In this update, we provide four predictions for the UK public M&A landscape in 2024, considering key statistics, trends, developments and highlights regarding UK public takeovers announced during 2023.

Given that the UK public takeover market has remained subdued for a couple of years (in line with the global M&A market more generally), the hope is that deal activity will recover in 2024. 2023 has provided signs that this is possible.

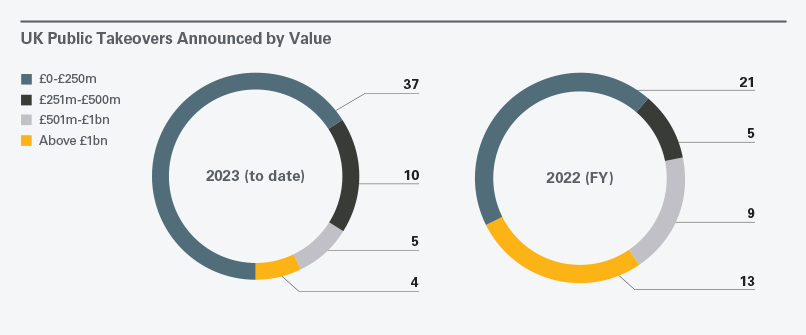

So far, 2023 has seen a higher number of firm offers announced compared to full-year 2022 (56 vs 48) but the average deal value is down significantly (by 36%) from £861 million in 2022 to £309 million. This demonstrates that the appetite for dealmaking has been present but bidders have been reluctant to target larger transactions, potentially due to:

- The economic environment, with high inflation and increasing interest rates impacting bid financing.

- Significant geopolitical instabilities, e.g., the Russia/Ukraine and Hamas/Israel conflicts and the impact they have had on, amongst many things, global markets.

- An unpredictable regulatory environment, with an expanding regulatory perimeter globally and the launch of significant interventions by regulators.

Many of these factors will remain relevant in 2024; however, with inflation and interest rates appearing to settle, there is cause for cautious optimism that M&A activity will rebound if parties are able to get comfortable with the geopolitical and regulatory landscape.

Four Predictions

Possible Return of Megadeals: M&A advisers would gladly see a return of ‘megadeals’, i.e., those valued in excess of £1 billion. These have been notably absent in 2023, with only four (as opposed to 13 in 2022). Whether the trend will reappear is difficult to predict. In the short term, the market will likely be driven by midmarket deals. Also, cross-border strategic bidders for UK targets, which drove many past megadeals, have been lacking in the last couple of years. Such bidders may return and stimulate upper-market activity as Brexit uncertainty subsides. Outside the UK, recent megadeals have been driven by the energy sector (e.g., the $64.5 billion merger of Exxon Mobil and Pioneer Natural Resources and $59.6 billion merger of Chevron and Hess) and pharmaceutical sector (e.g., the $42.1 billion merger of Pfizer and Seagen). Larger deals may also be driven by …

P2Ps: With interest rates stabilising, financing costs will become more certain, which should attract financial sponsors to the negotiating table to deploy their significant reserves of dry powder. In 2023, a majority of UK takeovers were public-to-private transactions (P2Ps), as has been the case in recent years. Additionally, in 2023, all four deals valued greater than £1 billion (KKR’s £1.3 billion offer for Smart Metering Systems, Brookfield’s £2.2 billion offer for Network International, EQT and ADIA’s £4.5 billion offer for Dechra Pharmaceuticals and Teddy Sagi’s $1.58 billion offer for Kape Technologies) involved P2Ps, providing optimism that financial sponsors may again look to larger transactions in 2024. Financial sponsors may also revisit 2022’s trend of participating in consortium bids or ‘club deals’ with other bidders, enabling them to spread the risk of undertaking larger transactions. P2Ps may also benefit from the increased use of …

Private Credit: One consequence of the recent high interest rate environment has been the growth of private credit lending as a source of bid financing. Most UK public M&A deals in 2023 to date have involved financial sponsors acting in a private credit lender capacity, and this trend is expected to continue, offering bidders an alternative to the traditional banking lenders. Bidders may also seek to use alternative consideration to cash, including …

Stub Equity: Examples of unlisted bidder shares (or ‘stub equity’) being offered as a form of consideration have been relatively uncommon historically. However, four deals in 2023 used stub equity, including three P2Ps and, notably, one strategic: Mars’ offer for Hotel Chocolat. The benefit of offering share alternative consideration is that rollover arrangements can be locked in at the time of announcement without the risk of having to obtain the approval of independent target shareholders (under Rule 16 of the Takeover Code). However, bidders contemplating share alternatives should consider the possibility that offering them to all shareholders can result in a number of unknown and unintended shareholders in the bidco structure post-closing.

Key Statistics: 2023 (to date) vs 2022 (full year ‘FY’)

| UK Public Takeovers Announced | 2023 (to date) | 2022 (FY) |

| Firm offers | 56* | 48 |

| Schemes vs offers | 43 (76.8%) vs 12 (21.4%) | 38 (79.2%) vs 10 (20.8%) |

| Average deal value | £309m | £861m |

| * Includes one tender offer |

||

Although the number of firm offers announced so far in 2023 marks a 17% increase over full-year 2022, the average deal value decreased significantly by 36%. As expected, schemes continued to be by far the most popular structure for implementing UK public takeovers.

So far in 2023, the small/mid-segments of the market drove activity, with deals under £500 million in value accounting for 84% of all transactions (by contrast, in 2022 they accounted for 54%).

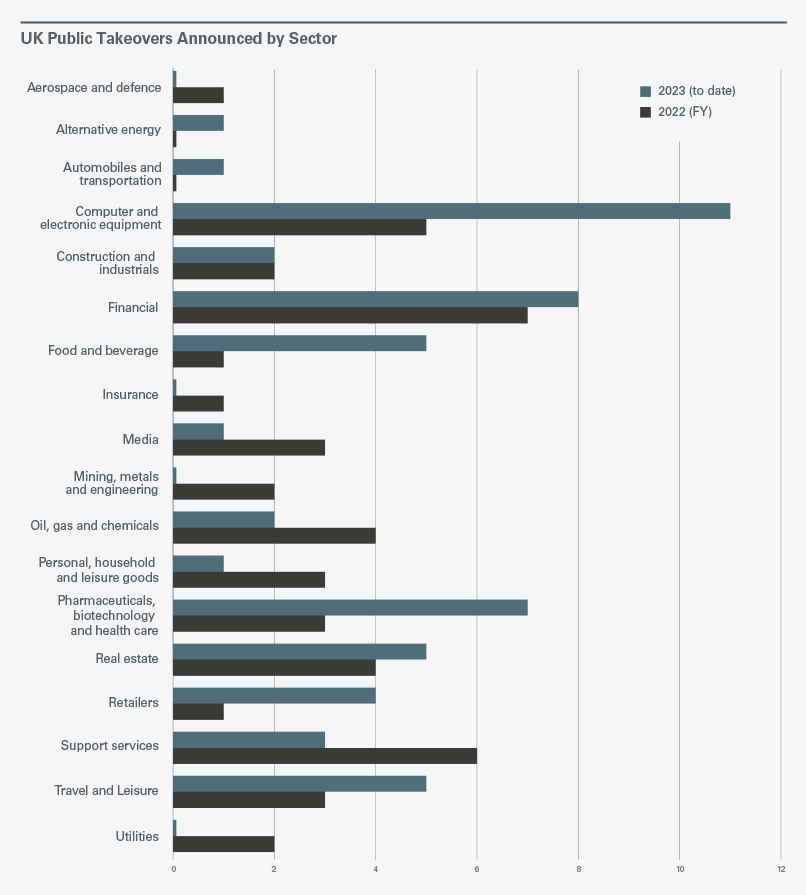

The computer/electronics sector has accounted for almost 20% of dealmaking activity in 2023 to date, with deals in the financial, pharma/biotech and retail/travel sectors also remaining popular.

Other Trends

Two other 2023 trends are worth bearing in mind when considering what 2024 might have in store:

Activism: Shareholder activism will continue to impact bids, in particular ‘bumpitrage’ strategies which may result in bidders being forced to increase their offer terms, even after securing the target board’s recommendation. For example, in December 2023, Apax increased its offer for Kin and Carta (and declared it ‘final’) partially in response to Coast Capital Management’s public opposition to its original bid price.

Sales Processes: Formal Sales Processes (FSPs) are likely to continue being used for companies in distress as a method of (almost) last resort, save for in a limited number of circumstances. Notably, in 2023, eight FSPs were launched, and whilst three remain ongoing at the time of writing, none of the rest resulted in a successful bid.

Knowledge strategy lawyer Sharon Jenman contributed to this article.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.