See all chapters of Encyclopaedia of Prudential Solvency and A Guide to Solvency II.

Introduction

Group supervision regulates the impact that members of a Solvency II group have on a Solvency II insurer. The UK rules governing Solvency II groups are contained in the Group Supervision Part of the PRA Rulebook, the Solvency 2 Regulations 2015 and Articles 328 to 350 of the Level 2 Delegated Regulation, and are supplemented by, among other things, PRA SS9/15: Group Supervision (as updated in February 2024) (PRA SS9/15), and the PRA Statement of Policy (February 2024): The PRA’s approach to insurance group supervision (effective from 31 December 2024).

The rules governing Solvency II groups set standards that must be maintained by the Solvency II group as a whole. In this chapter we dwell principally on the rules on group supervision that apply in the UK.

1. Types of Solvency II Groups

There are four scenarios where group supervision applies on a group-wide basis.

Scenario 1

Scenario 1 occurs either (i) when a UK Solvency II insurer owns directly or indirectly 20% or more of the voting rights or capital of, or otherwise exercises significant influence over, at least one other UK Solvency II insurer or third country (re)insurer, or (ii) when a Gibraltarian (re)insurer owns directly or indirectly 20% or more of the voting rights or capital of, or otherwise exercises significant influence over, at least one UK Solvency II insurer.

Example (b) above is deemed to be a group despite the fact that the subsidiary third country (re)insurer is not a UK Solvency II insurer.234

Scenario 2

Scenario 2 involves a UK Solvency II insurer that has a parent entity which is an insurance holding company or a mixed financial holding company with its head office in the UK or Gibraltar.235

An insurance holding company is a parent entity that is not a UK Solvency II insurer or a mixed financial holding company, whose main business is to acquire and hold directly or indirectly 20% or more of the voting rights or capital of, or otherwise exercises significant influence over, subsidiary undertakings that are either exclusively or mainly UK Solvency II insurers or third country (re)insurers, or ancillary insurance service undertakings, and where such entities comprise more than 50% of two or more of:

- The parent entity’s consolidated assets.

- The parent entity’s consolidated revenues.

- The group SCR (as if calculated at the level of the parent entity).236

At least one of the parent entity’s subsidiary undertakings must be a UK Solvency II insurer.237

A mixed financial holding company is a parent entity that is not a regulated entity itself but, along with its subsidiaries (at least one of which is a regulated entity with its head office in the UK) and other entities, forms a financial conglomerate as defined by the applicable rules.238

Scenario 3

Scenario 3 occurs where the top company is an insurance holding company or a mixed financial holding company with its head office outside the UK or Gibraltar or a third country (re)insurer.

Unless otherwise agreed with the PRA, the PRA must rely on the equivalent group supervision exercised by the third country supervisory authorities where the jurisdiction of the third country supervisory authority has been deemed equivalent and there is group supervision.239 In a UK context, equivalence, for this purpose, means Bermuda (save for captives and SPVs) and Switzerland (and see further below re the US); and in respect of EEA member states (but, note, not the other way around — i.e., the EU does not recognise the UK for group supervision equivalence).

Regarding EU Solvency II (as distinct from Solvency UK), only Bermuda, Switzerland and the EEA member countries have been deemed to be equivalent as it relates to EU supervision of groups under the Solvency II Directive (note also the position explained below regarding US-parented groups — the position in the UK and EU is similar).240

If there is a sub-group headed by a UK insurance holding company, additional group supervision can be imposed at the level of the UK Solvency II sub-group. Conversely, where it would be more efficient and, importantly, supervisory efforts are not negatively impacted, the PRA may exempt any UK sub-group from additional supervision.241

Where the jurisdiction of the third country parent entity is not equivalent, the PRA has the flexibility to determine whether to regulate the entire group (i.e., from the third country parent entity down) or, if satisfactory other methods can be agreed, from the level of the top UK holding company down.242 The PRA exercises this jurisdiction through the UK Solvency II insurer’s authorisation. The purpose of other methods pursuant to Group Supervision 20.1(2) is to ensure sufficiency of governance and prudential solvency at that lower level, and therefore other methods structures will involve ensuring that the group (and, in particular, the constituent UK Solvency II insurers) have appropriate governance, staffing, boards, independence and access to capital when it is required.

Scenario 4

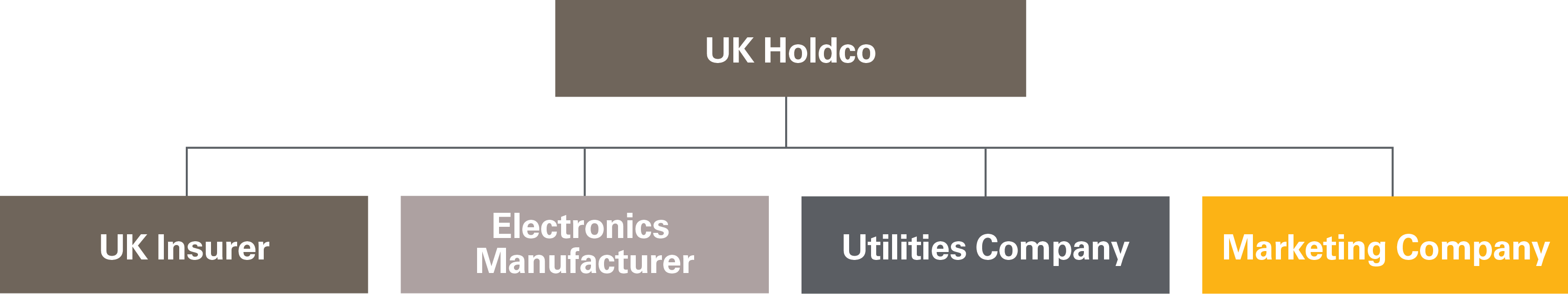

Scenario 4 occurs where a UK Solvency II insurer has a parent entity that is a mixed-activity insurance holding company.243

The extent of group supervision for Scenario 4 groups is limited. Parent companies of Scenario 4 groups are not insurance holding companies due to the fact that holding interests in (re)insurers is not its primary business and the group’s main activities are non-financial. The revised definition of insurance holding company has made the delineation between what is a mixed-activity insurance holding company and an insurance holding company clearer, though the presence of insurance intermediaries in a group that place most of their insurance business with group insurers (and/or group insurers who receive most of their business from group intermediaries) continues to complicate matters, especially in the case of Gibraltarian carriers.

In determining if a group with a UK Solvency II insurer or a third country (re)insurer falls within Scenario 4, one must first consider if the parent entity of the group is a UK Solvency II insurer. Second, one must consider whether the parent entity is an insurance holding company. Third, one must consider whether the parent entity is a mixed financial holding company. If the answer is no, in respect of the above three stages, the parent entity is a mixed-activity insurance holding company.

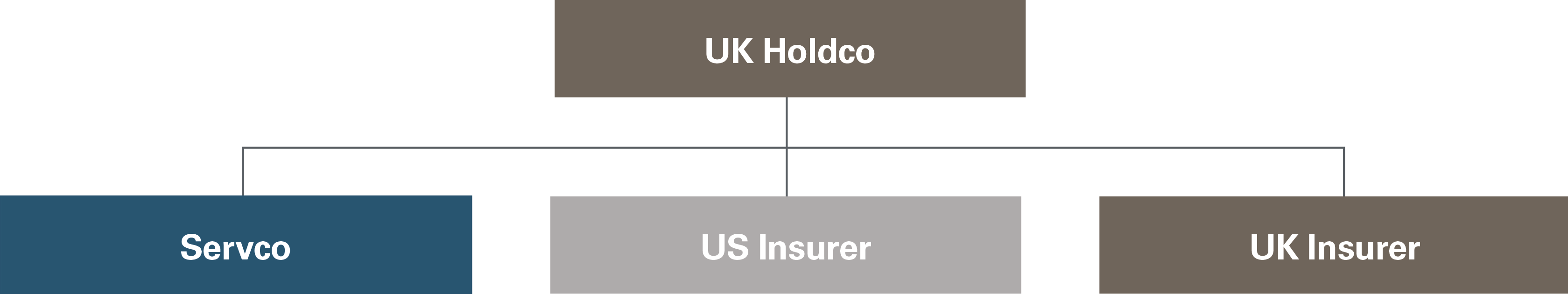

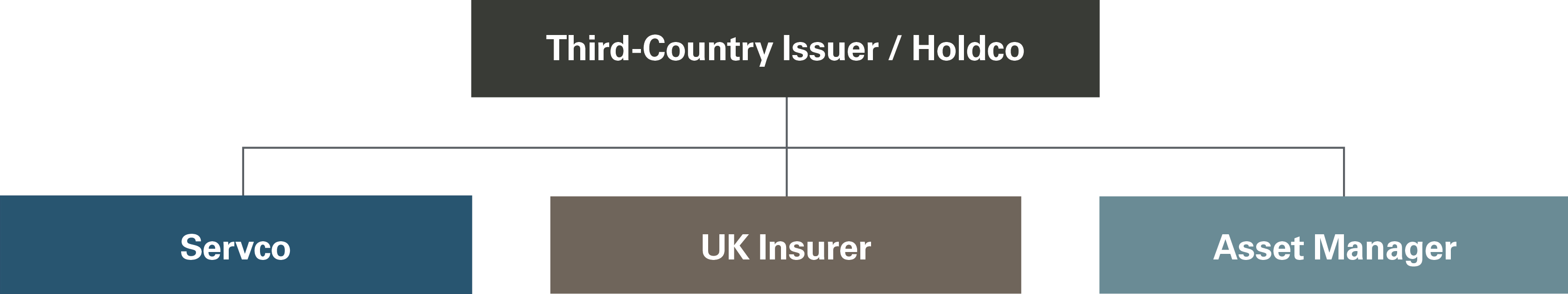

Existence of a UK Solvency II Group at Different Levels of the Group Structure

As noted in the diagram below, a UK Solvency II group can exist at different levels in a group structure.

In this scenario, group supervision rules will apply only at the level of the ultimate UK Solvency II insurer, UK insurance holding company or UK mixed financial holding company in the group. If the ultimate holding company’s head office is outside the UK, the applicable rules will depend on whether the jurisdiction in which the entity is incorporated is deemed to be equivalent to the UK and, if not, whether other methods apply244 However, the PRA has the option to supervise the group at a UK level where a group’s head office is in Gibraltar.245

2. Group Supervision: Applicable Rules and Specific Considerations

Scenario 1 and Scenario 2 Groups

Both Scenario 1 and Scenario 2 groups are supervised pursuant to the rules set out in the Group Supervision Part of the PRA Rulebook, which includes rules governing group solvency (discussed in the next section), group reporting requirements, certain requirements regarding intra-group transactions, and certain risk management and internal control requirements.

The governance requirements that apply at the level of a Scenario 1 and Scenario 2 group are largely similar to the equivalent solo level governance requirements. Requirements include carrying out an ORSA and implementing risk management and internal control systems.246

Scenario 1 and 2 groups must report on a regular basis (at least annually) to the PRA all “significant” intra-group transactions by (re)insurers. A very significant intra-group transaction must be reported as soon as practicable.247 The Level 2 Delegated Regulation makes it clear that an intra-group transaction can be considered “significant” if it would materially influence the solvency or liquidity position of the group or one of the companies involved in the transaction. The PRA expects to be notified of any very significant intra-group transaction before the relevant company has entered into the transaction. Article 377 of the Level 2 Delegated Regulation includes a non-exhaustive list of such transactions.248

Scenario 3 Groups

In respect of Scenario 3 groups, the PRA must rely on the equivalent group supervision exercised by the third country supervisory authorities where the jurisdiction of the third country supervisory authority has been deemed equivalent.249

At the date of this publication, only Bermuda,250 Switzerland251 and the EEA member countries252 have been deemed to be equivalent for this purpose.

Bermuda and Switzerland were granted equivalent status by the EU Commission. These decisions were given effect in the UK’s solvency regime by operation of Regulation 35(2) of the Solvency 2 Regulations 2015. These Delegated Decisions will no longer have any effect in the UK after 31 December 2024, at which point His Majesty’s Treasury (HM Treasury) will restate them such that Bermuda and Switzerland retain their equivalent status.253

Due to the UK-US Bilateral Agreement, supervision for US-parented groups occurs at the level of the US parent entity and by the supervisor in that parent entity’s home state, with the PRA having the ability to supervise at the level of any UK sub-group.

To exercise the process outlined in the UK-US Bilateral Agreement, UK Solvency II insurers in a US-parented group must apply for a rule modification. The application process is standardised. The PRA will issue bespoke individual other methods directions to UK Solvency II insurers that meet the requirements in the Bilateral Agreement, which effectively amend the requirements set out in Paragraphs 20.1 and 20.2 in the Group Supervision Part of the PRA Rulebook.254

The UK-US Bilateral Agreement streamlines the administrative impact for insurance groups with a US parent entity by requiring that each relevant member of the group and the UK insurance holding company provide to the PRA its group risk report (ORSA or equivalent) and provide the same to its US supervisor.255 The submission including the group risk report must include:

- A description of the (re)insurance group’s risk management framework.

- An assessment of the (re)insurance group’s risk exposure.

- A group assessment of risk capital and a prospective solvency assessment.

As regards to insurance groups with an EU parent entity, a single group supervisor is designated the group supervisor as per Article 247 of the Solvency II Directive.

If there are (re)insurers in more than one EU member state, and the relevant group is:

- Headed by a parent entity that is a (re)insurer, the group supervisor will be the national regulator that supervises that (re)insurer.

- Not headed by a parent entity that is a (re)insurer, Article 247 sets out a number of different factors that must be taken into account in establishing who the group supervisor should be, for example:

- Where more than one (re)insurer shares its headquarters with the same insurance holding company or mixed financial holding company, the supervisory authority of those (re)insurers shall be the group supervisor.

- Where the group is headed by more than one insurance holding company or mixed financial holding company, and these companies have their head offices in different EU member states and there is a (re)insurer in each of those EU member states, the supervisory authority of the (re)insurer with the largest balance sheet total shall be the group supervisor.

- Where multiple (re)insurers that have their head offices in the EU also have as their parent the same insurance holding company or mixed financial holding company, and none of the entities have been authorised in the member state in which the insurance holding company or mixed financial holding company has its head office, the supervisory authority that authorised the (re)insurer with the largest balance sheet total shall be the group supervisor.

- Where the group does not have a parent entity, the supervisory authority that authorised the (re)insurer with the largest balance sheet total shall be the group supervisor.

Under Article 247, each relevant national supervisor can dispute whether the selection criteria have been applied appropriately. In the event of a disagreement, the EIOPA has ultimate authority to resolve any dispute. Article 248 of the Solvency II Directive sets out the rights and duties of the group supervisor. Article 249 of the Solvency II Directive sets out obligations regarding the cooperation and exchange of information between regulators of (re)insurers in the group.

3. Group Solvency Calculation for Scenario 1 and 2 Groups

Groups falling within Scenarios 1 and 2 are required to calculate their group solvency in accordance with relevant provisions of the PRA Rulebook.256 In respect of Scenario 1, it is the UK Solvency II insurer that is required to ensure that group solvency requirements are met. In respect of Scenario 2, where the group is headed by an insurance holding company or a mixed financial holding company, it is the UK Solvency II insurer in the Solvency II group that is responsible for ensuring compliance with group solvency requirements.

There are two possible means of calculating group solvency:

- The accounting consolidation method (Method 1).

- The deduction and aggregation method (Method 2).

One key difference between the two methods is that under Method 2, diversification benefits between group members are not recognised (although there is a degree of nuance to this position in the recent Solvency UK reforms within subgroups). Additionally, the use of local rules is possible under Method 2 for the calculation of group solvency where the relevant non-UK entity is in an equivalent jurisdiction (at this time, Switzerland, Bermuda or an EEA member country).257

While Method 1 is the default, the PRA may allow Method 2 or a combination of both to be used (a partial Method 2 approach).258 When assessing whether or not to allow the use of Method 2, the PRA must consider if:

- There is a sufficient amount and quality of information available in a particular instance to allow for the use of Method 1.

- The use of Method 1 be disproportionately burdensome.

- Intra-group transactions are not significant both in terms of volume and value.

- The group includes non-UK entities that are equivalent (either provisionally or absolutely).

The use of Method 2 (in whole or part) most often occurs where the overseas operations of a group are located in a jurisdiction deemed equivalent for group solvency purposes.

4. Group Solvency Calculation: Method 1

Under Method 1 group solvency is assessed by calculating the difference between:

- The own funds eligible to cover the SCR, calculated on the basis of consolidated data.

- The SCR at group level, calculated on the basis of consolidated data.259

Consolidation includes all related undertakings whether they are regulated undertakings or not; but not all types of undertaking are included on a fully consolidated basis.

The own funds and SCR sections of the PRA Rulebook apply in respect of the calculation of:

- The group SCR based on consolidated data.

- The calculation of own funds eligible at group level.

Entities Included in the Method 1 Calculation

Group entities not included in the scope of group supervision are excluded from the calculation. It is explicitly stated in Article 335 of the Level 2 Delegated Regulation that consolidated data in respect of each group entity is included, save where:

- Necessary information in respect of an undertaking necessary to calculate group solvency is not available, in which case the book value of that entity must be deducted from the own funds eligible for the group SCR and the unrealised gains connected with the participation must not be recognised as own funds eligible for the group SCR.260

- A company has been granted a waiver by the PRA, excluding it from group supervision by the PRA where there are legal impediments to the transfer of information.261

- The relevant entity is an SPV and compliance has been made with certain relevant requirements.262

Data Included in the Method 1 Calculation

The basic principle is that Method 1 uses consolidated data from all entities within the Solvency II group and own funds is calculated as if the Solvency II group was one single insurer. There is proportional consolidation of data where members of the group share control of an entity with an entity outside the group. The proportional share of a group entity’s holdings in credit institutions, investment firms and UCITS management companies, among others, are calculated on the basis of sector specific rules.

Article 335 of the Level 2 Delegated Regulation specifies that the consolidated data should include:

- Full consolidation of data of the following types of undertaking where they are subsidiaries of the parent entity:

- (Re)insurers.

- Third country (re)insurers.

- Insurance holding companies.

- Mixed financial holding companies.

- Ancillary insurance services undertakings.

- Full consolidation of data of SPVs to which the participating undertaking or one of its subsidiaries has transferred risk and that are not excluded from the scope of the group solvency calculation under Article 329(3).

- Proportional consolidation of data of the same types of undertaking as are referred to in the first bullet above, but where they are managed jointly by one of the aforementioned undertakings and one or more other undertakings.

- Data of all holdings in the types of undertaking referred to in the first bullet above that are not subsidiaries of the parent entity and to which the proportional consolidation does not apply, on the basis of the adjusted equity method.

- The proportional share of the undertakings’ own funds calculated in accordance with the relevant sectoral rules in relation to holdings in related undertakings that are:

- Credit institutions.

- Investment firms.

- Financial institutions.

- Alternative investment fund managers.

- UCITS management companies.

- Institutions for occupational retirement provision.

- Non-regulated undertakings carrying out financial activities.

- Data of all other related undertakings (including ancillary service undertakings, collective investment undertakings and investments packaged as funds) other than those referred to above.263

As a default, related undertakings must be valued using quoted market prices in active markets as provided for in Article 10(2) of the Level 2 Delegated Regulation. Where this is not possible, undertakings should be valued using quoted market prices for similar assets, after having made any adjustments to reflect differences between the quoted asset and the undertaking being valued.

It may be necessary for adjustments to be made in order to account for:

- The condition or location of the asset.

- The extent to which the asset is comparable to the undertaking.

- The level of activity in the markets in which the asset is being assessed.

Third Country Subsidiaries

It is irrelevant under Method 1 whether or not third country (re)insurers in the group are in equivalent jurisdictions because the calculation will be carried out by applying Solvency II rules to consolidated data of the group as a whole. A partial use of Method 2 in respect of specific undertakings can be requested by a group. The PRA has wide discretion over whether or not the request is granted.

Treatment of Own-Fund Items

Under Method 1, own-fund items of third country (re)insurers are classified using the tests set out in Article 332 of the Level 2 Delegated Regulation and Paragraph 11.3 of the Group Supervision Part of the PRA Rulebook, with adjustments appropriate to the group calculation.

Proportional Shares

The calculation of group solvency under Method 1 should take into account the proportional share held in related undertakings that are not 100% owned.264 Where the subsidiary undertaking does not have sufficient eligible own funds to cover its SCR, unless the PRA decides otherwise, the total solvency deficit must be taken into account in the group solvency calculation.265

In addition, the PRA is allowed to determine the applicable proportional share in unusual circumstances. These are typically situations where the participation is held in an unusual way, such as significant influence.266

Treatment in Method 1 Calculation of Ring-Fenced Funds and Matching Adjustment Portfolios

RFFs and matching adjustment (MA) portfolios should not be fully consolidated in the Method 1 group solvency calculation. Method 1 groups will need to consider the availability and transferability of own funds attributable to an RFF or MA portfolio. Restricted own-fund items within RFFs would not be considered as effectively available to cover the group SCR.267

Minimum Capital Requirement Under Method 1

Where Method 1 is used to calculate group solvency, the consolidated group SCR must be, at a minimum, the sum of the MCR of each insurance carrier in the group and the proportional share of the MCR of the related Solvency II undertakings.268

For groups using Method 1, the sum of solo MCRs (the group MCR floor) can potentially prove to be higher than the group SCR, which has the effect of, in practice, limiting the diversification benefits available under Method 1.

5. Group Solvency Calculation: Method 2

Method 2 calculates the group solvency requirement based on the accounts of the solo entities. It is calculated by comparing:

- The aggregated group eligible own funds on the one hand.

- The aggregated group SCR plus the value in the participating undertaking of the related undertakings.269

The value of the related undertakings is added to avoid double counting between the value of those participations in the parent and the own funds of those undertakings in their contribution to group own funds.

Method 2 does not, unlike Method 1, facilitate the recognition of diversification benefits on an intragroup basis.

The application of Method 2 to third country (re)insurers means, however, that there may be a less onerous treatment than the application of Solvency II rules to the assets and liabilities of those (re)insurers on a consolidated Method 1 basis. Method 2 may also allow for a more practical calculation where calculation on a Solvency II basis may be problematic in respect of the assets and liabilities of a third country (re)insurer.

With regard to the own funds calculation and SCR and in the absence of equivalence, the SCR and own funds calculation should be carried out by applying Solvency II rules,270 which may be difficult to apply in practice and may negatively and materially impact group solvency calculations if such entities are significant relative to the size of the Solvency II regulated insurance group.

Equivalence for Group Solvency Purposes

Regulation 19 of the Solvency 2 Regulations 2015 provides for equivalence in respect of third country (re)insurers within a Solvency II group. This is not relevant for the application of the Method 1 calculation, under which Solvency II rules are applied to all consolidated data.

Where the third country regime is equivalent, the PRA must permit the group to take into account the own funds eligible to satisfy the SCR in the calculation of group solvency, and with respect to national laws adopted by the third country in respect of the group’s SCR, unless it is not in the interests of policyholders to do so or there has been a significant change in the relevant third country regime.271 If the third country (re)insurer is not subject to equivalent supervision, its contribution to the group SCR and group own funds must be calculated on the basis of Solvency II rules.

At the time of this publication, only Switzerland, Bermuda and the EEA member countries have been found to be equivalent for these purposes in the UK.272

Under the UK-US Bilateral Agreement, where a US (re)insurer is subject to a local group capital requirement, the PRA must not impose a group capital requirement or assessment at the level of the worldwide parent undertaking of the insurance or reinsurance group.

Treatment of Non-Insurance Undertakings

It is unclear how other related regulated entities should be treated under Method 2. Group Supervision 12.1 to 12.3 only requires the SCR and own funds of the participating (re)insurer and its related (re)insurers and, by virtue of Group Supervision 10.4, related third country (re)insurers to be taken into account in calculating group solvency.

However, Article 329 of the Level 2 Delegated Regulation requires the group solvency calculation to include capital requirements and own funds (calculated in accordance with applicable sectoral rules) — e.g., for investment firms, credit institutions, UCITS management companies, alternative investment fund managers, etc. — and, in addition, a notional capital requirement and own funds for related undertakings that are non-regulated undertakings carrying out financial activities.

Under Method 2, non-regulated related undertakings (other than those carrying out financial activities) are included as assets of the relevant regulated parent entity within the group calculation and valued in accordance with Article 13 of the Level 2 Delegated Regulation.

Availability and Transferability

As is the case for Method 1 groups, Method 2 groups will need to consider the availability and transferability of own funds attributable to an RFF or MA portfolio. Article 330(4) of the Level 2 Delegated Regulation specifies that restricted own-fund items within RFFs would not be considered as effectively available to cover the group SCR.

Proportional Shares

The same provisions apply with respect to Method 2 save that, instead of the proportional share being calculated as the percentage used for the establishment of the consolidated accounts. The proportional share is calculated as the proportion of the subscribed capital held, directly or indirectly, by the participating undertaking.273

MCR Under Method 2

Whereas under Method 1 the consolidated group SCR must be, at a minimum, the sum of the MCR of each insurance carrier in the group and the proportional share of the MCR of the related Solvency II undertakings, there is no comparable requirement for Method 2. This is because Method 2 results in an SCR that exceeds the sum of the MCR of each insurance carrier in the group plus the proportional share of the MCRs of the related undertakings that are not wholly owned or controlled.

6. Group Solvency Calculation: Specific Points

Holding Companies

The group solvency calculation should be carried out at the level of that holding company where (re)insurers are subsidiaries of an insurance holding company or mixed financial holding company274 Where a group includes a (re)insurer indirectly holding a participation in a related (re)insurer through an insurance holding company or mixed financial holding company, the relevant intermediate holding company through which that (re)insurer holds those shares should be treated as if it were a (re)insurer subject to the rules on SCR and own funds for the purposes of the group solvency calculation.275

Elimination of Double Use of Own Funds and Intragroup Creation of Capital

Own funds that represent the same assets in two separate entities must not be double counted. For example, the value of one insurer’s holding of ordinary shares in another insurer should not be valued as both an asset of the first insurer and an own-fund item of the second insurer. Paragraphs 9.1, 9.7 and 9.8 of the Group Supervision Part of the PRA Rulebook set out provisions to avoid such double counting. These provisions state that the following shall be excluded from the group SCR calculation:

- The value of any asset of the participating UK Solvency II insurer that represents the financing of own funds eligible for the SCR of one of its related (re)insurers.

- The value of any asset of a related (re)insurer of the participating UK Solvency II insurer that represents the financing of own funds eligible for the SCR of that participating UK Solvency II insurer or any other related (re)insurer of the UK Solvency II insurer.

- Own funds arising out of reciprocal financing between the participating UK Solvency II insurer and a related undertaking, participating undertaking or another related undertaking of any of its participating undertakings.

- Own funds of a related (re)insurer of a participating UK Solvency II insurer arising out of reciprocal financing with any other related undertaking of that UK Solvency II insurer.

Reciprocal financing includes situations where one undertaking holds shares in or makes loans to another undertaking that holds own funds eligible for the SCR of the first undertaking.276 Article 335(3) (for Method 1) and Article 342(1) (for Method 2) of the Level 2 Delegated Regulation mandate the elimination of intra-group transactions in the group own funds calculation.

Treatment of Undertakings Regulated Under Another Sector

There are conflicting rules in situations where a non-insurance undertaking is included in an insurance group with respect to the group solvency calculation. Article 223 of the Solvency II Directive only requires (re)insurance undertakings to participate in the group solvency calculation.277 However, Article 329 of the Level 2 Delegated Regulation provides that the calculation of group solvency shall include:

- The capital requirements for related undertakings that are credit institutions, investment firms or financial institutions and the own-fund items of those undertakings calculated according to the relevant sectoral rules referred to in Article 2(7) of the Financial Conglomerates Directive.

- The capital requirements for related undertakings that are institutions for occupational retirement provision and the own-fund items of those undertakings calculated according to Articles 17 to 17c of the IORP Directive (2003/41/EC).

- The capital requirements for related undertakings that are UCITS management companies and the own fund items of those undertakings calculated in accordance with the relevant provisions of Article 7(1)(a) of Directive 2009/65/EC and the own funds of those undertakings calculated in accordance with point 1 of Article 2(1) of that directive.

- The capital requirements for related undertakings that are alternative investment fund managers calculated in accordance with Article 9 of the Alternative Investment Fund Managers Directive (2011/61/EU) and the own funds of those undertakings calculated in accordance with Article 4(1) of that directive.

Special Purpose Vehicles

If an SPV complies with Solvency II requirements or is governed by rules that are deemed to be equivalent, it can be excluded from the group solvency calculation under Article 329(3) of the Level 2 Delegated Regulation.

Availability and Transferability

Pursuant to Group Supervision 9.4, if a supervisory authority considers that own funds eligible for the SCR of a related (re)insurer are not capable of being made available to cover the SCR of the participating undertaking for which group solvency is calculated, those own funds may only be included in the group solvency calculation to the extent that they are eligible for covering the SCR of the related undertaking to which the own funds belong.278

Pursuant to paragraph 5A.2 of the PRA SS9/15, a group must set out its own assessment of any items that, due to any significant restriction affecting the availability, fungibility or transferability, might be deducted from own funds. Unless a formal determination is made by the PRA in respect of a particular own-fund item, a group should report own-fund items as available (notwithstanding its own assessment), except where the treatment of that own-fund item is specifically referenced under Paragraphs 9.1 to 9.6 (inclusive) of the Group Supervision Part of the PRA Rulebook and Article 330 of the Level 2 Delegated Regulation.

Paragraph 5A.4 of the PRA SS9/15 provides that the assessment of the availability of own-fund items of a third country related undertaking must, instead of being assessed under local rules, be assessed by reference to the UK group provisions, where a group uses Method 2 for the calculation of its solvency requirements.

The PRA Rulebook states that subscribed but not paid-up capital of related (re)insurers of the participating (re)insurer and surplus own funds for which the group solvency is being calculated can only be included in the group solvency calculation insofar as they are eligible for covering the SCR of the related undertaking concerned.279 Furthermore, where subscribed but not paid-up capital of a relevant related undertaking represents a potential obligation of the participating undertaking or another relevant related undertaking, or vice versa, the amount must be excluded from the calculation entirely.280

Paragraph 5A.2B of the PRA SS9/15 clarifies that a group should not consider the solo SCR as restricting the availability of own-fund items or assets at group level where the relevant related (re)insurer is subject to the UK Solvency II regime. The PRA expects Solvency II groups to engage from an early stage with the PRA should there be any doubt as to the availability and transferability of group own-fund items.

Additionally, different valuation bases and quality of capital permitted for the purpose of local regulatory requirements may affect the availability of any capital that represents the difference between the contribution to the group SCR and the solo SCR, but also the availability of any surplus capital in excess of the local solo regulatory requirement.281 The PRA expects UK Solvency II insurers to take this into account when providing it with information on which the PRA will base its judgements as to the point at which other regulators would intervene to restrict flows of capital out of their jurisdiction.

Group Supervision 9.4, itself, refers only to non-availability of own funds eligible for the SCR of related (re)insurers. Therefore, the requirements with regard to other related undertakings are unclear.

Article 330 of the Level 2 Delegated Regulation expands on Group Supervision 9.4:

- Article 330(1) provides that, in assessing whether own funds can effectively be made available to cover the group SCR, supervisory authorities must consider whether:

- The own-fund item is subject to a legal or regulatory requirement that restricts the ability of the item to absorb all types of losses wherever they arise in the group.

- There are legal or regulatory requirements that restrict the transferability of assets to another (re)insurer in the group.

- Making those own funds available for covering the group SCR would not be possible within a maximum of nine months.

- Where Method 2 is used, the own-fund item does not satisfy the requirements set out in Articles 71, 73 and 77 of the Level 2 Delegated Regulation (features determining classification for Tier 1, Tier 2 and Tier 3 own funds), where the term SCR in those articles is to mean both the SCR of the issuer of the own funds and the group SCR.

- Article 330(2) provides that supervisory authorities should consider the Article 330(1) restrictions on an ongoing concern basis and should also take into account any likely costs to the relevant undertaking of making the own funds available for the group.

- Article 330(3) lists items that should be assumed not to be effectively available to cover the group SCR, unless the participating undertaking can demonstrate to the satisfaction of the supervisory authority that this assumption is inappropriate in the circumstances (but see Article 330(5) referred to below). These are:

- AOF.

- Preference shares, subordinated mutual members accounts and subordinated liabilities.

- Net deferred tax assets (after deducting the associated deferred tax liability).

- Article 330(4) builds on the list in Article 330(3), however the following items shall not, in any case, form part of the group SCR:

- Any minority interest in a subsidiary that is a (re)insurer, third country (re)insurer, insurance holding company or mixed financial holding company exceeding the contribution of that subsidiary to the group SCR.

- Any minority interest in a subsidiary ancillary services undertaking.

- Any restricted own-fund item in an RFF.

Where subordinated debt is intended to be used as group own funds, the UK Solvency II insurer will need to be able to demonstrate to the PRA that such debt should be eligible.282 The UK Solvency II insurer will need to satisfy the PRA that these own-fund items are available to absorb losses anywhere in the group. A firm may demonstrate this through intragroup guarantees, but this is not likely to be appropriate for most groups.283 The PRA is receptive to proposals for alternative approaches that address the legal restrictions associated with such instruments.284

Where an own-fund item of a related (re)insurer, third country (re)insurer, insurance holding company or mixed financial holding company cannot effectively be made available to cover the group SCR, it can be included in the calculation of group solvency but only up to the contribution of that undertaking to the group SCR.285

Groups must provide to the PRA details of how own funds may be made available, for example, by paying dividends or selling the assets of an undertaking or insurance holding company to recapitalise other group companies in difficulty, which the PRA will consider when reviewing a group’s assessment of transferability.286 The PRA will expect a group to demonstrate that own funds can be made available within a maximum of nine months, otherwise it will not be able to apply group own funds treatment to those particular own-fund items.287 It is questionable how the nine month rule can be applied in practice. Particular supervisory scrutiny/judgement is required in respect of assumptions made by insurance groups, which may be unrealistic.

PRA SS9/15 provides clarity on how firms may demonstrate that subordinated liabilities and preference shares are available to absorb losses anywhere in the UK Solvency II group. For example by demonstrating that:

- Each (re)insurer (including any (re)insurer acquired after the relevant instruments were issued) in the Solvency II group has the right to claim against the issuing entity if that (re)insurer is wound up and there is a shortfall for its policyholders and beneficiaries. Furthermore, the right of the group (re)insurers to claim on the issuing entity does not significantly increase group risks, including the level of complexity when winding up and contagion risk for issuing entities that are (re)insurers.

- The legal obligations of the issuing entity to the holders of the instruments, including coupon payments, are subordinated to any claims made by group (re)insurers that are being wound up.288

Pursuant to paragraph 5B.1D, the PRA considers, however, that intragroup guarantees used for this purpose increase certain risks in the group, particularly where:

- The issuing entity is a (re)insurer.

- There are multiple (re)insurers in the group.

- The issuing entity is a subsidiary of an entity that either has related (re)insurers or is a (re)insurer.

- There are significant intragroup transactions (both in terms of volume and value).289

The PRA expects that it will not be appropriate to use intragroup guarantees to ensure that subordinated liabilities and preference shares are available for these purposes for most groups. Correspondingly, the PRA is receptive to other approaches that UK Solvency II insurers may wish to propose when seeking to demonstrate availability of subordinated liabilities and preference shares, but these must address the legal restrictions derived from such instruments. The PRA will assess such proposals on a case-by-case basis. These complexities are a material driver for large groups to consolidate their carriers, insofar as reasonably possible.290

Classification of Group Own Funds

The Level 2 Delegated Regulation sets out rules for how the own funds of group companies should be classified in respect of the group solvency calculations, and these rules apply to both the Method 1 and Method 2 calculations.

Own Funds of Related (Re)insurers at Group Level

Own funds of (re)insurers in the group will be classified at group level in the same tier as they are classified at solo level provided that:

- The items must be free from encumbrances and not connected with other transactions that would undermine their satisfaction of the relevant criteria at group level.

- In order to qualify as group own funds, the item must meet the requirements of Article 71, 73 or 77 of the Level 2 Delegated Regulation (as applicable) both on a solo and a group basis. This means that references to SCR and MCR should be read also to mean the group SCR and the minimum group MCR, and references to the (re)insurer shall be read to mean the participating (re)insurer. Therefore, for example, to qualify as Tier 2 own funds at group level a Tier 2 subordinated debt instrument issued by a related (re)insurer will need to provide for deferral of distributions both on breach of the issuing undertaking’s SCR and on a breach of the group SCR.

- Own-fund items included in Tier 2 at solo level by of Article 73(1)(j) of the Level 2 Delegated Regulation — i.e., those that which meet the Tier 1 requirements but exceed the limits on subordinated mutual member accounts, preference shares, subordinated liabilities and grandfathered items set out in Article 82(3) of the Level 2 Delegated Regulation — can be included in Tier 1 at group level if the limits set out in Article 82(3) would be met at group level.291

Group Level Own Funds of Related Third Countries

Own funds of related third country (re)insurers should be classified using the criteria set out in Articles 69 to 79 of the Level 2 Delegated Regulation with the following additional requirements:

- The items must be free from encumbrances and not connected with other transactions that would undermine their satisfaction of the relevant criteria at group level.

- For the purposes of assessing compliance with Article 71, 73 or 77 of the Level 2 Delegated Regulation: (i) SCR shall mean the group SCR; and (ii) MCR shall mean both the capital requirement of the issuing undertaking as laid down by the relevant third country supervisory authority and the minimum group MCR.292

Own Funds of Insurance Holding Companies, Mixed Financial Holding Companies and Ancillary Insurance Services Undertakings at Group Level

Own funds of insurance holding companies, intermediate insurance holding companies, mixed financial holding companies, intermediate mixed financial holding companies and subsidiary ancillary insurance services undertakings are classified using the criteria set out in Articles 69 to 79) of the Level 2 Delegated Regulation with the following additional requirements:

- The items must be free from encumbrances and not connected with other transactions that would undermine their satisfaction of the relevant criteria at group level.

- For the purposes of assessing compliance with Article 71, 73 or 77 of the Level 2 Delegated Regulation: (i) SCR shall mean the group SCR; and (ii) MCR shall mean both the minimum group MCR, and the insolvency of the insurance holding company, intermediate insurance holding company, mixed financial holding company, intermediate mixed financial holding company or subsidiary ancillary insurance services undertaking.

- References to the (re)insurer shall be read to mean the insurance holding company, intermediate insurance holding company, mixed financial holding company, intermediate mixed financial holding company or subsidiary ancillary insurance services undertaking which has issued the own-fund item.

Own Funds of ‘Residual Related Undertakings’ at Group Level

Own funds of other related undertakings will be considered as part of the reconciliation reserve at group level.293 The own-fund items should be classified into tiers based on the criteria set out in Section 2 of the Level 2 Delegated Regulation where practicable and where the own-fund items are material.294

Subordination to Group Policyholders

Recital 127 of the Level 2 Delegated Regulation states that:

“In order to ensure that the policyholders and beneficiaries of insurance and reinsurance undertakings belonging to a group are adequately protected in the case of the winding-up of any undertakings included in the scope of group supervision, own-fund items which are issued by insurance holding companies and mixed financial holding companies in the group should not be considered to be free from encumbrances unless the claims relating to those own-fund items rank after the claims of all policyholders and beneficiaries of the insurance and reinsurance undertakings belonging to the group.”

Paragraph 6.5 of the PRA SS3/15 states that the PRA expects that the terms of instruments issued by insurance holding companies or mixed financial holding companies should include terms providing that, in the case of winding up proceedings of any firm in the group until all obligations by that member of the group to its policyholders and beneficiaries have been met, repayment of amounts due under the instrument are refused. In the absence of such provision, the instrument will not qualify as group own funds. The PRA subsequently confirmed in discussions with firms that:

- The deferral applies only to redemption and not payment of interest.

- The requirement does not extend to the winding up of the issuing insurance holding company or mixed financial holding company itself.

7. Group Internal Models

An application can be made to use an IM to calculate either only the group SCR or both the group SCR and the individual SCR of (re)insurers within the group.295

Articles 343 to 350 of the Level 2 Delegated Regulation set out details of the application requirements and approval procedures.

_______________

234 Article 213(2) of the Solvency II Directive (transposed in (i) Regulation 9A of the Solvency 2 Regulations 2015; and (ii) Paragraph 2.1, Group Supervision Part of the PRA Rulebook).

235 Ibid.

236 PRA Glossary “insurance holding company”.

237 Article 213(2) of the Solvency II Directive (transposed in (i) Regulation 9A of the Solvency 2 Regulations 2015; and (ii) Paragraph 2.1, Group Supervision Part of the PRA Rulebook).

238 PRA Glossary “mixed financial holding company”.

239 Article 262(2) of the Solvency II Directive (transposed in (i) Regulation 35 of the Solvency 2 Regulations 2015; and (ii) Paragraph 20.1(1), Group Supervision Part of the PRA Rulebook).

240 The EIOPA, “International Regulations and Equivalence”.

241 PRA CP12/23.

242 Paragraph 20.1(2), Group Supervision Part of the PRA Rulebook.

243 Article 213(2) of the Solvency II Directive (transposed in (i) Regulation 9A of the Solvency 2 Regulations 2015; and (ii) Paragraph 2.1(4), Group Supervision Part of the PRA Rulebook).

244 Article 213(2) of the Solvency II Directive (transposed in (i) Regulation 9A of the Solvency 2 Regulations 2015; and (ii) Paragraph 2.1, Group Supervision Part of the PRA Rulebook).

245 Regulation 13 of the Solvency 2 Regulations 2015.

246 Article 45 of the Solvency II Directive (transposed in Paragraph 3.8, Conditions Governing Business Part of the PRA Rulebook).

247 Article 245, ibid (transposed in (i) Regulation 24 of the Solvency 2 Regulations 2015; and (ii) Paragraph 16.2, Group Supervision Part of the PRA Rulebook).

248 Article 377 of the Level 2 Delegated Regulation.

249 Article 261 of the Solvency II Directive (transposed in (i) Regulation 35 of the Solvency 2 Regulations 2015; and (ii) Paragraph 20.1(1), Group Supervision Part of the PRA Rulebook).

250 Commission Delegated Decision (EU) 2016/309.

251 Commission Delegated Decision (EU) 2015/1602.

252 Solvency 2 Regulations 2015 Equivalence Directions 2020.

253 Financial Services and Markets Act 2023 (Commencement No 8) Regulations 2024 (SI 2024/1071).

254 Article 262(2) of the Solvency II Directive (transposed in (i) Regulation 35 of the Solvency 2 Regulations 2015; and (ii) Paragraph 20.1, Group Supervision Part of the PRA Rulebook).

255 Articles 4(c)-(d) of the UK-US Bilateral Agreement.

256 Paragraphs 4 to 14, Group Supervision Part of the PRA Rulebook.

257 Article 227 of the Solvency II Directive (transposed in Paragraph 10.4, Group Supervision Part of the PRA Rulebook).

258 Article 220(2), ibid (transposed in Paragraph 7.1, Group Supervision Part of the PRA Rulebook).

259 Article 230(1), ibid (transposed in Paragraph 10.4, Group Supervision Part of the PRA Rulebook).

260 Paragraph 10.6, Group Supervision Part of the PRA Rulebook.

261 Article 214 of the Solvency II Directive (transposed in Paragraph 2.3, Group Supervision Part of the PRA Rulebook).

262 Article 229(3) of the Level 2 Delegated Regulation.

263 Article 13, ibid.

264 Article 222(1) of the Solvency II Directive (transposed in Paragraph 8.1, Group Supervision Part of the PRA Rulebook).

265 Article 221(1), ibid (transposed in Paragraph 8.3, Group Supervision Part of the PRA Rulebook).

266 Article 221(2), ibid (transposed in Paragraph 8.3, Group Supervision Part of the PRA Rulebook).

267 Article 330(4) of the Level 2 Delegated Regulation.

268 Article 230(2) of the Solvency II Directive (transposed in Paragraph 11.3, Group Supervision Part of the PRA Rulebook).

269 Article 233(1), ibid (transposed in Paragraph 12.1, Group Supervision Part of the PRA Rulebook).

270 Article 227, ibid (transposed in Paragraph 10.4, Group Supervision Part of the PRA Rulebook).

271 Regulation 19(2) of the Solvency 2 Regulations 2015.

272 As at the time of publication, no reciprocal determination has been made by the EU in respect of the UK. UK insurers will need to apply the Solvency II Directive rules to calculate the contribution of the UK undertakings to group SCR.

273 Article 221(1) of the Solvency II Directive (transposed in Paragraph 8.2, Group Supervision Part of the PRA Rulebook).

274 Article 225, ibid (transposed in Paragraph 14.1, Group Supervision Part of the PRA Rulebook).

275 Article 221(2), ibid (transposed in Paragraph 10.3, Group Supervision Part of the PRA Rulebook).

276 Article 223, ibid (transposed in Paragraph 9.8, Group Supervision Part of the PRA Rulebook).

277 Article 223, ibid (transposed in Paragraphs 12.1 to 12.3, Group Supervision Part of the PRA Rulebook).

278 Article 222(5), ibid (transposed in Paragraph 9.4, Group Supervision Part of the PRA Rulebook).

279 Paragraph 9.2, Group Supervision Part of the PRA Rulebook.

280 Paragraph 9.3, ibid.

281 Paragraph 5A.2E of the PRA SS9/15.

282 Paragraph 5B.1B, ibid.

283 Paragraph 5B.1C, ibid.

284 Paragraph 5B.1E, ibid.

285 Article 218 of the Solvency II Directive (transposed in Paragraph 4, Group Supervision Part of the PRA Rulebook).

286 Paragraph 5A.3 of the PRA SS9/15.

287 Ibid.

288 Paragraph 5B.1B, ibid.

289 Paragraph 5B.1D, ibid.

290 Paragraph 5B.1E, ibid.

291 Article 331(1) of the Level 2 Delegated Regulation.

292 Article 332, ibid.

293 Article 334(1), ibid.

294 Article 334(2), ibid.

295 Article 231 of the Solvency II Directive (transposed in Paragraph 11.4, Group Supervision Part of the PRA Rulebook).

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.