On January 24, 2022, the Federal Trade Commission (FTC) announced the revised thresholds for determining whether companies are required to notify federal antitrust authorities about a transaction under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (HSR Act). If a proposed merger; acquisition of stock, assets or unincorporated interests; or other business combination meets certain thresholds, the parties must notify the FTC and the Department of Justice and observe a waiting period before consummating the transaction. Section 7A(a)(2) of the Clayton Act requires the FTC to revise all of the HSR Act thresholds annually, based on changes in the gross national product.

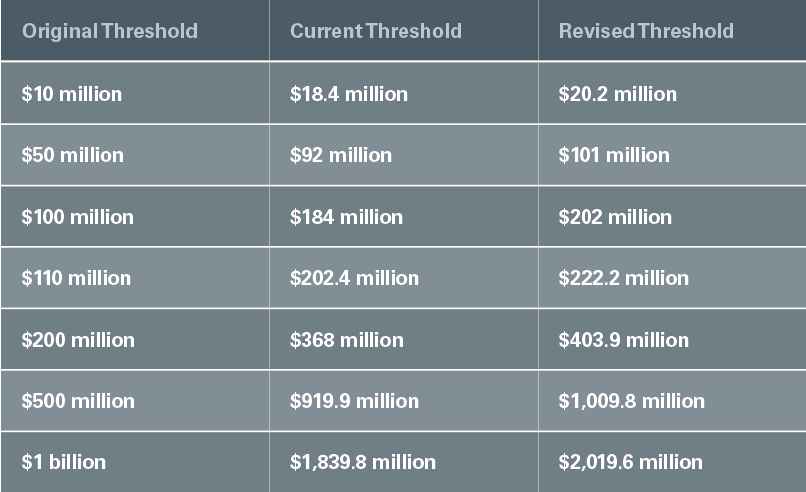

The new minimum filing threshold will be $101 million. All of the revised thresholds are higher than the current amounts, as shown on the chart below. The new HSR Act thresholds have been published in the Federal Register and will become effective February 23, 2022.

The FTC also announced the revised jurisdictional dollar thresholds applicable to Clayton Act Section 8 prohibitions of interlocking officers or directors on their corporate boards of directors. The revised thresholds are $41,034,000 for Section 8(a)(1) and $4,103,400 for Section 8(a)(2)(A). These new thresholds took effect immediately upon publication in the Federal Register on January 24, 2022.

These revised thresholds will affect the jurisdictional requirements and certain exemptions under the HSR Act, as well as the HSR Act’s filing fee schedule. Thus, for example, a transaction valued below the revised minimum notification threshold of $101 million generally will not need to be reported, and the size-of-person test will not apply to a transaction valued above $403.9 million. The filing fees for reportable transactions will be as follows:

- $45,000 for transactions valued in excess of $101 million but less than $202 million;

- $125,000 for transactions valued at $202 million or greater but less than $1,009.8 million; and

- $280,000 for transactions valued at $1,009.8 million or more.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.