As part of the wider review of the UK’s capital markets regulatory landscape, in May 2023, the Financial Conduct Authority (FCA) published Consultation Paper CP23/10, which set out proposed reforms for companies with listed shares on the Main Market of the London Stock Exchange (May Consultation Paper). On 20 December 2023, the FCA published Consultation Paper CP23/31, which contains revised proposed reforms taking into consideration market input on the May Consultation Paper and sets out the first tranche of the proposed new UK Listing Rules (UKLR). The FCA intends to publish the second tranche of the UKLR in Q1 2024.

The changes would be the most significant in over a generation and will result in a less onerous regulatory regime for premium-listed issuers. The amendments would, however, increase the regulatory requirements for some standard-listed issuers, but they should not prove unduly burdensome.

The proposed changes will align the UK listing regime more closely with those in other jurisdictions by removing some investor safeguards not typically seen elsewhere.

CP23/31 predominantly confirms the proposals set out in the May Consultation Paper (as discussed in our 5 May 2023 client alert “UK Listing Rules Reform Proposals – The Dawn of a Lighter Touch Regime in London?”) and reiterates the shift to a more disclosure-based regime in London.

The FCA has requested comments on the changes by 22 March 2024 (save for comments on the sponsor competency proposals, which have been requested by 16 February 2024 so that those changes can be implemented sooner). The FCA is expected to publish the new UKLR at the start of the second half of 2024 with a short two-week implementation period before the new rules come into force.

New Listing Categories

The latest consultation paper sets out five new listing categories that the FCA proposes to introduce, along with additional information on which companies will fall into each category. The equity shares in commercial companies category (Combined Listing Category) is the principal category and is intended to replace both the Standard and Premium Listing segments. Companies currently listed on the Standard Listing segment will initially be “mapped” to a new Transition Category, from which they will be able to transfer to the Combined Listing Category.

The other new listing categories include one for secondary listings and one for shell companies. The secondary listing category would be available solely to non-UK incorporated companies with primary listings in other jurisdictions, and the FCA does not intend to open this category to UK incorporated issuers with primary listings abroad. The FCA has said that it is concerned that allowing UK issuers to list on the secondary listing category could create an avenue for UK companies to avoid complying with the obligations applicable to issuers on the Combined Listing Category.

Shell companies and special purpose acquisition companies (SPACs) will also be listed on a separate category, which is intended to make it easier for investors to identify these companies.

The consultation paper details the FCA’s proposal to “map” currently listed companies to these new categories prior to the implementation of the UKLR.

The FCA does not propose to define what constitutes a “commercial company”. Instead, the Combined Listing Category will apply to any company that does not fall in one of the separate listing categories and which meets the eligibility requirements for the Combined Listing Category.

Proposed New Listing Categories

| Category | Notes |

|---|---|

| Commercial Companies | |

|

Equity shares (commercial companies) |

Sovereign controlled issuers will now be included in this category |

|

Equity Shares (secondary listing) |

For international commercial companies where the UK is their secondary listing |

|

Equity shares (transition category) |

For commercial companies currently listed on the Standard Segment of the Official List |

| Other | |

|

Equity shares (shell companies) |

For SPACs |

|

Non-equity shares and non-voting equity shares |

Predominantly for preference shares and deferred shares |

The FCA proposes to retain the following six pre-existing categories:

(i) Closed-ended investment funds.

(ii) Open-ended investment companies.

(iii) Debt and debt-like securities.

(iv) Certificates representing certain securities (depositary receipts).

(v) Securitised derivatives.

(vi) Warrants, options and other miscellaneous securities.

Key Amendments to the May Consultation Paper

The latest consultation proposes two key changes to the May Consultation Paper relating to the controlling shareholder regime and dual class share structure rules for issuers listed on the Combined Listing Category.

The FCA believes that the current controlling shareholder regime serves an important function and should be carried across to the Combined Listing Category. Therefore, CP23/31 proposes retaining the requirement for a written and legally binding agreement between the commercial company and a controlling shareholder to ensure that the shareholder complies with specified undertakings.

Following feedback on the May Consultation Paper, the FCA agrees that greater flexibility with respect to dual class share structures would be beneficial and therefore has removed the initially proposed sunset provision. In addition, the list of individuals who can hold weighted voting rights shares has been expanded.

The Appendix below sets out how, following the amendments made in the December consultation paper, the FCA proposes to apply (or in some cases remove) existing listing principles, eligibility criteria, and initial and continuing obligations for issuers in the Combined Listing Category.

Proposed Changes to the Sponsor Regime

As set out in the May Consultation Paper, the FCA has proposed significant reforms to the sponsor regime. A sponsor will still be required prior to admission in order to assess and provide assurances to the FCA that a company has met the listing and prospectus requirements and has established procedures to be able to comply with the applicable ongoing listing obligations. However, the sponsor’s role post-IPO will be considerably different.

The FCA proposes that the sponsor’s role be focused on significant increases in the issuer’s listed share capital, such as additional equity raises or share buybacks, reverse takeovers and the fair and reasonable opinions in connection with related party transactions. Although this significantly reduces the instances in which a sponsor would be required, the FCA has also proposed that a sponsor will still need to be appointed if an issuer wishes to seek individual guidance from the FCA (for example if a derogation is required from the FCA in connection with the preparation of a significant transaction notification).

Alongside these changes, the sponsor regime will also be extended to additional listing categories, not just the Combined Listing Category; namely, the closed-ended investment fund category and the shell companies category.

The FCA has also proposed amendments to the sponsor competence regime in order to take fluctuating levels of primary market activity into consideration and prepare for the increase in activity as a result of the UKLR. The proposals include extending the requirement to have submitted a sponsor declaration in the past three years to the past five years.

Implementation and Transition Arrangements

Unlike the May Consultation Paper, the latest consultation also provides additional information on how the FCA proposes to manage the transition to the new UKLR for existing listed companies (on both the Standard and Premium Listing segments) and for companies that are midway through their applications at the time when the UKLR are published (“in-flight” companies).

What does this mean for existing listed companies?

The FCA proposes to “map” premium listed and standard listed companies to the new applicable categories. Premium listed issuers will therefore be automatically transferred to the new Combined Listing Category whilst standard listed issuers, if they do not fall under a different category, such as the secondary listing category or the shell companies category, will be transferred to the Transition Category.

The FCA intends to map standard listed issuers based on the FCA’s analysis of the Official List. Issuers would then be informed prior to the new rules coming into force if the FCA believes that the issuer should be mapped to a new category other than the Transition Category. If an issuer believes it has been incorrectly allocated to such a category, it would have four weeks to respond to the FCA and discuss the decision.

How will “in-flight” companies be impacted?

The FCA has set out procedures for companies that are midway through their applications to the Official List when the new regime takes effect.

The consultation paper defines an “in-flight application” as a complete submission made to the FCA for an eligibility review by an applicant for admission of securities received by 4 p.m. on the date the policy statement with the final rules is published, where listing is expected to occur after the commencement date of the new UKLR. If an application is incomplete, it would not be treated as in-flight and would need to be considered under the new UKLR.

If a company is deemed to be in-flight and is applying for a Premium Listing, from the commencement date of the UKLR, the new rules for admission to the Combined Listing Category will apply and the company’s application will be changed to an application for the Combined Listing Category.

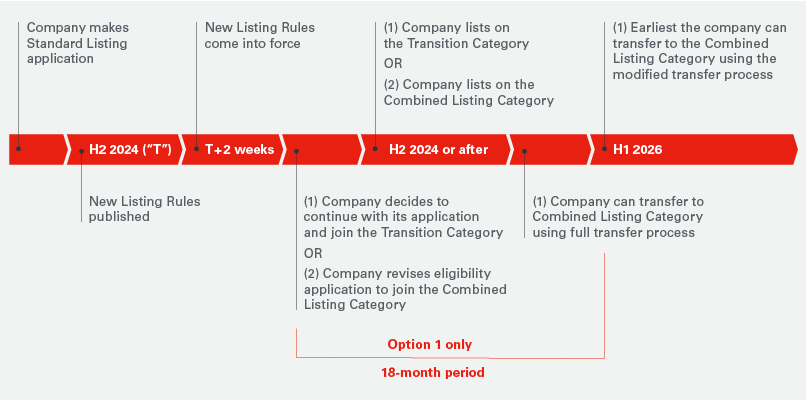

If a company is applying for a Standard Listing, the FCA intends to maintain the status quo regarding the eligibility requirements. Therefore, a company would have the option either to (1) complete its admission to the Transition Category, the shell companies category or the secondary listing category within one year from the date of implementation of the UKLR, or (2) revise its eligibility submission to explain how it complies with the new UKLR in order to list on the Combined Listing Category.

The FCA proposes retaining its rule that cases will lapse where there has been no substantive activity for three months. Companies looking to list on the Standard Listing segment must therefore be deemed in-flight and then complete their applications within one year in order to list on the Transition Category.

CP23/31 also proposes to treat applicants which are mid-transfer between listing categories in the same manner as companies which are in-flight.

How will the Transition Category work?

The proposed Transition Category will maintain the status quo for existing standard listed issuers which do not fall within the other new categories. The Transition Category will carry forward the current continuing obligations set out in Chapter 14 of the Listing Rules but will be closed to new applicants and to transfers from other categories. The FCA does not propose introducing an end date for the Transition Category but will keep it under review and may seek to wind it down in the medium term.

No sponsor role is proposed to be introduced for the Transition Category other than in connection with an issuer’s transfer from the Transition Category to another UK listing category. Given the expectation that companies will transfer out of the Transition Category, the FCA proposes that, if an issuer listed on the Transition Category undertakes a reverse takeover, it will need to request cancellation from the Transition Category and reapply to another listing category that is open to it.

In order to encourage issuers to transfer, the FCA has also proposed a modified transfer process for issuers in the Transition Category to move to the Combined Listing Category, the shell companies category or the secondary listing category.

How does a company transfer from the Transition Category to the Combined Listing Category?

As set out above, a modified transfer process will apply for issuers seeking to move from the Transition Category to the Combined Listing Category. The FCA has proposed that the eligibility assessment for an application to transfer would focus on the additional requirements of the Combined Listing Category and the appointment of a sponsor, with the issuer needing to demonstrate that it has complied and is able to comply with the relevant listing obligations.

If a company listed on the Transition Category does not meet the eligibility requirements for the modified transfer process, it will still be able to transfer between categories but will need to comply with a full, unmodified, transfer process, which will be in line with the current Premium Listing application process.

In order to be eligible for the modified transfer process, an issuer:

- must have had shares admitted to the Official List for at least 18 months on a continuous basis;

- cannot have had any securities, which are currently or were previously listed, suspended from trading in the last 18 months; and

- cannot be undergoing or have recently undergone (in the last 18 months) a significant change to its business.

The eligibility assessment for the transfer would not require a review of the issuer’s ability to comply with all of the eligibility requirements for listing on the Combined Listing Category. Instead, it would specifically focus on the controlling shareholder rules, the issuer’s constitutional arrangements and the externally managed company requirements.

In addition, the FCA proposes that such a targeted assessment would consider if the directors of the issuer have established procedures to enable the issuer to comply with the additional continuing obligations required. That would include procedures to identify potential transactions that may amount to significant transactions or related party transactions and the obligation to comply with the proposed additional annual reporting obligations for companies listed on the Combined Listing Category.

The FCA does not propose requiring a shareholder vote for transfers from the Transition Category or the secondary listing category to the Combined Listing Category given that any such transfer would result in an increase in the obligations of the issuer to the benefit of its shareholders.

Implications for Companies Considering an IPO in 2024

For companies considering an IPO in London in the coming months, the latest consultation clarifies the options available depending on the issuer’s IPO timeline and the type of listing they are seeking.

Listing on the Premium Segment

If a company completes its listing on the Premium Listing segment prior to the publication of the UKLR, it will automatically transfer to the Combined Listing Category and be subject to the new rules.

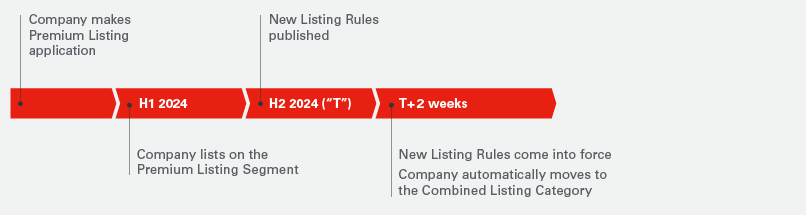

A timeline sets out the sequence of events and consequences if a company lists on the Premium Segment before the New Listing Rules are published.

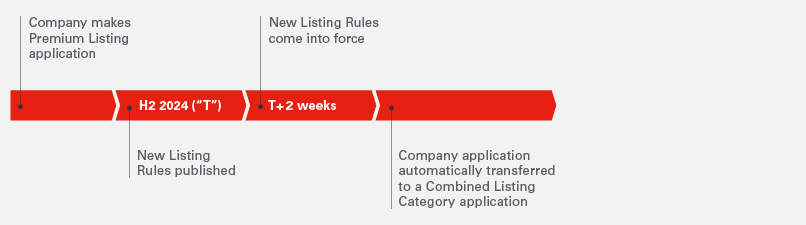

If the listing has not closed but the company has made an in-flight application, the company’s application will automatically be transferred to a Combined Listing Category application.

A timeline sets out the sequence of events and consequences if a company applies for a listing on the Premium Segment before the New Listing Rules are published but the application is not complete at that time.

Listing on the Standard Segment

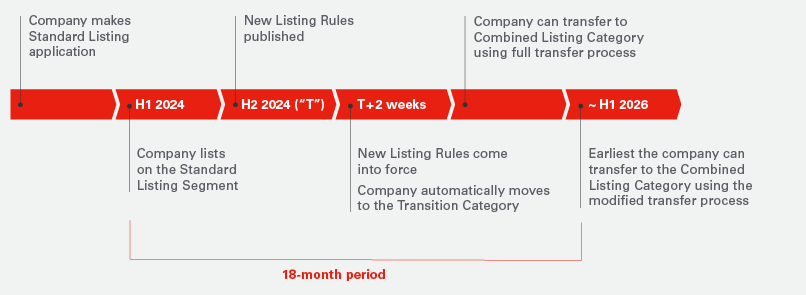

Companies which list on the Standard Listing segment prior to the publication of the policy statement on the UKLR will be transferred to the Transition Category once the rules come into force. However, companies should note that, if they take this approach, they will not be eligible for the modified transfer process for a period of at least 18 months.

A timeline sets out the sequence of events and consequences if a company lists on the Standard Segment before the New Listing Rules are published.

A timeline sets out the sequence of events and consequences if a company applies for a listing on the Standard Segment before the New Listing Rules are published but the application is not complete at that time.

Conclusion

As highlighted in the consultation paper, these proposals link to the FCA’s broader vision for the UK’s capital markets, including retaining London’s position as a capital markets and financial services hub. These proposals are intended to play a key role in encouraging not just more companies but a more diverse array of companies to list in London.

Investors, stakeholders and the FCA are aware that a variety of additional reforms will be required to ensure that the UK remains a competitor on the global stage. The upcoming consultation on the UK prospectus regime this year will offer another opportunity for market participants to have their say on the future of listings in London.

* * *

Appendix: New Combined Listing Category Compared to Existing Premium and Standard Listing Segments

| Key Listing Rules | Premium Listing Requirements | Standard Listing Requirements | Proposed Combined Listing Category Requirements |

|---|---|---|---|

| General | |||

|

Listing principles |

Two principles and additional six premium principles apply |

Only two principles apply |

Combined and enhanced principles apply |

|

Sponsor regime |

Applies |

Does not apply |

Applies: Focus on significant further increases in the issuer’s listed share capital, fair and reasonable opinions for related party transactions and reverse takeovers Sponsor not required for significant transactions but a sponsor must be appointed where an issuer seeks individual guidance from the FCA |

| Eligibility | |||

|

Minimum market capitalisation |

£30 million |

£30 million |

£30 million |

|

Historical financial information on 75% of business covering three years |

Required |

Not Required |

Not required |

|

Three-year revenue track record |

Required |

Not required |

Not required |

|

Clean working capital statement |

Required |

Not required |

Not required |

|

Free float |

10% |

10% |

10% |

|

Independence |

Required. |

Not required |

[CP 23/31 Amendment] No specific eligibility requirement or continuing obligations in relation to independence and control of business Existing prospectus disclosure should continue to identify any relevant risks to independence or control of business |

|

Control of business |

Required |

Not required |

|

| Initial / Ongoing Obligations | |||

|

Controlling shareholder regime |

Applies |

Does not apply |

[CP 23/31 Amendment] Retain requirement for a written and legally binding agreement with the controlling shareholder to ensure the shareholder complies with specified undertakings Retain requirements relating to election of independent directors |

|

Dual class share structures/weighted voting rights |

Permitted but subject to the following restrictions:

|

No restrictions |

[CP 23/31 Amendment] Generally permitted but can only be held by (i) directors; (ii) natural persons who are investors in, or shareholders of, the applicant; (iii) employees; or (iv) persons established for the sole benefit or solely owned and controlled by a person who falls under (i), (ii) or (iii) [CP 23/31 Amendment] No sunset clause required Restrictions on when weighted voting right can be exercised, as well as restrictions on transfer, continue to apply |

|

Task Force on Climate-Related Financial Disclosures (TCFD) and UK diversity and inclusion disclosures |

Required (on a comply-or-explain basis). |

Required (on a comply-or-explain basis) |

Required (on a comply-or-explain basis). |

| Continuing Obligations | |||

|

UK corporate governance code disclosure |

Required (on a comply-or-explain basis) |

An issuer must disclose if it is subject to or opts to follow any code |

[CP 23/31 Amendment] Required (on a comply-or-explain basis) and the proposed secondary listing category should address concerns for issuers following a non-UK corporate governance code |

|

Related party transaction rules |

At ≥0.25% value:

At ≥5% value:

|

At value ≥ 5%:

|

At ≥5% value:

|

|

Significant transaction rules |

At ≥5% value (Class 2):

At ≥25% value (Class 1):

|

None apply |

At ≥25% value (class test rules are being reviewed):

|

|

Shareholder vote on reverse takeovers |

Required. A reverse takeover is subject to shareholder approval and information requirements similar to those for a Class 1 significant transaction |

Not required |

A reverse takeover is subject to the circulation of an FCA-approved explanatory circular to the shareholders and shareholder approval |

|

Shareholder vote to delist |

Required. 75% shareholder approval required and controlling shareholder regime applies |

Not required |

Required. 75% shareholder approval required and controlling shareholder regime applies |

|

Shareholder vote on discounted share offers |

Required |

Not required |

Required |

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.