Key Points

- The number of activist campaigns launched against European companies rose again in 2023, with a new focus on German targets.

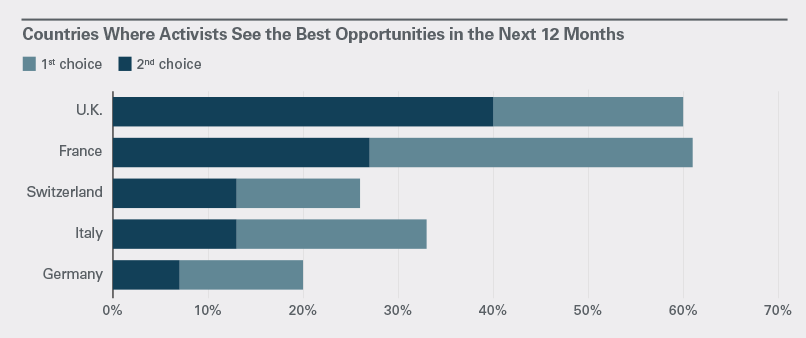

- Many activists surveyed believe that France offers them good opportunities.

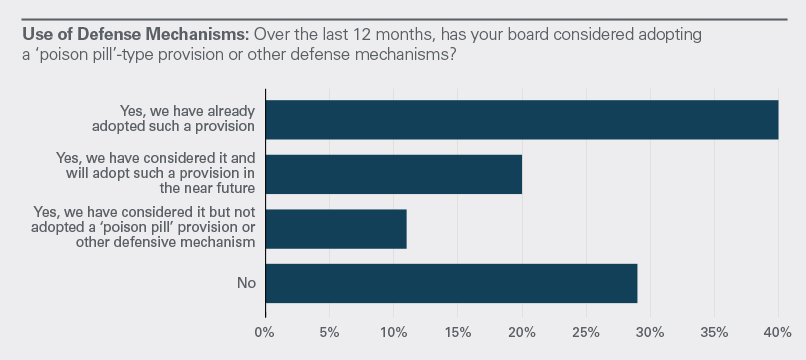

- Most of the companies surveyed said they have moved to install defenses against activists, or plan to in the near future.

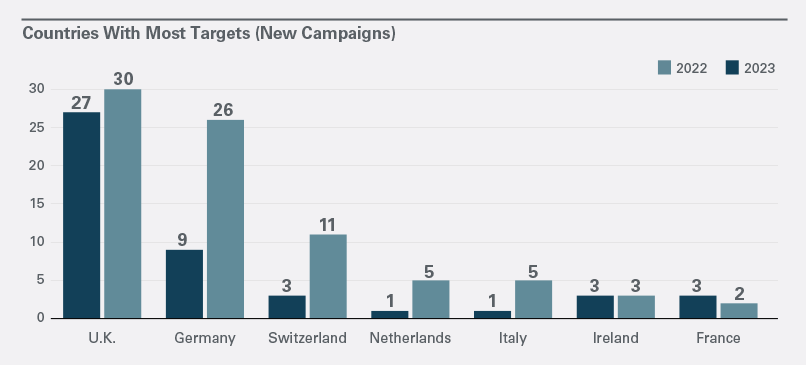

The boards of listed European companies increasingly find themselves faced with pressure from activist investors. A record number of new public activist campaigns were launched in 2023 and a number of new activist players entered the scene, Skadden’s fourth annual survey of the European activist landscape reports. Germany saw the most dramatic increase in activity, with 26 companies targeted in 2023.

In addition, activists in Europe are now more likely to make their demands publicly rather than approaching companies privately, companies report.

The report, conducted in collaboration with Activistmonitor, combines statistics with a survey of 35 corporate executives of listed companies and 15 activist investors conducted in the fourth quarter of 2024. Below are excerpts. The full report can be found here.

Some of the report’s findings were striking — even surprising.

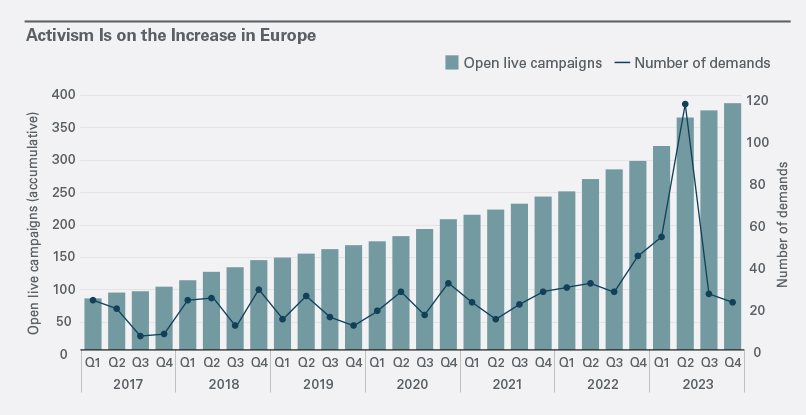

New campaigns and cumulative live campaigns were up significantly again in 2023.

The number of new public activist campaigns soared in 2023, to 89, sharply up from the 53 launched in 2022, a 68% increase. That brought the cumulative total of open live campaigns to 380 at the end of 2023, versus 291 a year earlier.

Because some campaigns include multiple demands, the increase in new campaigns in 2023 pushed up the number of new demands issued to 225, up 62% from 132 in 2022.

A large majority of corporations report that they have faced an activist recently.

Seventy-four percent of corporate respondents said their companies faced one or two activists approaches in the past 12 months, and 8% said they had received demands from three or four such investors.

Germany emerged as an important market for activists in 2023.

Twenty-six new campaigns were launched against German companies in 2023 — nearly as many as in the U.K. (30), where there is a longer tradition of activist pressure. Moreover, the three activist investors initiating the most new campaigns were all German: Union Investments/DZ Bank, DSW and Deka Investment.

French companies could be targets

Notwithstanding the sharp rise in German targets, the 15 activists surveyed ranked France second to U.K. as the jurisdiction offering the most opportunities in the year ahead, and put Germany behind Switzerland and Italy.

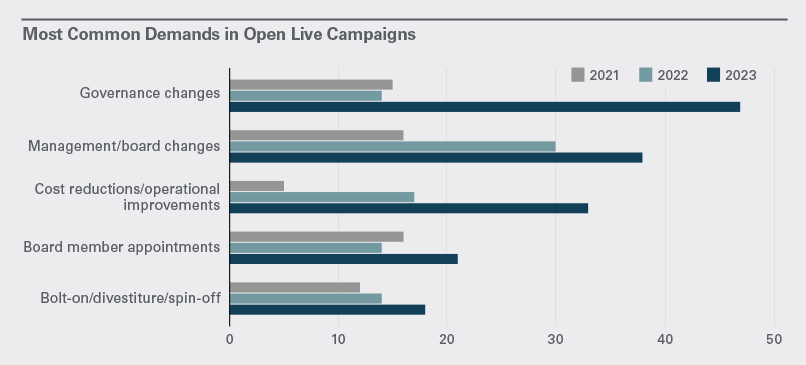

Governance changes (including board or management changes), cost and operational changes and transactions topped the lists of demands.

A majority of companies responding (40%) said they have recently added, or enhanced, their corporate defense mechanisms or plan to (20%) “in the near future.” These mechanisms are typically less aggressive than the “poison pill” tools that many U.S. corporations utilize and may just require notification of a holding of voting rights at a lower threshold. However, the wider prevalence of these measures indicates that companies are more concerned; last year, only 3% reported installing such defenses.

Insights From Skadden Partners

“In the past, activists would usually demand that the CEO and chair go. Today, the more

common demand is for the appointment of a ‘challenger’ non-executive director offering alternative perspective. Companies facing attempts to remove their lead executives would naturally fight back, whereas adding a fresh voice to the board may be something to be welcomed.

“In almost all cases there is a benefit to engaging with activists. It shows the company is willing

to talk with its investors, and some of the ideas may be worthwhile. The company will learn something from the dialogue.” — George Knighton, London

“German corporates are suffering from supply-chain issues, as well as decoupling and derisking. These and other factors have brought to light needs for reorganization, spin-offs, M&A and other corporate transactions. Activists are seeing these needs and have increasingly used them for their campaigns.” — Matthias Horbach and Holger Hofmeister, Frankfurt

“Given the significant gap that persists between public and private market valuations — and the resulting temptation for activists to pressure corporates to divest non-core assets to realize short-term value — it is unsurprising that more financial sponsors are looking at this space.” — Katja Butler, London

“The continuing market headwinds and unpredictable macro environment are likely to increase pressure on corporates experiencing periods of underperformance or a challenge to the execution of their business strategy. Activists will continue to be on the hunt for these opportunities in Europe in 2024.” — Simon Toms, London

“Public campaigns force companies to engage with activists as well as non-activist investors. This can be a significant source of pressure and commitment in terms of timing, communication and investment.” — Pascal Bine, Paris

“While lawmakers are pretty busy with a lot of topics, new laws that are targeted at governing activist campaigns are not, and likely will not be at least short term, atop their priority lists. Nonetheless, given the publicity and steady increase of campaigning activity, lawmakers and policy makers should be expected to monitor the developments and take note of potential areas of action– they will likely not hesitate to act should dysfunctions become apparent.” — Bruce Embley, London

“With increased tensions feeding the public debate, boards may find themselves in the crossfire between activists’ differing — and potentially contradictory — views for the same company in campaigns in 2024.” — Armand Grumberg, Paris, head of Skadden’s European M&A practice

View other articles from this issue of The Informed Board

- Emerging Expectations: The Board’s Role in Oversight of Cybersecurity Risks

- Seven Myths About the US Law Banning Imports Made With Forced Labor

- AI Executive Order: The Ramifications for Business Become Clearer

- A Guide for Directors to Political Law Issues in This Election Year

- Podcast: CEO Succession Planning on a Clear Day

See all the editions of The Informed Board

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.