.” The court affirmed that the defendants’ profitability was “within the range of their competitors.”

Quality and Performance: The court rejected the plaintiffs’ argument that the defendants’ services did not justify their fees, holding that plaintiffs “must do more than demonstrate Defendants’ fees were higher than other advisers,” determining instead that plaintiffs must show that defendants’ fees bear “no reasonable relationship to the services rendered.” The plaintiffs could not meet this burden where “the quality of Defendants’ services [were] evidenced by the funds’ comparatively good performance.”

Taking into account all of the Gartenberg factors as well as all other “relevant circumstances,” the court held that the plaintiffs failed to prove a breach of fiduciary duty under Section 36(b). Because the plaintiffs failed to demonstrate a breach of fiduciary duty, the Tenth Circuit declined to review the district court’s additional finding that the plaintiffs “failed to meet their burden with respect to damages.”

For a summary of the trial court’s ruling, see our client alert “Investment Management Retrospective: 2020’s Second Half.”

SEC Chair Discusses Cryptocurrencies at Aspen Security Forum

On August 3, 2021, SEC Chair Gary Gensler spoke at the Aspen Security Forum, offering his views on the regulation of cryptocurrencies.

Chair Gensler echoed former chair Jay Clayton, noting with respect to the status of tokens as securities:

I think former SEC Chairman Jay Clayton said it well when he testified in 2018: “To the extent that digital assets like [initial coin offerings, or ICOs] are securities — and I believe every ICO I have seen is a security — we have jurisdiction, and our federal securities laws apply.”

I find myself agreeing with Chairman Clayton. You see, generally, folks buying these tokens are anticipating profits, and there’s a small group of entrepreneurs and technologists standing up and nurturing the projects. I believe we have a crypto market now where many tokens may be unregistered securities, without required disclosures or market oversight.

…

Make no mistake: It doesn’t matter whether it’s a stock token, a stable value token backed by securities, or any other virtual product that provides synthetic exposure to underlying securities. These products are subject to the securities laws and must work within our securities regime.

With respect to exchange-traded funds (ETFs), Chair Gensler did not comment on the potential for approving a bitcoin ETF.4 Instead, he addressed bitcoin future ETFs:

Next, I want to turn to investment vehicles providing exposure to crypto assets. Such investment vehicles already exist, with the largest among them having been around for eight years and worth more than $20 billion. [See FN 13 of the speech.] Also, there are a number of mutual funds that invest in bitcoin futures on the Chicago Mercantile Exchange (CME).

I anticipate that there will be filings with regard to exchange-traded funds (ETFs) under the Investment Company Act (1940 Act). When combined with the other federal securities laws, the 1940 Act provides significant investor protections. Given these important protections, I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded bitcoin futures.

On the topic of custody of digital assets, Chair Gensler noted that the SEC is seeking public input on custody arrangements by broker-dealers and relating to investment advisers and intends to “maximize regulatory protections in this area.”

Chair Gensler expressed in his statement that the SEC needs additional congressional authority to regulate crypto products. He stated:

We need additional congressional authorities to prevent transactions, products, and platforms from falling between regulatory cracks. We also need more resources to protect investors in this growing and volatile sector. … Regulators benefit from additional plenary authority to write rules for and attach guardrails to crypto trading and lending.

See Chair Gensler’s public statement here.

Over 60 of the Nation’s Leading Law Firms Respond to Investment Company Act Lawsuits Targeting the SPAC Industry

In fall of 2021, a purported shareholder of multiple special purpose acquisition companies (SPACs) initiated derivative lawsuits asserting that the SPACs are investment companies under the 1940 Act because proceeds from their initial public offerings are invested in short-term treasuries and qualifying money market funds. In response, 60 leading law firms filed a joint statement, noting:

SPACs, however, are engaged primarily in identifying and consummating a business combination with one or more operating companies within a specified period of time. In connection with an initial business combination, SPAC investors may elect to remain invested in the combined company or get their money back. If a business combination is not completed in a specified period of time, investors also get their money back. Pending the earlier to occur of the completion of a business combination or the failure to complete a business combination within a specified timeframe, almost all of a SPAC’s assets are held in a trust account and limited to short-term treasuries and qualifying money market funds.

Consistent with longstanding interpretations of the 1940 Act, and its plain statutory text, any company that temporarily holds short-term treasuries and qualifying money market funds while engaging in its primary business of seeking a business combination with one or more operating companies is not an investment company under the 1940 Act. As a result, more than 1,000 SPAC IPOs have been reviewed by the staff of the SEC over two decades and have not been deemed to be subject to the 1940 Act.

The undersigned law firms view the assertion that SPACs are investment companies as without factual or legal basis and believe that a SPAC is not an investment company under the 1940 Act if it (i) follows its stated business plan of seeking to identify and engage in a business combination with one or more operating companies within a specified period of time and (ii) holds short-term treasuries and qualifying money market funds in its trust account pending completion of its initial business combination.

For a copy of the letter, see our September 3, 2021, client alert “Over 60 of the Nation’s Leading Law Firms Respond to Investment Company Act Lawsuits Targeting the SPAC Industry.”

SEC Approves Inflation Adjustment of the Dollar Amount Tests for Qualified Clients Under Advisers Act Rule 205-3

On June 17, 2021, the SEC published an order approving an adjustment to the dollar amount thresholds of the “assets-under-management test” and the “net worth test” for a “qualified client” under Rule 205-3 of the Investment Advisers Act of 1940, as amended (Advisers Act). The new tests became effective August 16, 2021.

Background

Section 205(a)(1) of the Advisers Act generally prohibits a registered investment adviser from entering into, extending, renewing or performing any investment advisory contract that provides for compensation to the adviser based on a share of capital gains on or capital appreciation of the funds of a client (also referred to as “performance fees”). Rule 205-3 promulgated under the Advisers Act exempts a registered investment adviser from this prohibition when the client is a “qualified client” (defined in Rule 205-3(d)(1)), allowing an adviser to charge performance fees if the client has at least a certain dollar amount in assets under management with the adviser immediately after entering into the advisory contract (referred to as the “assets-under-management test”) or if the adviser reasonably believes, immediately prior to entering into the contract, that the client has a net worth of more than a certain dollar amount (referred to as the “net worth test”). The Dodd-Frank Wall Street Reform and Consumer Protection Act requires the SEC to adjust the dollar thresholders for the effects of inflation (rounded to the nearest multiple of $100,000) every five years, with the prior inflation adjustment occurring in 2016.

SEC Order

The SEC’s order will increase the dollar amount of the assets-under-management test from $1,000,000 to $1,100,000 and the dollar amount of the net worth test from $2,100,000 to $2,200,000 to reflect inflation from 2016 to the end of 2020. The SEC’s order provides that to the extent that parties entered into contractual relationships prior to the order’s August 16, 2021, effective date, the dollar amount test adjustments would not generally apply retroactively to such contractual relationships, subject to the transition rules incorporated in Rule 205-3.

See the SEC’s order here.

SEC Modernizes Filing Fee Disclosure and Payment Methods

On October 13, 2021, the SEC adopted amendments to modernize filing fee disclosure and payment methods. The amendments revise most fee-bearing forms, schedules and related rules to require operating companies and investment companies to present the information required for filing fee calculation in a separate exhibit structured in Inline eXtensible Business Reporting Language. The amendments also add new options to pay filing fees by automated clearing house and debit and credit cards, and eliminate options to pay fees via paper checks and money orders.

The amendments affect the following rules and forms under the Securities Act of 1933 (Securities Act), the Securities Exchange Act of 1934 (Exchange Act) and the 1940 Act:

- Securities Act

- Rules 111, 415, 424, 456, 457, 473; and

- Forms S-1, S-3, S-8, S-11, N-14, S-4, F-1, F-3, F-4, F-10, SF-1, SF-3.

- Exchange Act

- Rules 0-9, 0-11, 13e-1; and

- Schedules 13E-3, 13E-4F, 14A, 14C, TO, 14D-1F.

- 1940 Act

- Rule 0-8; and

- Form 24F-2.

- Securities Act and 1940 Act

- Form N-2.

The amendments generally will be effective on January 31, 2022. The amendments that will add or eliminate payment options will be effective on May 31, 2022.

The amendments provide for a transition period for compliance with the structuring requirements. Large accelerated filers will become subject to the structuring requirements for filings they submit on or after 30 months after the January 31, 2022, effective date. Accelerated filers, certain investment companies that file registration statements on Forms N-2 and N-14 and all other filers will become subject to the structuring requirements for filings they submit on or after 42 months after the January 31, 2022, effective date. Compliance with the amended disclosure requirements other than the structuring requirements will be mandatory on the January 31, 2022, effective date.

See the final rule release here.

SEC Outlines Observations From Examinations in Registered Investment Company Initiatives

On October 26, 2021, the SEC’s Division of Examinations issued a risk alert that outlined observations made by the staff during a series of examinations of mutual funds and exchange-traded funds and their investment advisers from 2018 and 2019 that focused on industry practices and regulatory compliance in several areas that may have an impact on retail investors (referred to as the RIC Initiatives). The staff noted that the risk alert is intended to highlight risk areas and to assist funds and their advisers in developing and enhancing their compliance programs and practices.

Compliance Programs

The staff observed deficiencies or weaknesses related to funds’ and their advisers’ compliance programs for portfolio management and other business practices, and to board oversight of funds’ compliance programs, including the following:

- Funds and their advisers did not establish, maintain, update, follow and/or appropriately tailor their compliance programs to address various business practices, including portfolio management, valuation, trading, conflicts of interest, fees and expenses, and advertising. The staff listed examples of inadequate policies and procedures relating to compliance oversight of investments and portfolios, valuation, trading practices, conflicts of interest, fees and expenses, and fund advertisements and sales literature.

- Regarding funds’ policies and procedures for their boards’ oversight of the funds’ compliance programs, funds failed to:

- maintain appropriate policies, procedures and processes for monitoring and reporting to their boards with accurate information;

- provide appropriate processes as part of the respective fund board’s annual review and approval of the fund’s investment advisory agreement under Section 15(c) of the 1940 Act regarding the board’s considerations as to whether the adviser has any financial condition that is reasonably likely to impair its ability to meet its contractual commitments to clients;

- complete required annual reviews of the funds’ compliance programs that address the adequacy of policies and procedures and effectiveness of their implementation;

- ensure that the annual report from the respective fund’s chief compliance officer addressed the operation of the policies and procedures of the fund’s adviser, including whether the adviser had policies and procedures in specific risk areas; and

- adopt or maintain appropriate policies and procedures for the funds’ boards to exercise appropriate oversight in instances where the funds delegated responsibilities to their advisers that were not reflected in the advisers’ compliance programs.

Disclosure to Investors

The staff observed deficiencies or weaknesses related to funds’ disclosures to investors in fund filings, advertisements, sales literature and/or other shareholder communications, including the following:

- Funds’ filings contained inaccurate, incomplete and/or omitted disclosures.

- Funds had inaccurate, incomplete and/or omitted disclosures on a variety of advertising and sales literature-related topics.

Compliance and Disclosure Best Practices

In the risk alert, the staff also provided examples of practices that they observed that may assist funds and their advisers in designing and implementing their compliance programs.

- The practices included:

- review of compliance policies and procedures for consistency with practices;

- conducting periodic testing and reviews for compliance with disclosures and assessing the effectiveness of compliance policies and procedures in addressing conflicts of interests;

- ensuring compliance programs adequately address the oversight of key vendors, such as pricing vendors; and

- adopting and implementing policies and procedures to address: (i) compliance with applicable regulations; (ii) compliance with the terms and conditions of applicable exemptive orders and any related required disclosures; and (iii) undisclosed conflicts of interest, including potential conflicts between funds and/or advisors and their affiliated service providers.

- Board oversight of funds’ compliance programs included assessment by the board of whether:

- the information provided to the board is accurate, including whether funds’ and their advisors are accurately disclosing to the board: (i) funds’ fees, expenses and performance; and (ii) funds’ investment strategies, and changes to and risks associated with the respective strategies; and

- the funds adhere to processes for board reporting, including an annual review of the adequacy of the funds’ compliance program and effectiveness of its implementation.

- Policies and procedures concerning disclosure required:

- review and amendment of disclosures in funds’ prospectuses, statements of additional information (SAIs), shareholder reports or other investor communications consistent with the funds’ investments and investment policies and restrictions;

- amendment of disclosures for consistency with actions taken by the funds’ board, as applicable;

- update of funds’ website disclosures concurrently with new or amended disclosures in the funds’ prospectuses, SAIs, shareholder reports or other client communications;

- review and testing of fees and expenses disclosed in funds’ prospectuses, SAIs, shareholder reports or other client communications for accuracy and completeness of presentation; and

- review and testing of funds’ performance advertising for accuracy and appropriateness of presentation and applicable disclosures.

See the “Observations From Examinations in the Registered Investment Company Initiatives” risk alert here.

SEC Outlines Observations From Examinations in Advisory Fee Calculation Initiative

On November 10, 2021, the SEC’s Division of Examinations issued a risk alert based on the staff’s observations of whether advisers have (i) instituted procedures and policies reasonably designed to result in fees that are fair and accurate and (ii) disclosed fees with sufficient clarity such that clients understand the costs associated with the advisers’ services. This risk alert supplements a prior risk alert issued by the Division of Examinations in 2018, providing greater detail on certain compliance issues. The updated risk alert notes that the staff’s observations are derived from a recent advisory fees examination initiative assessing how investment advisers charge fees for their services and evaluating the adequacy of fee disclosures and the accuracy of fee calculations (Fee Initiative).

Fee Initiative Scope

The risk alert explained that during the Fee Initiative, the staff focused its review on the following areas:

- the accuracy of the fees charged by the examined advisers;

- the accuracy and adequacy of the examined advisers’ disclosures; and

- the effectiveness of the examined advisers’ compliance programs and accuracy of their books and records.

Observations Related to the Fees Initiative Scope

The risk alert noted that while fee arrangements and calculation methodologies vary by adviser, the typical adviser featured the following characteristics, which may provide helpful context when reviewing the observations:

- a standard fee schedule with tiered fee levels based on assets under management;

- quarterly assessment of its advisory fees;

- deduction of advisory fees directly from clients’ accounts;

- calculation of fees based on the account value at the beginning or ending date of the billing period;

- use of software or third-party service providers to calculate fees;

- documentation of advisory fees with clients through written advisory agreements or contracts; and

- combination of family account values when such actions resulted in lower fees.

Advisory Fee Calculations

Several examined advisers charged advisory fees inaccurately due to a variety of errors including:

- using inaccurate percentages to calculate advisory fees;

- double-billing advisory fees;

- incorrectly calculating breakpoint or tiered billing rates;

- incorrectly calculating householding of client accounts; and

- using incorrect client account valuations.

Several advisers either did not refund prepaid fees on terminated accounts or did not assess fees for new accounts on a pro rata basis. Common issues related to refunding prepaid fees included inconsistently refunding unearned fees and requiring clients to provide written requests to refund unearned advisory fees.

False, Misleading or Omitted Disclosures

The Fee Initiative identified a range of disclosure issues, including disclosure that (i) did not reflect current fees charged or whether fees were negotiable, (ii) did not accurately describe how fees were calculated or billed and (iii) was inconsistent across advisory documents. For example:

- Disclosures inconsistently or insufficiently described how cash flows may impact client advisory fees.

- Disclosures reflected inaccurate timing of advisers’ fee billing.

- Disclosures reflected inaccurate values used to calculate advisory fees.

- Advisers did not fully disclosure fee structures related to minimum fees, extra fees and discounts.

Missing or Inadequate Policies and Procedures

Many of the examined advisers did not maintain written policies and procedures addressing advisory fee billing, monitoring of fee calculations and billing, or both. Policies and procedures should specifically address fee calculations and material advisory fee components, including the valuation of hard-to-value assets, fee offsets, reimbursements, or proration and family account aggregation.

Inaccurate Financial Statements

The staff observed issues or inaccuracies with financial statements with respect to advisory fees, including advisers’ improperly recording prepaid advisory fees as liabilities or maintaining their financial statements.

Observations To Improve Compliance

The risk alert also discussed industry best practices observed by the staff, Some of the best industry practices regarding compliance included:

- adopting and implementing written policies and procedures addressing advisory fee billing processes and validating fee calculations;

- centralizing the fee billing process and validating that fees charged to clients are consistent with compliance procedures, advisory contracts and disclosures;

- ensuring use of the resources and tools established for reviewing fee calculations; and

- properly recording all advisory expenses and fees assessed to and received from clients, including those paid directly to advisory personnel.

See the Investment Advisers’ Fee Calculations risk alert here.

SEC Issues Risk Alert Regarding Fixed Income Principal and Cross Trades by Investment Advisers

On July 21, 2021, the SEC’s Division of Examinations issued a risk alert based on the staff’s observations of compliance issues related to fixed income principal and cross trades by registered investment advisers. The risk alert supplements a prior risk alert issued by the Division of Examinations in 2019 by providing greater detail on certain compliance issues (see the 2019 risk alert). The updated risk alert notes that the staff’s observations are derived from a 2017 examination initiative that focused on registered investment advisers that engaged in cross trades, principal trades or both involving fixed income securities (FIX Initiative).

FIX Initiative Focus Areas

The risk alert explained that during the FIX Initiative, the staff focused its review on the following areas:

- conflicts of interest, such as whether these trades appeared to be made in the clients’ best interests, rather than to further the interests of the advisers;

- compliance programs, such as whether the advisers’ adopted written policies and procedures pursuant to Rule 206(4)-7 of the Advisers Act (Compliance Rule)5 effectively addressed these trades; and

- disclosures, such as whether the conflicts of interest related to these trades were fully and fairly disclosed to clients.

Observations Related to FIX Initiative Focus Areas

The risk alert noted that nearly two-thirds of the advisers examined by the staff received staff-issued deficiency letters. The vast majority of deficiencies the staff observed were related to compliance program issues, conflicts of interest and disclosures.

Compliance Programs

Over half of the deficiencies the staff observed were related to issues with the examined advisers’ compliance policies and procedures. For example:

- Policies and procedures were inconsistent with the advisers’ practices, its disclosures and/or regulatory requirements.

- Policies and procedures lacked certain considerations or guidance, such that the advisers’ personnel did not have the full scope of information that may be necessary to achieve compliance.

- Policies and procedures were not effectively tested.

Conflicts of Interest

The staff’s review of the advisers’ practices often identified conflicts of interest associated with cross trades that were not identified by the advisers and mitigated, disclosed or otherwise addressed by their compliance programs. For example:

- Cross trades were contrary to the advisers’ written policies and procedures in that they were not executed at independent market prices for the securities and did not use best price and best execution efforts, which resulted in at least one of the participating clients receiving an unfair price for the securities.

- Cross traders were subject to markups or other fees that were not fully disclosed.

Written Disclosures

The staff observed that over one-third of the cross trade-related deficiencies addressed disclosure issues, including omissions of relevant cross trades and information about conflicts of interest in the advisers’ Form ADV and/or other written communications with clients.

Observations To Improve Compliance

The risk alert also discussed industry best practices observed by the staff.

Some of the best industry practices regarding compliance programs included:

- adopting and enforcing compliance policies and procedures that:

(i) incorporate all applicable legal and regulatory requirements;

(ii) clearly articulate the activities covered by the advisers’ written compliance policies and procedures;

(iii) set standards that address the firms’ expectations for each of these activities;

(iv) include supervisory policies and procedures; and

(v) establish controls to determine whether policies and procedures are being properly followed and documented in the required manner;

- conducting testing for compliance with policies and procedures; and

- placing conditions, qualifications or restrictions within clients’ accounts on the execution of principal trades, cross trades or both.

Some of the best industry practices regarding written disclosures included:

- providing clients with full and fair disclosure of all material facts surrounding principal and cross trades; and

- providing disclosures to clients regarding principal- and cross-trading practices in multiple documents, including in:

(i) Form ADV, Part 2A;

(ii) advisory agreements;

(iii) separate written communications to clients; and/or

(iv) private fund offering documents, when applicable.

SEC Proposes To Enhance Proxy Voting Disclosure by Investment Companies and Require Disclosure of ‘Say-on-Pay’ Votes for Institutional Investment Managers

On September 29, 2021, the SEC proposed amendments to Form N-PX to enhance the information mutual funds, exchange-traded funds and certain other funds, including closed-end funds and insurance company separate accounts organized as management investment companies that offer variable annuity contracts, report annually about their proxy votes.

The proposal, if adopted, would require a fund to:

- tie the description of each voting matter to the issuer’s form of proxy and categorize each matter by type to help investors identify votes of interest and compare voting records;

- use a structured data language either via an SEC-supplied web-based form or an Extensible Markup Language file;

- disclose how its securities lending activity, if any, impacted its voting; and

- provide its proxy record on (or through) its website.

The proposal would also require institutional investment managers subject to Section 13(f) reporting requirements under the Exchange Act to disclose annually how they voted their proxies on executive compensation, or “say-on-pay” matters. The SEC noted in the release proposing the rule that this aspect of the proposal is aimed at completing implementation of the remaining rulemaking mandates under the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Interested parties can submit comments on the proposal on or before December 14, 2021.

See the “Enhanced Reporting of Proxy Votes by Registered Management Investment Companies; Reporting of Executive Compensation Votes by Institutional Investment Managers” proposal release here.

SEC Issues Risk Alert Regarding Investment Advisers Managing Client Accounts That Participate in Wrap Fee Programs

On July 21, 2021, the SEC’s Division of Examinations issued a risk alert based on the staff’s examinations of investment advisers associated with wrap fee programs, which generally focused on:

- whether the adviser had acted consistently with its fiduciary duty obligations;

- whether the adviser provided full and fair disclosures of all material facts to its clients participating in the wrap fee programs, particularly regarding the fees, expenses, conflicts of interest and entities involved in the programs; and

- the effectiveness of the adviser’s compliance policies and procedures and other processes, particularly those for determining whether the wrap fee programs and accounts were in the best interests of its clients.

The risk alert describes the most common deficiencies observed by the staff, as well as industry best practices, which are summarized below.

Observations Regarding Common Deficiencies

The risk alert notes that the most frequently cited deficiencies were related to (i) compliance and oversight, including policies and procedures regarding the tracking and monitoring of the wrap fee programs; and (ii) disclosures, particularly those regarding conflicts, fees and expenses.

Fiduciary Duty and Recommendations Not Made in Clients’ Best Interest

The staff observed issues with the advisers’ recommendations for clients to participate in wrap fee programs relating to both the advisers’ trading practices and their assessments that the wrap fee programs were initially, and on an ongoing basis, in the best interests of their clients. For example:

- Advisers did not monitor the trading activity in clients’ accounts, or their monitoring activities were ineffective. The risk alert noted that the most common duty-of-care issue was the advisers’ failure to monitor for “trading-away” from the broker-dealers providing bundled brokerage services to the wrap fee programs and the associated costs of such trading-away practices.

- Advisers did not have a reasonable basis to believe that the wrap fee programs were in the clients’ best interests. The staff observed instances where the advisers routinely recommended that their clients participate in wrap fee programs without conducting any assessments as to whether programs were in the best interests of clients (initially, on an ongoing basis or both).

Potentially Misleading or Omitted Disclosures

The staff observed that many of the advisers had omitted or provided inadequate disclosures, particularly disclosures regarding conflicts of interest, fees and expenses. For example:

- Disclosure was inconsistent across advisers’ Part 2A of Form ADV (the firm brochure), sponsors’ Part 2A Appendix 1 of Form ADV (the wrap fee program brochure), advisory agreements and other account documents and agreements for wrap fee clients.

- The disclosures often omitted or inadequately described the financial incentives the examined advisers and their supervised persons had to make certain recommendations.

Compliance Programs

The staff observed that some advisers maintained weak or ineffective compliance policies and procedures relating to their wrap fee programs. The staff also observed instances in which the advisers did not comply with their own policies and procedures, and a few advisers did not comply with the annual review and other provisions of the Compliance Rule. For example:

- In many cases, the advisers did not adopt and implement written compliance policies and procedures for key business functions and risk areas, including conducting initial and/or ongoing best interest reviews when recommending wrap fee accounts to clients. In some instances, the advisers had no compliance policies or procedures that addressed the risk applicable to recommending and managing client participation in wrap fee programs, despite providing advisory services to such programs. Finally, some advisers followed internal guidelines or informal practices for key operational areas, but had not memorialized these practices in written compliance policies and procedures.

- Some examined advisers failed to maintain adequate policies and procedures for key areas in their compliance programs.

- Several of the advisers had not fully implemented or enforced their compliance policies and procedures.

- Some of the advisers either did not conduct annual compliance reviews or conducted annual reviews that were inadequate due to: (i) limited testing or validation; (ii) failures to review the effectiveness of the advisers’ policies and procedures; or (iii) inability to demonstrate that the advisers performed an annual review.

Best Industry Practices

The risk alert also discussed the staff’s observations of industry best practices. The staff noted that during the examinations, it observed advisers implementing a range of policies and practices to address their legal and regulatory obligations related to the compliance issues identified in the risk alert.

Some of the best industry practices regarding fiduciary duty and recommendations made in clients’ best interest included:

- conducting reviews of wrap fee programs — both initially and periodically thereafter — to assess whether the programs recommended to clients are in the best interests of the clients, using information obtained directly from them (e.g., through interviews, discussions and/or questionnaires);

- periodically reminding clients, after conducting initial best interest reviews associated with the recommendation to participate in wrap fee programs, to report any changes to their personal situations, financial standing or needs and their investment objectives that might impact their risk tolerances, investment allocations and/or recommended investments; and

- communicating with clients — in-person or by telephone, as appropriate — to prepare and educate them when recommending to convert their accounts from non-wrap fee accounts to participate in wrap fee programs.

Some of the best industry practices regarding disclosures included:

- providing clients with disclosures regarding the advisers’ conflicts of interest related to transactions executed within the wrap fee programs; and

- providing clear disclosures when recommending wrap fee programs to clients about services or expenses that are not included in the wrap fee.

Some of the best industry practices regarding compliance programs demonstrated that:

- Written compliance policies and procedures should include factors for advisers to consider, including asset allocations and selection of managers, when assessing whether investment recommendations made to clients participating in wrap fee programs are in the clients’ best interests.

- Compliance programs should monitor and validate that the advisers sought the best execution for clients’ transactions.

- Compliance policies and procedures should define what the advisers that recommend wrap fee programs to clients consider to be “infrequently” traded accounts and include review of such accounts to determine whether the wrap fee programs remain in the clients’ best interests.

See the “Observations From Examinations of Investment Advisers Managing Client Accounts That Participate in Wrap Fee Programs” risk alert here.

SEC Approves Nasdaq’s Board Diversity Rule

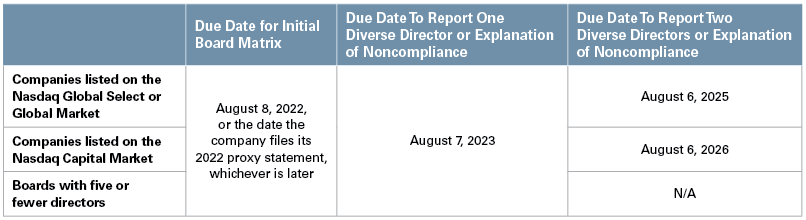

On August 6, 2021, the SEC approved the Nasdaq Stock Market’s (Nasdaq) proposal to amend its listing standards to encourage greater board diversity and to require board diversity disclosures for Nasdaq-listed companies. Subject to transition periods and limited exceptions, the new rules generally require Nasdaq-listed companies to (i) publicly disclose board-level diversity statistics on an annual basis using a standardized matrix under Nasdaq Rule 5606 and (ii) have or disclose why they do not have a minimum of two diverse board members under Nasdaq Rule 5605(f).

The new rules exempt certain SPACs, asset-backed issuers and other passive issuers, cooperatives, limited partnerships, management investment companies and issuers of certain specified securities from the board diversity objectives and disclosure requirements under Rules 5605 and 5606. Although Nasdaq has indicated in informal guidance that this rule applies to BDCs, Nasdaq’s informal guidance, in our view, contradicts the plain language of Rule 5605(f)(4) and Rule 5615(a)(5), which exempt BDCs from Nasdaq’s board diversity rules. The definition of “management investment company” in Rule 5615(a)(5) expressly includes BDCs, and Nasdaq appears to be conflating the application of the generalized exemption from Nasdaq’s corporate governance requirements applicable to “registered” management investment companies (i.e., registered closed-end funds) with the express exclusion from Rule 5605(f) of “management investment companies.” Absent further clarifying guidance from Nasdaq, however, BDCs listed on Nasdaq should prepare for compliance with the new board diversity rules.

The transition periods for companies listed on Nasdaq prior to August 6, 2021, are provided below:

For more information on the SEC’s order, see our August 10, 2021, client alert “SEC Approves Nasdaq Board Diversity Listing Standard.”

FINRA Issues Guidance Encouraging Firms To Prepare for Forthcoming Anti-Money Laundering Rules

On October 8, 2021, the Financial Industry Regulatory Authority (FINRA) issued a Regulatory Notice urging its member firms (i.e., broker-dealers) to consider how they will incorporate the U.S. Treasury Department’s governmentwide Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) priorities into their risk-based AML compliance programs.

The Treasury’s Financial Crimes Enforcement Network (FinCEN) has not yet promulgated final regulations specifying how financial institutions, including broker-dealers, should incorporate the AML/CFT priorities, but expects to do by the end of 2021. A proactive assessment of how to implement the priorities would put firms in a position to promptly incorporate the final regulations and ensure compliance with applicable rules, including FINRA Rule 3310.

For more information regarding the AML/CFT priorities and FINRA’s notice, see our October 15, 2021, client alert “FINRA Issues Guidance Encouraging Firms To Prepare for Forthcoming Anti-Money Laundering Rules.”

SEC Heightens Focus on Cybersecurity

On August 30, 2021, the SEC announced that eight broker-dealers and/or investment advisers will pay civil monetary penalties to resolve enforcement actions arising from cybersecurity incidents that led to exposure of personally identifying information of thousands of customers and clients. Each of the incidents involved email account takeovers by unauthorized third parties.

The SEC found that each of the firms violated Rule 30(a) of Regulation S-P — also known as the Safeguard Rule — that requires registered broker-dealers, investment companies and investment advisers to adopt policies to safeguard customer records and information. The actions underscore that consumer privacy regulations continue to provide the SEC with a mechanism to bring enforcement actions following cyber events, particularly where companies fail to (i) adopt or implement written cybersecurity policies or (ii) enhance their cybersecurity policies and practices in a timely manner following a breach.

For more information, see our September 1, 2021, client alert “SEC Heightens Focus on Cybersecurity.”

SEC Charges 27 Financial Firms for Form CRS Filing and Delivery Failures

On July 26, 2021, the SEC announced that 21 investment advisers and six broker-dealers have agreed to settle charges that they failed to timely file and deliver their client or customer relationship summaries (Form CRS) to their retail investors. All 27 firms agreed to settle their cases and pay civil penalties ranging from $10,000 to $97,523.

SEC Charges Mutual Fund Executives With Misleading Investors Regarding Investment Risks in Funds That Suffered $1 Billion Trading Loss

On May 27, 2021, the SEC filed a complaint in the U.S. District Court for the Northern District of Illinois against investment advisers LJM Funds Management Ltd. and LJM Partners Ltd. (collectively, LJM) and their portfolio managers, Anthony Caine and Anish Parvataneni, alleging that LJM fraudulently misled investors and the board of directors of a fund they advised about LJM’s risk management practices and the level of risk in LJM’s portfolios.

According to the SEC’s complaint, LJM adopted a short volatility trading strategy that carried remote but extreme risks. The complaint alleges that, in order to ease investor concerns about the potential for losses, LJM, Caine and Parvataneni made a series of misstatements to investors and the mutual fund’s board about LJM’s risk management practices, including false statements about its use of historical event stress testing and its commitment to maintaining a consistent risk profile instead of prioritizing returns. The complaint further alleges that, beginning in late 2017, during a period of historically low volatility, LJM, Caine, and Parvataneni increased the level of risk in the portfolios to seek return targets, while falsely assuring investors that the portfolios’ risk profiles remained stable. According to the complaint, in February 2018, the markets suffered a large spike in volatility, resulting in catastrophic trading losses exceeding $1 billion, or more than 80% of the value of the funds LJM managed, over two trading days.

The complaint charges the defendants with violating the antifraud provisions of the federal securities laws and seeks permanent injunctions, disgorgement with prejudgment interest and civil penalties.

In related proceedings, the SEC also instituted and settled administrative and cease-and-desist proceedings against LJM’s chief risk officer, Arjuna Ariathurai, who agreed, without admitting or denying the SEC’s findings, to an associational bar with a right to apply for reentry after three years, a civil penalty of $150,000, and disgorgement and prejudgment interest of $97,444.

See the SEC’s press release regarding the complaint and the order against Ariathurai here.

_______________

1 See our October 15, 2020, client alert “Impact of Rule 14a-8 Amendments on Closed-End Funds.”

2 Chair Gensler issued a public statement on June 1, 2020, in which he directed the staff of the Division of Corporate Finance as follows:

I am now directing the staff to consider whether to recommend further regulatory action regarding proxy voting advice. In particular, the staff should consider whether to recommend that the Commission revisit its 2020 codification of the definition of solicitation as encompassing proxy voting advice, the 2019 Interpretation and Guidance regarding that definition, and the conditions on exemptions from the information and filing requirements in the 2020 Rule Amendments, among other matters.

3 See our July 27, 2020, client alert “SEC Adopts Proxy Rule Amendments Relating to Proxy Voting Advice Businesses.”

4 Since Chair Gensler’s August 2021 public statement, the first U.S. bitcoin futures ETF launched on October 19, 2021.

5 Rule 206(4)-7 of the Advisers Act requires registered investment advisers to adopt and implement written policies and procedures that are reasonably designed to prevent violations of the Advisers Act and the rules thereunder by the advisers and their supervised persons.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.