In this update, we consider key statistics, trends, developments and highlights regarding UK public M&A transactions governed by the UK Takeover Code that were announced during the first half (H1) of 2022.

Key Statistics and Trends

H1 2022 vs. H1 2021

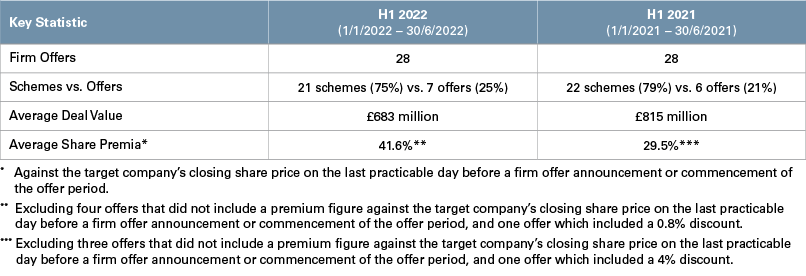

Public M&A deal activity was resilient at the start of H1 2022 but has since been affected by rising market scepticism. With 28 firm offers announced, the volume of deals was in line with that in H1 2021 and demonstrated a steady return to prepandemic levels of activity. The most popular offer structure continued to be a scheme of arrangement, accounting for 75% of the offers announced in H1 2022.

However, geopolitical factors such as the Russia-Ukraine war and associated sanctions that have been imposed,1 as well as rising inflation and interest rates, have brought uncertainty to public M&A markets. The decrease in deal volume and value compared to a very strong H2 2021 indicates investors’ caution and limited eagerness to engage in transactions in the current market. The complex environment, which is redolent of the uncertainty seen at the beginning of the COVID-19 pandemic, makes deal movement in the second half of 2022 difficult to predict. The current regulatory environment also continues to impact transactions, in particular by elongating the overall timeline and making transaction execution less certain for bids in certain sensitive sectors.

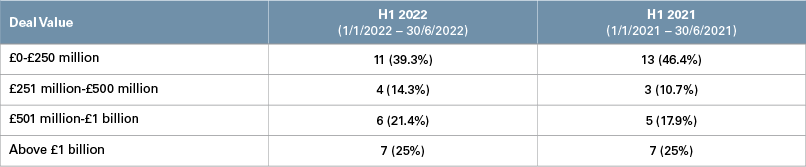

While H1 2022 did not match the number of high-value transactions that were characteristic of H2 2021 (seven deals valued at above £1 billion in H1 2022, compared with 11 in H2 2021), deal values were broadly similar to those experienced in H1 2021. Transactions valued at above £1 billion reflect the same proportion as for H1 2021, constituting 25% of all firm offers, with the highest firm offer being valued at just over £4 billion. The number of deals below £250 million decreased slightly, from 46.4% in H1 2021 to 39.3% in H1 2022.

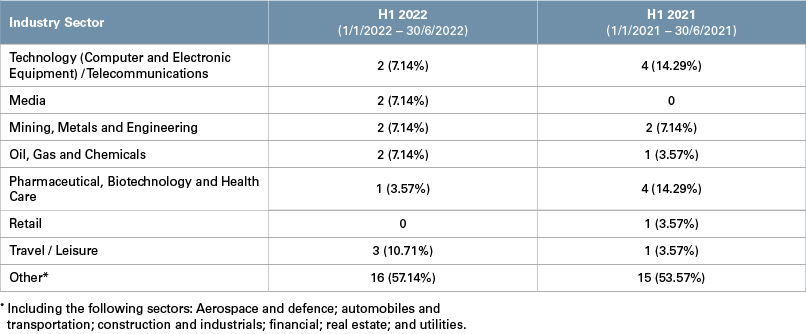

With COVID-19 related travel restrictions easing, deals in the travel and leisure sector have seen an increase in activity, accounting for 10.7% of all firm offers announced in H1 2022. This represented a significant increase, from 3.57% in H1 2021. Other particularly active sectors included industrial support services, real estate and public transport.

The ongoing conflict in Ukraine and sanctions against Russia have resulted in high market volatility in the mining, metals and engineering sector as well as the oil, gas and chemicals sector, the effects of which are likely to continue to show in the second half of 2022. The Russia-related sanctions and uncertainty about the outcome of the war have led to a surge in commodity prices, including for energy and food, and supply chains have been disrupted. At the same time, deals involving tech, pharmaceutical and biotech companies appear to have lagged due to a global trend of market uncertainty concerning these sectors and increased regulatory scrutiny on both competition and national security grounds.

Key Developments and Highlights

Public to Private (P2P) Transactions

Interest from private equity sponsors in acquiring public companies remained relatively strong, with eight P2Ps announced in H1 2022, representing 28.6% of all firm offers. However, this was materially down from 2021, where P2P transactions accounted for 64% of firm offers announced. In H1 2022, P2Ps accounted for a significant proportion of the larger transactions, with six of the eight P2Ps (75%) being in excess of £500 million by value. However, with inflation and rising interest rates driving the current levels of uncertainty in the debt markets, and with unclear public company valuations, it is doubtful that H2 2022 will see financial sponsors remain as active in public takeovers as they have been in the previous 24 months. One possible exception to this would be the increasing number of financial sponsors able to fund offers on a full equity basis, rather than having to rely on third-party debt.

Formal Sale Processes (FSP)

H1 2022 saw a significant increase in FSPs, with nine announced (compared with two in H1 2021), reflecting a continued interest in companies being able to conduct a competitive and confidential private auction process with multiple potential bidders. FSPs have also been driven by pressure from shareholders, with Countryside Partnerships announcing an FSP two weeks after rejecting an offer from In-Cap, a US fund, which resulted in its shareholders pushing for a sale. With decreasing share prices and continued pressure being placed upon UK plc boards by investors (including activists), we expect FSPs to remain popular in H2 2022.

Changes to the Takeover Code

Various amendments to the Takeover Code took effect on 13 June 2022. In particular, the Takeover Panel introduced a new requirement for potential bidders to publicly specify in their possible offer announcements whether their offer would need to be at any minimum price or form of consideration. A new rule was introduced which prevents mandatory bidders from acquiring additional interests in target shares in the 14 days prior to and including the unconditional date of the mandatory bid. Finally, the restriction on acquiring shares through the anonymous order book system was removed.

The Takeover Panel also published Practice Statement 33 on 13 June 2022, which provides guidance on purchasing target shares during an offer period.

On 26 May 2022, the Takeover Panel published a consultation paper concerning certain proposed changes to the presumptions of the definition of “acting in concert” and related matters.

1 See our recent client alerts for more on the Russia-related sanctions.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.