Takeaways

- U.S. IPOs skyrocketed in 2021, with SPAC IPOs and direct listings contributing meaningfully to the increase.

- Along with the rise in IPO activity, companies are receiving more SEC comments on their filings.

- Companies are reaching new investors through stock trading apps, opening up their roadshows to the public and negotiating more flexible lockup agreements.

- Strong tailwinds suggest 2022 will be another big year.

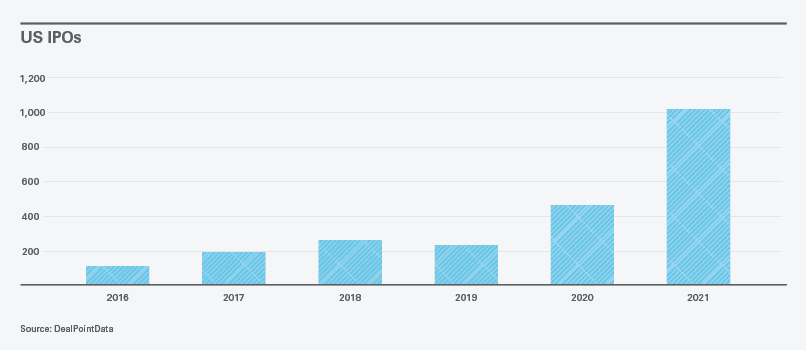

It was a banner year for companies going public in the United States: Over 1,000 companies gained listings on American exchanges in 2021, up from just 118 companies in 2016.

While the number of traditional U.S. IPOs rose in 2020-21, new models of going public also became more mainstream. Special purpose acquisition companies (SPACs) have dominated headlines since 2020 and direct listings increased in popularity. Companies seeking to go public are finding more flexibility than ever to choose the path that best fits their needs.

Traditional IPOs

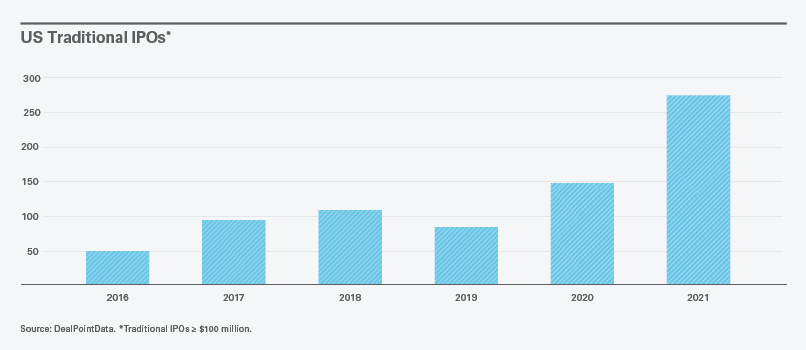

Conventional IPOs generally involve the company issuing shares to the public for cash. The number of companies going public via a “traditional” $100 million-plus IPO rose to more than 275 in 2021, up from just 49 in 2016.

More SEC Comments

Along with this uptick in activity, we have seen an increase in Securities and Exchange Commission (SEC) scrutiny of IPO disclosures. In 2021, a company could expect to receive an average of 21 SEC comments on its initial IPO registration statement filing, an increase of more than 30% from 2015. Similarly, the average number of comments received during subsequent back and forth with the SEC increased over 30% from 2015. We expect this trend to carry into 2022, with continued SEC scrutiny of topics such as non-GAAP financial measures and "cheap stock" issuances to company insiders.

Virtual Roadshows

Like other transactions, and business practices in general, COVID-19 has affected the IPO process. Historically, a company would conduct a seven- to 10-day roadshow, traveling to major cities in the U.S. and abroad to meet with potential investors. During the pandemic, roadshows turned virtual — with bankers and companies trading conference rooms for Zoom backgrounds. Although some in-person investor meetings resumed toward the end of 2021, we expect a substantial majority of these meetings to continue virtually for at least the first half of 2022 not only because of the recent surge in variant cases, but also since virtual meetings have the ability to reach more investors in a shorter time frame.

Reaching Out to Retail Investors

We saw the target of IPO marketing widen in 2021. Historically, companies and investment banks have focused almost exclusively on meeting institutional accounts during the roadshow, allocating the IPO shares to them in the process. Last year, FIGS, Inc. became the first company conducting a traditional IPO to allocate roughly 1% of its offering to retail investors via the Robinhood and SoFi trading apps. To date, upward of 20 companies, including Rivian Automotive, Inc. and Duolingo, Inc., have followed suit.

Live Q&As Open to the Public

At the same time, companies have adapted the traditional playbook for meeting investors. The availability of new communication technology and widening of the investor pool have led businesses to reimagine their roadshows, introducing “investor days,” when management is broadly accessible to any and all potential investors via the internet. For example, Robinhood conducted a live Q&A, available for worldwide streaming, and answered questions submitted by the public, as part of its IPO marketing effort. We expect marketing targeting both institutional and retail investors to become more commonplace going forward.

Less Rigid Lockups

Another trend we have seen is increasing flexibility for companies and their pre-IPO shareholders around underwriting lockup periods. In the past, all pre-IPO shareholders were expected to sign lockup agreements with the underwriters, committing to not sell any of their existing securities for 180 days following the IPO. The downside to this approach was that a significant amount of stock became available for sale on the 181st day post-IPO.

In recent years, the traditional lockup has been watered down, with a significant number of recent IPOs having early release provisions allowing holders to sell their shares within the traditional 180-day lockup period. For example, some of Riskified Ltd.'s shareholders were allowed to sell a portion of their shares in the first two months post IPO. Likewise, some of monday.com Ltd.’s holders were allowed to sell 25% of their shares if the company's share price was at least 33% higher than the IPO price following the release of the company’s first post-IPO earnings report. We expect that in 2022 companies will continue enjoying meaningful flexibility in negotiating lockup provisions with the investment banks leading their IPOs — flexibility that was unheard of a handful of years ago.

More Direct Listings

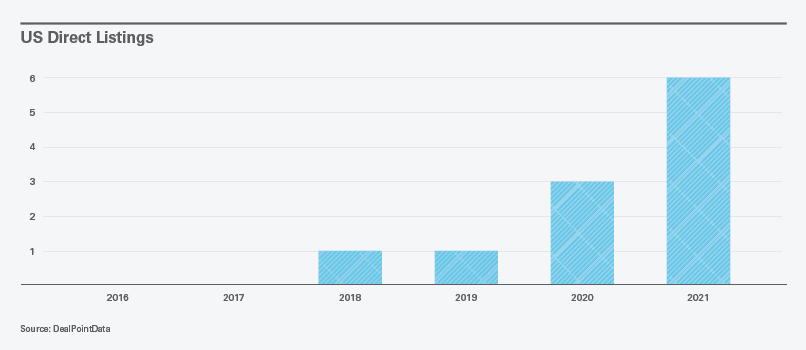

In 2018, Spotify became the first company to conduct a direct listing (in which shares to date have not been issued to the public as they are in traditional IPOs). Since 2018, 12 companies have gone public via direct listings in the United States, half of which occurred in 2021.

A company undertaking a direct listing should expect more comments from the SEC, specifically from the agency’s Trading and Markets Division, which oversees the mechanics of direct listings, than those companies opting for traditional IPOs. The 12 companies that have gone public via direct listings since 2016 received an average of 52 SEC comments, compared to an average of 31 for traditional IPOs. Going forward, as companies, investment banks, lawyers and the SEC itself work out the kinks in the direct listing process, we expect the number of comments to come down, moving more in line with the figure for traditional IPOs.

SPACs

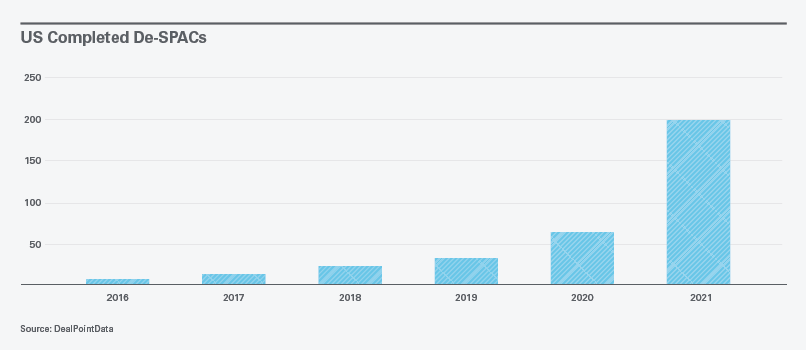

The boom in SPAC IPOs we saw in 2020 continued into the first quarter of 2021. But that activity began to slow significantly in the second quarter, due to market forces and greater regulatory scrutiny of SPACs generally. (See “Choppy Market for SPACs and PIPEs, Competition for Targets Spurs Deal Innovations.”)

For public-ready private companies, de-SPACs can still offer important advantages compared to traditional IPOs, including more certain price and value discovery at the beginning stage; the ability to incorporate favorable terms more common to M&A transactions, such as earnouts; and the flexibility to negotiate within the confines of an acquisition agreement. However, while historically, de-SPAC transactions often could move faster than an IPO, a company undertaking a de-SPAC transaction should expect timing more similar to, and in some cases longer than, a traditional IPO process given increased time for deal structuring and negotiations and a greater number of SEC comments. The SEC also has been looking more closely at how projections and related valuations are presented and used in de-SPAC documentation, including whether that type of forward-looking information should be excluded from certain liability safe harbors under the securities laws.

The number of announced de-SPACs in the U.S. increased by over 200% in 2021 relative to 2019. This comes as no surprise given the enormous sums raised through SPAC IPOs in recent years and the 15- to 24-month windows in which SPACs typically must consummate a de-SPAC.

In 2022, we expect to see continued strong de-SPAC activity, since more than 400 SPACs were still looking for M&A targets as of the end of 2021. We also should see SPAC IPOs continue in 2022, although in fewer numbers than 2020-21 given the regulatory environment and the overall SPAC market.

See all of Skadden’s 2022 Insights

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.