Key Statistics and Trends

2022 vs. 2021

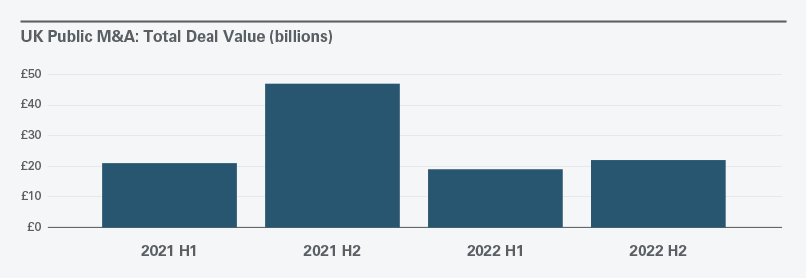

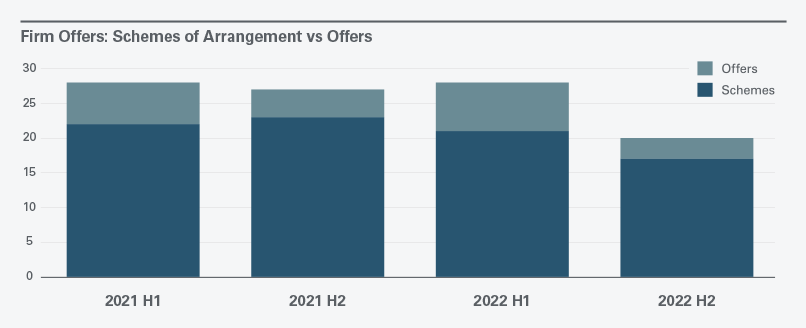

Public M&A activity in the UK in 2022 returned to moderate levels after a busy 2021. The 28 firm offers announced in H1 2022 was in line with H1 2021, demonstrating a steady trajectory back towards pre-pandemic levels of activity. However, geopolitical factors such as the Russian invasion of Ukraine and the resulting sanctions have brought uncertainty to the public M&A market, causing deal activity to decline in H2 2022. The current regulatory environment also continues to impact transactions by elongating timelines and increasing execution risk for bids in sensitive sectors.

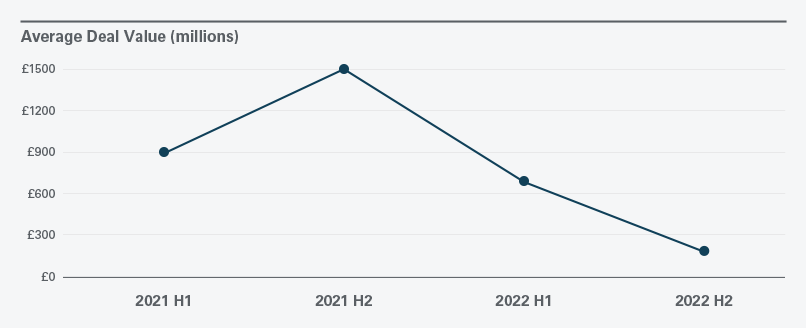

In addition, rising inflation and interest rates have materially increased the cost and availability of financing, which particularly affects larger transactions. Coupled with falling valuations, investors face the prospect of reduced returns. The decrease in deal volume and value, compared to a strong H2 2021, indicates investors’ caution and a more limited appetite to engage in transactions in the current market.

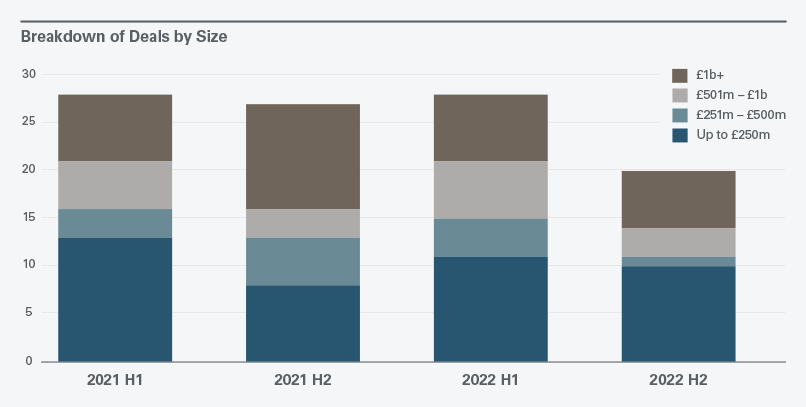

H2 2022 did not see the number of high-value transactions announced H2 2021 — just six valued at above £1 billion in H2 2022 versus 11 in H2 2021 — and deal values were generally lower than those in H2 2021.

Transactions valued at more than £1 billion accounted for a lower proportion of the total than they did in H2 2021 — just 30% of all firm offers — with the highest firm offer valued at £9.8 billion. Around half of all deals during H2 2022 were valued below £250 million, compared to 39.3% in H1 2022 and 29.6% during the same period in 2021.

Industry Breakdown

The ongoing war in Ukraine and sanctions against Russia have resulted in high market volatility in the mining, metals and engineering sector, as well as in the oil, gas and chemicals industries, the effects of which are likely to continue into H1 2023. In 2022, the Russia-related sanctions and uncertainty about the outcome of the war led to a surge in commodity prices, and energy in particular, and supply chains have been disrupted.

Deals involving tech, pharma and biotech companies appear to have remained slow, with a moderate increase, but due to market uncertainty globally surrounding these sectors and increased regulatory scrutiny of transactions on both competition and national security grounds, it is unclear what the outlook will be for 2023.

Other Key Developments and Highlights

Public to Private (P2P) Transactions

Interest from financial sponsors in public companies remained relatively strong, with seven P2Ps announced in H2 2022, or 35% of all firm offers. Financial sponsors continued to play an active role on the largest transactions: Six (46%) of the 13 takeovers valued at more than £1 billion announced in 2022 were P2P transactions. Still, that was down materially from 2021, when they accounted for 64% of firm offers of all sizes.

With inflation and rising interest rates creating uncertainty in the debt markets, and subdued public company valuations, it is uncertain whether financial sponsors will remain as active in public takeovers in H1 2023 as they were in the previous 24 months. An increasing number of financial sponsors are able to fund offers on a full equity basis, without relying on third-party debt, but there may still be limited appetite to make acquisitions without leverage.

Consortium and Overseas Bidders

Four consortium bids were announced in H2 2022, with participants including private equity investors, pension funds, corporates and family offices.

Overseas bidders were involved in 29 (63%) of the 48 firm offers announced during 2022, compared to 39 (70%) of the 55 firm offers announced in 2021, with an aggregate deal value of £33.6 billion in 2022, compared to £60.1 billion in 2021. Overseas bidders accounted for 81% of the aggregate deal value in 2022, compared to 90% in 2021.

Changes to the Takeover Code

The Takeover Panel published RS 2022/2 on 14 December 2022, which confirmed changes to be made to the presumptions regarding ‘acting in concert’ under the Takeover Code. Among other changes, the statement proposes to increase the threshold for presumed ‘associated company’ concert party status from 20% to 30% of the equity share capital, and codifies other existing guidance. These changes will come into effect on 20 February 2023.

The Panel also published consultation paper PCP 2022/3 on 19 October 2022, which clarifies that the Panel will not call for an auction to resolve a competitive bid situation without satisfaction or waiver of the relevant official authorisation of regulatory clearance. The paper also provides guidance regarding how the offer timetable operates in competitive situations.

On the same date, the Panel published the consultation paper PCP 2022/4, which proposes various changes to the Code, including enhancing the Panel’s power to grant derogations and waivers from the requirements of the Code; mandatory offer prices; target board recommendations and disclosure of directors’ intentions with respect to their own shares; and amending the deadline for irrevocable commitments.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.