In this update, we consider key statistics, trends, developments and highlights regarding U.K. public M&A transactions governed by the U.K. City Code on Takeovers and Mergers that were announced during the second half (H2) of 2021.1 For a review of the first half of 2021, see our client alert “UK Public M&A Update – H1 2021.”

Key Statistics and Trends

2021 vs. 2020

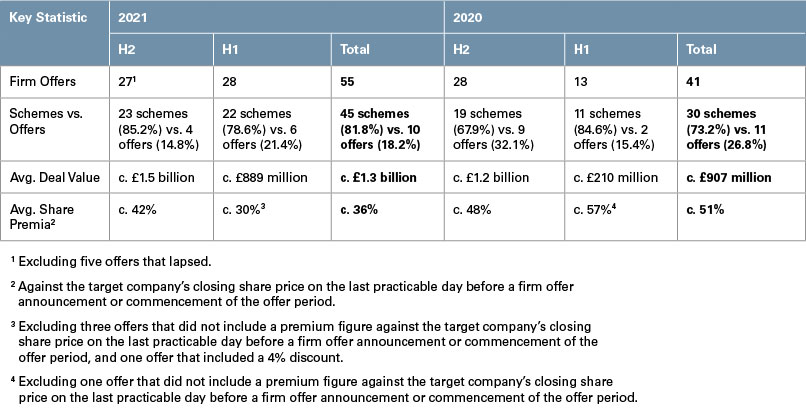

U.K. public M&A activity over the course of H2 2021 was elevated compared to H1 2021. The higher number of firm offers announced (including the five firm offers that lapsed) and average deal value seem to have been primarily driven by the recovery in market confidence following the successful nationwide COVID-19 vaccine rollout in H1 2021. With respect to fiscal year (FY) 2021 as a whole, the significant increase over 2020 in the volume and average value of deals — in particular over the latter half of the year, as set out below — resulted in a substantially higher aggregate deal value of approximately £68 billion (compared to £36 billion in 2020).

Deal Values

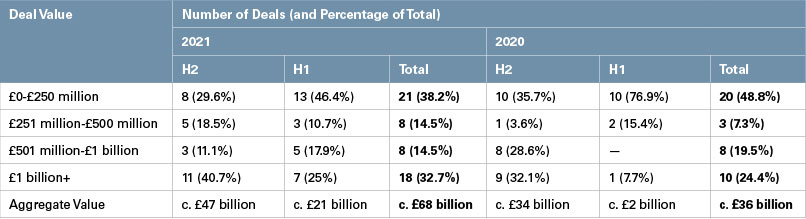

As compared to H1 2021, in H2 2021 we saw even higher deal values, with 11 transactions (or 40.7% of all offers) valued at above £1 billion (excluding two firm offers that lapsed). H2 2021 had a lower number of deals valued at below £500 million, coming in at 13 (or 48.1% of all deals) compared to 16 (or 57.1% of all deals) in H1 2021. The number of deals valued at over £1 billion in FY 2021 came in at almost double that of FY 2020, with 18 deals (or 32.7% of all deals), including two that lapsed. This shows that the upward trajectory of higher deal values that we recognised at the end of H1 2021 (as compared to H1 2020) maintained its momentum towards the end of the year. The higher deal values are attributable to the significant amount of capital awaiting investment, driven by the participation of multiple consortium members in deals as well as the availability of funds to private equity and sovereign wealth funds.

Industry Breakdown

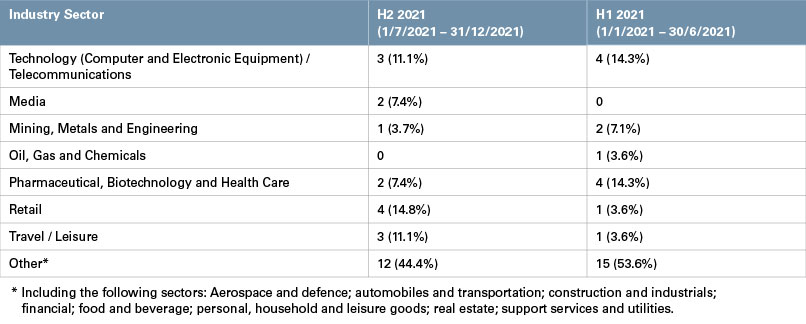

As recognised above with respect to the elevated U.K. public M&A activity in FY 2021 continuing all the way to the end of the year (as well as the larger number of higher-value deals in H2 2021), the global COVID-19 vaccine rollout may have had an impact on the increased deal activity in the travel and leisure sector, which saw three deals (or 11.1% of all deals) in H2 2021, up from one (or 3.6% of all deals) in H1 2021. The retail sector also saw a sizeable increase in deals, with four (or 14.8% of all deals) in H2 2021 compared to one (or 3.6% of all deals) in H2 2021. That increase may also reflect confidence in the steady recovery of both of these sectors in the wake of the pandemic, as restrictions begin to ease.

Key Developments and Highlights

Public to Private (P2P) Transactions

As identified at the end of H1 2021, P2P activity remained strong towards the end of 2021. The year saw approximately 64% of the firm offers announced during the year made by bidcos backed by private equity, financial investors, individuals or family offices. Private equity’s appetite to engage on larger transactions continued to grow, with P2P transactions in 2021 having an aggregate deal value of £41.1 billion (compared to £20.5 billion in 2020) and an average deal value of £1.2 billion (compared to £733 million in 2020). P2P transactions represented 63% of total deal value in 2021 (compared to 57% in 2020). The trend is likely to continue into 2022, as private equity funds look to further capitalise on availability of targets and any continuing uncertainty driven by COVID-19. It is also notable that several of the high-value P2P transactions announced in 2021 involved bidders backed by individuals or family offices.

Consortium and Overseas Bidders

A feature of a number of P2Ps in 2021 was that they were “club deals” involving multiple consortium members, giving the bidco access to multiple financing sources. There were 10 consortium bids in 2021 — double that of 2020 — five of which had deal values exceeding £1 billion. The composition of consortia was diverse and included private equity firms, pension funds, sovereign wealth funds, corporates, individuals and family offices.

Overseas bidders continued to be a significant presence in UK plc acquisitions in 2021 and were involved in approximately 70% of the firm offers announced during the year (up from 62% in 2020). Overseas bidders were also active on the highest-value deals, being involved in almost all of the deals valued at over £1 billion announced in 2021.

Shareholder Activism

2021 saw increased shareholder opposition to bids where they felt that the offer undervalued the target company and their investment. This engagement took several different forms, including questioning the offer price, challenging schemes in the courts and engaging in “bumpitrage” to improve offer terms. This trend of sustained shareholder activism is likely to continue into 2022, with shareholders feeling increasingly emboldened to challenge target company boards to negotiate robustly and even to take their concerns public in order to secure offer terms that adequately reflect the value of their investments.

__________

1 The data in this article is from Thomson Reuters Practical Law.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.