Key Points

- Stock markets continue to reward “pure play” companies, driving sustained pressure from both institutional investors and activists to separate businesses that are not deemed “core” or are inconsistent with a pure-play equity story.

- Tax-free spin-offs and similar transactions remain one of the most attractive ways to separate a business. That’s in part because companies retain flexibility during the process to change the transaction structure, corporate governance framework and capital allocation strategy, while also having the ability to evaluate other strategic opportunities, including third-party bids.

- Compared to carve-out sales, spin-offs are less dependent on third parties and market conditions, providing the company with more control over the timing of a separation and unlocking value on the company’s chosen time frame.

__________

Companies continue to be pressured to move away from the conglomerate model and toward simplified and targeted strategies and risk profiles. As a result, boards of public companies with diversified portfolios or otherwise differentiated businesses will continue to look at portfolio optimization in the form of divestitures, spin-offs and other separation transactions to keep up with the demand for “corporate clarity” and shareholder value creation.

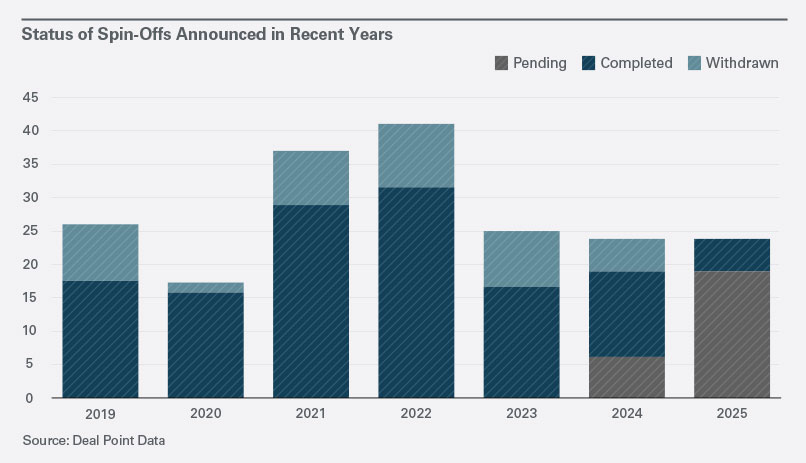

Separation transactions may find their way onto the board agenda at the behest of both long-term institutional investors searching for “pure play” opportunities and activist investors, who initiated 27 public campaigns at U.S. registrants centered around corporate break-ups in 2024 and 23 year to date in 2025 as of December 1, according to the research firm Deal Point Data. (See “As Activism Becomes a Year-Round Sport, Possible Regulatory Changes Could Impact Both Activists’ and Companies’ Approaches.”)

As 2026 unfolds, boards and management can anticipate even more calls to unlock value by separation. One catalyst is the capital markets, where equity multiples for conglomerates and other companies with multi-line businesses continue to face challenges in reaching their implied sum of the parts value. Another catalyst is geographic decoupling due to macroeconomic factors, the efforts of state and private actors to reduce actual or perceived reliance on a globalized supply chain in areas of strategic importance, and regulatory divergence.

As boards and management teams evaluate business portfolios and potential separation transactions, they must navigate a complex M&A environment of:

- Economic uncertainty.

- Geopolitical risk.

- Actual or perceived geographic decoupling.

- Actual or perceived politicization of regulatory review.

- Uncertain or heightened capital allocation requirements for next-generation technologies and infrastructure.

While carve-out sales continue to be a means to shed non-core assets and offer liquidity to companies and their investors, auction dynamics for carved-out businesses face some headwinds as strategic buyers encounter similar pressures to streamline, not expand, their business lines and sponsors are increasingly wary of the operational complexity and other challenges to standing up a new company.

Confronted with such an environment and the backdrop of an increasingly complicated global tax regime applicable to disposition transactions, boards and management teams contemplating separations may want to carefully consider spin-offs and similar transactions like Morris Trusts, Reverse Morris Trusts, split-offs and incubator joint ventures — transactions we will refer to collectively as spin-offs.

If well designed, these transactions can not only unlock value for shareholders but also leave the company with flexibility regarding the final structure, allowing the company to pivot along the way in response to input from shareholders, alternative strategic opportunities or changing market conditions.

Why Pursue a Spin-Off Transaction?

The Value Proposition

Board analysis of a spin-off, like any other proposed transaction, begins with the value proposition.

From a corporate growth perspective, spin-offs can improve returns by:

- Better aligning pay and performance for businesses leaders.

- Providing equity currency for future transactions that is more closely linked to the characteristics of each business.

- Focusing management on improving organic business performance and growth.

- Enhancing operational and strategic flexibility.

- Making it easier for the public capital markets to properly value businesses with different underlying growth trajectories or “pure play” peer valuation multiples.

However, the upside must be weighed against one-time transaction costs, recurring cost dis-synergies stemming from maintaining separate corporate infrastructures and loss of scale.

Value Creation and Tax Considerations

One of the chief advantages to the parent company of a spin-off is that the spin-off itself does not entail any tax liability to the parent company the way a straight sale to a buyer typically would (although in each case, there may be local tax consequences depending on the particulars of the steps to effect any internal pre-transaction restructuring).

In situations where the parent company’s tax basis in the separated business is low (and there would thus be a large taxable gain on a straight sale), but valuations are not robust enough to compensate for the tax burden, the tax-free nature of a spin-off alone may lead the parent company to favor this form of transaction.

It is important to note that the value of this type of transaction is usually best viewed through a “shareholder” lens (e.g., does the value of post-spin parent company shares plus spin-off company shares exceed that of the pre-spin parent company shares) rather than through the “corporate” lens of maximizing value received by the pre-spin parent company.

Spin-offs offer tax advantages to parent company shareholders, who receive valuable shares in a new public company without recognizing taxable dividend income or gain. In addition, when the equity markets attach a higher multiple to the new spin-off company (or to the remaining parent company) because of a better growth profile or alignment with comparable companies, shareholders may see an immediate increase in the value of their investments.

There is also the potential for future shareholder value through improved earnings growth or a later sale of the spun-off business or the parent company.

A parent company may also be able to bolster its balance sheet and rightsize the post-spin capital structure of both the parent and the spin-off company — for example:

- Through a cash distribution to the parent before the spin-off (up to the level of its tax basis in the assets transferred to the spin-off company).

- By exchanging new debt of the spin-off company for outstanding debt owed by the parent (debt-for-debt-exchange).

- By exchanging a portion (generally up to 20%) of the spin-off company’s shares to retire outstanding parent debt (equity-for-debt exchange).

It is important to note that in order to ensure the receipt of cash from the spin-off company remains tax-free to the parent, such cash must be “purged” to parent shareholders (e.g., through dividends or share buybacks) or to parent creditors (e.g., by retiring historical or refinanced parent debt), generally within one year after the spin-off.

The Internal Revenue Service (IRS) recently withdrew controversial proposed regulations that created significant challenges for these types of monetization techniques, indicating a significant shift in how the IRS will approach these matters in the private letter ruling (PLR) context. (See the below sidebar, “Key IRS Developments.”)

If a parent company is pursuing a separation at a time of market uncertainty or if a buyer willing to pay a pure-play multiple or enough of a premium to offset tax friction does not emerge, a spin-off represents an attractive way for the parent company to maximize shareholder value but avoid the risk of selling “low” and missing out on the value accretion that may be available to its shareholders in the future.

Freedom to Control Timing and Pivot to a Third-Party Sale

Often, boards and management teams analyzing a separation conclude that the business under consideration has its own life cycle that demands a near-term break from the parent company. Separation may be necessary to properly allocate capital for growth, to attract talent through management incentives or to pave the way for growth through acquisitions.

However, there may not be third-party interest at the time, or current valuations may not be attractive.

Unlike a carve-out sale, boards can choose to announce a spin-off when the parent company and the separated business are ready, regardless of the plans of other market players.

In our experience, when a spin-off can be consummated hinges mainly on two factors:

- The preparation of carve-out and pro forma financials for the securities registration statement, and Securities and Exchange Commission (SEC) review of such registration statement.

- The time needed to prepare the parent and spin-off companies to functionally operate as separate, independent companies — whether by achieving, pre-spin, the ultimate “end state” to fully disentangle shared systems, assets, personnel, processes and operations, or by reaching a “transitional” state with well-developed plans to achieve a permanent solution within one to two years after the spin-off. The transitional approach tends to be preferred, as it can result in a faster spin-off, but it warrants careful planning in order to ensure that the dis-synergies, capital expenditures and other related nonrecurring costs are taken into account in capital structure planning.

Timing may also hinge on the board’s and management’s determination that the spin-off company’s growth and business case has been fully developed and will support a healthy market valuation. These factors are largely under the control (or at least the purview) of the parent company.

Moreover, the board and management can continue to evaluate their course of action in response to changing circumstances after announcement of the spin-off, as the announcement itself sometimes attracts inbound offers from potential buyers.

Importantly, a company that has announced plans for a spin-off can, with the proper tax advice, entertain indications of interest and even engage in discussions with potential buyers. The announcement of the spin-off may also be helpful for negotiation dynamics, as it can credibly improve the perceived pricing floor from its current implied sum-of-the-parts contribution to the parent company to the “unlocked” value post-spin.

However, if a third party that participated in negotiations does not agree to a sale pre-spin and then buys the separated business after the spin-off, that can jeopardize the tax-free treatment of the spin-off in certain circumstances, so caution must be exercised. If a post-spin sale is a possibility, consideration should be given to pursuing any discussions as early as possible after spin-off announcement, both to minimize management distraction and to limit any restrictions on potential buyers after the spin-off.

What We’re Watching

In 2026, boards can expect to be called upon frequently to guide management teams as they consider separation transactions advocated by investors or, in some cases, seek to control their own destiny by preempting outside calls for a separation.

In a challenging environment defined by economic and geopolitical uncertainty and stricter capital allocation, pursuing a spin-off may offer thematic focus and near-term advantages.

Key IRS Developments

In September 2025, the IRS and Treasury Department withdrew proposed regulations dealing with spin-offs and related debt allocation transactions that had been issued earlier in 2025.

The proposed regulations contained some helpful rules — including a safe harbor for retained equity of the spin-off company, a presumptive two-year rule for the completion of post-spin-off debt-for-debt and equity-for-debt exchanges, and provisions permitting so-called “direct issuance” structures to effectuate such exchanges. But they were widely criticized by tax practitioners and other stakeholders as overly complex and restrictive.

The overall impact of those proposed regulations was a significant increase in uncertainty and compliance burdens for companies pursuing spin-offs, particularly for those seeking private letter rulings from the IRS to confirm the tax-free nature of their transactions.

While many boards may be comfortable relying on a “will” level tax opinion from a law firm, when the particular facts and circumstances lead the law firm to provide only “should” or lower level of confidence opinion, boards may want the assurance of a PLR before proceeding with a transaction.

Although the proposed regulations would have become effective only if and when finalized, the IRS had indicated that it would apply the standards under the proposed regulations in the PLR process.

In withdrawing the proposed regulations, the IRS restored the prior PLR guidelines that were in effect before 2024. Those standards are generally familiar to tax practitioners and, in many respects, are significantly less rigid and burdensome than the standards under the proposed regulations.

While important questions remain as to how the IRS will apply certain aspects of the reinstated PLR standards — particularly with respect to time limitations for debt exchanges and the availability of rulings on direct issuance structures — this shift in ruling policy may help facilitate the planning and execution of spin-offs.

Companies considering spin-offs may want to work closely with their advisers to understand how these changes may affect upcoming transactions.

Read more about M&A:

- M&A in the AI Era: What Buyers Can Do to Confirm and Protect Value

- The Long-Anticipated Wave of Bank Consolidation Starts to Break

- ‘Premiumization’ and Slow Organic Growth Are Likely to Feed Food and Beverage M&A

- M&A in the Middle East: AI, Financial Services and Energy Transition Lead the New Wave

- Liability Divestiture Transactions: A Win-Win for Financial Buyers and Mass Tort Defendants

- Political Law Due Diligence in M&A Transactions Is Increasingly Critical

See the full 2026 Insights publication

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.